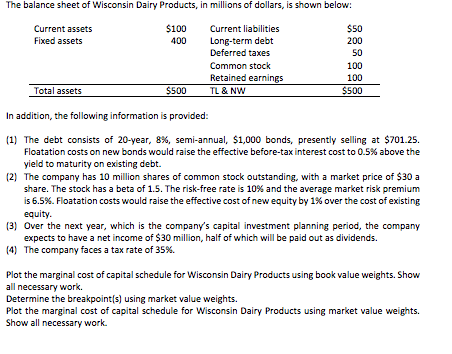

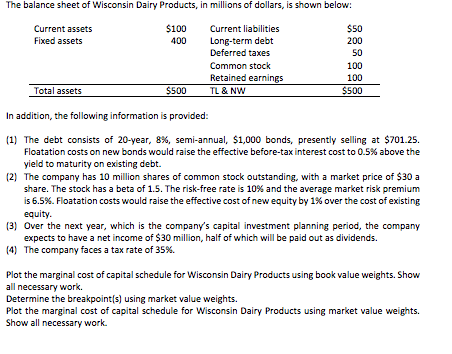

The balance sheet of Wisconsin Dairy Products, in millions of dollars, is shown below Current assets Fixed assets $50 200 50 100 100 $100 Crrent liabilities 400 Long-term debt Deferred taxes Common stock Retained earnings TL & NW Total assets $500 In addition, the following information is provided: 1) The debt consists of 20-year, 8%, semi-annual, $1,000 bonds, presently selling at $701.25. Floatation costs on new bonds would raise the effective before-tax interest cost to 0.5% above the yield to maturity on existing debt. 2) The company has 10 million shares of common stock outstanding, with a market price of S30 a share. The stock has a beta of 1.5. The risk-free rate is 10% and the average market risk premium is 6.5%. Floatation costs would raise the effective cost of new equity by 1% over the cost of existing equity 3) Over the next yea r, which is the company's capital investment p lanning period, the company expects to have a net income of $30 million, half of which will be paid out as dividends. The company faces a tax rate of 35%. (4) Plot the marginal cost of capital schedule for Wisconsin Dairy Products using book value weights. Show all necessary work. Determine the breakpoints) using market value weights. Plot the marginal cost of capital schedule for Wisconsin Dairy Products using market value weights. Show all necessary work The balance sheet of Wisconsin Dairy Products, in millions of dollars, is shown below Current assets Fixed assets $50 200 50 100 100 $100 Crrent liabilities 400 Long-term debt Deferred taxes Common stock Retained earnings TL & NW Total assets $500 In addition, the following information is provided: 1) The debt consists of 20-year, 8%, semi-annual, $1,000 bonds, presently selling at $701.25. Floatation costs on new bonds would raise the effective before-tax interest cost to 0.5% above the yield to maturity on existing debt. 2) The company has 10 million shares of common stock outstanding, with a market price of S30 a share. The stock has a beta of 1.5. The risk-free rate is 10% and the average market risk premium is 6.5%. Floatation costs would raise the effective cost of new equity by 1% over the cost of existing equity 3) Over the next yea r, which is the company's capital investment p lanning period, the company expects to have a net income of $30 million, half of which will be paid out as dividends. The company faces a tax rate of 35%. (4) Plot the marginal cost of capital schedule for Wisconsin Dairy Products using book value weights. Show all necessary work. Determine the breakpoints) using market value weights. Plot the marginal cost of capital schedule for Wisconsin Dairy Products using market value weights. Show all necessary work