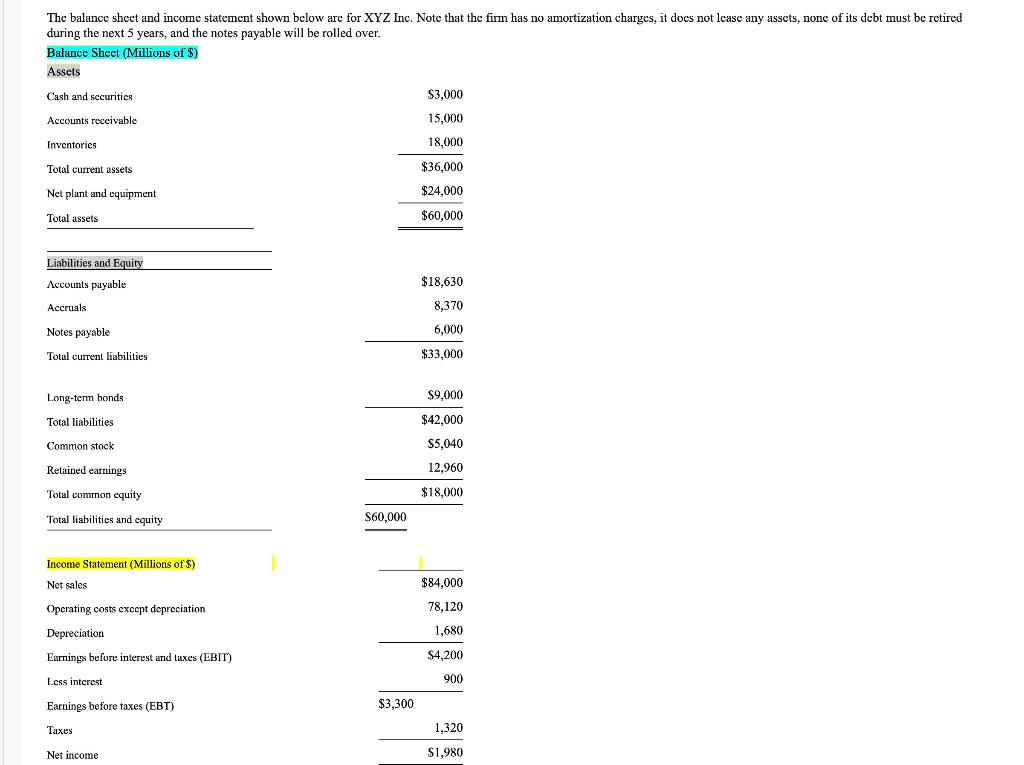

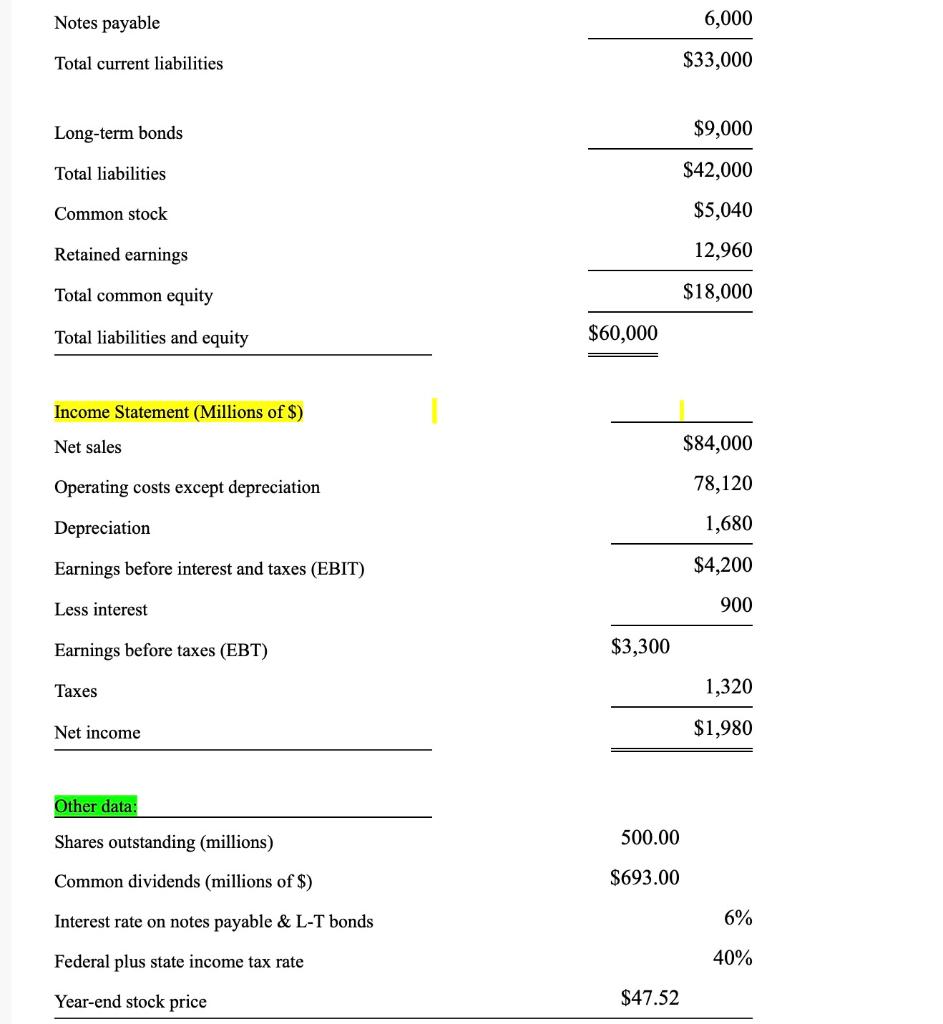

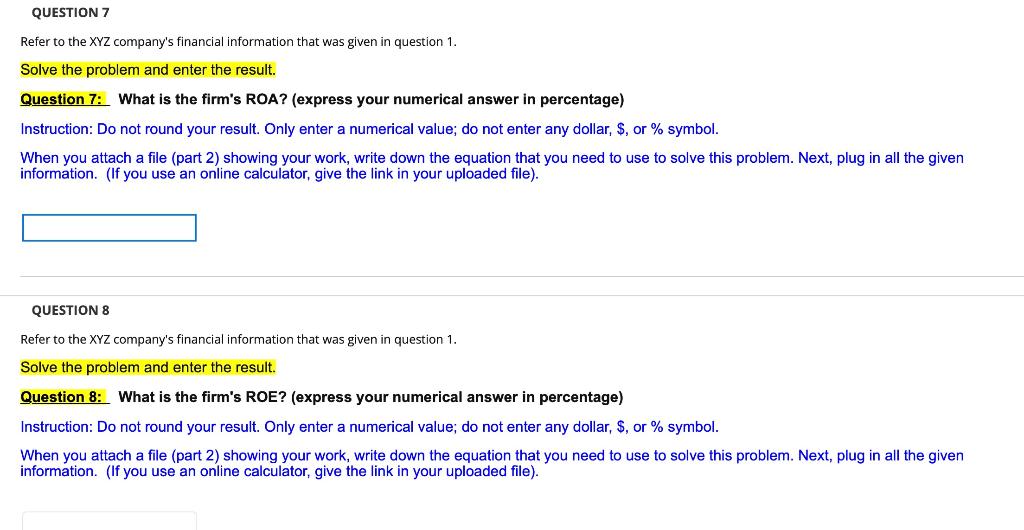

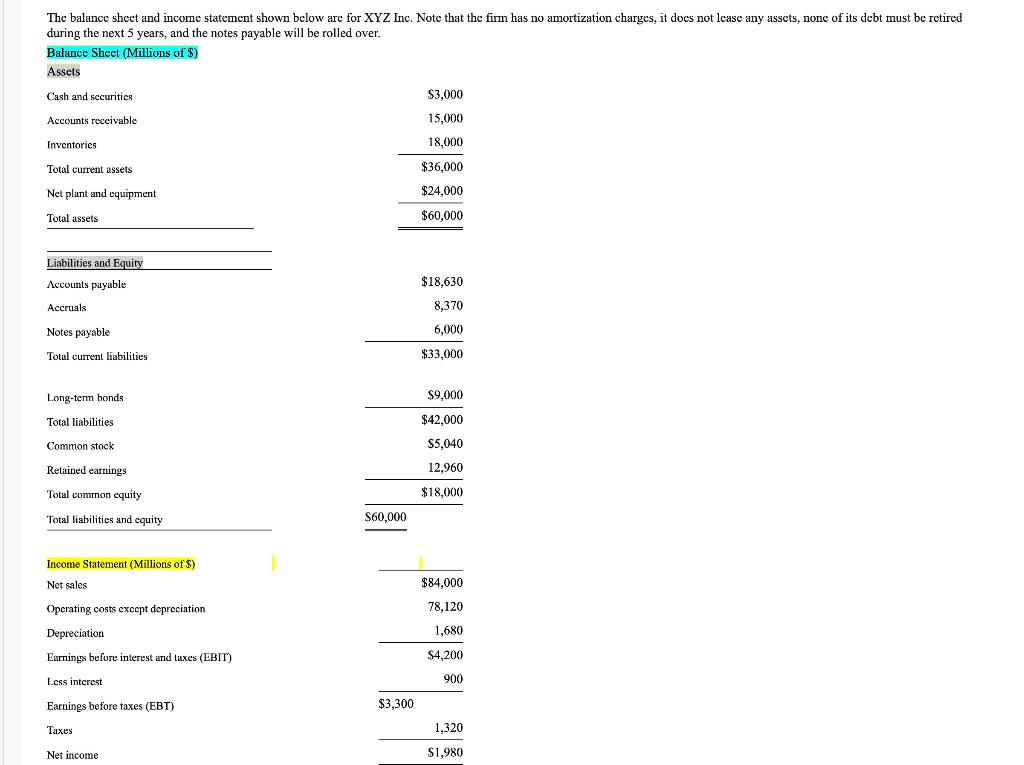

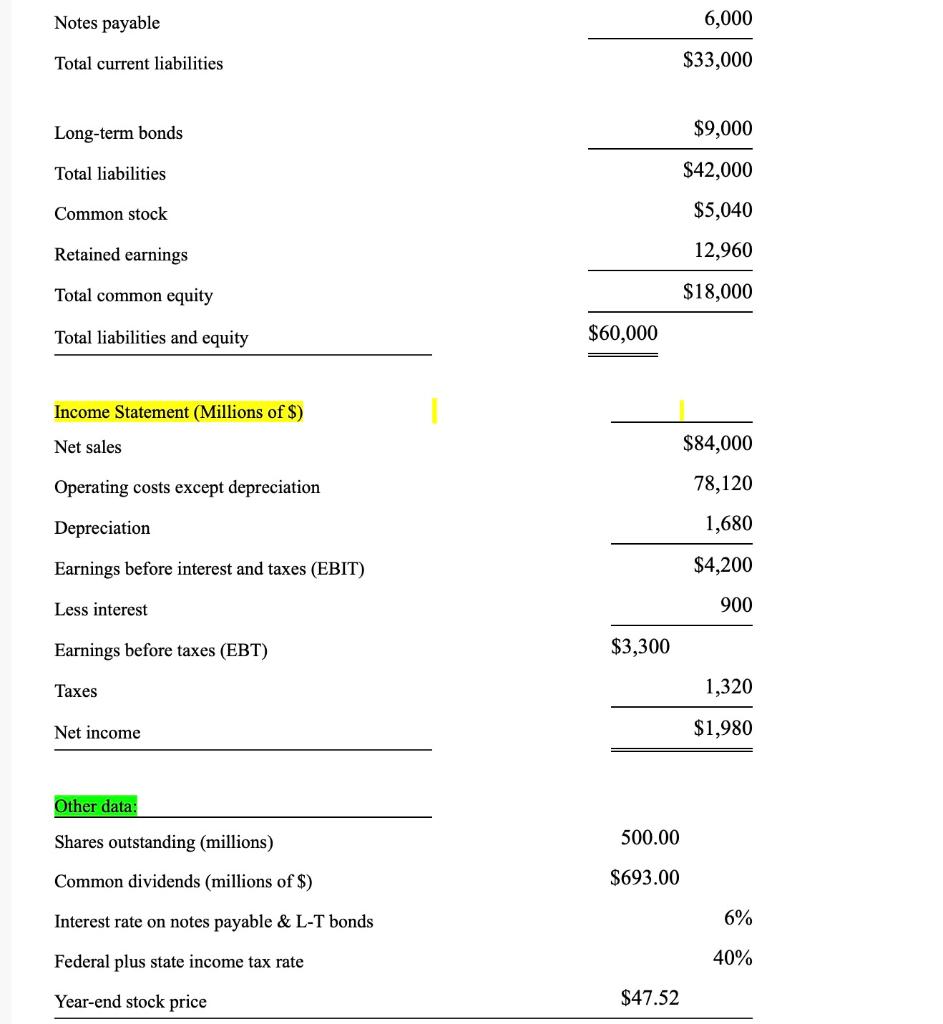

The balance sheet and income statement shown below are for XYZ Inc. Note that the firm has no amortization charges, it does not lcase any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over. Balance Sheet (Millions of $) Assets Cash and securities $3,000 Accounts receivable 15,000 Inventories 18,000 Total current assets $36,000 Net plant and equipment $24,000 Total assets $60,000 Liabilities and Equity Accounts payable $18,630 Accruals 8,370 Notes payable 6,000 Total current liabilities $33,000 Long-term