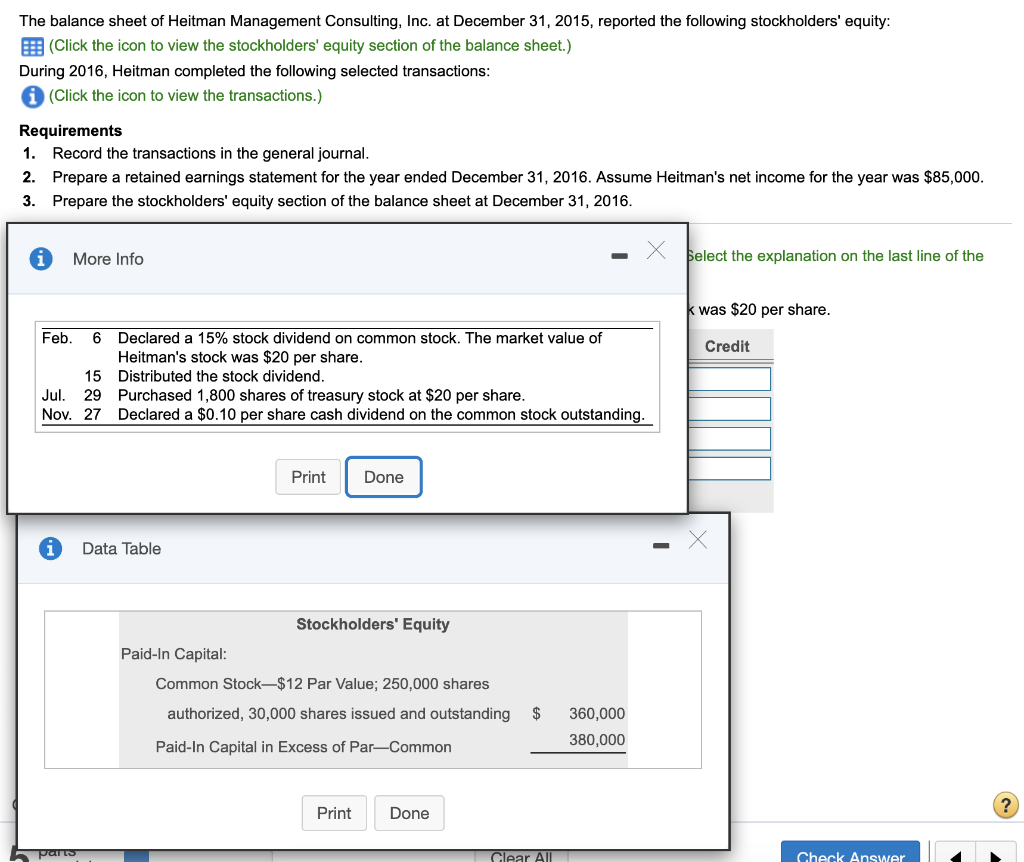

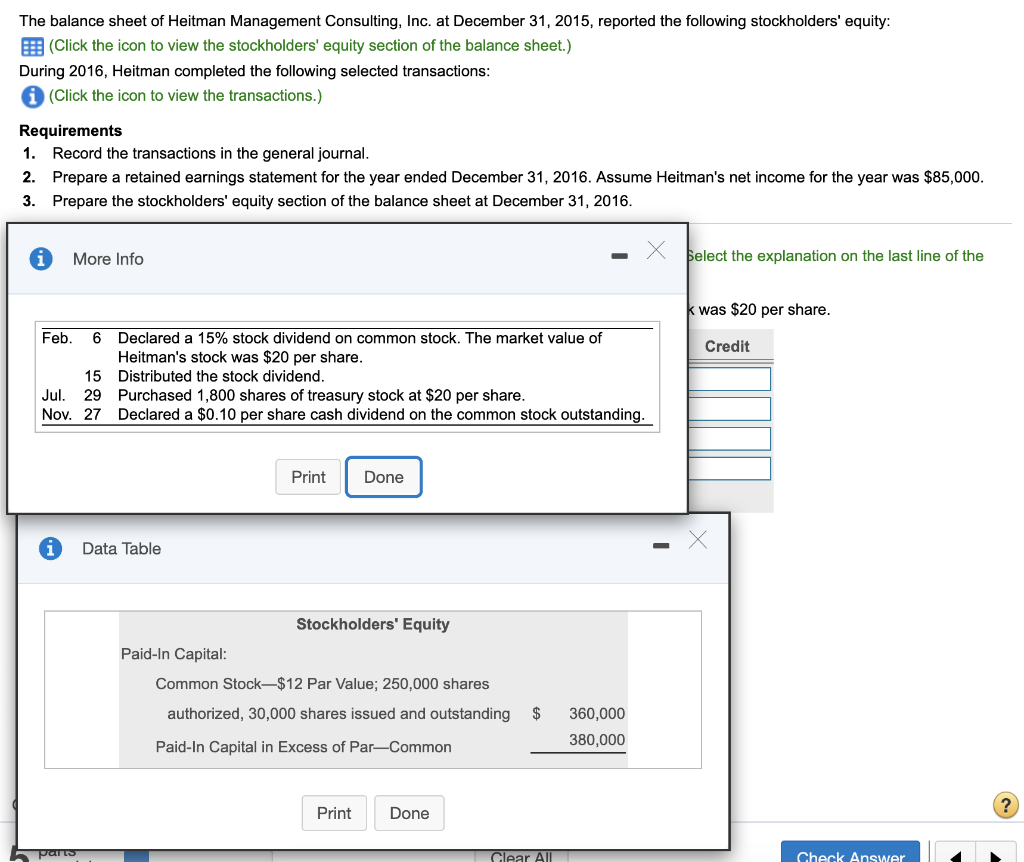

The balance sheet of Heitman Management Consulting, Inc. at December 31, 2015, reported the following stockholders' equity: (Click the icon to view the stockholders' equity section of the balance sheet.) During 2016, Heitman completed the following selected transactions: (Click the icon to view the transactions.) Requirements 1. Record the transactions in the general journal. 2. Prepare a retained earnings statement for the year ended December 31, 2016. Assume Heitman's net income for the year was $85,000. 3. Prepare the stockholders' equity section of the balance sheet at December 31, 2016. More Info Select the explanation on the last line of the was $20 per share. Credit Feb. 6 Declared a 15% stock dividend on common stock. The market value of Heitman's stock was $20 per share. 15 Distributed the stock dividend. Jul. 29 Purchased 1,800 shares of treasury stock at $20 per share. Nov. 27 Declared a $0.10 per share cash dividend on the common stock outstanding. Print Done Data Table Stockholders' Equity Paid-In Capital: Common Stock$12 Par Value; 250,000 shares authorized, 30,000 shares issued and outstanding $ 360,000 380,000 Paid-In Capital in Excess of Par-Common Print Done Perts Clear All Check Answer The balance sheet of Heitman Management Consulting, Inc. at December 31, 2015, reported the following stockholders' equity: (Click the icon to view the stockholders' equity section of the balance sheet.) During 2016, Heitman completed the following selected transactions: (Click the icon to view the transactions.) Requirements 1. Record the transactions in the general journal. 2. Prepare a retained earnings statement for the year ended December 31, 2016. Assume Heitman's net income for the year was $85,000. 3. Prepare the stockholders' equity section of the balance sheet at December 31, 2016. More Info Select the explanation on the last line of the was $20 per share. Credit Feb. 6 Declared a 15% stock dividend on common stock. The market value of Heitman's stock was $20 per share. 15 Distributed the stock dividend. Jul. 29 Purchased 1,800 shares of treasury stock at $20 per share. Nov. 27 Declared a $0.10 per share cash dividend on the common stock outstanding. Print Done Data Table Stockholders' Equity Paid-In Capital: Common Stock$12 Par Value; 250,000 shares authorized, 30,000 shares issued and outstanding $ 360,000 380,000 Paid-In Capital in Excess of Par-Common Print Done Perts Clear All Check