Answered step by step

Verified Expert Solution

Question

1 Approved Answer

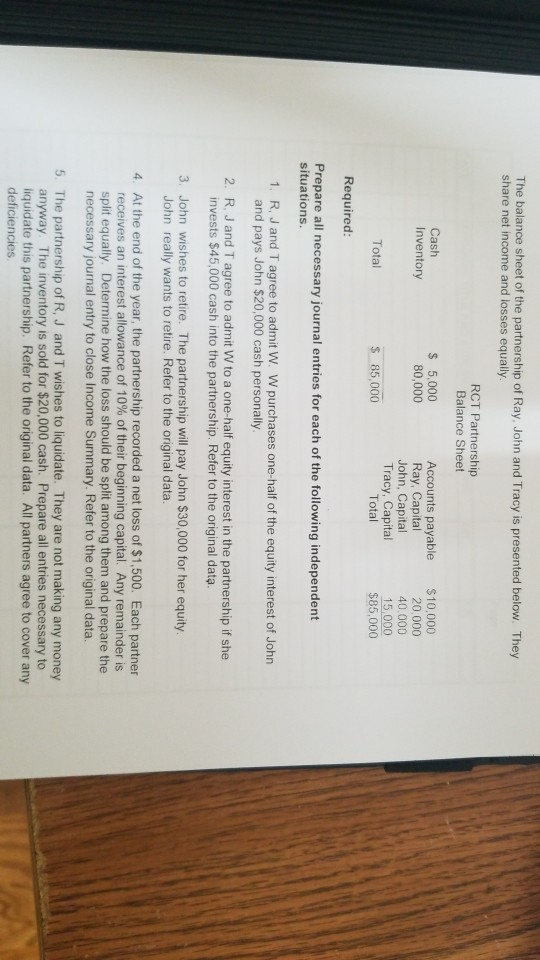

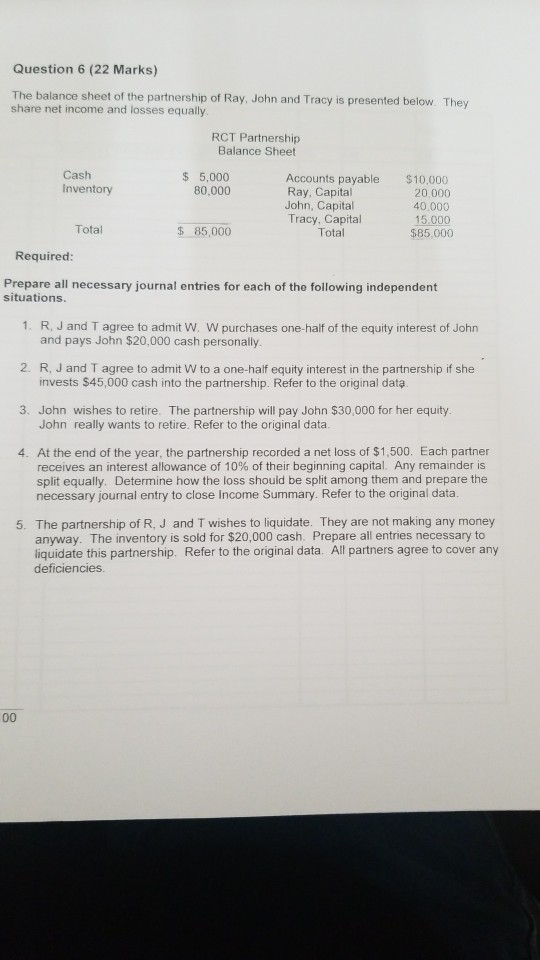

The balance sheet of the partnership of Ray, John and Tracy is presented below. They share net income and losses equally. RCT Partnership Balance Sheet

The balance sheet of the partnership of Ray, John and Tracy is presented below. They share net income and losses equally. RCT Partnership Balance Sheet Cash $ 5,000 80,000 $10,000 Accounts payable Ray, Capital John, Capital Tracy, Capital Total Inventory 20,000 40.000 15,000 $85,000 Total $ 85,000 Required: Prepare all necessary journal entries for each of the following independent situations. 1. R, J and T agree to admit W. W purchases one-half of the equity interest of John and pays John $20,000 cash personally 2. R, J and T agree to admit W to a one-half equity interest in the partnership if she invests $45,000 cash into the partnership. Refer to the original data. 3. John wishes to retire. The partnership will pay John $30,000 for her equity John really wants to retire. Refer to the original data. 4. At the end of the year, the partnership recorded a net loss of $1,500. Each partner receives an interest allowance of 10% of their beginning capital. Any remainder is split equally. Determine how the loss should be split among them and prepare the necessary journal entry to close Income Summary. Refer to the original data. 5 The partnership of R, J and T wishes to liquidate. They are not making any money anyway. The inventory is sold for $20,000 cash. Prepare all entries necessary to liquidate this partnership. Refer to the original data. All partners agree to cover any deficiencies Question 6 (22 Marks) The balance sheet of the partnership of Ray, John and Tracy is presented below. They share net income and losses equally RCT Partnership Balance Sheet Cash $ 5,000 Accounts payable Ray, Capital John, Capital Tracy, Capital Total $10,000 20.000 40.000 Inventory 80,000 15.000 $85.000 Total ,000 Required: Prepare all necessary journal entries for each of the following independent situations. 1. R, J and T agree to admit W. W purchases one-half of the equity interest of John and pays John $20,000 cash personally. 2. R, J and T agree to admit W to a one-half equity interest in the partnership if she invests $45,000 cash into the partnership. Refer to the original data 3. John wishes to retire. The partnership will pay John $30,000 for her equity. John really wants to retire. Refer to the original data. 4. At the end of the year, the partnership recorded a net loss of $1,500. Each partner receives an interest allowance of 10 % of their beginning capital. Any remainder is split equally. Determine how the loss should be split among them and prepare the necessary journal entry to close Income Summary. Refer to the original data. 5 The partnership of R, J and T wishes to liquidate. They are not making any money anyway. The inventory is sold for $20,000 cash. Prepare all entries necessary to liquidate this partnership. Refer to the original data. All partners agree to cover any deficiencies. 00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started