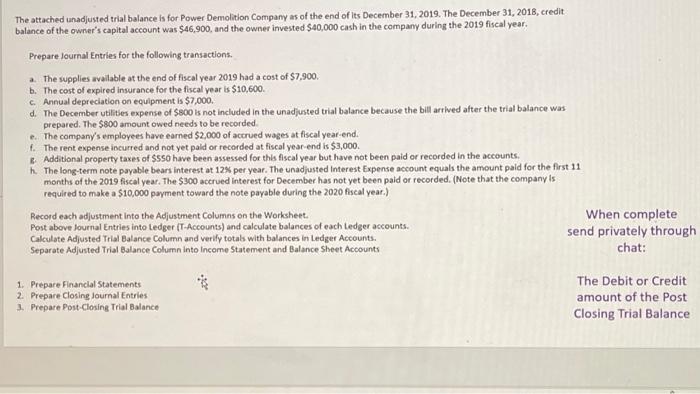

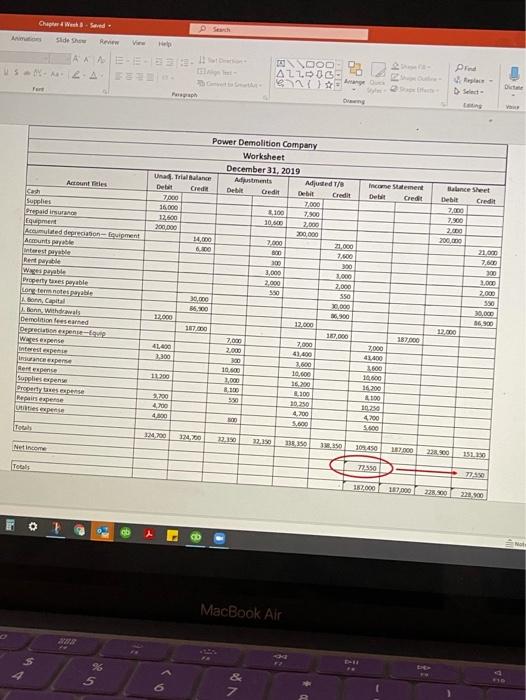

The attached unadjusted trial balance is for Power Demolition Company as of the end of its December 31, 2019. The December 31, 2018, credit balance of the owner's capital account was $46,900, and the owner invested $40,000 cash in the company during the 2019 fiscal year. Prepare Journal Entries for the following transactions. The supplies wailable at the end of fiscal year 2019 had a cost of $7.900. b. The cost of expired insurance for the fiscal year is $10,600 Annual depreciation on equipment is $7,000. d. The December utilities expense of $800 is not included in the unadjusted trial balance because the bill arrived after the trial balance was prepared. The $800 amount owed needs to be recorded e. The company's employees have earned $2,000 of accrued wages at fiscal year-end. 1. The rent expense incurred and not yet pald or recorded at fiscal year end is $3,000. Additional property taxes of $550 have been assessed for this fiscal year but have not been paid or recorded in the accounts. h. The long-term note payable bears interest at 12% per year. The unadjusted Interest Expense account equals the amount paid for the first 11 months of the 2019 fiscal year. The $300 accrued interest for December has not yet been paid or recorded. (Note that the company is required to make a $10,000 payment toward the note payable during the 2020 fiscal year.) Record each adjustment into the Adjustment Columns on the Worksheet. When complete Post above Journal Entries into Ledger (T-Accounts) and calculate balances of each Ledger accounts. Calculate Adjusted Trial Balance Column and verify totals with balances in Ledger Accounts. send privately through Separate Adjusted Trial Balance Column into Income Statement and Balance Sheet Accounts chat: 1. Prepare Financial Statements 2. Prepare Closing Journal Entries 2. Prepare Post-Closing Trial Balance The Debit or Credit amount of the Post Closing Trial Balance Chap Wessed Search Rew Vio US- A2-A SOOD AL100G V Artes Supplies Prepaid insurance Equipment Accumulated depreciation-ment Amounts Rentable Weble Property des payable Long term notes Capital on Withdrawals Demolition fees earned Deprecensere Wires expense Power Demolition Company Worksheet December 31, 2019 Un.Trial Balance Astments Adjused Te Income Statement Debat Credit Balance Sheet Debit Credit Debit 7000 Credit Credit Debit Credit 16.000 3.000 3.100 7.900 12,600 7.900 20.500 2.000 200,000 2.000 14,000 200,00 7.000 220,000 6.00 600 21.00 7.000 7.600 200 300 300 3,000 3,000 2.000 1.000 2,000 550 2.000 550 30.000 580 2000 36.500 30.0 22.000 12.000 16,900 107.000 12.000 107.000 7,000 187.000 7,000 41.200 2.000 2000 41,400 3,300 42.400 300 3,600 1,600 10.000 11.200 10.600 2.000 16.00 16200 3.100 1.100 2200 30 100 20250 4700 10.250 4.700 4.800 4700 5.600 S1600 M700 2020 22.150 12,350 50 109450 17 000 22.900 151 Besponse Croperty tapes Map Total 1350 