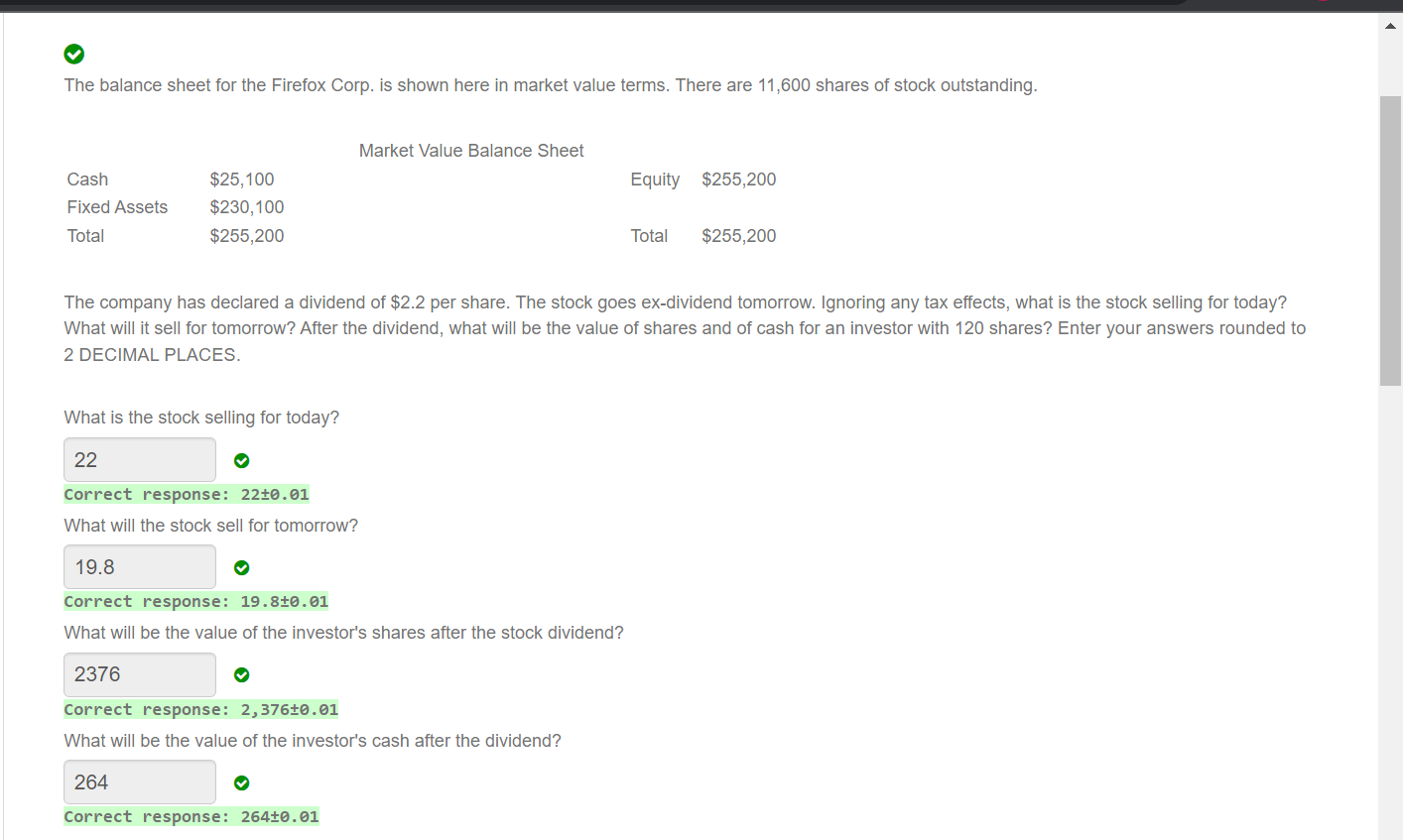

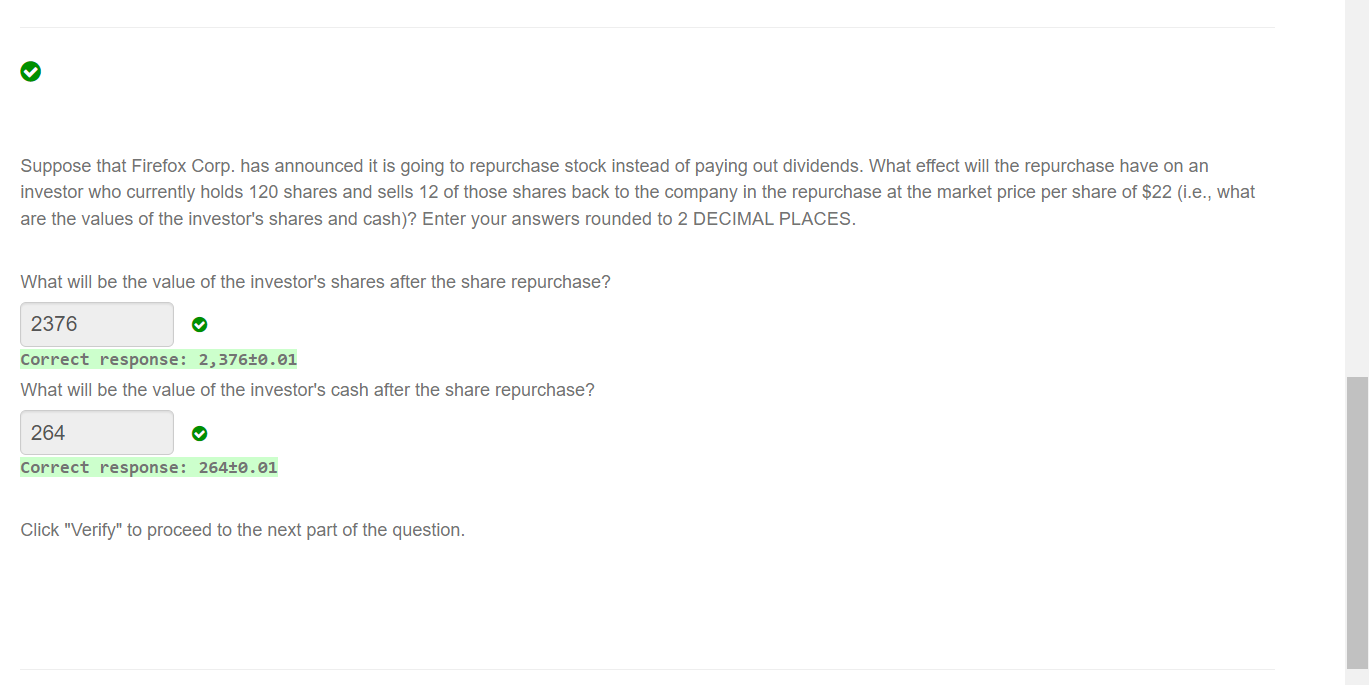

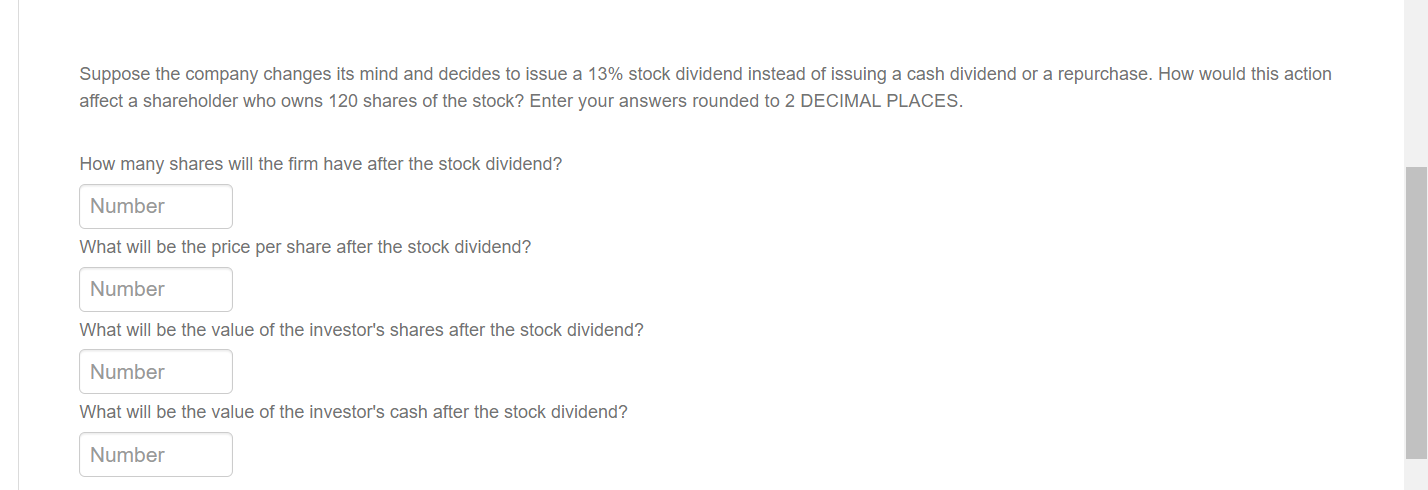

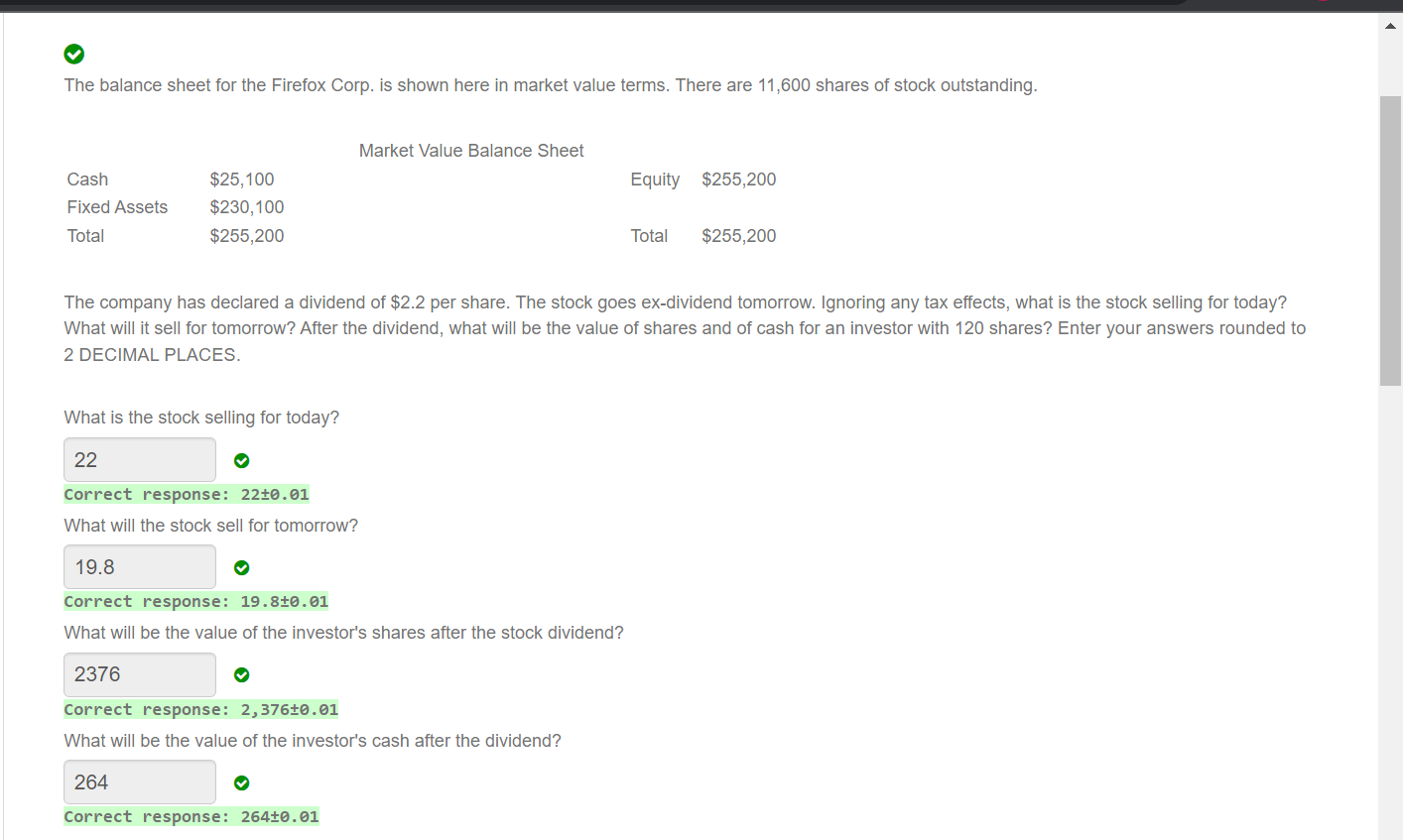

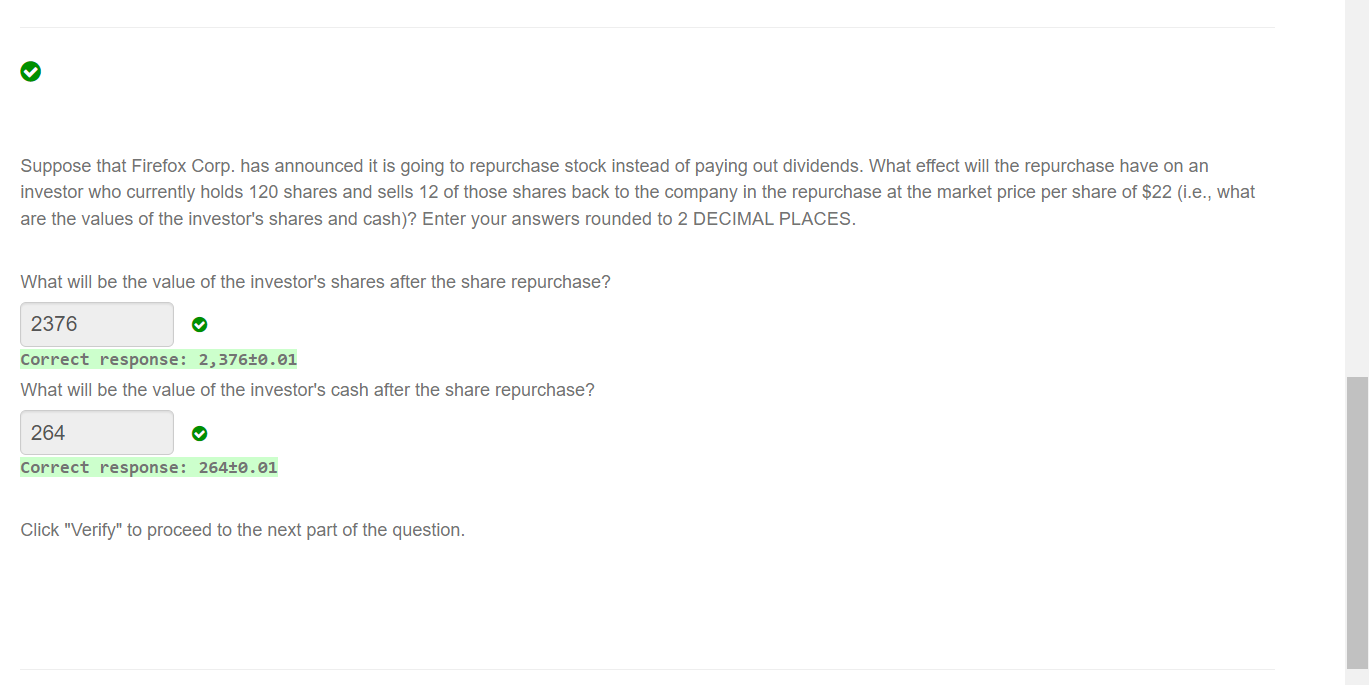

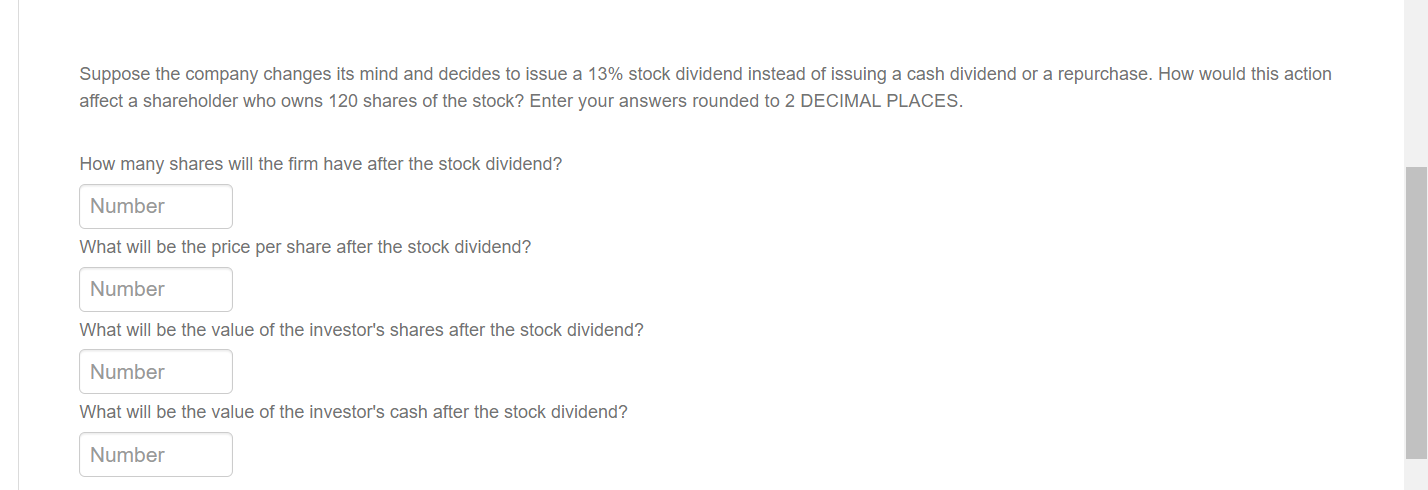

The balance sheet for the Firefox Corp. is shown here in market value terms. There are 11,600 shares of stock outstanding. Market Value Balance Sheet Cash Equity $255,200 Fixed Assets Total $25,100 $230,100 $255,200 Total $255,200 The company has declared a dividend of $2.2 per share. The stock goes ex-dividend tomorrow. Ignoring any tax effects, what is the stock selling for today? What will it sell for tomorrow? After the dividend, what will be the value of shares and of cash for an investor with 120 shares? Enter your answers rounded to 2 DECIMAL PLACES. What is the stock selling for today? 22 Correct response: 22+0.01 What will the stock sell for tomorrow? 