Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The average budgeted total compensation per professional for 2020 is $110,000. Each professional is budgeted to have 2,000 billable hours to clients in 2020.

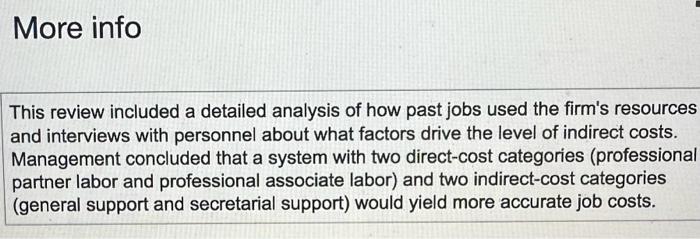

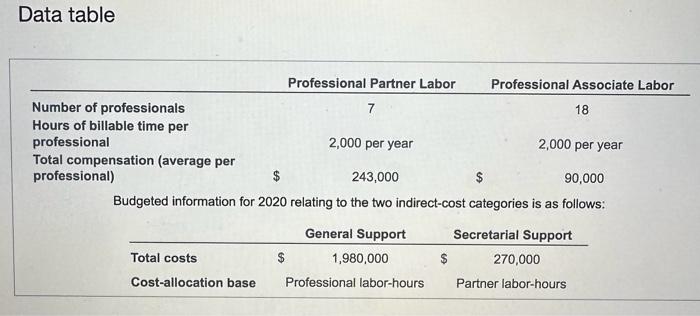

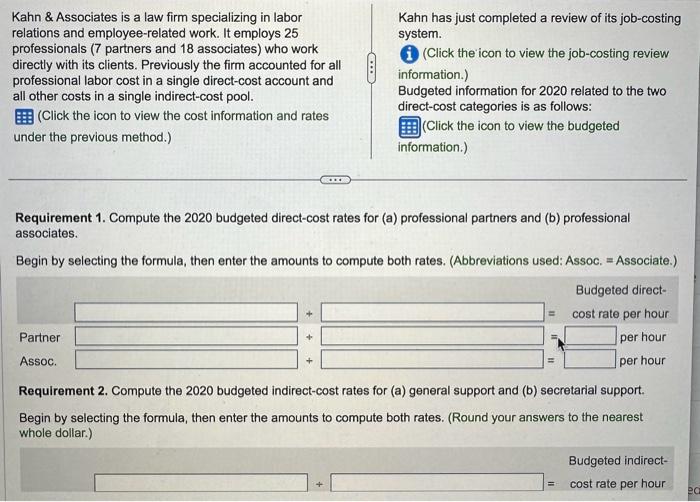

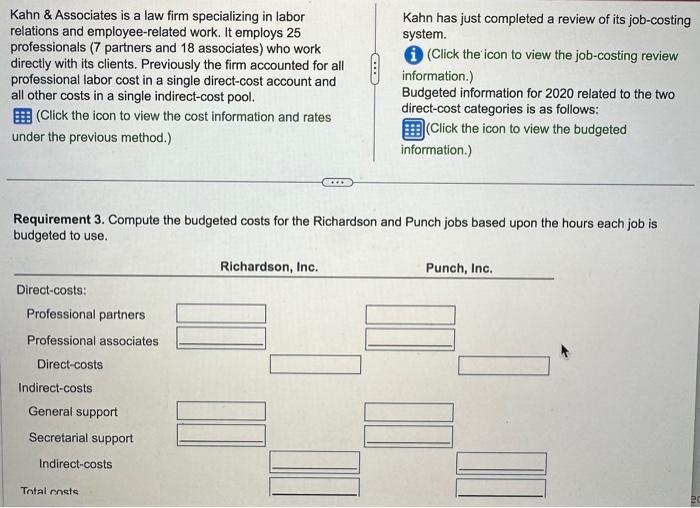

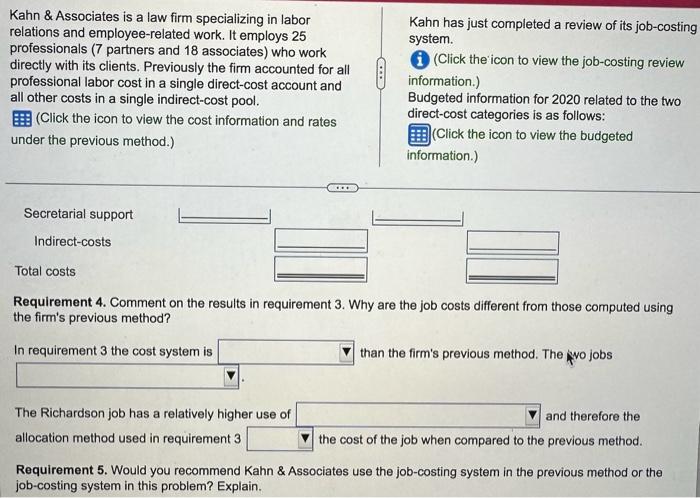

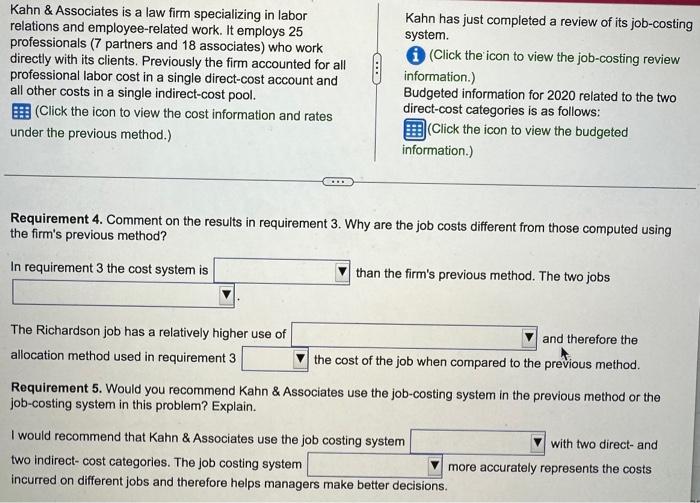

The average budgeted total compensation per professional for 2020 is $110,000. Each professional is budgeted to have 2,000 billable hours to clients in 2020. All professionals work for clients to their maximum 2,000 billable hours available. All professional labor costs are included in a single direct-cost category and are traced to jobs on a per-hour basis. All costs of Kahn & Associates other than professional labor costs are included in a single indirect-cost pool (legal support) and are allocated to jobs using professional labor-hours as the allocation base. The budgeted level of indirect costs in 2020 is $2,250,000. The cost estimates for the Richardson, Inc. job, which requires 120 budgeted hours of professional labor and for the Punch, Inc. job, which requires 170 budgeted hours of professional labor are as follows: Direct-costs Indirect-costs Total costs $ 69 $ Richardson 6,600 $ 5,400 12,000 $ Punch 9,350 7,650 17,000 More info This review included a detailed analysis of how past jobs used the firm's resources and interviews with personnel about what factors drive the level of indirect costs. Management concluded that a system with two direct-cost categories (professional partner labor and professional associate labor) and two indirect-cost categories (general support and secretarial support) would yield more accurate job costs. Data table Number of professionals Hours of billable time per professional Total compensation (average per professional) Professional Partner Labor Total costs Cost-allocation base 7 2,000 per year 2,000 per year 243,000 $ 90,000 Budgeted information for 2020 relating to the two indirect-cost categories is as follows: General Support Secretarial Support 1,980,000 Professional Associate Labor Professional labor-hours 18 270,000 Partner labor-hours Kahn & Associates is a law firm specializing in labor relations and employee-related work. It employs 25 professionals (7 partners and 18 associates) who work directly with its clients. Previously the firm accounted for all professional labor cost in a single direct-cost account and all other costs in a single indirect-cost pool. EEE (Click the icon to view the cost information and rates under the previous method.) C Partner Assoc. Kahn has just completed a review of its job-costing system. i (Click the icon to view the job-costing review information.) Budgeted information for 2020 related to the two direct-cost categories is as follows: (Click the icon to view the budgeted information.) Requirement 1. Compute the 2020 budgeted direct-cost rates for (a) professional partners and (b) professional associates. Begin by selecting the formula, then enter the amounts to compute both rates. (Abbreviations used: Assoc. = Associate.) Budgeted direct- cost rate per hour per hour per hour Requirement 2. Compute the 2020 budgeted indirect-cost rates for (a) general support and (b) secretarial support. Begin by selecting the formula, then enter the amounts to compute both rates. (Round your answers to the nearest whole dollar.) Budgeted indirect- cost rate per hour 20 Kahn & Associates is a law firm specializing in labor relations and employee-related work. It employs 25 professionals (7 partners and 18 associates) who work directly with its clients. Previously the firm accounted for all professional labor cost in a single direct-cost account and all other costs in a single indirect-cost pool. EEE (Click the icon to view the cost information and rates under the previous method.) General Secretarial *** Direct-costs: Professional partners Professional associates Kahn has just completed a review of its job-costing system. Begin by selecting the formula, then enter the amounts to compute both rates. (Round your answers to the nearest whole dollar.) Richardson, Inc. i (Click the icon to view the job-costing review information.) Budgeted information for 2020 related to the two direct-cost categories is as follows: (Click the icon to view the budgeted information.) Requirement 3. Compute the budgeted costs for the Richardson and Punch jobs based upon the hours each job is budgeted to use. = Punch, Inc. Budgeted indirect- cost rate per hour per hour per hour Kahn & Associates is a law firm specializing in labor relations and employee-related work. It employs 25 professionals (7 partners and 18 associates) who work directly with its clients. Previously the firm accounted for all professional labor cost in a single direct-cost account and all other costs in a single indirect-cost pool. (Click the icon to view the cost information and rates under the