Answered step by step

Verified Expert Solution

Question

1 Approved Answer

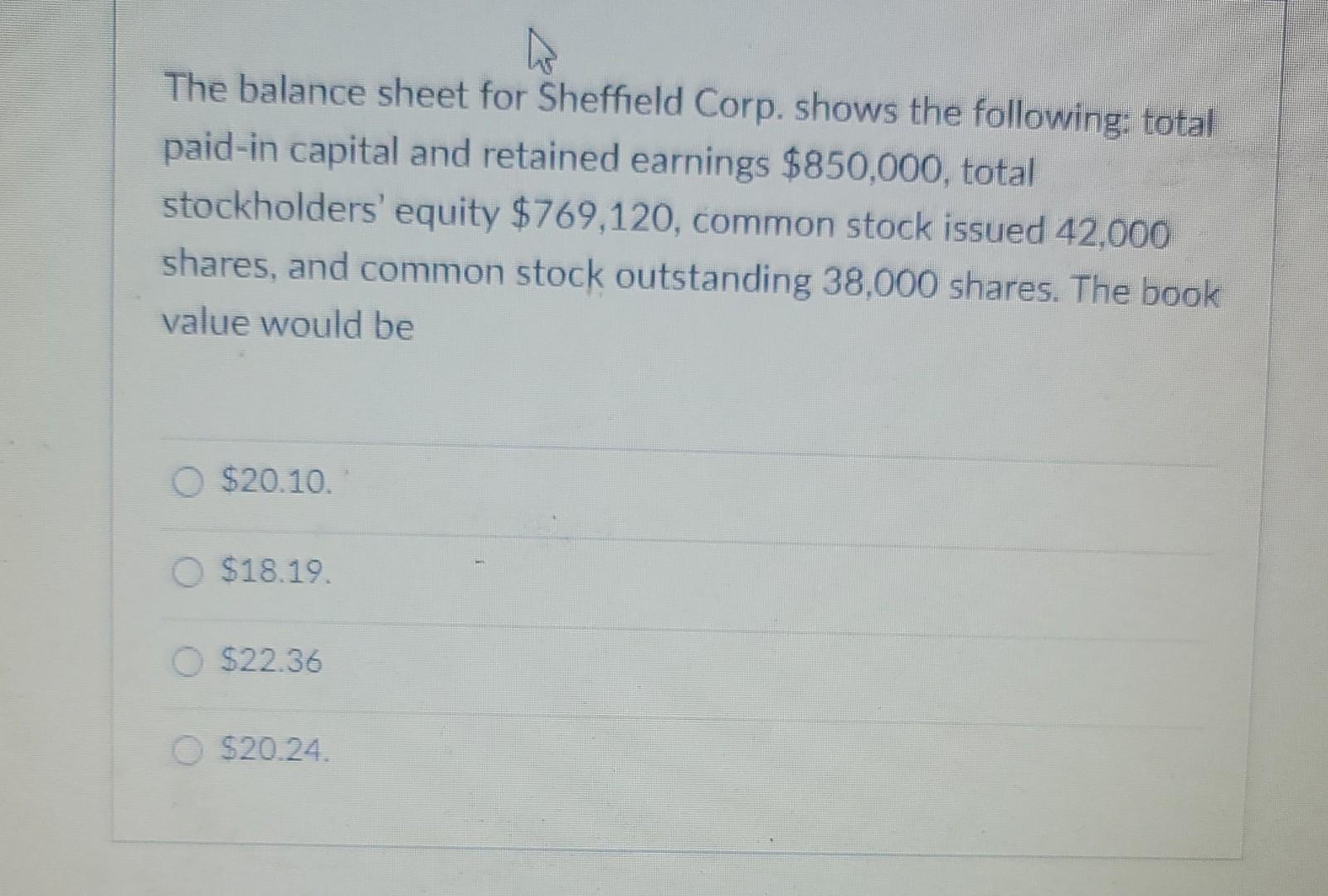

The balance sheet for Sheffield Corp. shows the following: total paid-in capital and retained earnings $850,000, total stockholders' equity $769,120, common stock issued 42,000 shares,