19.8 Correct response: 19.8+0.01 What will be the value of the investor's shares after the stock dividend? 2376 Correct response: 2,376+0.01 What will be the value of the investor's cash after the dividend? 264 Correct response: 264+0.01 Suppose that Firefox Corp. has announced it is going to repurchase stock instead of paying out dividends. What effect will the repurchase have on an investor who currently holds 120 shares and sells 12 of those shares back to the company in the repurchase at the market price per share of $22 (i.e., what are the values of the investor's shares and cash)? Enter your answers rounded to 2 DECIMAL PLACES. What will be the value of the investor's shares after the share repurchase? 2376 Correct response: 2, 376+0.01 What will be the value of the investor's cash after the share repurchase? 264 Correct response: 264+0.01 Click "Verify" to proceed to the next part of the question. Suppose the company changes its mind and decides to issue a 13% stock dividend instead of issuing a cash dividend or a repurchase. How would this action affect a shareholder who owns 120 shares of the stock? Enter your answers rounded to 2 DECIMAL PLACES. How many shares will the firm have after the stock dividend? Number What will be the price per share after the stock dividend? Number What will be the value of the investor's shares after the stock dividend? Number What will be the value of the investor's cash after the stock dividend? Number The balance sheet for the Firefox Corp. is shown here in market value terms. There are 11,600 shares of stock outstanding. Market Value Balance Sheet Cash Equity $255,200 Fixed Assets Total $25,100 $230,100 $255,200 Total $255,200 The company has declared a dividend of $2.2 per share. The stock goes ex-dividend tomorrow. Ignoring