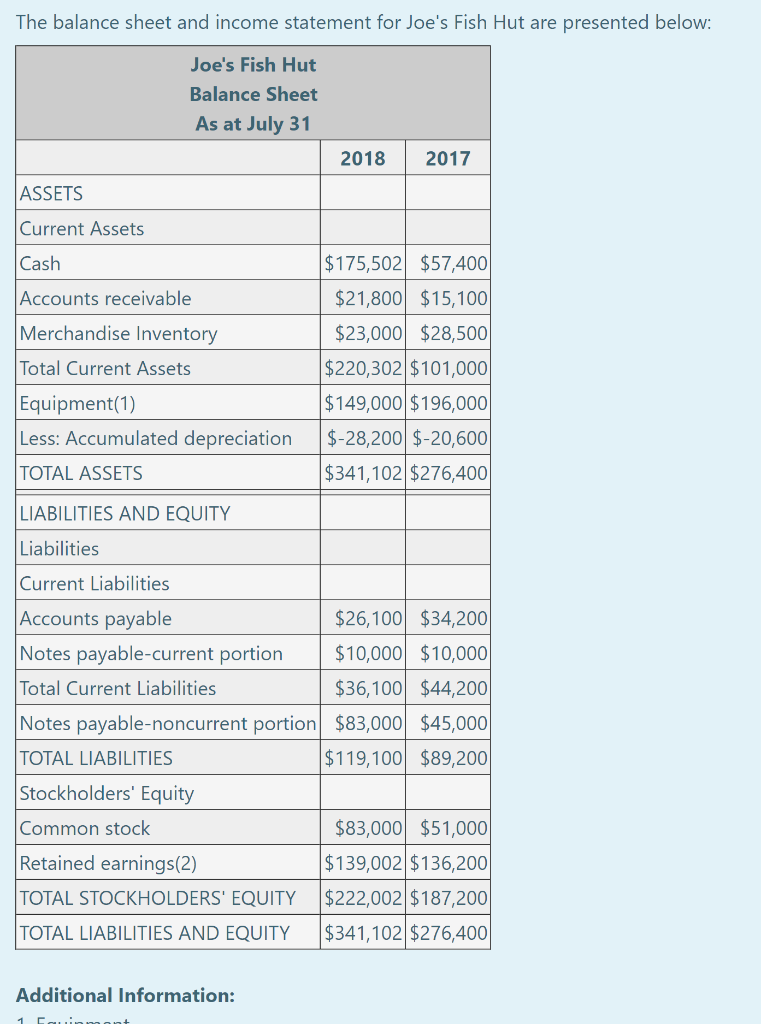

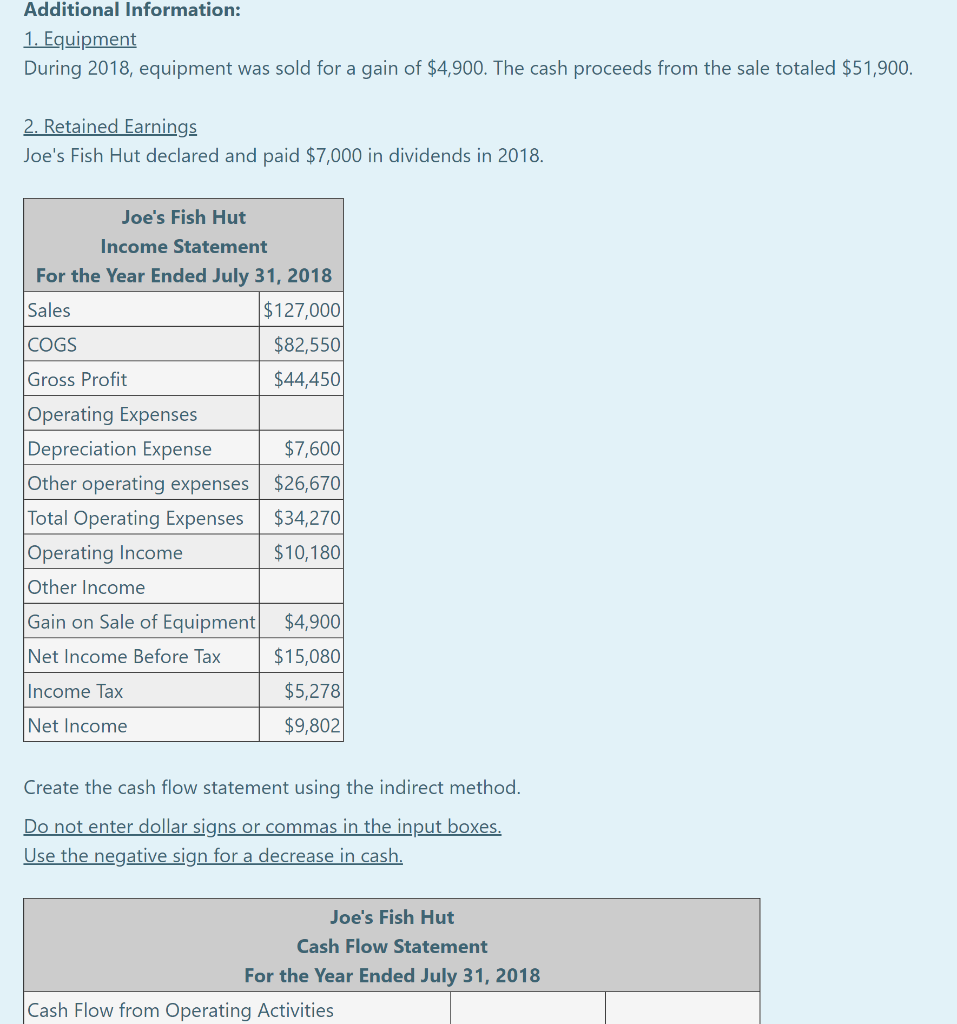

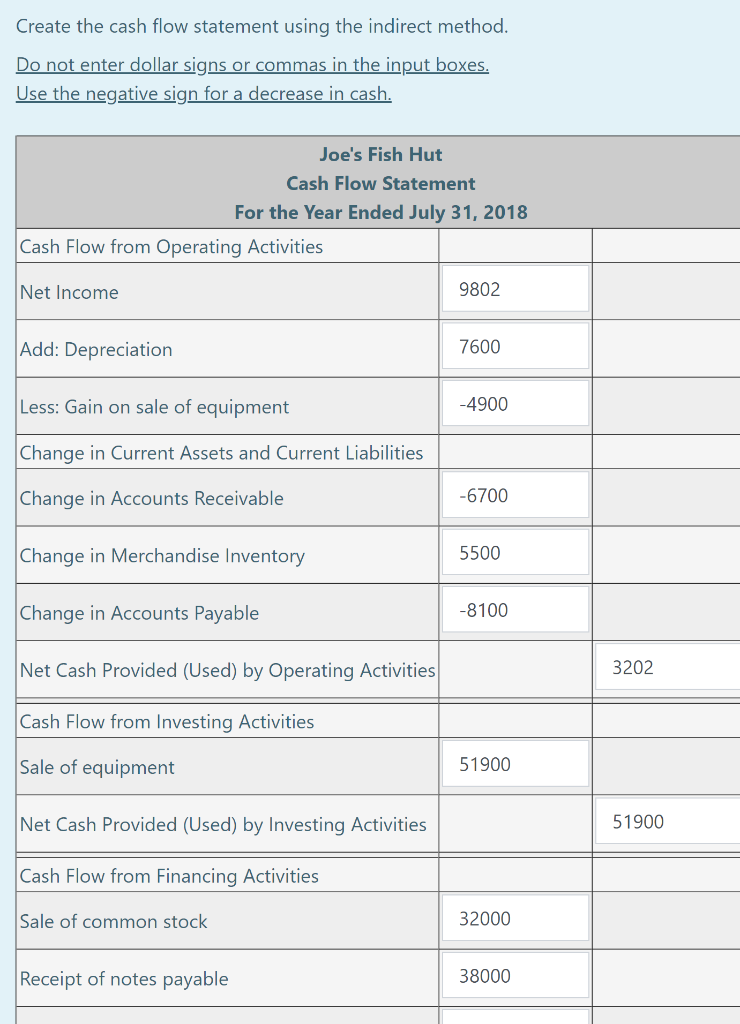

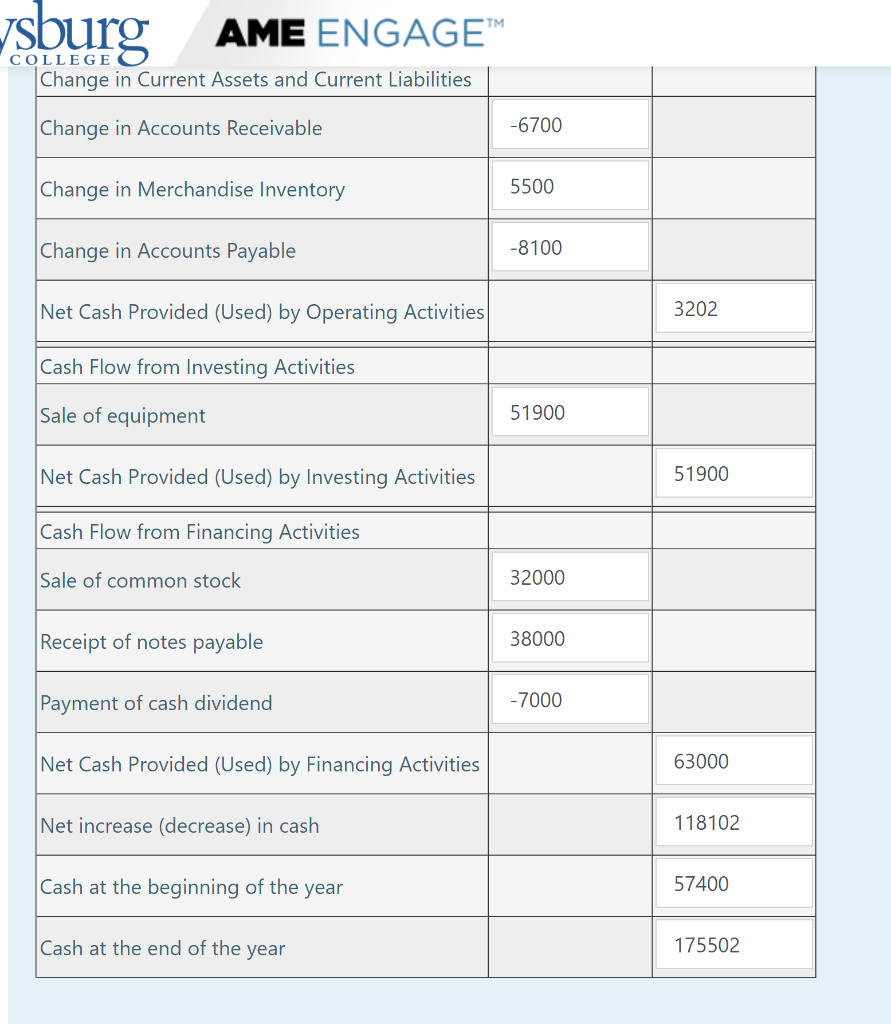

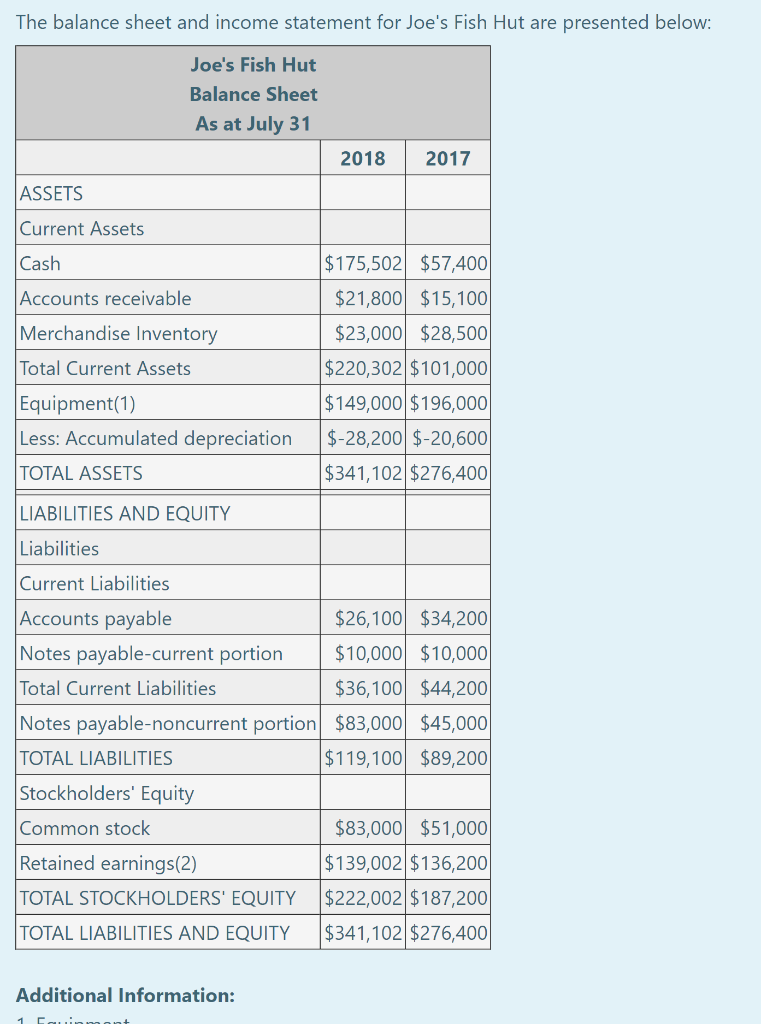

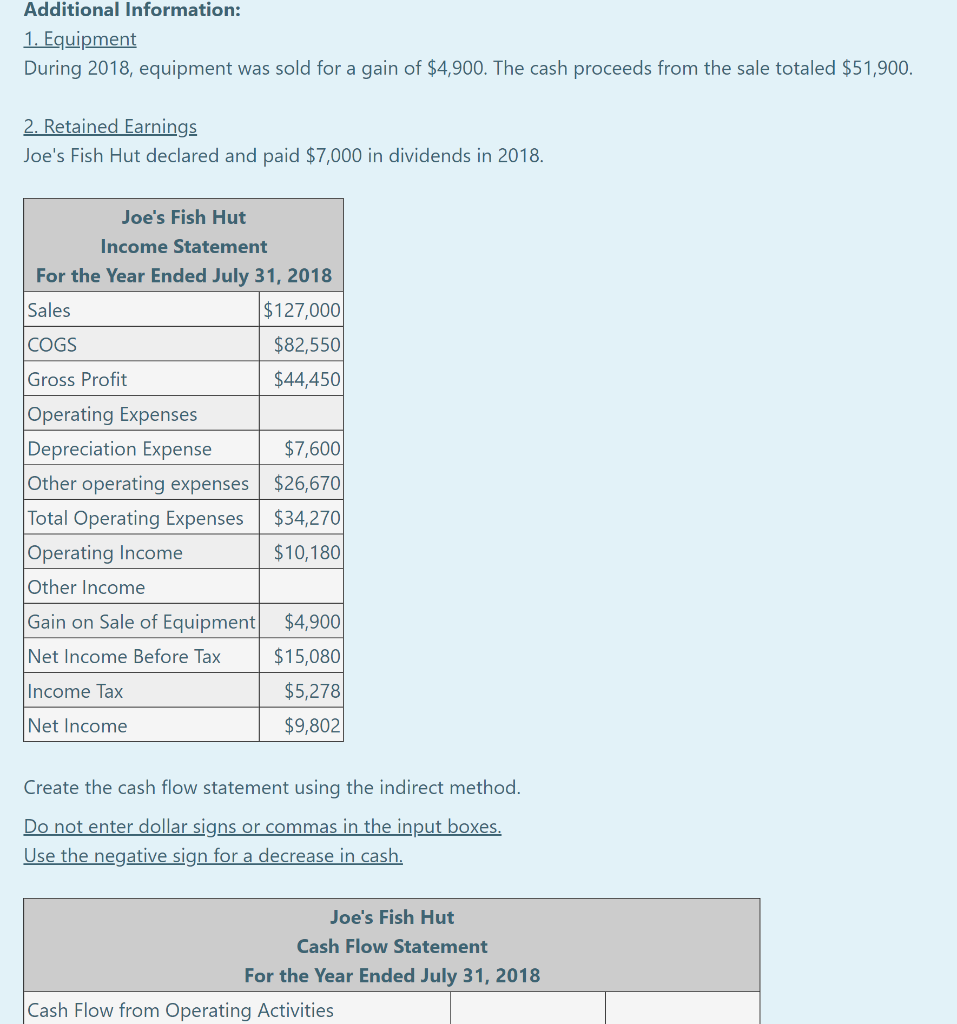

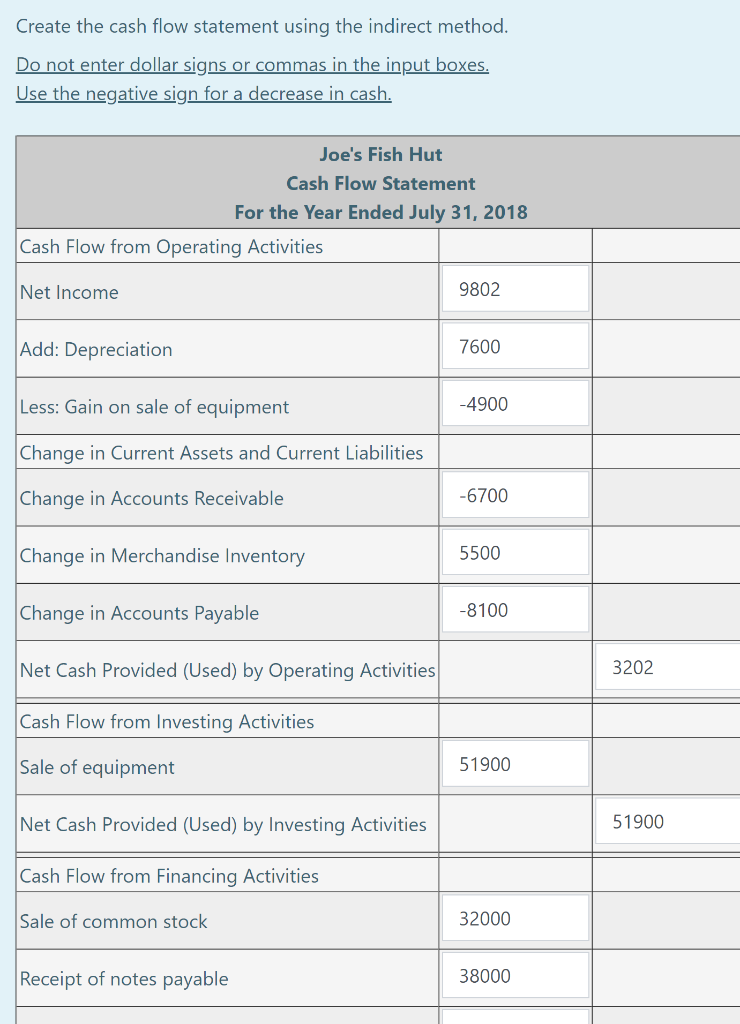

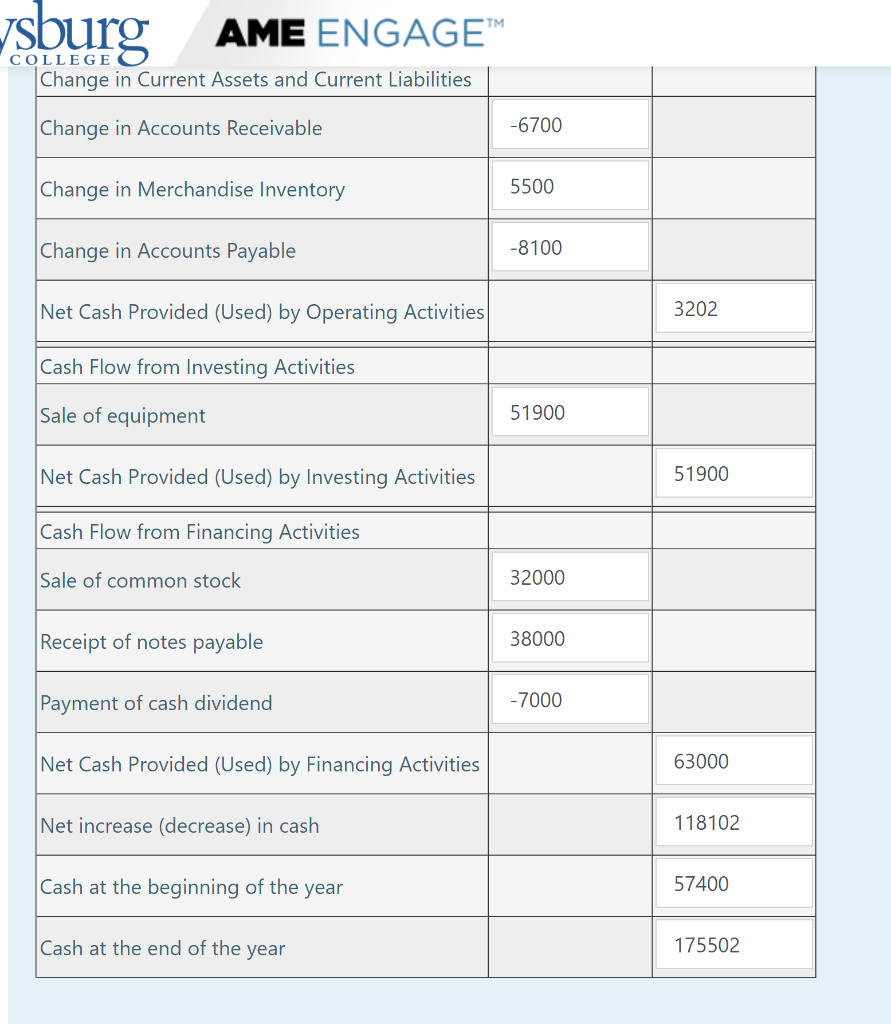

The balance sheet and income statement for Joe's Fish Hut are presented below: Joe's Fish Hut Balance Sheet As at July 31 2018 2017 ASSETS Current Assets Cash Accounts receivable Merchandise Inventory Total Current Assets Equipment(1) Less: Accumulated depreciation TOTAL ASSETS $175,502 $57,400 $21,800 $15,100 $23,000 $28,500 $220,302 $101,000 $149,000 $196,000 $-28,200 $-20,600 $341,102 $276,400 LIABILITIES AND EQUITY Liabilities Current Liabilities Accounts payable $26,100 $34,200 Notes payable-current portion $10,000 $10,000 Total Current Liabilities $36,100 $44,200 Notes payable-noncurrent portion $83,000 $45,000 TOTAL LIABILITIES $119,100 $89,200 Stockholders' Equity Common stock $83,000 $51,000 Retained earnings(2) $139,002 $136,200 TOTAL STOCKHOLDERS' EQUITY $222,002 $187,200 TOTAL LIABILITIES AND EQUITY $341,102 $276,400 Additional Information: 1 Cinnant Create the cash flow statement using the indirect method. Do not enter dollar signs or commas in the input boxes. Use the negative sign for a decrease in cash. Joe's Fish Hut Cash Flow Statement For the Year Ended July 31, 2018 Cash Flow from Operating Activities Net Income 9802 Add: Depreciation 7600 Less: Gain on sale of equipment -4900 Change in Current Assets and Current Liabilities Change in Accounts Receivable -6700 Change in Merchandise Inventory 5500 Change in Accounts Payable -8100 Net Cash Provided (Used) by Operating Activities 3202 Cash Flow from Investing Activities Sale of equipment 51900 Net Cash Provided (Used) by Investing Activities 51900 Cash Flow from Financing Activities Sale of common stock 32000 Receipt of notes payable 38000 sburg COLLEGE AME ENGAGEM Change in Current Assets and Current Liabilities Change in Accounts Receivable -6700 Change in Merchandise Inventory 5500 Change in Accounts Payable -8100 Net Cash Provided (Used) by Operating Activities 3202 Cash Flow from Investing Activities Sale of equipment 51900 Net Cash Provided (Used) by Investing Activities 51900 Cash Flow from Financing Activities Sale of common stock 32000 Receipt of notes payable 38000 Payment of cash dividend -7000 Net Cash Provided (Used) by Financing Activities 63000 Net increase (decrease) in cash 118102 Cash at the beginning of the year 57400 Cash at the end of the year 175502 Based on your calculations, analyze the financial condition of the company. 7 B $ The balance sheet and income statement for Joe's Fish Hut are presented below: Joe's Fish Hut Balance Sheet As at July 31 2018 2017 ASSETS Current Assets Cash Accounts receivable Merchandise Inventory Total Current Assets Equipment(1) Less: Accumulated depreciation TOTAL ASSETS $175,502 $57,400 $21,800 $15,100 $23,000 $28,500 $220,302 $101,000 $149,000 $196,000 $-28,200 $-20,600 $341,102 $276,400 LIABILITIES AND EQUITY Liabilities Current Liabilities Accounts payable $26,100 $34,200 Notes payable-current portion $10,000 $10,000 Total Current Liabilities $36,100 $44,200 Notes payable-noncurrent portion $83,000 $45,000 TOTAL LIABILITIES $119,100 $89,200 Stockholders' Equity Common stock $83,000 $51,000 Retained earnings(2) $139,002 $136,200 TOTAL STOCKHOLDERS' EQUITY $222,002 $187,200 TOTAL LIABILITIES AND EQUITY $341,102 $276,400 Additional Information: 1 Cinnant Create the cash flow statement using the