previous method.) Direct-costs: Professional partners Professional associates Direct-costs Indirect-costs General support Secretarial support Indirect-costs Requirement 3. Compute the budgeted costs for the Richardson and Punch jobs based upon the hours each job is budgeted to use. Total costs *** Richardson, Inc. Kahn has just completed a review of its job-costing system. i (Click the icon to view the job-costing review information.) Budgeted information for 2020 related to the two direct-cost categories is as follows: (Click the icon to view the budgeted information.) Punch, Inc. 11 Kahn & Associates is a law firm specializing in labor relations and employee-related work. It employs 25 professionals (7 partners and 18 associates) who work directly with its clients. Previously the firm accounted for all professional labor cost in a single direct-cost account and all other costs in a single indirect-cost pool. (Click the icon to view the cost information and rates under the previous method.) Secretarial support Indirect-costs Total costs Kahn has just completed a review of its job-costing system. The Richardson job has a relatively higher use of allocation method used in requirement 3 (Click the icon to view the job-costing review information.) Budgeted information for 2020 related to the two direct-cost categories is as follows: (Click the icon to view the budgeted information.) Requirement 4. Comment on the results in requirement 3. Why are the job costs different from those computed using the firm's previous method? In requirement 3 the cost system is than the firm's previous method. The vo jobs and therefore the the cost of the job when compared to the previous method. Requirement 5. Would you recommend Kahn & Associates use the job-costing system in the previous method or the job-costing system in this problem? Explain. Kahn & Associates is a law firm specializing in labor relations and employee-related work. It employs 25 professionals (7 partners and 18 associates) who work directly with its clients. Previously the firm accounted for all professional labor cost in a single direct-cost account and all other costs in a single indirect-cost pool. (Click the icon to view the cost information and rates under the previous method.) *** The Richardson job has a relatively higher use of allocation method used in requirement 3 Kahn has just completed a review of its job-costing system. (Click the icon to view the job-costing review information.) Budgeted information for 2020 related to the two direct-cost categories is as follows: (Click the icon to view the budgeted information.) Requirement 4. Comment on the results in requirement 3. Why are the job costs different from those computed using the firm's previous method? In requirement 3 the cost system is than the firm's previous method. The two jobs and therefore the the cost of the job when compared to the previous method. Requirement 5. Would you recommend Kahn & Associates use the job-costing system in the previous method or the job-costing system in this problem? Explain. I would recommend that Kahn & Associates use the job costing system two indirect- cost categories. The job costing system incurred on different jobs and therefore helps managers make better decisions. with two direct- and more accurately represents the costs The average budgeted total compensation per professional for 2020 is $110,000. Each professional is budgeted to have 2,000 billable hours to clients in 2020. All professionals work for clients to their maximum 2,000 billable hours available. All professional labor costs are included in a single direct-cost category and are traced to jobs on a per-hour basis. All costs of Kahn & Associates other than professional labor costs are included in a single indirect-cost pool (legal support) and are allocated to jobs using professional labor-hours as the allocation base. The budgeted level of indirect costs in 2020 is $2,250,000. The cost estimates for the Richardson, Inc. job, which requires 120 budgeted hours of professional labor and for the Punch, Inc. job, which requires 170 budgeted hours of professional labor are as follows: Direct-costs Indirect-costs Total costs $ 69 $ Richardson 6,600 $ 5,400 12,000 $ Punch 9,350 7,650 17,000 More info This review included a detailed analysis of how past jobs used the firm's resources and interviews with personnel about what factors drive the level of indirect costs. Management concluded that a system with two direct-cost categories (professional partner labor and professional associate labor) and two indirect-cost categories (general support and secretarial support) would yield more accurate job costs. Data table Number of professionals Hours of billable time per professional Total compensation (average per professional) Professional Partner Labor Total costs Cost-allocation base 7 2,000 per year 2,000 per year 243,000 $ 90,000 Budgeted information for 2020 relating to the two indirect-cost categories is as follows: General Support Secretarial