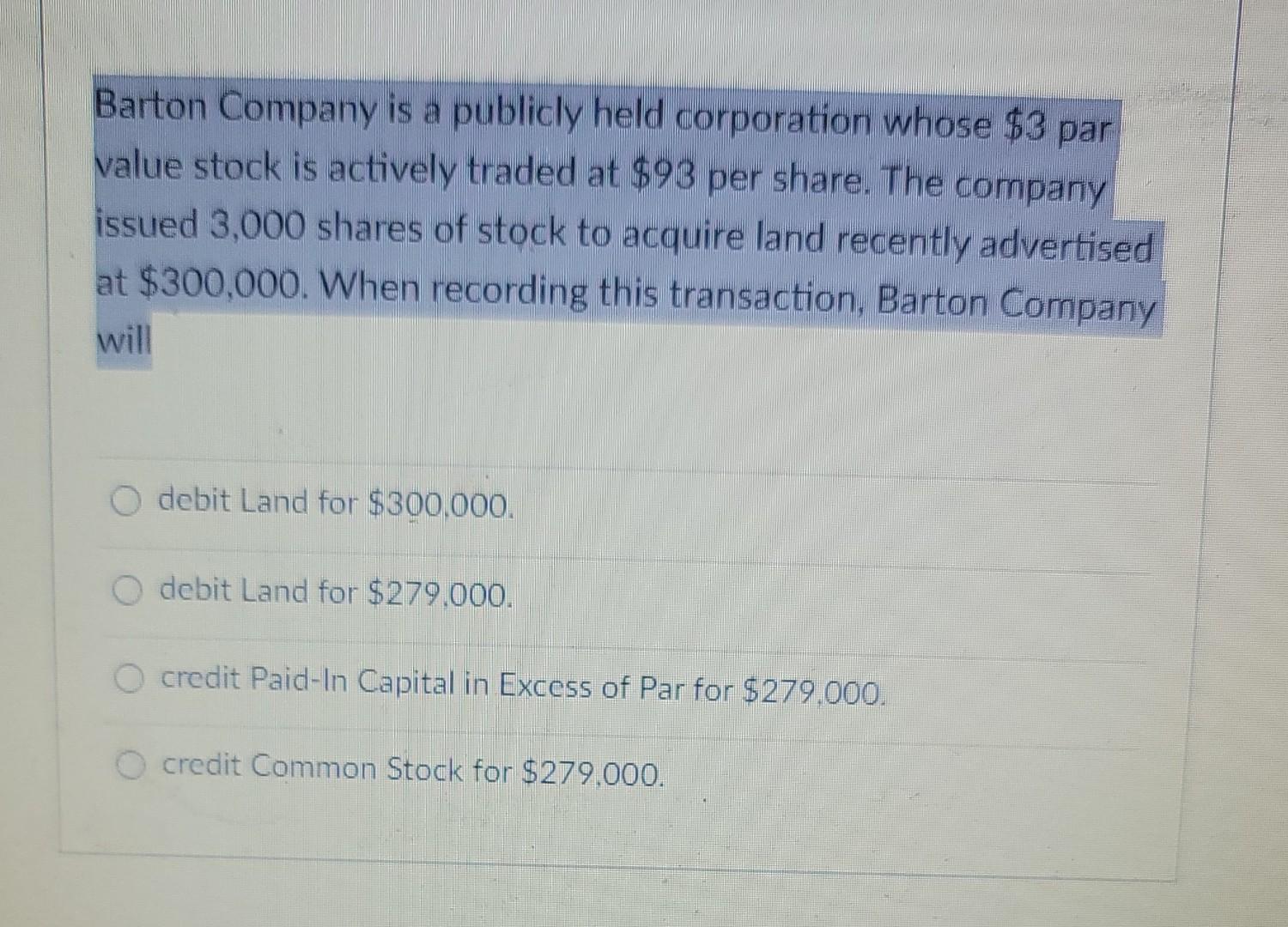

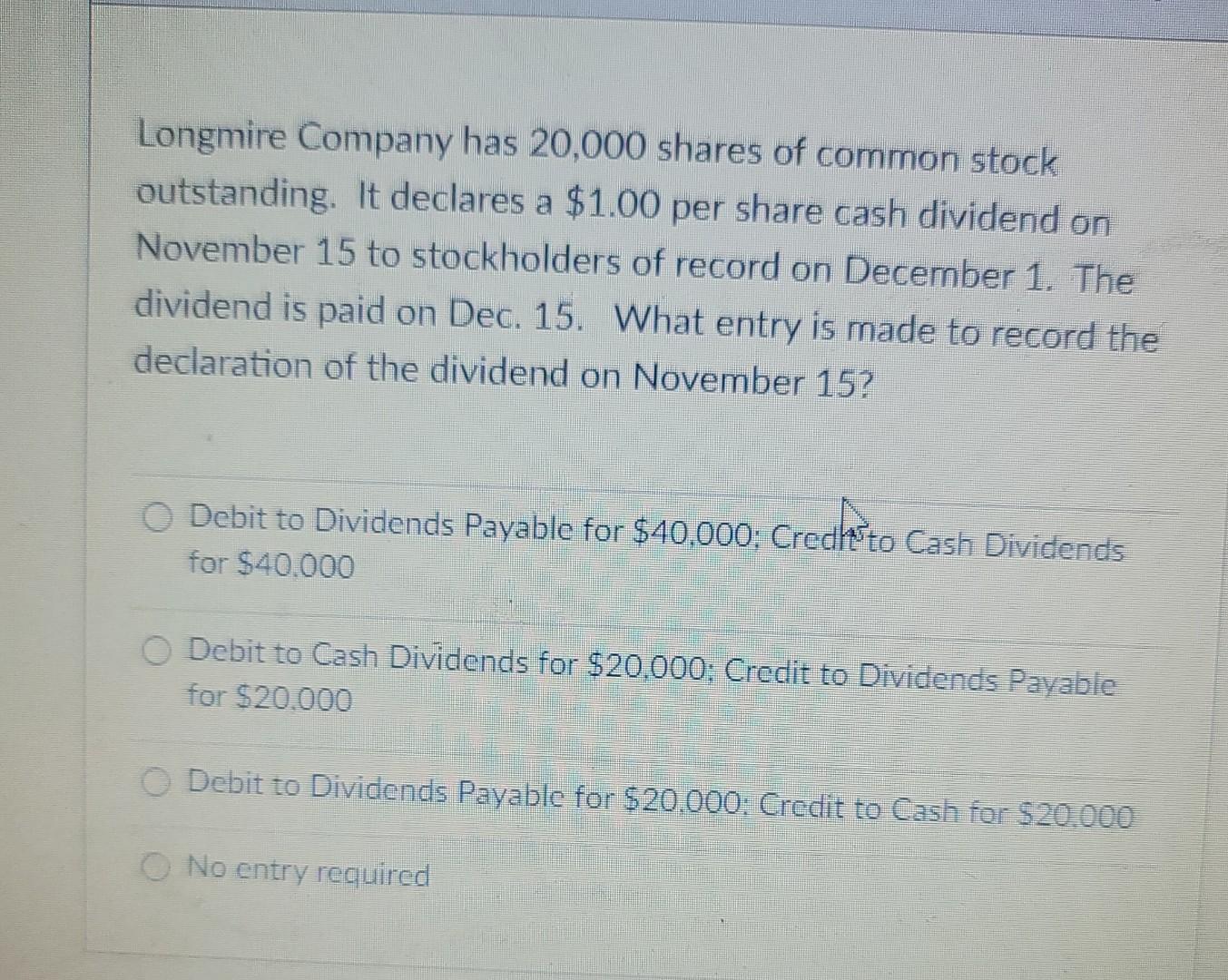

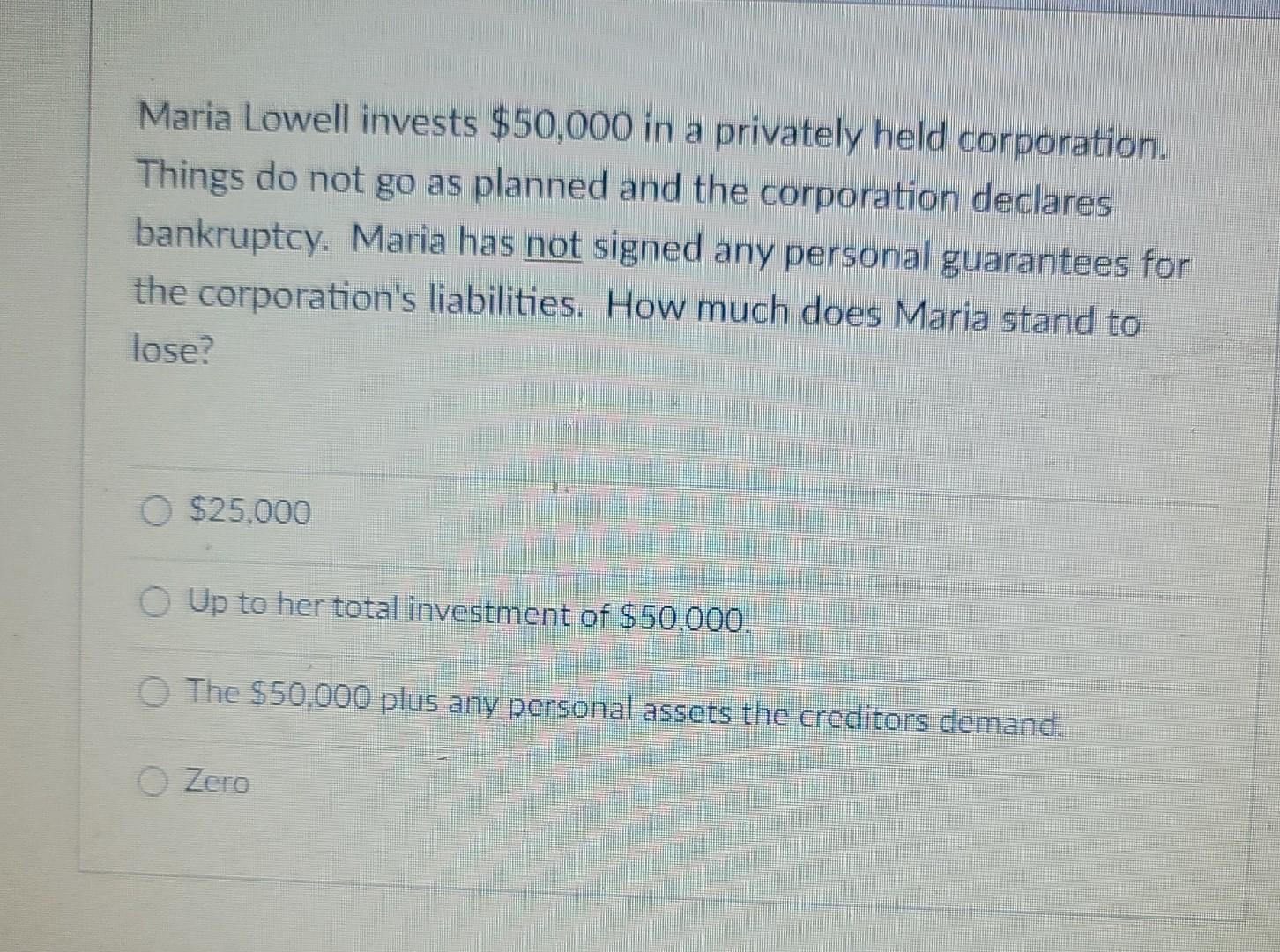

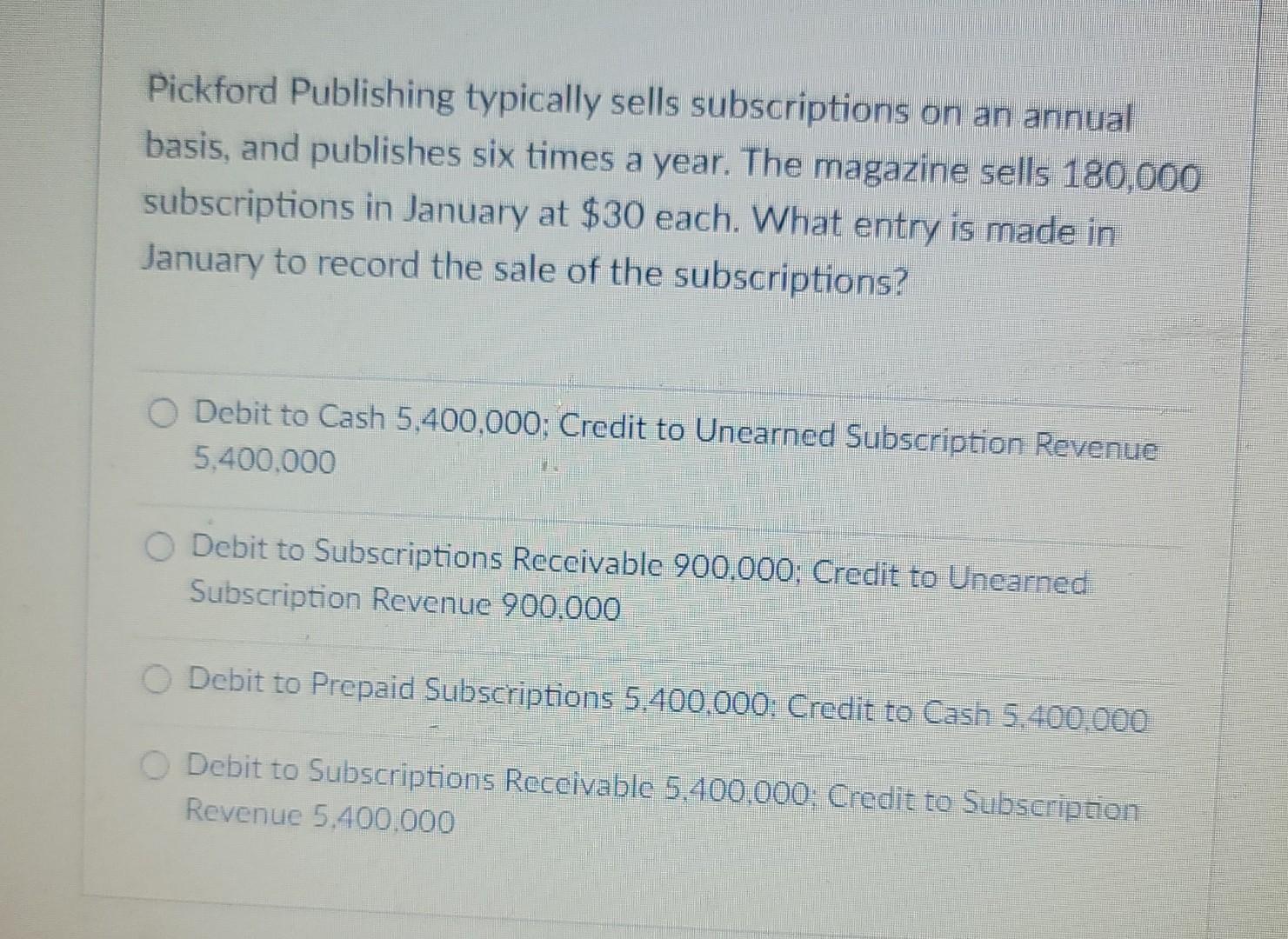

The balance sheet for Sheffield Corp. shows the following: total paid-in capital and retained earnings $850,000, total stockholders' equity $769,120, common stock issued 42,000 shares, and common stock outstanding 38,000 shares. The book value would be $20.10. O $18.19. $22.36 $20.24. Barton Company is a publicly held corporation whose $3 par value stock is actively traded at $93 per share. The company issued 3,000 