indirect method. Do not enter dollar signs or commas in the input boxes. Use the negative sign for a decrease in cash. Joe's Fish Hut Cash Flow Statement For the Year Ended July 31, 2018 Cash Flow from Operating Activities Net Income 9802 Add: Depreciation 7600 Less: Gain on sale of equipment -4900 Change in Current Assets and Current Liabilities Change in Accounts Receivable -6700 Change in Merchandise Inventory 5500 Change in Accounts Payable -8100 Net Cash Provided (Used) by Operating Activities 3202 Cash Flow from Investing Activities Sale of equipment 51900 Net Cash Provided (Used) by Investing Activities 51900 Cash Flow from Financing Activities Sale of common stock 32000 Receipt of notes payable 38000 sburg COLLEGE AME ENGAGEM Change in Current Assets and Current Liabilities Change in Accounts Receivable -6700 Change in Merchandise Inventory 5500 Change in Accounts Payable -8100 Net Cash Provided (Used) by Operating Activities 3202 Cash Flow from Investing Activities Sale of equipment 51900 Net Cash Provided (Used) by Investing Activities 51900 Cash Flow from Financing Activities Sale of common stock 32000 Receipt of notes payable 38000 Payment of cash dividend -7000 Net Cash Provided (Used) by Financing Activities 63000 Net increase (decrease) in cash 118102 Cash at the beginning of the year 57400 Cash at the end of the year 175502 Based on your calculations, analyze the financial condition of the company. 7 B $