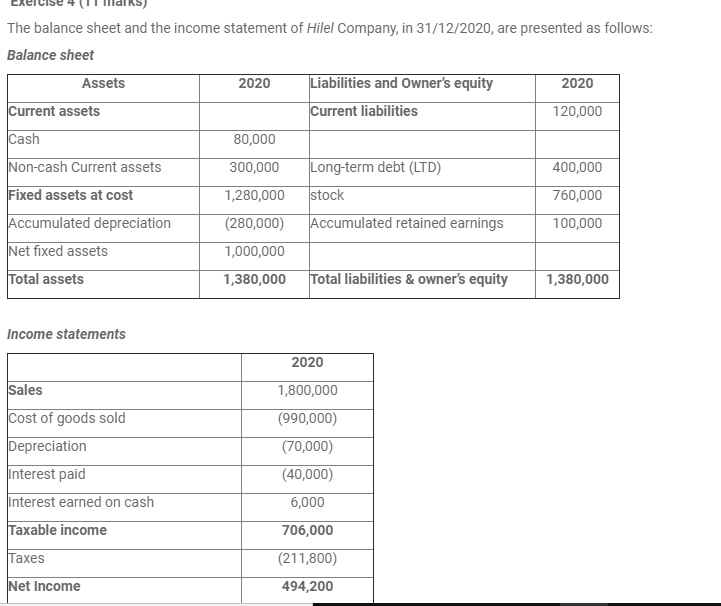

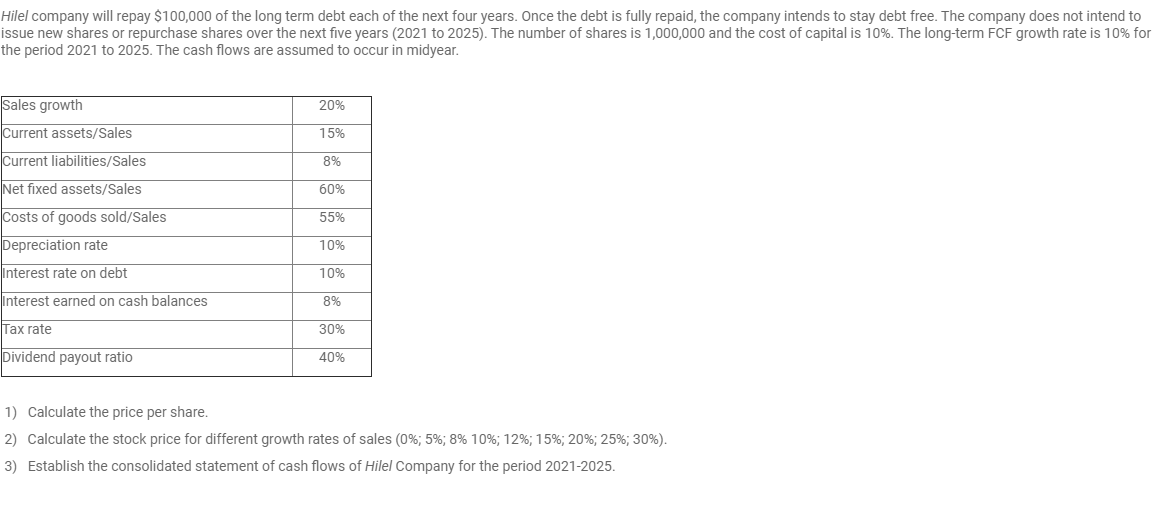

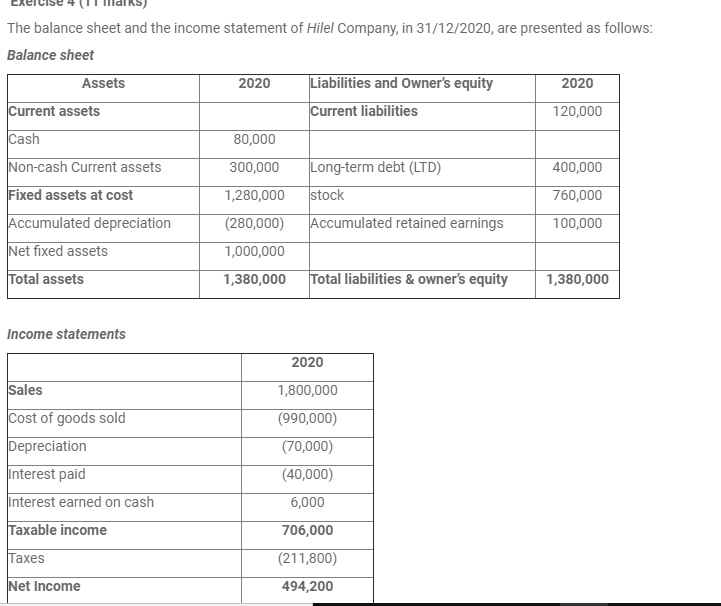

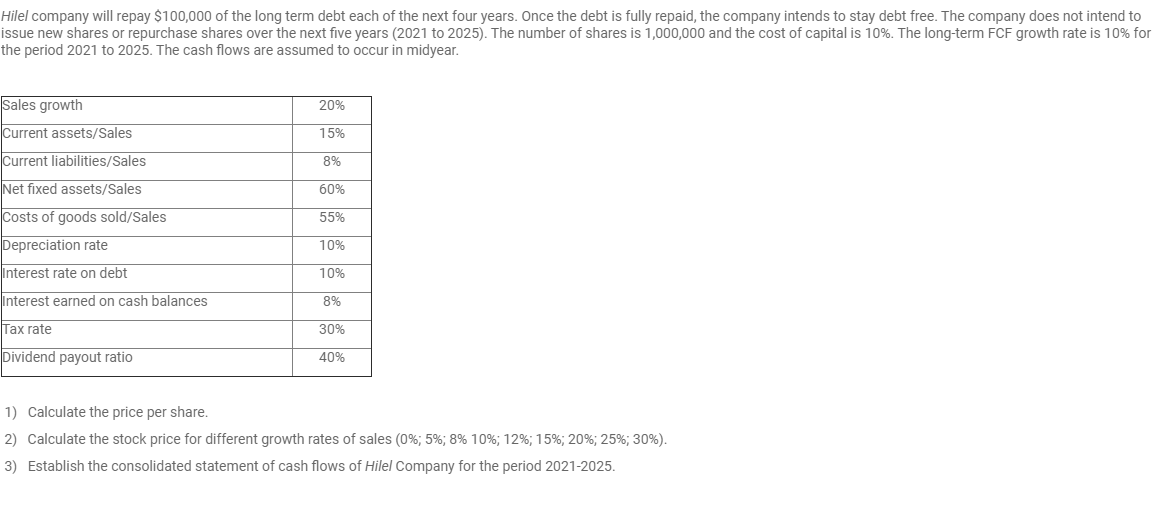

The balance sheet and the income statement of Hilel Company, in 31/12/2020, are presented as follows: Balance sheet Assets 2020 Liabilities and Owner's equity 2020 Current assets Current liabilities 120,000 Cash 80,000 Non-cash Current assets 300,000 Long-term debt (LTD) 400,000 Fixed assets at cost 1,280,000 stock 760,000 Accumulated depreciation (280,000) Accumulated retained earnings 100,000 Net fixed assets 1,000,000 Total assets 1,380,000 Total liabilities & owner's equity 1,380,000 Income statements 2020 Sales 1,800,000 (990,000) (70,000) Cost of goods sold Depreciation Interest paid Interest earned on cash Taxable income (40,000) 6,000 706,000 (211,800) 494,200 Taxes Net Income Hilel company will repay $100,000 of the long term debt each of the next four years. Once the debt is fully repaid, the company intends to stay debt free. The company does not intend to issue new shares or repurchase shares over the next five years (2021 to 2025). The number of shares is 1,000,000 and the cost of capital is 10%. The long-term FCF growth rate is 10% for the period 2021 to 2025. The cash flows are assumed to occur in midyear. Sales growth 20% Current assets/Sales 15% Current liabilities/Sales 8% 60% 55% Net fixed assets/Sales Costs of goods sold/Sales Depreciation rate Interest rate on debt 10% 10% Interest earned on cash balances 8% 30% Tax rate Dividend payout ratio 40% 1) Calculate the price per share 2) Calculate the stock price for different growth rates of sales (0%; 5%; 8% 10%; 12%; 15%, 20%, 25%; 30%). 