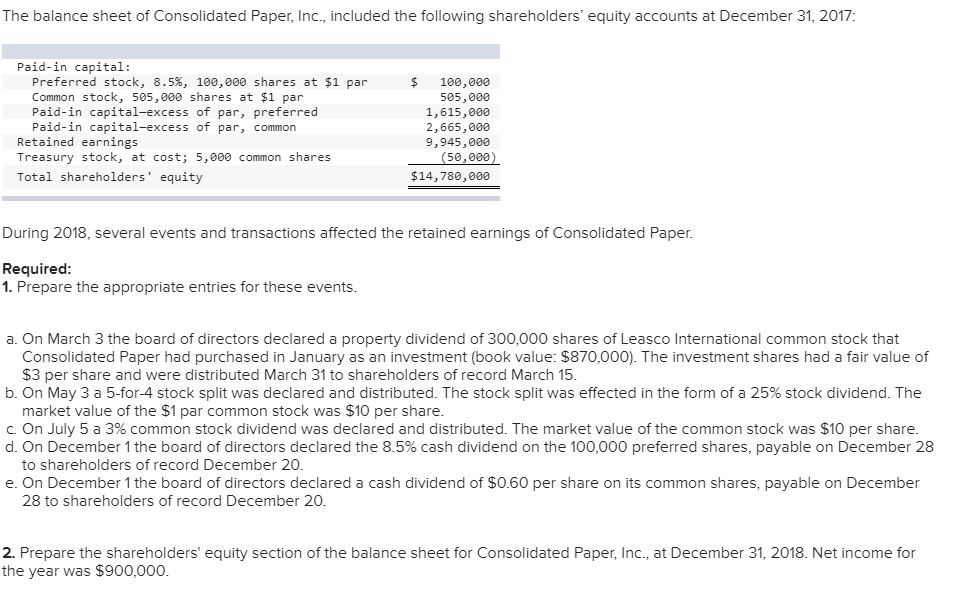

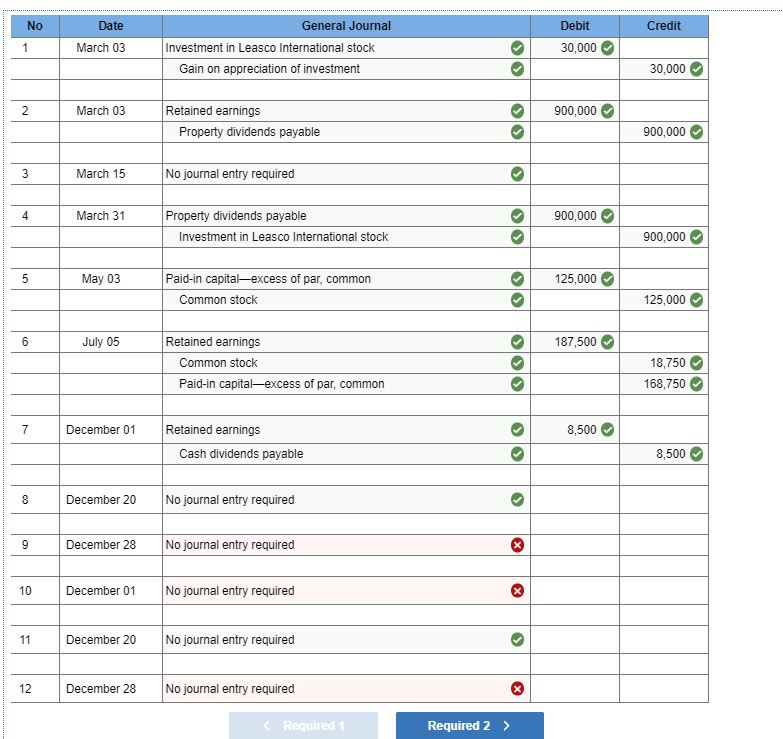

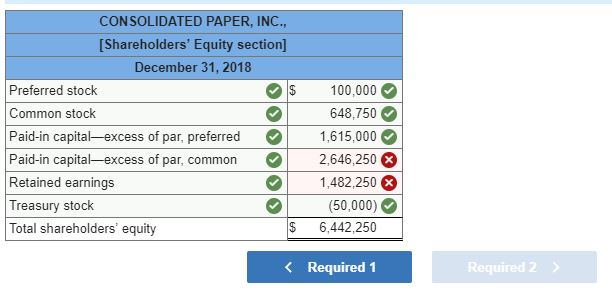

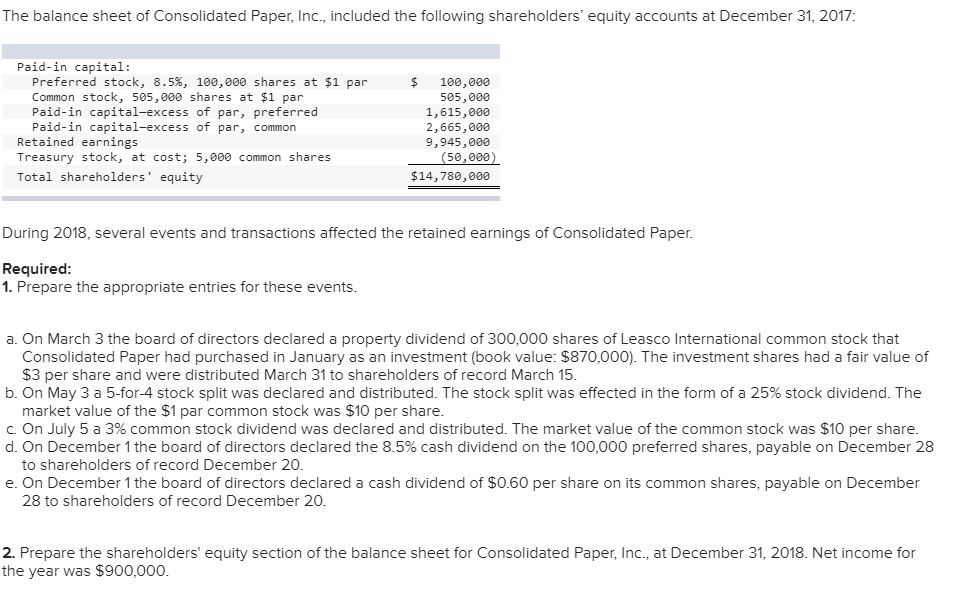

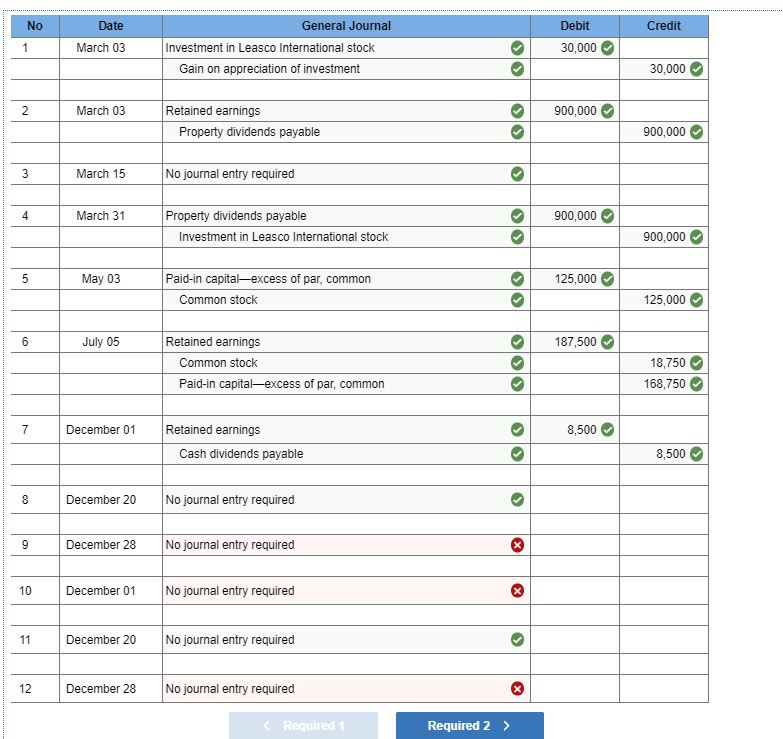

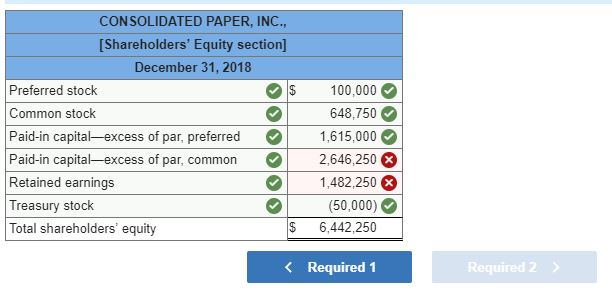

The balance sheet of Consolidated Paper, Inc., included the following shareholders' equity accounts at December 31, 2017: Paid-in capital: Preferred stock, 8.5 % , 100,000 shares at $1 par 100,000 505,000 1,615,000 2,665,000 9,945,000 (50,000) Common stock, 505,000 shares at $1 par Paid-in capital-excess of par, preferred Paid-in capital-excess of par, common Retained earnings Treasury stock, at cost; 5,000 common shares Total shareholders' equity $14,780,000 During 2018, several events and transactions affected the retained earnings of Consolidated Paper. Required: 1. Prepare the appropriate entries for these events. a. On March 3 the board of directors declared a property dividend of 300,000 shares of Leasco International common stock that Consolidated Paper had purchased in January as an