Answered step by step

Verified Expert Solution

Question

1 Approved Answer

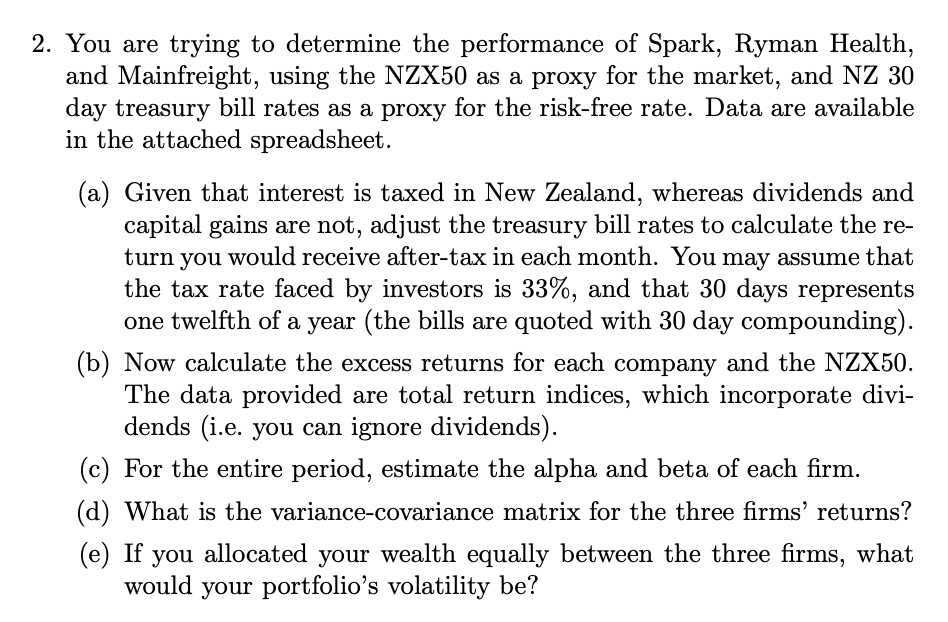

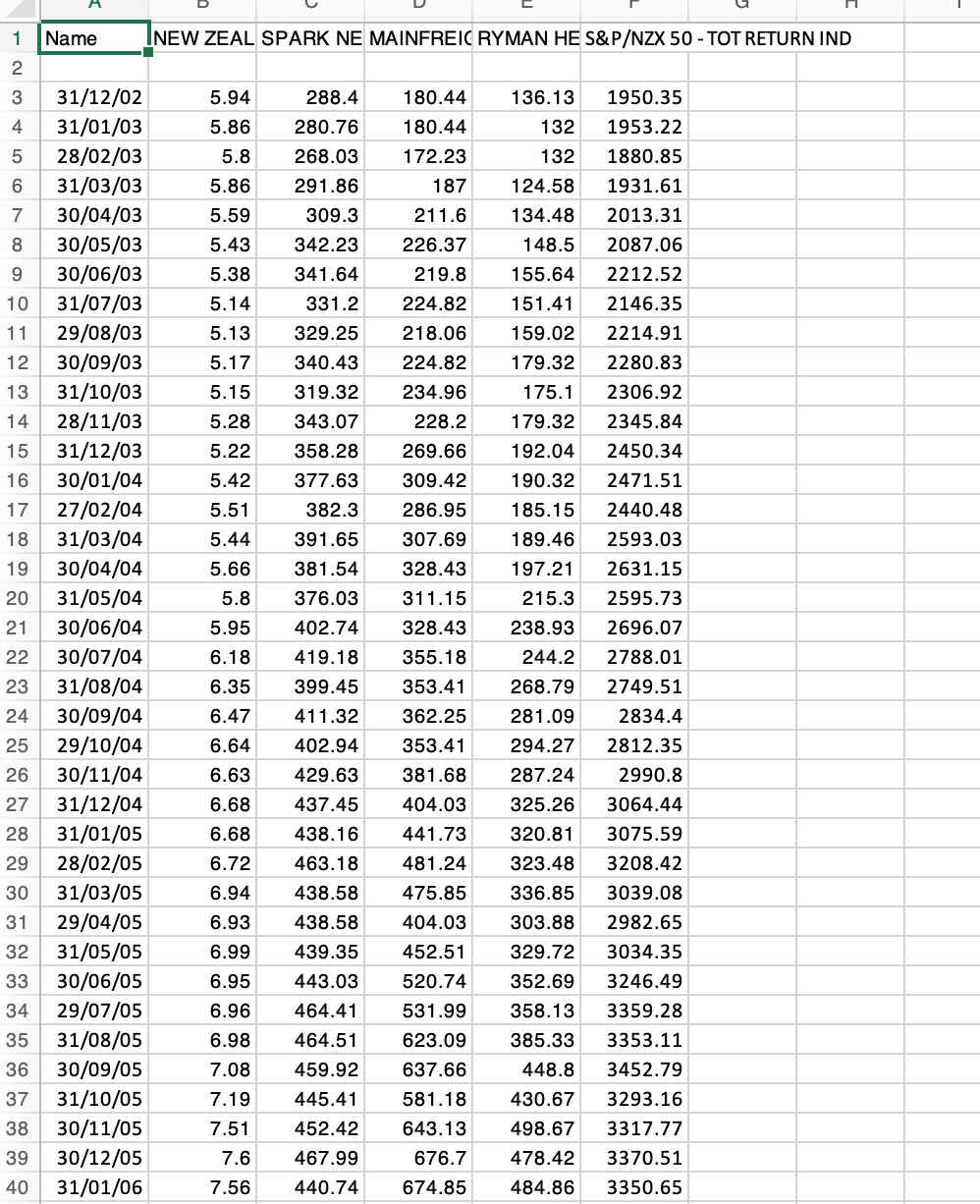

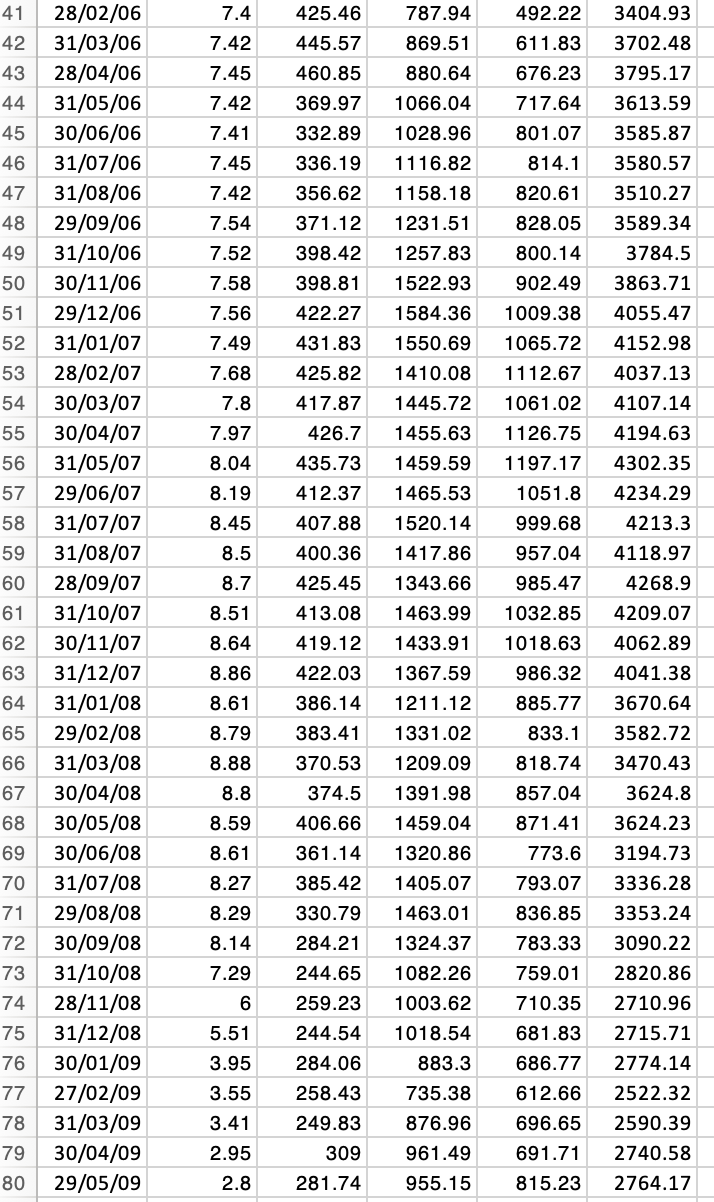

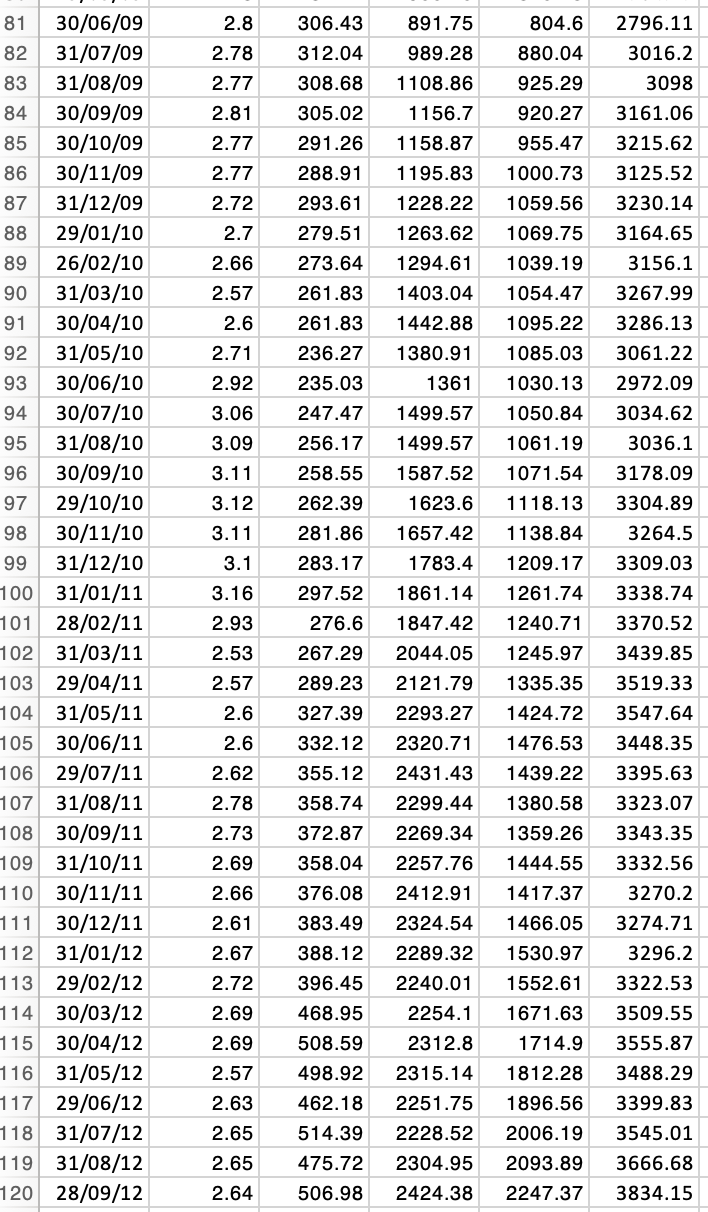

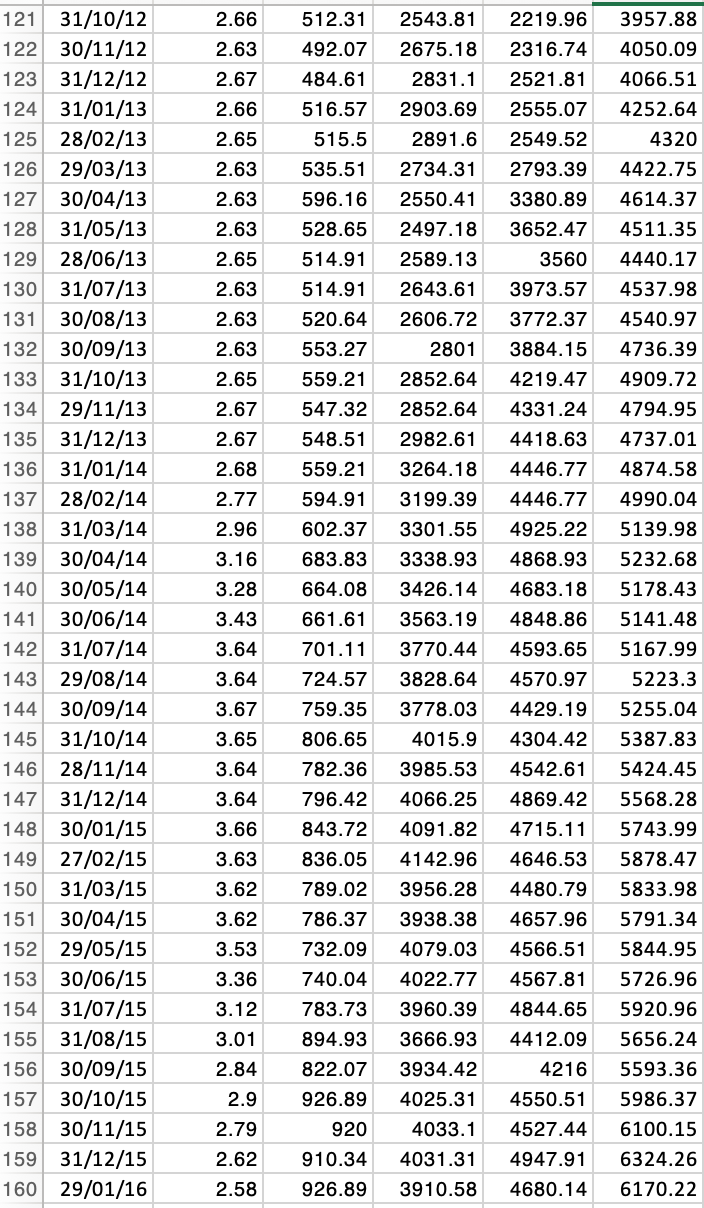

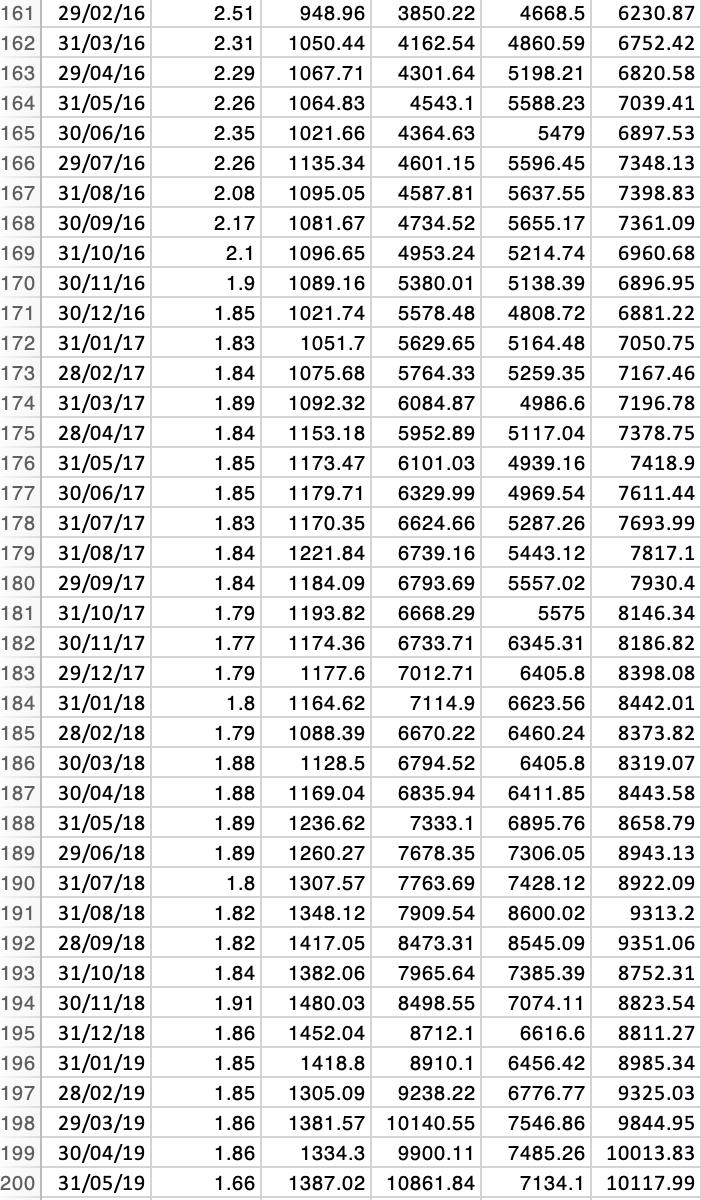

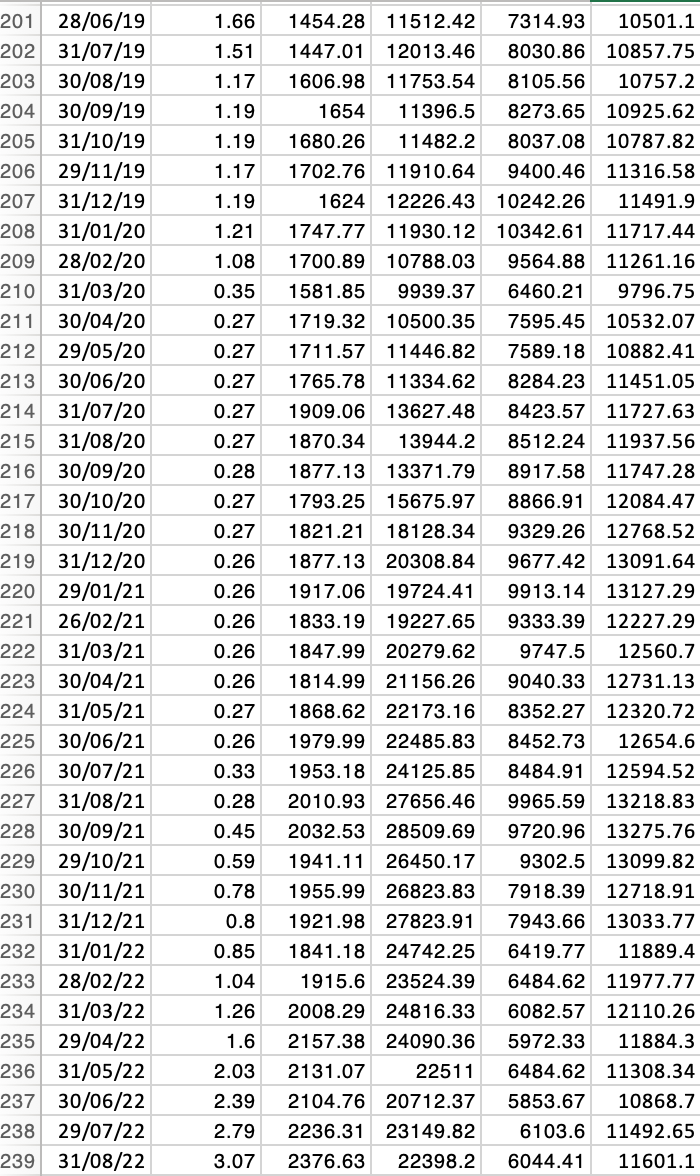

the attached photos are screenshots of the data 2. You are trying to determine the performance of Spark, Ryman Health, and Mainfreight, using the NZX50

the attached photos are screenshots of the data