Support 1,980,000 Professional Associate Labor Professional labor-hours 18 270,000 Partner labor-hours Kahn & Associates is a law firm specializing in labor relations and employee-related work. It employs 25 professionals (7 partners and 18 associates) who work directly with its clients. Previously the firm accounted for all professional labor cost in a single direct-cost account and all other costs in a single indirect-cost pool. EEE (Click the icon to view the cost information and rates under the previous method.) C Partner Assoc. Kahn has just completed a review of its job-costing system. i (Click the icon to view the job-costing review information.) Budgeted information for 2020 related to the two direct-cost categories is as follows: (Click the icon to view the budgeted information.) Requirement 1. Compute the 2020 budgeted direct-cost rates for (a) professional partners and (b) professional associates. Begin by selecting the formula, then enter the amounts to compute both rates. (Abbreviations used: Assoc. = Associate.) Budgeted direct- cost rate per hour per hour per hour Requirement 2. Compute the 2020 budgeted indirect-cost rates for (a) general support and (b) secretarial support. Begin by selecting the formula, then enter the amounts to compute both rates. (Round your answers to the nearest whole dollar.) Budgeted indirect- cost rate per hour 20 Kahn & Associates is a law firm specializing in labor relations and employee-related work. It employs 25 professionals (7 partners and 18 associates) who work directly with its clients. Previously the firm accounted for all professional labor cost in a single direct-cost account and all other costs in a single indirect-cost pool. EEE (Click the icon to view the cost information and rates under the previous method.) General Secretarial *** Direct-costs: Professional partners Professional associates Kahn has just completed a review of its job-costing system. Begin by selecting the formula, then enter the amounts to compute both rates. (Round your answers to the nearest whole dollar.) Richardson, Inc. i (Click the icon to view the job-costing review information.) Budgeted information for 2020 related to the two direct-cost categories is as follows: (Click the icon to view the budgeted information.) Requirement 3. Compute the budgeted costs for the Richardson and Punch jobs based upon the hours each job is budgeted to use. = Punch, Inc. Budgeted indirect- cost rate per hour per hour per hour Kahn & Associates is a law firm specializing in labor relations and employee-related work. It employs 25 professionals (7 partners and 18 associates) who work directly with its clients. Previously the firm accounted for all professional labor cost in a single direct-cost account and all other costs in a single indirect-cost pool. (Click the icon to view the cost information and rates under the previous method.) Direct-costs: Professional partners Professional associates Direct-costs Indirect-costs General support Secretarial support Indirect-costs Requirement 3. Compute the budgeted costs for the Richardson and Punch jobs based upon the hours each job is budgeted to use. Total costs *** Richardson, Inc. Kahn has just completed a review of its job-costing system. i (Click the icon to view the job-costing review information.) Budgeted information for 2020 related to the two direct-cost categories is as follows: (Click the icon to view the budgeted information.) Punch, Inc. 11 Kahn & Associates is a law firm specializing in labor relations and employee-related work. It employs 25 professionals (7 partners and 18 associates) who work directly with its clients. Previously the firm accounted for all professional labor cost in a single direct-cost account and all other costs in a single indirect-cost pool. (Click the icon to view the cost information and rates under the previous method.) Secretarial support Indirect-costs Total costs Kahn has just completed a review of its job-costing system. The Richardson job has a relatively higher use of allocation method used in requirement 3 (Click the icon to view the job-costing review information.) Budgeted information for 2020 related to the two direct-cost categories is as follows: (Click the icon to view the budgeted information.) Requirement 4. Comment on the results in requirement 3. Why are the job costs different from those computed using the firm's previous method? In requirement 3 the cost system is than the firm's previous method. The vo jobs and therefore the the cost of the job when compared to the previous method. Requirement 5. Would you recommend Kahn & Associates use the job-costing system in the previous method or the job-costing system in this problem? Explain. Kahn & Associates is a law firm specializing in labor relations and employee-related work. It employs 25 professionals (7 partners and 18 associates) who work directly with its clients. Previously the firm accounted for all professional labor cost in a single direct-cost account and all other costs in a single