Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Australian fintech company. Afterpay, makes it simple for customers to buy products by requiring them to pay four equal installments spread over four

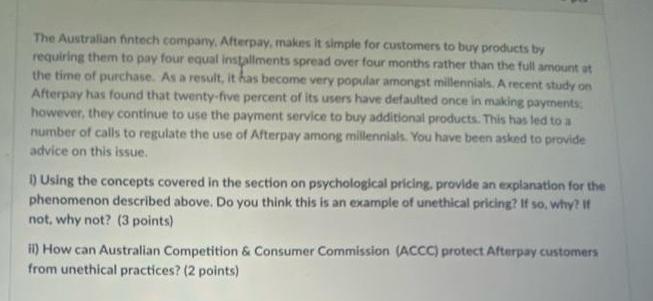

The Australian fintech company. Afterpay, makes it simple for customers to buy products by requiring them to pay four equal installments spread over four months rather than the full amount at the time of purchase. As a result, it has become very popular amongst millennials. A recent study on Afterpay has found that twenty-five percent of its users have defaulted once in making payments: however, they continue to use the payment service to buy additional products. This has led to a number of calls to regulate the use of Afterpay among millennials. You have been asked to provide advice on this issue. 1) Using the concepts covered in the section on psychological pricing, provide an explanation for the phenomenon described above. Do you think this is an example of unethical pricing? If so, why? If not, why not? (3 points) ii) How can Australian Competition & Consumer Commission (ACCC) protect Afterpay customers from unethical practices? (2 points)

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1 Explanation of the phenomenon using psychological pricing The phenomenon described above can be attributed to the concept of mental accounting and the allure of deferred payment through Afterpay Men...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started