2. You are trying to determine the performance of Spark, Ryman Health, and Mainfreight, using the NZX50 as a proxy for the market, and NZ 30 day treasury bill rates as a proxy for the risk-free rate. Data are available in the attached spreadsheet. (a) Given that interest is taxed in New Zealand, whereas dividends and capital gains are not, adjust the treasury bill rates to calculate the return you would receive after-tax in each month. You may assume that the tax rate faced by investors is 33%, and that 30 days represents one twelfth of a year (the bills are quoted with 30 day compounding). (b) Now calculate the excess returns for each company and the NZX50. The data provided are total return indices, which incorporate dividends (i.e. you can ignore dividends). (c) For the entire period, estimate the alpha and beta of each firm. (d) What is the variance-covariance matrix for the three firms' returns? (e) If you allocated your wealth equally between the three firms, what would your portfolio's volatility be? 1 Name NEW ZEAL SPARK NE MAINFREIC RYMAN HE S\&P/NZX 50 -TOT RETURN IND 2 2. You are trying to determine the performance of Spark, Ryman Health, and Mainfreight, using the NZX50 as a proxy for the market, and NZ 30 day treasury bill rates as a proxy for the risk-free rate. Data are available in the attached spreadsheet. (a) Given that interest is taxed in New Zealand, whereas dividends and capital gains are not, adjust the treasury bill rates to calculate the return you would receive after-tax in each month. You may assume that the tax rate faced by investors is 33%, and that 30 days represents one twelfth of a year (the bills are quoted with 30 day compounding). (b) Now calculate the excess returns for each company and the NZX50. The data provided are total return indices, which incorporate dividends (i.e. you can ignore dividends). (c) For the entire period, estimate the alpha and beta of each firm. (d) What is the variance-covariance matrix for the three firms' returns? (e) If you allocated your wealth equally between the three firms, what would your portfolio's volatility be? 1 Name NEW ZEAL SPARK NE MAINFREIC RYMAN HE S\&P/NZX 50 -TOT RETURN IND 2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started