7259 187000 22.500 200 MacBook Air s 5 SB The attached unadjusted trial balance is for Power Demolition Company as of the end of its December 31, 2019. The December 31, 2018, credit balance of the owner's capital account was $46,900, and the owner invested $40,000 cash in the company during the 2019 fiscal year. Prepare Journal Entries for the following transactions. The supplies wailable at the end of fiscal year 2019 had a cost of $7.900. b. The cost of expired insurance for the fiscal year is $10,600 Annual depreciation on equipment is $7,000. d. The December utilities expense of $800 is not included in the unadjusted trial balance because the bill arrived after the trial balance was prepared. The $800 amount owed needs to be recorded e. The company's employees have earned $2,000 of accrued wages at fiscal year-end. 1. The rent expense incurred and not yet pald or recorded at fiscal year end is $3,000. Additional property taxes of $550 have been assessed for this fiscal year but have not been paid or recorded in the accounts. h. The long-term note payable bears interest at 12% per year. The unadjusted Interest Expense account equals the amount paid for the first 11 months of the 2019 fiscal year. The $300 accrued interest for December has not yet been paid or recorded. (Note that the company is required to make a $10,000 payment toward the note payable during the 2020 fiscal year.) Record each adjustment into the Adjustment Columns on the Worksheet. When complete Post above Journal Entries into Ledger (T-Accounts) and calculate balances of each Ledger accounts. Calculate Adjusted Trial Balance Column and verify totals with balances in Ledger Accounts. send privately through Separate Adjusted Trial Balance Column into Income Statement and Balance Sheet Accounts chat: 1. Prepare Financial Statements 2. Prepare Closing Journal Entries 2. Prepare Post-Closing Trial Balance The Debit or Credit amount of the Post Closing Trial Balance Chap Wessed Search Rew Vio US- A2-A SOOD AL100G V Artes Supplies Prepaid insurance Equipment Accumulated depreciation-ment Amounts Rentable Weble Property des payable Long term notes Capital on Withdrawals Demolition fees earned Deprecensere Wires expense Power Demolition Company Worksheet December 31, 2019 Un.Trial Balance Astments Adjused Te Income Statement Debat Credit Balance Sheet Debit Credit Debit 7000 Credit Credit Debit Credit 16.000 3.000 3.100 7.900 12,600 7.900 20.500 2.000 200,000 2.000 14,000 200,00 7.000 220,000 6.00 600 21.00 7.000 7.600 200 300 300 3,000 3,000 2.000 1.000 2,000 550 2.000 550 30.000 580 2000 36.500 30.0 22.000 12.000 16,900 107.000 12.000 107.000 7,000 187.000 7,000 41.200 2.000 2000 41,400 3,300 42.400 300 3,600 1,600 10.000 11.200 10.600 2.000 16.00 16200 3.100 1.100 2200 30 100 20250 4700 10.250 4.700 4.800 4700 5.600 S1600 M700 2020 22.150 12,350 50 109450 17 000 22.900 151 Besponse Croperty tapes Map Total 1350 7259 187000 22.500 200 MacBook Air s 5 SB