indirect-cost pool. (Click the icon to view the cost information and rates under the previous method.) *** The Richardson job has a relatively higher use of allocation method used in requirement 3 Kahn has just completed a review of its job-costing system. (Click the icon to view the job-costing review information.) Budgeted information for 2020 related to the two direct-cost categories is as follows: (Click the icon to view the budgeted information.) Requirement 4. Comment on the results in requirement 3. Why are the job costs different from those computed using the firm's previous method? In requirement 3 the cost system is than the firm's previous method. The two jobs and therefore the the cost of the job when compared to the previous method. Requirement 5. Would you recommend Kahn & Associates use the job-costing system in the previous method or the job-costing system in this problem? Explain. I would recommend that Kahn & Associates use the job costing system two indirect- cost categories. The job costing system incurred on different jobs and therefore helps managers make better decisions. with two direct- and more accurately represents the costs The average budgeted total compensation per professional for 2020 is $110,000. Each professional is budgeted to have 2,000 billable hours to clients in 2020. All professionals work for clients to their maximum 2,000 billable hours available. All professional labor costs are included in a single direct-cost category and are traced to jobs on a per-hour basis. All costs of Kahn & Associates other than professional labor costs are included in a single indirect-cost pool (legal support) and are allocated to jobs using professional labor-hours as the allocation base. The budgeted level of indirect costs in 2020 is $2,250,000. The cost estimates for the Richardson, Inc. job, which requires 120 budgeted hours of professional labor and for the Punch, Inc. job, which requires 170 budgeted hours of professional labor are as follows: Direct-costs Indirect-costs Total costs $ 69 $ Richardson 6,600 $ 5,400 12,000 $ Punch 9,350 7,650 17,000 More info This review included a detailed analysis of how past jobs used the firm's resources and interviews with personnel about what factors drive the level of indirect costs. Management concluded that a system with two direct-cost categories (professional partner labor and professional associate labor) and two indirect-cost categories (general support and secretarial support) would yield more accurate job costs. Data table Number of professionals Hours of billable time per professional Total compensation (average per professional) Professional Partner Labor Total costs Cost-allocation base 7 2,000 per year 2,000 per year 243,000 $ 90,000 Budgeted information for 2020 relating to the two indirect-cost categories is as follows: General Support Secretarial Support 1,980,000 Professional Associate Labor Professional labor-hours 18 270,000 Partner labor-hours Kahn & Associates is a law firm specializing in labor relations and employee-related work. It employs 25 professionals (7 partners and 18 associates) who work directly with its clients. Previously the firm accounted for all professional labor cost in a single direct-cost account and all other costs in a single indirect-cost pool. EEE (Click the icon to view the cost information and rates under the previous method.) C Partner Assoc. Kahn has just completed a review of its job-costing system. i (Click the icon to view the job-costing review information.) Budgeted information for 2020 related to the two direct-cost categories is as follows: (Click the icon to view the budgeted information.) Requirement 1. Compute the 2020 budgeted direct-cost rates for (a) professional partners and (b) professional associates. Begin by selecting the formula, then enter the amounts to compute both rates. (Abbreviations used: Assoc. = Associate.) Budgeted direct- cost rate per hour per hour per hour Requirement 2. Compute the 2020 budgeted indirect-cost rates for (a) general support and (b) secretarial support. Begin by selecting the formula, then enter the amounts to compute both rates. (Round your answers to the nearest whole dollar.) Budgeted indirect- cost rate per hour 20 Kahn & Associates is a law firm specializing in labor relations and employee-related work. It employs 25 professionals (7 partners and 18 associates) who work directly with its clients. Previously the firm accounted for all professional labor cost in a single direct-cost account and all other costs in a single indirect-cost pool. EEE (Click the icon to view the cost information and rates under the previous method.) General Secretarial *** Direct-costs: Professional partners Professional associates Kahn has just completed a review of its job-costing system. Begin by selecting the formula, then enter the amounts to compute both rates. (Round your answers to the nearest whole dollar.) Richardson, Inc. i (Click the icon to view the job-costing review information.) Budgeted information for 