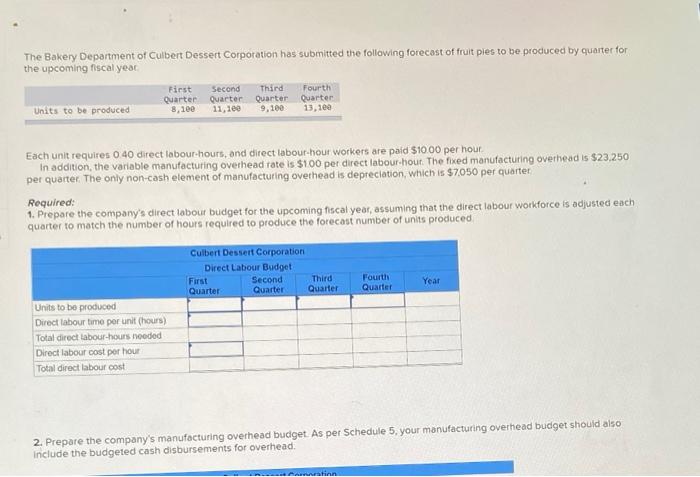

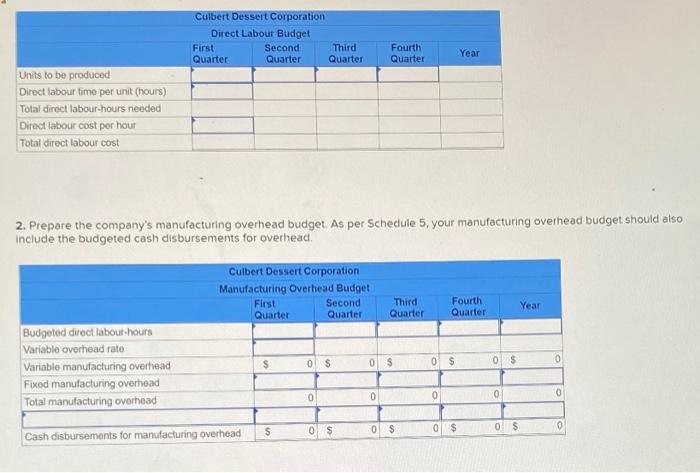

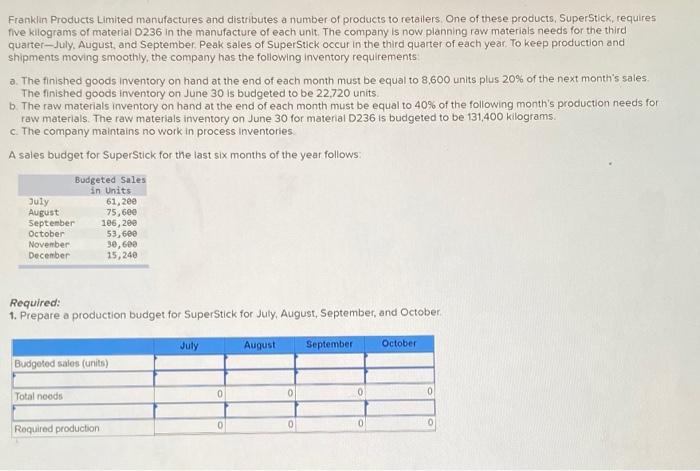

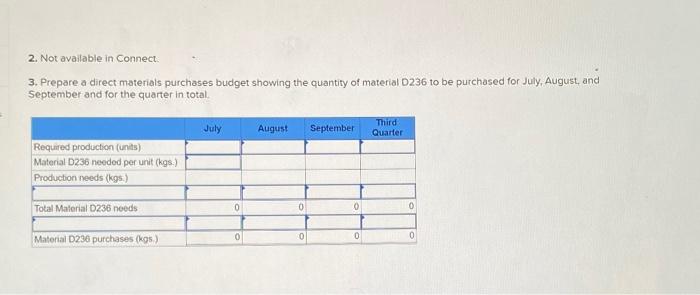

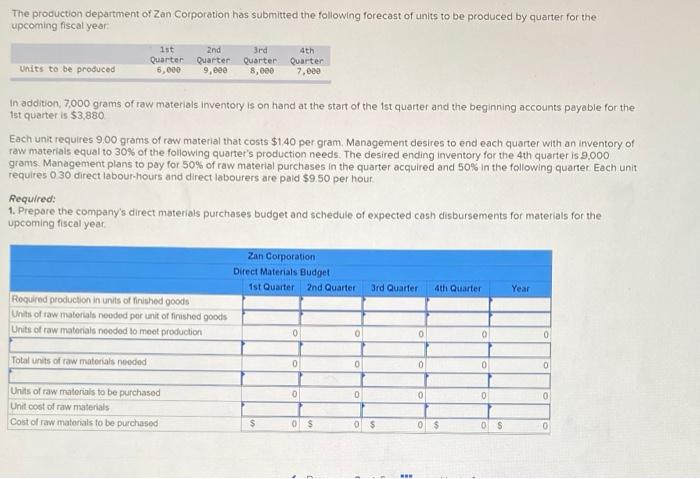

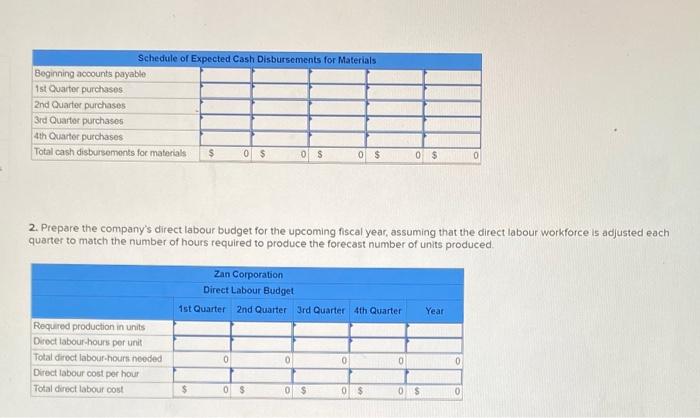

The Bakery Department of Culbert Dessert Corporation has submitted the following forecast of fruit ples to be produced by quarter for the upcoming fiscal year First Second Third Fourth Quarter Quarter Quarter Quarter Units to be produced 8,100 11,100 9,100 13,100 Each unit requires 0 40 direct labour-hours, and direct labour hour workers are paid $10.00 per hour In addition, the variable manufacturing overhead rate is $100 per direct labour hour. The fixed manufacturing overhead is $23.250 per quarter. The only non-cash element of manufacturing overhead is depreciation, which is $7050 per quarter Required: 1. Prepare the company's direct labour budget for the upcoming fiscal year, assuming that the direct labour workforce is adjusted each quarter to match the number of hours required to produce the forecast number of units produced Culbert Dessert Corporation Direct Labour Budget First Second Third Quarter Quarter Quarter Fourth Quarter Year Units to be produced Direct labour time per unit (hours) Total direct labour-hours needed Direct labour cost per hour Total direct labour cost 2. Prepare the company's manufacturing overhead budget. As per Schedule 5, your manufacturing overhead budget should also include the budgeted cash disbursements for overhead tinn Culbert Dessert Corporation Direct Labour Budget First Second Third Quarter Quarter Quarter Fourth Quarter Year Units to be produced Direct labour time per unit (hours) Total direct labour-hours needed Direct labour cost por hour Total direct labour cost 2. Prepare the company's manufacturing overhead budget. As per Schedule 5, your manufacturing overhead budget should also include the budgeted cash disbursements for overhead Culbert Dessert Corporation Manufacturing Overhead Budget First Second Quarter Quarter Third Quarter Fourth Quarter Year $ 0 $ Budgeted direct labour-hours Variable overhead rate Variable manufacturing overhead Fixed manufacturing overhead Total manufacturing overhead 0 $ 0 $ 0 0 $ 0 0 0 0 0 0 $ $ 0 0 $ $ 0 0 $ Cash disbursements for manufacturing overhead Franklin Products Limited manufactures and distributes a number of products to retailers. One of these products, SuperStick, requires five kilograms of material D236 in the manufacture of each unit. The company is now planning raw materials needs for the third quarter--July, August, and September. Peak sales of SuperStick occur in the third quarter of each year. To keep production and shipments moving smoothly, the company has the following Inventory requirements a. The finished goods inventory on hand at the end of each month must be equal to 8,600 units plus 20% of the next month's sales The finished goods inventory on June 30 is budgeted to be 22,720 units b The raw materials inventory on hand at the end of each month must be equal to 40% of the following month's production needs for raw