Question

The average duration of the loans is 10 years. The average duration of the deposits is 3 years. If the current (spot) rate for one-year

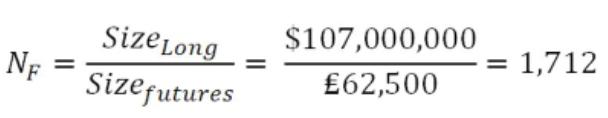

If the current (spot) rate for one-year British pound futures is currently at $1.58/≤ and each contract size is ≤62,500.

If the current (spot) rate for one-year British pound futures is currently at $1.58/≤ and each contract size is ≤62,500.

How many contracts are required to be purchased or sold in order to fully hedge against the pound exposure? (Assume no basis risk). Buy 1,712 BP futures.

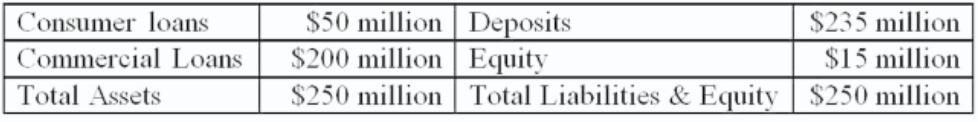

Consumer loans Commercial Loans Total Assets $50 million $200 million Deposits Equity $235 million $15 million $250 million Total Liabilities & Equity $250 million

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Given Consumer Loans 50 million Commercial Loans 235 million Total Assets 250 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting Financial Statement Analysis And Valuation A Strategic Perspective

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

9th Edition

1337614689, 1337614688, 9781337668262, 978-1337614689

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App