Answered step by step

Verified Expert Solution

Question

1 Approved Answer

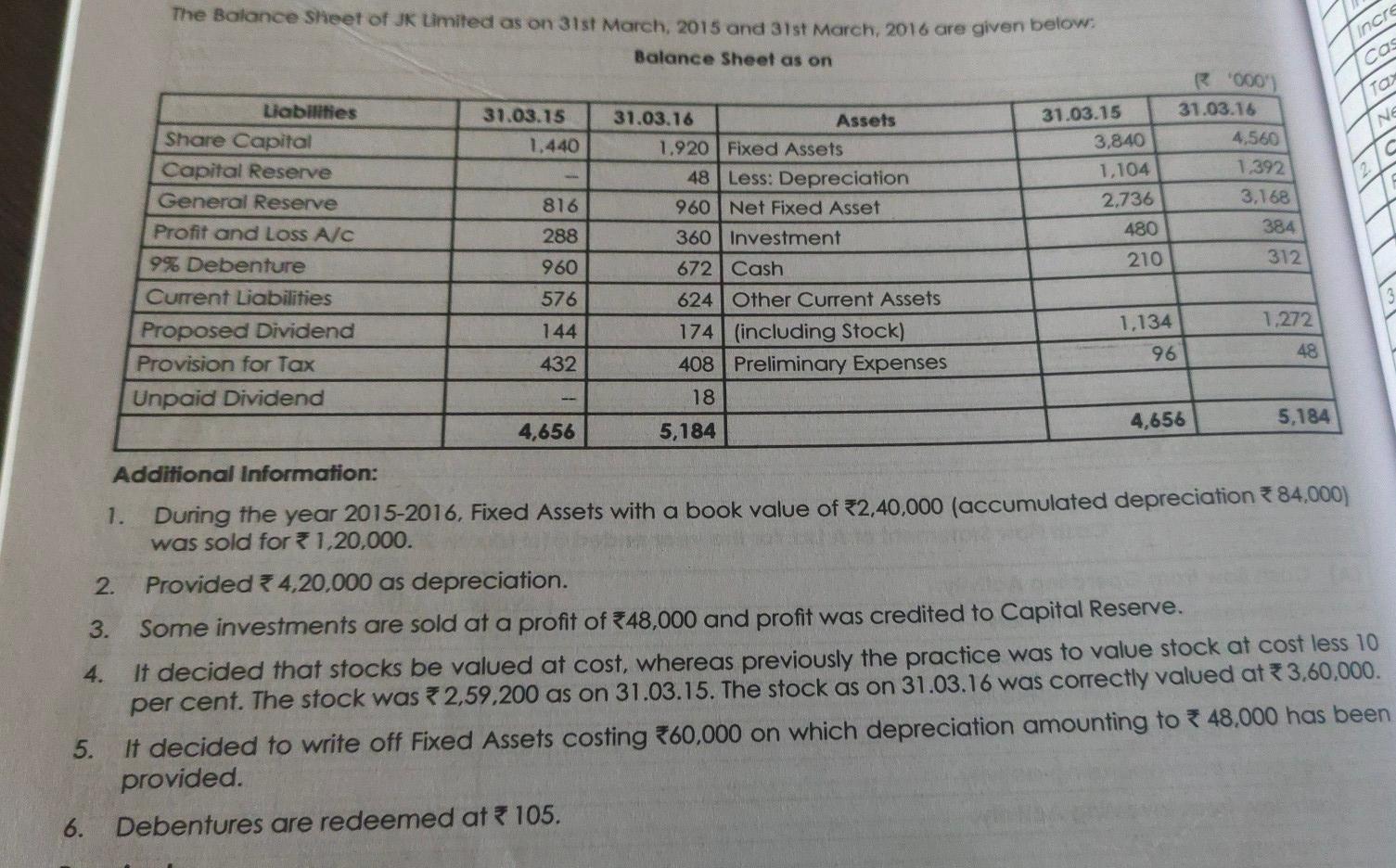

The Balance sheet of JK Limited as on 31st March, 2015 and 31st March, 2016 are given below. Balance Sheet as on Incrs 31.03.15 1,440

The Balance sheet of JK Limited as on 31st March, 2015 and 31st March, 2016 are given below. Balance Sheet as on Incrs 31.03.15 1,440 31.03.15 3,840 1,104 2,736 480 cas Ta NE a R"000 31.03.16 4,560 1.392 3,168 384 312 Liabilities Share Capital Capital Reserve General Reserve Profit and Loss A/C 9% Debenture Current Liabilities Proposed Dividend Provision for Tax Unpaid Dividend 816 31.03.16 Assets 1.920 Fixed Assets 48 Less: Depreciation 960 Net Fixed Asset 360 Investment 672 Cash 624 | Other Current Assets 174 (including Stock) 408 Preliminary Expenses 18 288 960 576 210 1,272 144 1,134 96 48 432 4,656 4,656 5,184 5,184 Additional Information: 1. During the year 2015-2016, Fixed Assets with a book value of 52,40,000 (accumulated depreciation 84.000) was sold for 1,20,000. 2. Provided 4,20,000 as depreciation. 3. Some investments are sold at a profit of 48,000 and profit was credited to Capital Reserve. 4. It decided that stocks be valued at cost, whereas previously the practice was to value stock at cost less 10 per cent. The stock was 2,59,200 as on 31.03.15. The stock as on 31.03.16 was correctly valued at 3,60,000. 5. It decided to write off Fixed Assets costing 60,000 on which depreciation amounting to 48,000 has been provided. 6. Debentures are redeemed at 105

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started