2020 related to the two direct-cost categories is as follows: (Click the icon to view the budgeted information.) Requirement 3. Compute the budgeted costs for the Richardson and Punch jobs based upon the hours each job is budgeted to use. = Punch, Inc. Budgeted indirect- cost rate per hour per hour per hour Kahn & Associates is a law firm specializing in labor relations and employee-related work. It employs 25 professionals (7 partners and 18 associates) who work directly with its clients. Previously the firm accounted for all professional labor cost in a single direct-cost account and all other costs in a single indirect-cost pool. (Click the icon to view the cost information and rates under the previous method.) Direct-costs: Professional partners Professional associates Direct-costs Indirect-costs General support Secretarial support Indirect-costs Requirement 3. Compute the budgeted costs for the Richardson and Punch jobs based upon the hours each job is budgeted to use. Total costs *** Richardson, Inc. Kahn has just completed a review of its job-costing system. i (Click the icon to view the job-costing review information.) Budgeted information for 2020 related to the two direct-cost categories is as follows: (Click the icon to view the budgeted information.) Punch, Inc. 11 Kahn & Associates is a law firm specializing in labor relations and employee-related work. It employs 25 professionals (7 partners and 18 associates) who work directly with its clients. Previously the firm accounted for all professional labor cost in a single direct-cost account and all other costs in a single indirect-cost pool. (Click the icon to view the cost information and rates under the previous method.) Secretarial support Indirect-costs Total costs Kahn has just completed a review of its job-costing system. The Richardson job has a relatively higher use of allocation method used in requirement 3 (Click the icon to view the job-costing review information.) Budgeted information for 2020 related to the two direct-cost categories is as follows: (Click the icon to view the budgeted information.) Requirement 4. Comment on the results in requirement 3. Why are the job costs different from those computed using the firm's previous method? In requirement 3 the cost system is than the firm's previous method. The vo jobs and therefore the the cost of the job when compared to the previous method. Requirement 5. Would you recommend Kahn & Associates use the job-costing system in the previous method or the job-costing system in this problem? Explain. Kahn & Associates is a law firm specializing in labor relations and employee-related work. It employs 25 professionals (7 partners and 18 associates) who work directly with its clients. Previously the firm accounted for all professional labor cost in a single direct-cost account and all other costs in a single indirect-cost pool. (Click the icon to view the cost information and rates under the previous method.) *** The Richardson job has a relatively higher use of allocation method used in requirement 3 Kahn has just completed a review of its job-costing system. (Click the icon to view the job-costing review information.) Budgeted information for 2020 related to the two direct-cost categories is as follows: (Click the icon to view the budgeted information.) Requirement 4. Comment on the results in requirement 3. Why are the job costs different from those computed using the firm's previous method? In requirement 3 the cost system is than the firm's previous method. The two jobs and therefore the the cost of the job when compared to the previous method. Requirement 5. Would you recommend Kahn & Associates use the job-costing system in the previous method or the job-costing system in this problem? Explain. I would recommend that Kahn & Associates use the job costing system two indirect- cost categories. The job costing system incurred on different jobs and therefore helps managers make better decisions. with two direct- and more accurately represents the costs The average budgeted total compensation per professional for 2020 is $110,000. Each professional is budgeted to have 2,000 billable hours to clients in 2020. All professionals work for clients to their maximum 2,000 billable hours available. All professional labor costs are included in a single direct-cost category and are traced to jobs on a per-hour basis. All costs of Kahn & Associates other than professional labor costs are included in a single indirect-cost pool (legal support) and are allocated to jobs using professional labor-hours as the allocation base. The budgeted level of indirect costs in 2020 is $2,250,000. The cost estimates for the Richardson, Inc. job, which requires 120 budgeted hours of professional labor and for the Punch, Inc. job, which requires 170 budgeted hours of professional labor are as follows: Direct-costs Indirect-costs Total costs $ 69 $ Richardson 6,600 $ 5,400 12,000 $ Punch 9,350 7,650 17,000 More info This review included a detailed analysis of how past jobs