shares of stock to acquire land recently advertised at $300,000. When recording this transaction, Barton Company will O debit Land for $300.000. debit Land for $279.000. O credit Paid-In Capital in Excess of Par for $279.000. credit Common Stock for $279.000. Longmire Company has 20,000 shares of common stock outstanding. It declares a $1.00 per share cash dividend on a November 15 to stockholders of record on December 1. The dividend is paid on Dec. 15. What entry is made to record the declaration of the dividend on November 15? O Debit to Dividends Payable for $40.000; Credh'to Cash Dividends for $40.000 Debit to Cash Dividends for $20,000: Credit to Dividends Payable for $20.000 O Debit to Dividends Payable for $20.000: Credit to Cash for $20.000 No entry required Maria Lowell invests $50,000 in a privately held corporation. Things do not go as planned and the corporation declares bankruptcy. Maria has not signed any personal guarantees for the corporation's liabilities. How much does Maria stand to lose? O $25.000 O Up to her total investment of $50.000. O The $50.000 plus any personal assets the creditors demand. O Zero Pickford Publishing typically sells subscriptions on an annual basis, and publishes six times a year. The magazine sells 180,000 subscriptions in January at $30 each. What entry is made in January to record the sale of the subscriptions? O Debit to Cash 5,400,000; Credit to Unearned Subscription Revenue 5.400.000 Debit to Subscriptions Receivable 900,000. Credit to Unearned Subscription Revenue 900.000 Debit to Prepaid Subscriptions 5.400,000. Credit to @ash 5 400.000 Debit to Subscriptions Receivable 5.400,000 Credit to Subscription Revenue 5.400.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started