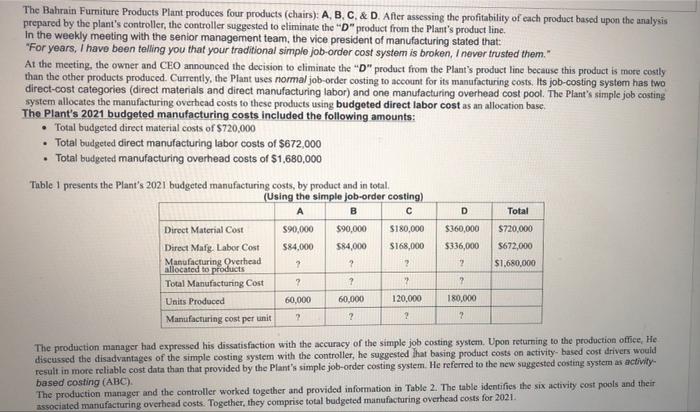

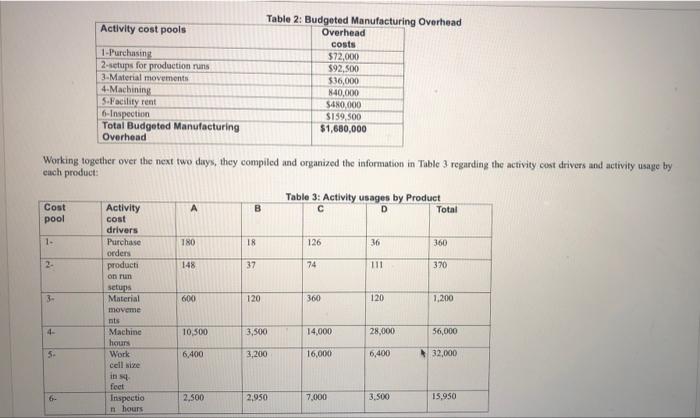

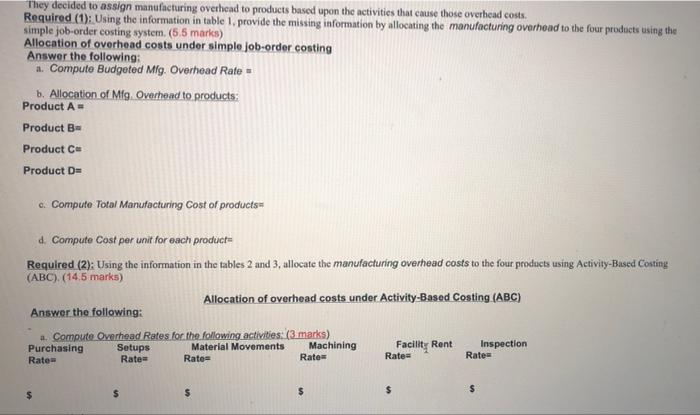

The Bahrain Furniture Products Plant produces four products (chairs): A, B, C, \& D. After assessing the profitability of each product based upon the analysis prepared by the plant's controller, the controller suggested to eliminate the " D " product from the Plant's product line. In the weekly meeting with the senior management team, the vice president of manufacturing stated that: "For years, I have been telling you that your traditional simple job-order cost system is broken, I never trusted them." At the meeting, the owner and CEO announced the decision to eliminate the "D" product from the Plant's product line because this product is more costly than the other products produced. Currently, the Plant uses nomal job-order costing to account for its manufacturing costs. Its job-costing system has two direct-cost categories (direct materials and direct manufacturing labor) and one manufacturing overhead cost pool. The Plant's simple job costing system allocates the manufacturing overhead costs to these products using budgeted direct labor cost as an allocation base: The Plant's 2021 budgeted manufacturing costs included the following amounts: - Total budgeted direct material costs of $720,000 - Total budgeted direct manufacturing labor costs of $672,000 - Total budgeted manufacturing overhead costs of $1,680,000 Thble 1 presents the Plant's 2021 budgeted manufacturing costs, by product and in total, (Usina the simple iob.order costinal The production manager had expressed his dissatisfaction with the accuracy of the simple job costing system. Upon returning to the production office, He discussed the disadvantages of the simple costing system with the controller, he suggested that basing product costs on activity- hased cort afrivers would result in more reliable cost data than that provided by the Plant's simple job-order costing system. He referred to the new saggested costing systera as activily. based costing (ABC). The production manager and the controller worked together and provided information in Table 2 . The table identifies the six activity cost pools and their zssociated manufacturing overhead costs. Together, they comprise total budgeted manufactaring overhead costs for 2021 . y Ovorhead Working together over the next two days, they compiled and organized the information in Table 3 regarding the activity cost drivers and activity usage by cach product: They decided to assign manufacturing overhead to products based upon the activities that cause those overhead costs. Required (1): Using the information in table 1, provide the missing information by allocating the manufacturing overhead to the four prodocts using the simple job-order costing system. ( 5.5 marks) Allocation of overhead costs under simple job-order costing Answer the following: a. Compute Budgoted Mig. Overhead Rate = b. Allocation of Mig. Overhead to products: Product A= Product Ba Product C= Product D= c. Compute Total Manufacturing Cost of products= d. Compute Cost per unit for each product= Required (2): Using the information in the tables 2 and 3 , allocate the manufacturing overhead costs to the four prodacts using Activity-Based Costing (ABC),(14.5 marks ) Answer the following: Allocation of overhead costs under Activity-Based Costing (ABC) b. Compute Total Manufacturing overhead of products= c. Compute Total Manufacturing Cost of products= d. Compute Cost per unit for each product= e. Which product is more costly? f. Recommend which activity cost drivers should be reduced to reduce the overhead costs? Required (3): Compare the results in requirements 1 and 2. (3 marks) Do you agree with the controller in the Plant to eliminate the " D product from the Plant's product line? and Why