used the firm's resources and interviews with personnel about what factors drive the level of indirect costs. Management concluded that a system with two direct-cost categories (professional partner labor and professional associate labor) and two indirect-cost categories (general support and secretarial support) would yield more accurate job costs. Data table Number of professionals Hours of billable time per professional Total compensation (average per professional) Professional Partner Labor Total costs Cost-allocation base 7 2,000 per year 2,000 per year 243,000 $ 90,000 Budgeted information for 2020 relating to the two indirect-cost categories is as follows: General Support Secretarial Support 1,980,000 Professional Associate Labor Professional labor-hours 18 270,000 Partner labor-hours Kahn & Associates is a law firm specializing in labor relations and employee-related work. It employs 25 professionals (7 partners and 18 associates) who work directly with its clients. Previously the firm accounted for all professional labor cost in a single direct-cost account and all other costs in a single indirect-cost pool. EEE (Click the icon to view the cost information and rates under the previous method.) C Partner Assoc. Kahn has just completed a review of its job-costing system. i (Click the icon to view the job-costing review information.) Budgeted information for 2020 related to the two direct-cost categories is as follows: (Click the icon to view the budgeted information.) Requirement 1. Compute the 2020 budgeted direct-cost rates for (a) professional partners and (b) professional associates. Begin by selecting the formula, then enter the amounts to compute both rates. (Abbreviations used: Assoc. = Associate.) Budgeted direct- cost rate per hour per hour per hour Requirement 2. Compute the 2020 budgeted indirect-cost rates for (a) general support and (b) secretarial support. Begin by selecting the formula, then enter the amounts to compute both rates. (Round your answers to the nearest whole dollar.) Budgeted indirect- cost rate per hour 20 Kahn & Associates is a law firm specializing in labor relations and employee-related work. It employs 25 professionals (7 partners and 18 associates) who work directly with its clients. Previously the firm accounted for all professional labor cost in a single direct-cost account and all other costs in a single indirect-cost pool. EEE (Click the icon to view the cost information and rates under the previous method.) General Secretarial *** Direct-costs: Professional partners Professional associates Kahn has just completed a review of its job-costing system. Begin by selecting the formula, then enter the amounts to compute both rates. (Round your answers to the nearest whole dollar.) Richardson, Inc. i (Click the icon to view the job-costing review information.) Budgeted information for 2020 related to the two direct-cost categories is as follows: (Click the icon to view the budgeted information.) Requirement 3. Compute the budgeted costs for the Richardson and Punch jobs based upon the hours each job is budgeted to use. = Punch, Inc. Budgeted indirect- cost rate per hour per hour per hour Kahn & Associates is a law firm specializing in labor relations and employee-related work. It employs 25 professionals (7 partners and 18 associates) who work directly with its clients. Previously the firm accounted for all professional labor cost in a single direct-cost account and all other costs in a single indirect-cost pool. (Click the icon to view the cost information and rates under the previous method.) Direct-costs: Professional partners Professional associates Direct-costs Indirect-costs General support Secretarial support Indirect-costs Requirement 3. Compute the budgeted costs for the Richardson and Punch jobs based upon the hours each job is budgeted to use. Total costs *** Richardson, Inc. Kahn has just completed a review of its job-costing system. i (Click the icon to view the job-costing review information.) Budgeted information for 2020 related to the two direct-cost categories is as follows: (Click the icon to view the budgeted information.) Punch, Inc. 11 Kahn & Associates is a law firm specializing in labor relations and employee-related work. It employs 25 professionals (7 partners and 18 associates) who work directly with its clients. Previously the firm accounted for all professional labor cost in a single direct-cost account and all other costs in a single indirect-cost pool. (Click the icon to view the cost information and rates under the previous method.) Secretarial support Indirect-costs Total costs Kahn has just completed a review of its job-costing system. The Richardson job has a relatively higher use of allocation method used in requirement 3 (Click the icon to view the job-costing review information.) Budgeted information for 2020 related to the two direct-cost categories is as follows: (Click the icon to view the budgeted information.) Requirement 4. Comment on the results in requirement 3. Why are the