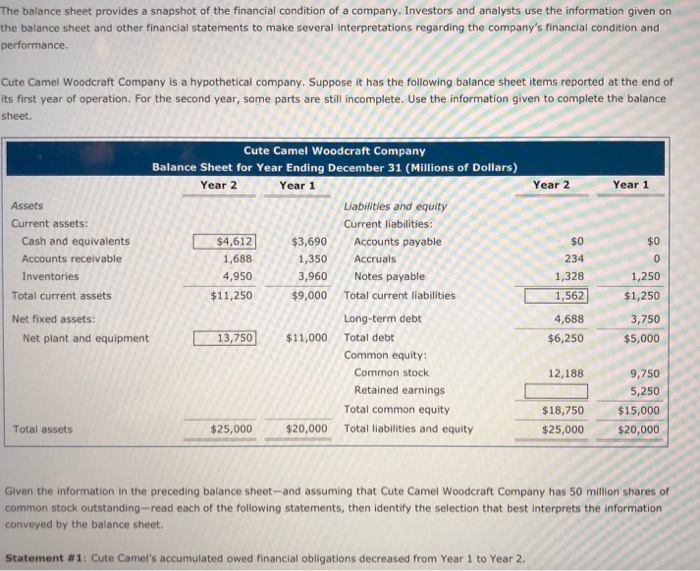

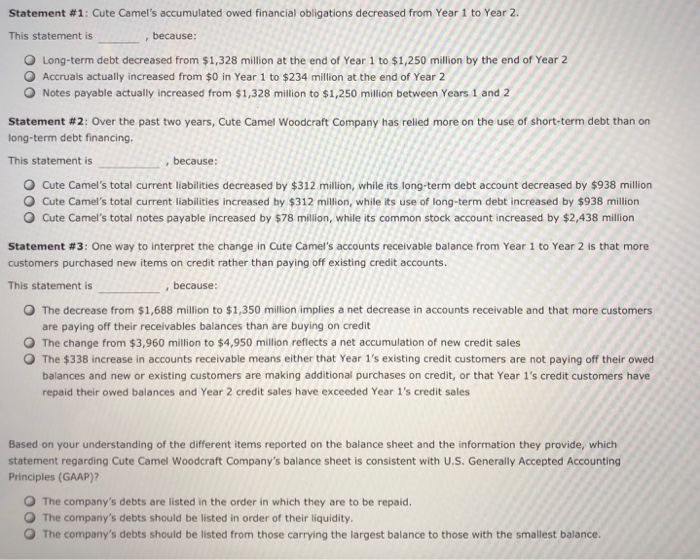

The balance sheet provides a snapshot of the financial condition of a company. Investors and analysts use the information given on the balance sheet and other financial statements to make several interpretations reg performance. Cute Camel Woodcraft Company is a hypothetical company. Suppose it has the following balance sheet items reported at the end of its first year of operation. For the second year, some parts are still incomplete. Use the information given to complete the balance sheet. Year 2 Year 1 $0 $0 234 0 1,328 Cute Camel Woodcraft Company Balance Sheet for Year Ending December 31 (Millions of dollars) Year 2 Year 1 Assets Liabilities and equity Current assets: Current liabilities: Cash and equivalents $4,612 $3,690 Accounts payable Accounts receivable 1,688 1,350 Accruals Inventories 4,950 3,960 Notes payable Total current assets $11,250 $9,000 Total current liabilities Net fixed assets: Long-term debt Net plant and equipment 13,750 $11,000 Total debt Common equity: Common stock Retained earnings Total common equity Total assets $25,000 $20,000 Total liabilities and equity 1,562 1,250 $1,250 3,750 $5,000 4,688 $6,250 12,188 9,750 5,250 $15,000 $20,000 $18,750 $25,000 Given the information in the preceding balance sheet-and assuming that Cute Camel Woodcraft Company has 50 million shares of common stock outstanding-read each of the following statements, then identify the selection that best interprets the information conveyed by the balance sheet. Statement #1: Cute Camel's accumulated owed financial obligations decreased from Year 1 to Year 2. Statement #1: Cute Camel's accumulated owed financial obligations decreased from Year 1 to Year 2. This statement is , because: Long-term debt decreased from $1,328 million at the end of Year 1 to $1,250 million by the end of Year 2 Accruals actually increased from $0 in Year 1 to $234 million at the end of Year 2 Notes payable actually increased from $1,328 million to $1,250 million between Years 1 and 2 Statement #2: Over the past two years, Cute Camel Woodcraft Company has relied more on the use of short-term debt than on long-term debt financing, This statement is , because: Cute Camel's total current liabilities decreased by $312 million, while its long-term debt account decreased by $938 million Cute Camel's total current liabilities increased by $312 million, while its use of long-term debt increased by $938 million Cute Camel's total notes payable increased by $78 million, while its common stock account increased by $2,438 million Statement #3: One way to interpret the change in Cute Camel's accounts receivable balance from Year 1 to Year 2 is that more Customers purchased new items on credit rather than paying off existing credit accounts. This statement is because: The decrease from $1,688 million to $1,350 million implies a net decrease in accounts receivable and that more customers are paying off their receivables balances than are buying on credit The change from $3,960 million to $4,950 million reflects a net accumulation of new credit sales The $338 increase in accounts receivable means either that Year 1's existing credit customers are not paying off their owed balances and new or existing customers are making additional purchases on credit, or that Year 1's credit customers have heir owed balances and Year 2 credit sales have exceeded Year 1's credit sales Based on your understanding of the different items reported on the balance sheet and the information they provide, which statement regarding Cute Camel Woodcraft Company's balance sheet is consistent with U.S. Generally Accepted Accounting Principles (GAAP)? O The company's debts are listed in the order in which they are to be repaid. The company's debts should be listed in order of their liquidity. The company's debts should be listed from those carrying the largest balance to those with the smallest balance