Answered step by step

Verified Expert Solution

Question

1 Approved Answer

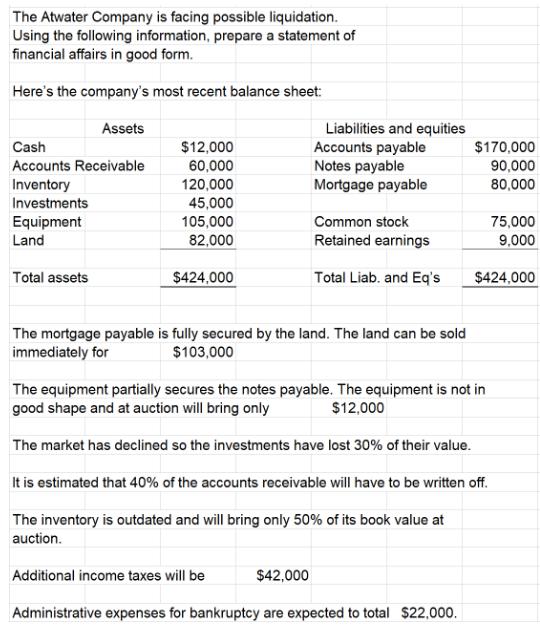

The Atwater Company is facing possible liquidation. Using the following information, prepare a statement of financial affairs in good form. Here's the company's most

The Atwater Company is facing possible liquidation. Using the following information, prepare a statement of financial affairs in good form. Here's the company's most recent balance sheet: Assets Cash Accounts Receivable Inventory Investments Equipment Land Total assets $12,000 60,000 120,000 45,000 105,000 82,000 $424,000 Liabilities and equities Accounts payable Notes payable Mortgage payable Common stock Retained earnings Total Liab, and Eq's The mortgage payable is fully secured by the land. The land can be sold immediately for $103,000 $170,000 90,000 80,000 $424,000 The equipment partially secures the notes payable. The equipment is not in good shape and at auction will bring only $12,000 The market has declined so the investments have lost 30% of their value. 75,000 9,000 It is estimated that 40% of the accounts receivable will have to be written off. The inventory is outdated and will bring only 50% of its book value at auction. Additional income taxes will be $42,000 Administrative expenses for bankruptcy are expected to total $22,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Statement of Financial Affairs for Atwater Company Assets Cash 12000 Accounts Receivable 60000 Estimated 40 writeoff 24000 Inventory 120000 Estimated ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started