Question

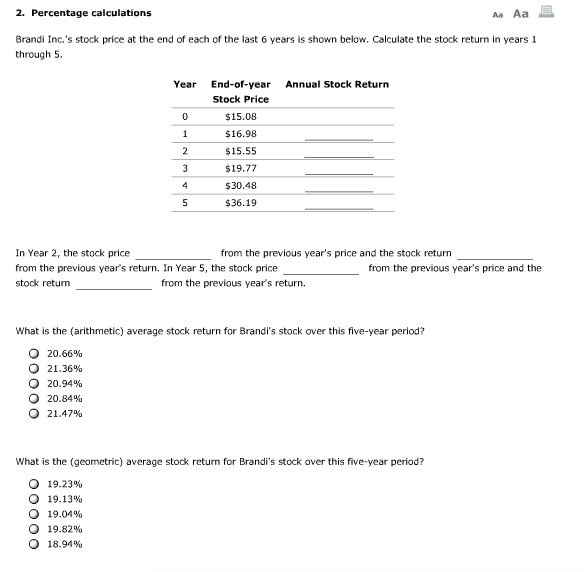

The available choices for year one are: 14.59%, 12.60%, 11.94%, 13.93%, 15.92%, 11.27%, 15.25%, 11.27%, 15.25%, 16.58%, 17.24%, and 13.26%. The available choices for year

The available choices for year one are: 14.59%, 12.60%, 11.94%, 13.93%, 15.92%, 11.27%, 15.25%, 11.27%, 15.25%, 16.58%, 17.24%, and 13.26%.

The available choices for year two are: -7.33%, -11.55%, -8.42%, -11.04%, -10.53%,-9.49%, -10.01%, -12.05%, -7.88%, and -8.96%.

The available choices for year three are: 25.85, 28.42, 29.71,27.78, 31.00, 31.64, 26.50, 27.14, 29.07, and 30.35%

The available choices for year four are: 52.63, 51.87, 54.17, 50.37, 55.75, 51.12, 54.96, 48.90, 49.63, and 53.40%

The available choices for year five are: 20.70, 20.21, 17.75, 21.69, 18.73, 19.23, 19.72, 18.24, 21.19, and 22.18%

In year 2... all drop downs are either Increased or Decreased.

2. Percentage calculations Aa Aa Brandi Inc.'s stock price at the end of each of the last 6 years is shown below. Calculate the stock return in years 1 through 5. Year End-of-year Annual Stock Return Stock Price S15.08 $16.98 $15.55 $19.77 $30.48 S36.19 In Year 2, the stock price from the previous year's price and the stock return from the previous year's return. In Year 5, the stock price from the previous year's price and the stock retum from the previous year's return. What is the (arithmetic) average stock return for Brandi's stock over this five-year period? 20.66% 21.36% o 20.94% 20.34% 21.47% What is the (geometric) average stock return for Brandi's stock over this five-year period? 19.23% 19.13% 19.04% 19.82% 18.94%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started