Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The balance sheet for Shaver Corporation reported the following: cash, $17,000; short-term investments, $22,000; net accounts receivable, $59,000; inventory, $64,000; prepaids, $22,000; equipment, $107,000; current

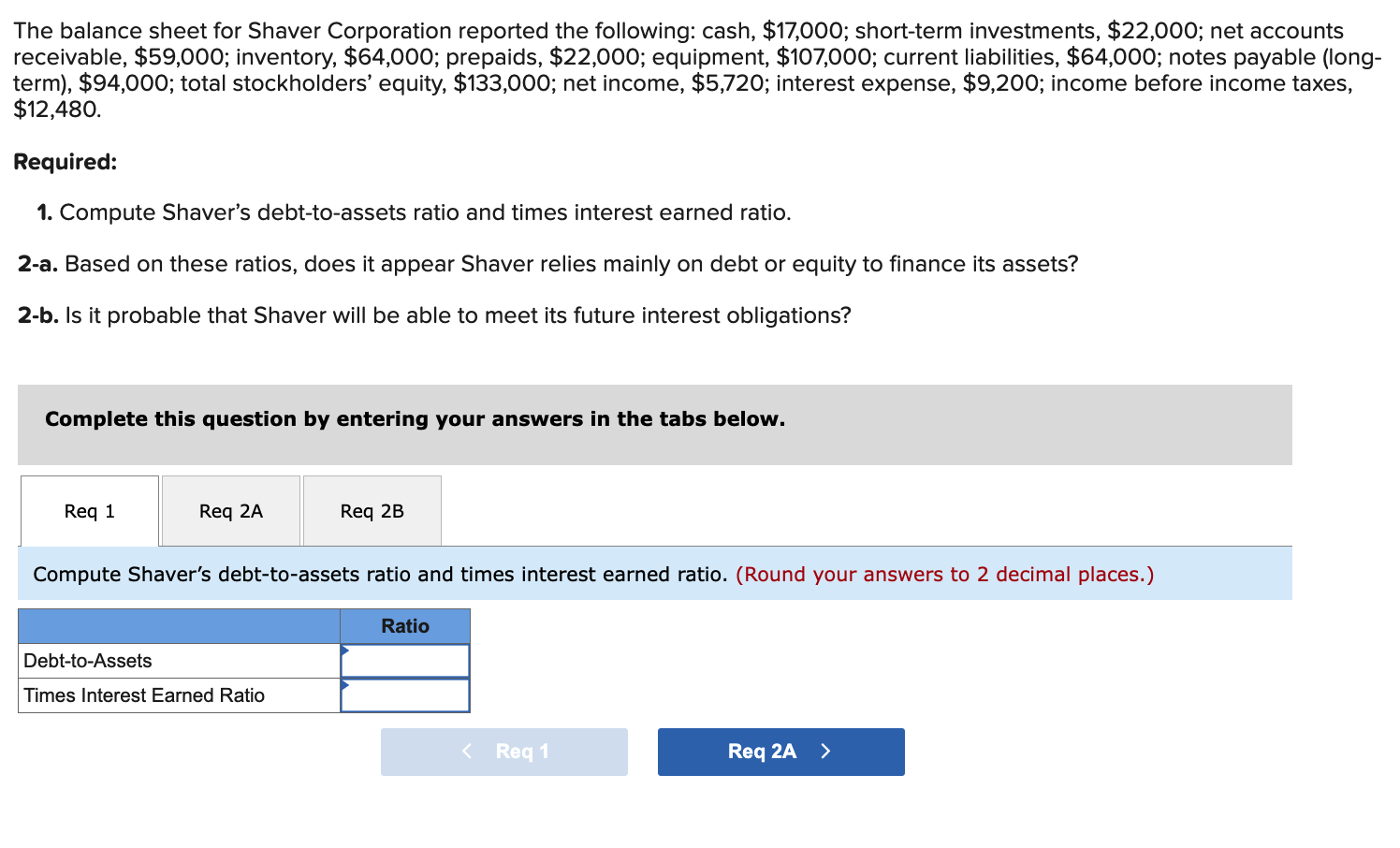

The balance sheet for Shaver Corporation reported the following: cash, $17,000; short-term investments, $22,000; net accounts receivable, $59,000; inventory, $64,000; prepaids, $22,000; equipment, $107,000; current liabilities, $64,000; notes payable (longterm), \$94,000; total stockholders' equity, $133,000; net income, $5,720; interest expense, $9,200; income before income taxes, $12,480. Required: 1. Compute Shaver's debt-to-assets ratio and times interest earned ratio. 2-a. Based on these ratios, does it appear Shaver relies mainly on debt or equity to finance its assets? 2-b. Is it probable that Shaver will be able to meet its future interest obligations? Complete this question by entering your answers in the tabs below. Compute Shaver's debt-to-assets ratio and times interest earned ratio. (Round your answers to 2 decimal places.)

The balance sheet for Shaver Corporation reported the following: cash, $17,000; short-term investments, $22,000; net accounts receivable, $59,000; inventory, $64,000; prepaids, $22,000; equipment, $107,000; current liabilities, $64,000; notes payable (longterm), \$94,000; total stockholders' equity, $133,000; net income, $5,720; interest expense, $9,200; income before income taxes, $12,480. Required: 1. Compute Shaver's debt-to-assets ratio and times interest earned ratio. 2-a. Based on these ratios, does it appear Shaver relies mainly on debt or equity to finance its assets? 2-b. Is it probable that Shaver will be able to meet its future interest obligations? Complete this question by entering your answers in the tabs below. Compute Shaver's debt-to-assets ratio and times interest earned ratio. (Round your answers to 2 decimal places.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started