investment (book value: $870,000). The investment shares had a fair value of $3 per share and were distributed March 31 to shareholders of record March 15 b. On May 3 a 5-for-4 stock split was declared and distributed. The stock split was effected in the form of a 25% stock dividend. The market value of the $1 par common stock was $10 per share. c. On July 5 a 3% common stock dividend was declared and distributed. The market value of the common stock was $10 per share d. On December 1 the board of directors declared the 8.5% cash dividend on the 100,000 preferred shares, payable on December 28 to shareholders of record December 20. W e. On December 1 the board of directors declared a cash dividend of $0.60 per share on its common shares, payable on December 28 to shareholders of record December 20. 2. Prepare the shareholders' equity section of the balance sheet for Consolidated Paper, Inc., at December 31, 2018. Net income for the year was $900,000. Debit No Date General Journal Credit Investment in Leasco International stock 30,000 March 03 1 Gain on appreciation of investment 30,000 Retained earnings 2 March 03 900,000 Property dividends payable 900,000 No journal entry required March 15 3 Property dividends payable 900,000 March 31 4 900,000 Investment in Leasco International stock Paid-in capital-excess of par, common May 03 125,000 Common stock 125,000 Retained earnings July 05 187,500 6 Common stock 18,750 Paid-in capital-excess of par, common 168,750 Retained earnings 8,500 7 December 01 Cash dividends payable 8,500 No journal entry required 8 December 20 No journal entry required December 28 9 No journal entry required 10 December 01 No journal entry required 11 December 20 No journal entry required 12 December 28 Required 1 Required 2 O: iC CONSOLIDATED PAPER, INC. Shareholders' Equity section] December 31, 2018 100,000 Preferred stock 648,750 Common stock Paid-in capital excess of par, preferred Paid-in capital-exce Retained earnings Treasury stock Total shareholders' equity 1,615,000 cess of par, common 2,646,250 1,482,250 (50,000) 6,442,250 Required 1 Required 2 >