Answered step by step

Verified Expert Solution

Question

1 Approved Answer

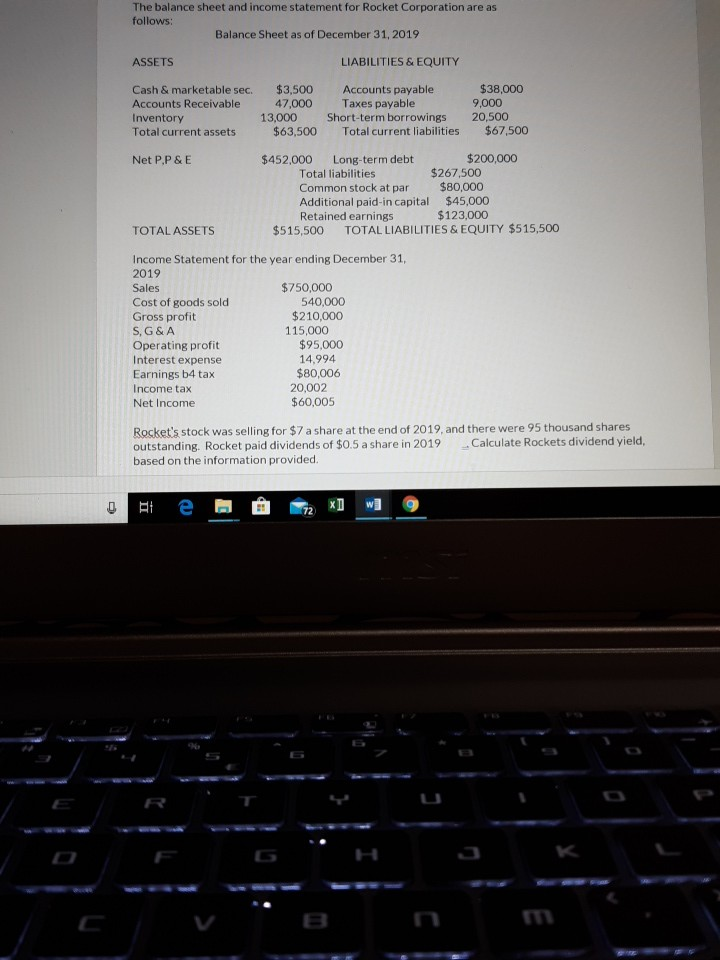

The balance sheet and income statement for Rocket Corporation are as follows: Balance Sheet as of December 31, 2019 ASSETS LIABILITIES & EQUITY Cash &

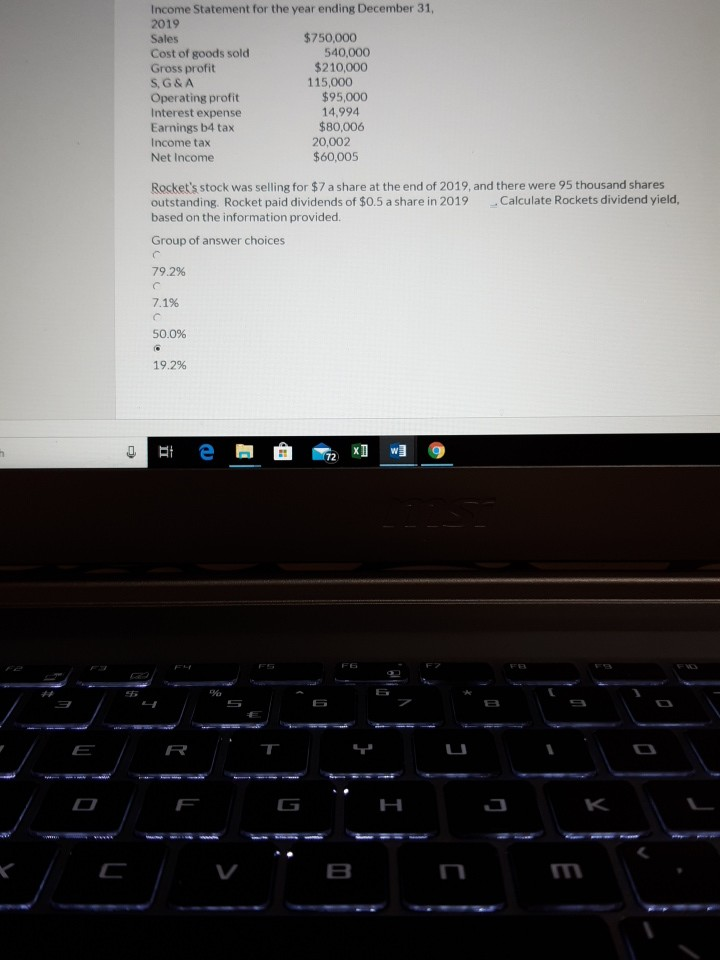

The balance sheet and income statement for Rocket Corporation are as follows: Balance Sheet as of December 31, 2019 ASSETS LIABILITIES & EQUITY Cash & marketable sec. $3,500 Accounts payable $38,000 Accounts Receivable 47,000 Taxes payable 9,000 Inventory 13,000 Short-term borrowings 20,500 Total current assets $63,500 Total current liabilities $67,500 Net P.P & E $452.000 Long-term debt $200,000 Total liabilities $267,500 Common stock at par $80,000 Additional paid-in capital $45,000 Retained earnings $123,000 TOTAL ASSETS $515,500 TOTAL LIABILITIES & EQUITY $515,500 Income Statement for the year ending December 31, 2019 Sales $750,000 Cost of goods sold 540,000 Gross profit $210,000 S, G&A 115,000 Operating profit $95,000 Interest expense 14.994 Earnings b4 tax $80,006 Income tax 20,002 Net Income $60,005 Rocket's stock was selling for $7 a share at the end of 2019, and there were 95 thousand shares outstanding. Rocket paid dividends of $0.5 a share in 2019 Calculate Rockets dividend yield, based on the information provided. At e B Income Statement for the year ending December 31, 2019 Sales $750,000 Cost of goods sold 540,000 Gross profit $210,000 SG&A 115,000 Operating profit $95,000 Interest expense 14.994 Earnings b4 tax $80,006 Income tax 20,002 Net Income $60,005 Rocket's stock was selling for $7 a share at the end of 2019, and there were 95 thousand shares outstanding. Rocket paid dividends of $0.5 a share in 2019 Calculate Rockets dividend yield, based on the information provided. Group of answer choices 79.2% 7.1% 50.0% 19.2% e CH x] g 172 FE % B

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started