3) Establish the consolidated statement of cash flows of Hilel Company for the period 2021-2025. The balance sheet and the income statement of Hilel Company, in 31/12/2020, are presented as follows: Balance sheet Assets 2020 Liabilities and Owner's equity 2020 Current assets Current liabilities 120,000 Cash 80,000 Non-cash Current assets 300,000 Long-term debt (LTD) 400,000 Fixed assets at cost 1,280,000 stock 760,000 Accumulated depreciation (280,000) Accumulated retained earnings 100,000 Net fixed assets 1,000,000 Total assets 1,380,000 Total liabilities & owner's equity 1,380,000 Income statements 2020 Sales 1,800,000 (990,000) (70,000) Cost of goods sold Depreciation Interest paid Interest earned on cash Taxable income (40,000) 6,000 706,000 (211,800) 494,200 Taxes Net Income Hilel company will repay $100,000 of the long term debt each of the next four years. Once the debt is fully repaid, the company intends to stay debt free. The company does not intend to issue new shares or repurchase shares over the next five years (2021 to 2025). The number of shares is 1,000,000 and the cost of capital is 10%. The long-term FCF growth rate is 10% for the period 2021 to 2025. The cash flows are assumed to occur in midyear. Sales growth 20% Current assets/Sales 15% Current liabilities/Sales 8% 60% 55% Net fixed assets/Sales Costs of goods sold/Sales Depreciation rate Interest rate on debt 10% 10% Interest earned on cash balances 8% 30% Tax rate Dividend payout ratio 40% 1) Calculate the price per share 2) Calculate the stock price for different growth rates of sales (0%; 5%; 8% 10%; 12%; 15%, 20%, 25%; 30%). 3) Establish the consolidated statement of cash flows of Hilel Company for the period 2021-2025