job costs different from those computed using the firm's previous method? In requirement 3 the cost system is than the firm's previous method. The vo jobs and therefore the the cost of the job when compared to the previous method. Requirement 5. Would you recommend Kahn & Associates use the job-costing system in the previous method or the job-costing system in this problem? Explain. Kahn & Associates is a law firm specializing in labor relations and employee-related work. It employs 25 professionals (7 partners and 18 associates) who work directly with its clients. Previously the firm accounted for all professional labor cost in a single direct-cost account and all other costs in a single indirect-cost pool. (Click the icon to view the cost information and rates under the previous method.) *** The Richardson job has a relatively higher use of allocation method used in requirement 3 Kahn has just completed a review of its job-costing system. (Click the icon to view the job-costing review information.) Budgeted information for 2020 related to the two direct-cost categories is as follows: (Click the icon to view the budgeted information.) Requirement 4. Comment on the results in requirement 3. Why are the job costs different from those computed using the firm's previous method? In requirement 3 the cost system is than the firm's previous method. The two jobs and therefore the the cost of the job when compared to the previous method. Requirement 5. Would you recommend Kahn & Associates use the job-costing system in the previous method or the job-costing system in this problem? Explain. I would recommend that Kahn & Associates use the job costing system two indirect- cost categories. The job costing system incurred on different jobs and therefore helps managers make better decisions. with two direct- and more accurately represents the costs The average budgeted total compensation per professional for 2020 is $110,000. Each professional is budgeted to have 2,000 billable hours to clients in 2020. All professionals work for clients to their maximum 2,000 billable hours available. All professional labor costs are included in a single direct-cost category and are traced to jobs on a per-hour basis. All costs of Kahn & Associates other than professional labor costs are included in a single indirect-cost pool (legal support) and are allocated to jobs using professional labor-hours as the allocation base. The budgeted level of indirect costs in 2020 is $2,250,000. The cost estimates for the Richardson, Inc. job, which requires 120 budgeted hours of professional labor and for the Punch, Inc. job, which requires 170 budgeted hours of professional labor are as follows: Direct-costs Indirect-costs Total costs $ 69 $ Richardson 6,600 $ 5,400 12,000 $ Punch 9,350 7,650 17,000 More info This review included a detailed analysis of how past jobs used the firm's resources and interviews with personnel about what factors drive the level of indirect costs. Management concluded that a system with two direct-cost categories (professional partner labor and professional associate labor) and two indirect-cost categories (general support and secretarial support) would yield more accurate job costs. Data table Number of professionals Hours of billable time per professional Total compensation (average per professional) Professional Partner Labor Total costs Cost-allocation base 7 2,000 per year 2,000 per year 243,000 $ 90,000 Budgeted information for 2020 relating to the two indirect-cost categories is as follows: General Support Secretarial Support 1,980,000 Professional Associate Labor Professional labor-hours 18 270,000 Partner labor-hours Kahn & Associates is a law firm specializing in labor relations and employee-related work. It employs 25 professionals (7 partners and 18 associates) who work directly with its clients. Previously the firm accounted for all professional labor cost in a single direct-cost account and all other costs in a single indirect-cost pool. EEE (Click the icon to view the cost information and rates under the previous method.) C Partner Assoc. Kahn has just completed a review of its job-costing system. i (Click the icon to view the job-costing review information.) Budgeted information for 2020 related to the two direct-cost categories is as follows: (Click the icon to view the budgeted information.) Requirement 1. Compute the 2020 budgeted direct-cost rates for (a) professional partners and (b) professional associates. Begin by selecting the formula, then enter the amounts to compute both rates. (Abbreviations used: Assoc. = Associate.) Budgeted direct- cost rate per hour per hour per hour Requirement 2. Compute the 2020 budgeted indirect-cost rates for (a) general support and (b) secretarial support. Begin by selecting the formula, then enter the amounts to compute both rates. (Round your answers to the nearest whole dollar.) Budgeted indirect- cost rate per hour 20 Kahn & Associates is a law firm specializing in labor relations and employee-related work. It