Question: Accounting procedures allow a business to evaluate their inventory costs based on two methods: LIFO (Last In First Out) or FIFO (First In First Out).

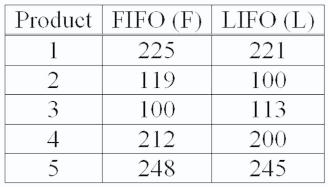

Accounting procedures allow a business to evaluate their inventory costs based on two methods: LIFO (Last In First Out) or FIFO (First In First Out). A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference, they computed (FIFO - LIFO) for each product. Based on the following results, does the LIFO method result in a lower cost of inventory than the FIFO method?

What are the degrees of freedom?

Select one:

a. 4

b. 5

c. 15

d. 10

Product FIFO (F) LIFO (L) 1 225 221 119 100 3 100 113 4 212 200 248 245

Step by Step Solution

3.54 Rating (151 Votes )

There are 3 Steps involved in it

Answer Option C is correct 15 FIFO O and LIFO are me... View full answer

Get step-by-step solutions from verified subject matter experts