the attached information is what to use

would it be this one? the previous pictures i have posted are the only info given

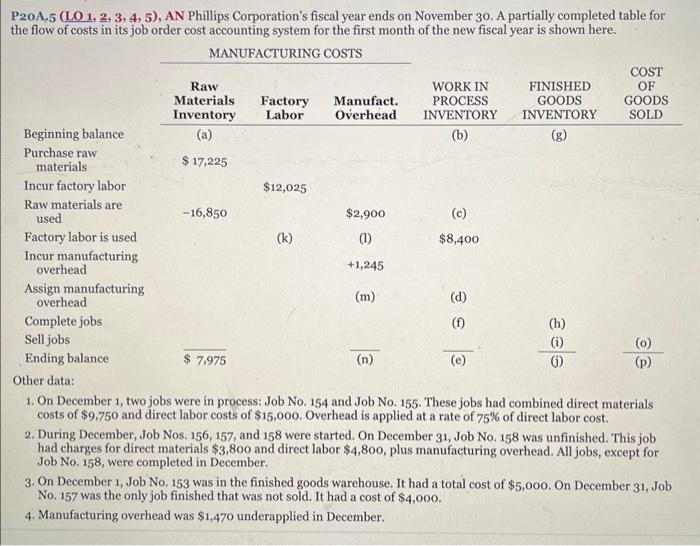

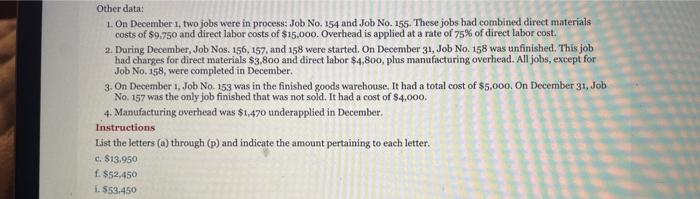

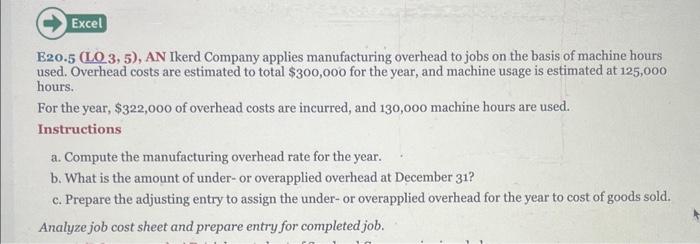

P20A.5 (LO 1, 2, 3, 4, 5), AN Phillips Corporation's fiscal year ends on November 30. A partially completed table for the flow of costs in its job order cost accounting system for the first month of the new fiscal year is shown here. 1. On December 1, two jobs were in process: Job No. 154 and Job No. 155. These jobs had combined direct materials costs of $9,750 and direct labor costs of $15,000. Overhead is applied at a rate of 75% of direct labor cost. 2. During December, Job Nos. 156, 157, and 158 were started. On December 31 , Job No. 158 was unfinished. This job had charges for direct materials $3,800 and direct labor $4,800, plus manufacturing overhead. All jobs, except for Job No. 158, were completed in December. 3. On December 1 , Job No, 153 was in the finished goods warehouse, It had a total cost of $5,000. On December 31 , Job No. 157 was the only job finished that was not sold. It had a cost of $4,000. 4. Manufacturing overhead was $1,470 underapplied in December. (g)(m) Other data: 1. On December 1, two jobs were in process: Job No. 154 and Job No. 155. These jobs had combined direct materials costs of $9,750 and direct labor costs of $15,000. Overhead is applied at a rate of 75% of direct labor cost. 2. During December, Job Nos, 156, 157, and 158 were started. On December 31, Job No. 158 was unfinished. This job had charges for direct materials $3,800 and direct labor $4,800, plus manufacturing overhead. All jobs, except for Job No. 158, were completed in December. 3. On December 1, Job No. 153 was in the finished goods warehouse. It had a total cost of $5,000. On December 31 , Job Na. 157 was the only job finished that was not sold. It had a cost of $4,000. 4. Manufacturing overhead was $1,470 underapplied in December. Instructions List the letters (a) through (p) and indicate the amount pertaining to each letter. c. $13,950 f. $52,450 f. $53,450 E20.5 (LO 3, 5), AN Ikerd Company applies manufacturing overhead to jobs on the basis of machine hours used. Overhead costs are estimated to total $300,000 for the year, and machine usage is estimated at 125,000 hours. For the year, $322,000 of overhead costs are incurred, and 130,000 machine hours are used. Instructions a. Compute the manufacturing overhead rate for the year. b. What is the amount of under- or overapplied overhead at December 31? c. Prepare the adjusting entry to assign the under- or overapplied overhead for the year to cost of goods sold. Analyze job cost sheet and prepare entry for completed job

would it be this one? the previous pictures i have posted are the only info given

would it be this one? the previous pictures i have posted are the only info given