employs 25 professionals (7 partners and 18 associates) who work directly with its clients. Previously the firm accounted for all professional labor cost in a single direct-cost account and all other costs in a single indirect-cost pool. EEE (Click the icon to view the cost information and rates under the previous method.) General Secretarial *** Direct-costs: Professional partners Professional associates Kahn has just completed a review of its job-costing system. Begin by selecting the formula, then enter the amounts to compute both rates. (Round your answers to the nearest whole dollar.) Richardson, Inc. i (Click the icon to view the job-costing review information.) Budgeted information for 2020 related to the two direct-cost categories is as follows: (Click the icon to view the budgeted information.) Requirement 3. Compute the budgeted costs for the Richardson and Punch jobs based upon the hours each job is budgeted to use. = Punch, Inc. Budgeted indirect- cost rate per hour per hour per hour Kahn & Associates is a law firm specializing in labor relations and employee-related work. It employs 25 professionals (7 partners and 18 associates) who work directly with its clients. Previously the firm accounted for all professional labor cost in a single direct-cost account and all other costs in a single indirect-cost pool. (Click the icon to view the cost information and rates under the previous method.) Direct-costs: Professional partners Professional associates Direct-costs Indirect-costs General support Secretarial support Indirect-costs Requirement 3. Compute the budgeted costs for the Richardson and Punch jobs based upon the hours each job is budgeted to use. Total costs *** Richardson, Inc. Kahn has just completed a review of its job-costing system. i (Click the icon to view the job-costing review information.) Budgeted information for 2020 related to the two direct-cost categories is as follows: (Click the icon to view the budgeted information.) Punch, Inc. 11 Kahn & Associates is a law firm specializing in labor relations and employee-related work. It employs 25 professionals (7 partners and 18 associates) who work directly with its clients. Previously the firm accounted for all professional labor cost in a single direct-cost account and all other costs in a single indirect-cost pool. (Click the icon to view the cost information and rates under the previous method.) Secretarial support Indirect-costs Total costs Kahn has just completed a review of its job-costing system. The Richardson job has a relatively higher use of allocation method used in requirement 3 (Click the icon to view the job-costing review information.) Budgeted information for 2020 related to the two direct-cost categories is as follows: (Click the icon to view the budgeted information.) Requirement 4. Comment on the results in requirement 3. Why are the job costs different from those computed using the firm's previous method? In requirement 3 the cost system is than the firm's previous method. The vo jobs and therefore the the cost of the job when compared to the previous method. Requirement 5. Would you recommend Kahn & Associates use the job-costing system in the previous method or the job-costing system in this problem? Explain. Kahn & Associates is a law firm specializing in labor relations and employee-related work. It employs 25 professionals (7 partners and 18 associates) who work directly with its clients. Previously the firm accounted for all professional labor cost in a single direct-cost account and all other costs in a single indirect-cost pool. (Click the icon to view the cost information and rates under the previous method.) *** The Richardson job has a relatively higher use of allocation method used in requirement 3 Kahn has just completed a review of its job-costing system. (Click the icon to view the job-costing review information.) Budgeted information for 2020 related to the two direct-cost categories is as follows: (Click the icon to view the budgeted information.) Requirement 4. Comment on the results in requirement 3. Why are the job costs different from those computed using the firm's previous method? In requirement 3 the cost system is than the firm's previous method. The two jobs and therefore the the cost of the job when compared to the previous method. Requirement 5. Would you recommend Kahn & Associates use the job-costing system in the previous method or the job-costing system in this problem? Explain. I would recommend that Kahn & Associates use the job costing system two indirect- cost categories. The job costing system incurred on different jobs and therefore helps managers make better decisions. with two direct- and more accurately represents the costs

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To solve the given problem lets go step by step Requirement 1 To compute the 2020 budgeted directcost rates for professional partners and professional associates we need to divide the total c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started