bonds $9,000 Total liabilities $42,000 Common stock S5,040 Retained earnings 12,960 Total common equity $18,000 Total liabilities and equity S60,000 Income Statement (Millions of $) Net sales $84,000 Operating costs except depreciation 78,120 Depreciation 1,680 Earnings before interest and taxes (EBIT) $4,200 Less interest 900 Earnings before taxes (EBT) $3,300 Taxes 1,320 Net income $1,980 Notes payable 6,000 Total current liabilities $33,000 Long-term bonds $9,000 Total liabilities $42,000 Common stock $5,040 Retained earnings 12,960 Total common equity $18,000 Total liabilities and equity $60,000 Income Statement (Millions of $) Net sales $84,000 Operating costs except depreciation 78,120 Depreciation 1,680 Earnings before interest and taxes (EBIT) $4,200 Less interest 900 Earnings before taxes (EBT) $3,300 Taxes 1,320 Net income $1,980 Other data: Shares outstanding (millions) 500.00 Common dividends (millions of $) $693.00 Interest rate on notes payable & L-T bonds 6% Federal plus state income tax rate 40% Year-end stock price $47.52 QUESTION 7 Refer to the XYZ company's financial information that was given in question 1. Solve the problem and enter the result. Question 7: What is the firm's ROA? (express your numerical answer in percentage) Instruction: Do not round your result. Only enter a numerical value; do not enter any dollar, $, or % symbol. When you attach a file (part 2) showing your work, write down the equation that you need to use to solve this problem. Next, plug in all the given information. (If you use an online calculator, give the link in your uploaded file). QUESTION 8 Refer to the XYZ company's financial information that was given in question 1. Solve the problem and enter the result. Question 8: What is the firm's ROE? (express your numerical answer in percentage) Instruction: Do not round your result. Only enter a numerical value; do not enter any dollar, $, or % symbol. When you attach a file (part 2) showing your work, write down the equation that you need to use to solve this problem. Next, plug in all the given information. (If you use an online calculator, give the link in your uploaded file)