materials. The raw materials inventory on June 30 for material D236 is budgeted to be 131,400 kilograms. c. The company maintains no work in process inventories A sales budget for SuperStick for the last six months of the year follows: Budgeted Sales in Units July 61,200 August 75,6ee September 106,200 October 53,600 November 30, 600 December 15,240 Required: 1. Prepare a production budget for Super Stick for July August, September, and October July August September October Budgeted sales (unit) 0 0 0 0 Total noods 0 0 0 Roquired production 2. Not available in Connect 3. Prepare a direct materials purchases budget showing the quantity of material D236 to be purchased for July, August, and September and for the quarter in total July August September Third Quarter Required production (units) Material D236 needed per unit (kgs.) Production needs (kos) Total Material D236 needs 0 0 0 0 0 0 0 Material D236 purchases (kos) 0 The production department of Zan Corporation has submitted the following forecast of units to be produced by quarter for the upcoming fiscal year units to be produced ist 2nd Quarter Quarter 5,000 9, eee 3rd 4th Quarter Quarter 8,000 7.000 In addition, 7.000 grams of raw materials inventory is on hand at the start of the 1st quarter and the beginning accounts payable for the Ist quarter is $3,880 Each unit requires 9.00 grams of raw material that costs $140 per gram Management desires to end each quarter with an inventory of raw materials equal to 30% of the following quarter's production needs. The desired ending inventory for the 4th quarter is 9,000 grams Management plans to pay for 50% of raw material purchases in the quarter acquired and 50% In the following quarter Each unit requires o 30 direct labour-hours and direct labourers are paid $9.50 per hour. Required: 1. Prepare the company's direct materials purchases budget and schedule of expected cash disbursements for materials for the upcoming fiscal year Zan Corporation Direct Materials Budget 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Year Roquired production in units of finished goods Units of raw materials nooded per unit of finished goods Units of raw materials needed to meet production 0 0 0 0 0 Total units of raw materials needed 0 0 0 0 0 0 0 0 0 0 Units of raw materials to be purchased Unit cost of raw materials Cost of raw materials to be purchased $ 0 $ 05 0 $ OS 0 Schedule of Expected Cash Disbursements for Materials Beginning accounts payablo 1st Quarter purchases 2nd Quarter purchases 3rd Quarter purchases 4th Quarter purchases Total cash disbursements for materials $ 0 $ 0 $ 0 $ 0 $ 0 2. Prepare the company's direct labour budget for the upcoming fiscal year, assuming that the direct labour workforce is adjusted each quarter to match the number of hours required to produce the forecast number of units produced Zan Corporation Direct Labour Budget 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Year Required production in units Direct labour-hours per unit Total direct labour-hours needed Direct labour cost per hour Total direct labour cost 0 0 0 0 0 $ 0$ 0 $ 0 $ OS 0