any tax effects, what is the stock selling for today? What will it sell for tomorrow? After the dividend, what will be the value of shares and of cash for an investor with 120 shares? Enter your answers rounded to 2 DECIMAL PLACES. What is the stock selling for today? 22 Correct response: 22+0.01 What will the stock sell for tomorrow? 19.8 Correct response: 19.8+0.01 What will be the value of the investor's shares after the stock dividend? 2376 Correct response: 2,376+0.01 What will be the value of the investor's cash after the dividend? 264 Correct response: 264+0.01 Suppose that Firefox Corp. has announced it is going to repurchase stock instead of paying out dividends. What effect will the repurchase have on an investor who currently holds 120 shares and sells 12 of those shares back to the company in the repurchase at the market price per share of $22 (i.e., what are the values of the investor's shares and cash)? Enter your answers rounded to 2 DECIMAL PLACES. What will be the value of the investor's shares after the share repurchase? 2376 Correct response: 2, 376+0.01 What will be the value of the investor's cash after the share repurchase? 264 Correct response: 264+0.01 Click "Verify" to proceed to the next part of the question. Suppose the company changes its mind and decides to issue a 13% stock dividend instead of issuing a cash dividend or a repurchase. How would this action affect a shareholder who owns 120 shares of the stock? Enter your answers rounded to 2 DECIMAL PLACES. How many shares will the firm have after the stock dividend? Number What will be the price per share after the stock dividend? Number What will be the value of the investor's shares after the stock dividend? Number What will be the value of the investor's cash after the stock dividend? Number