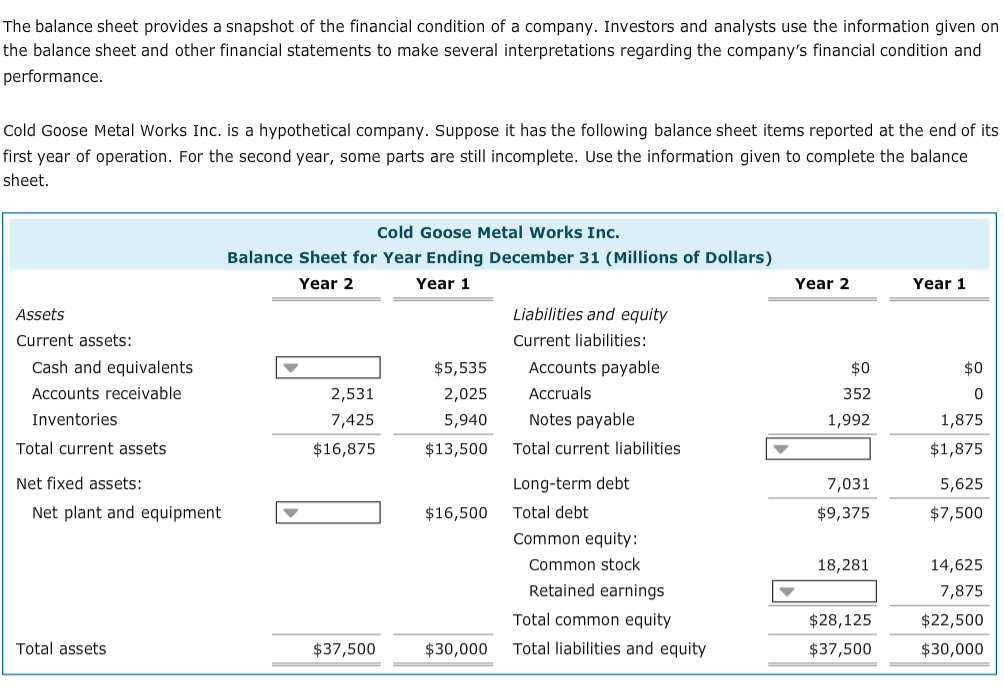

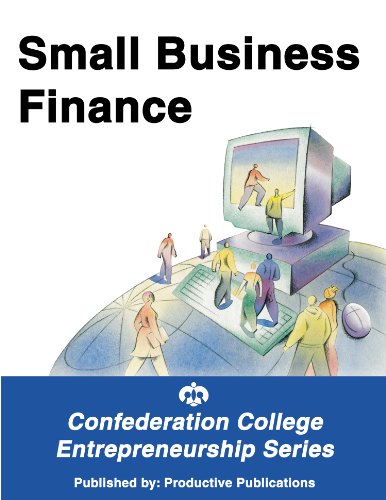

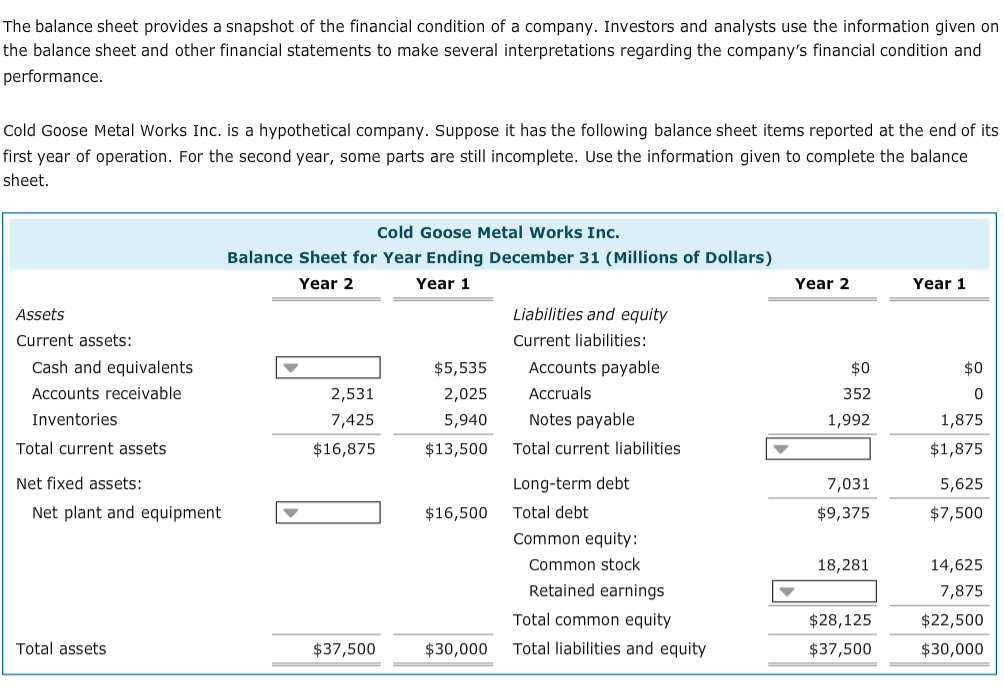

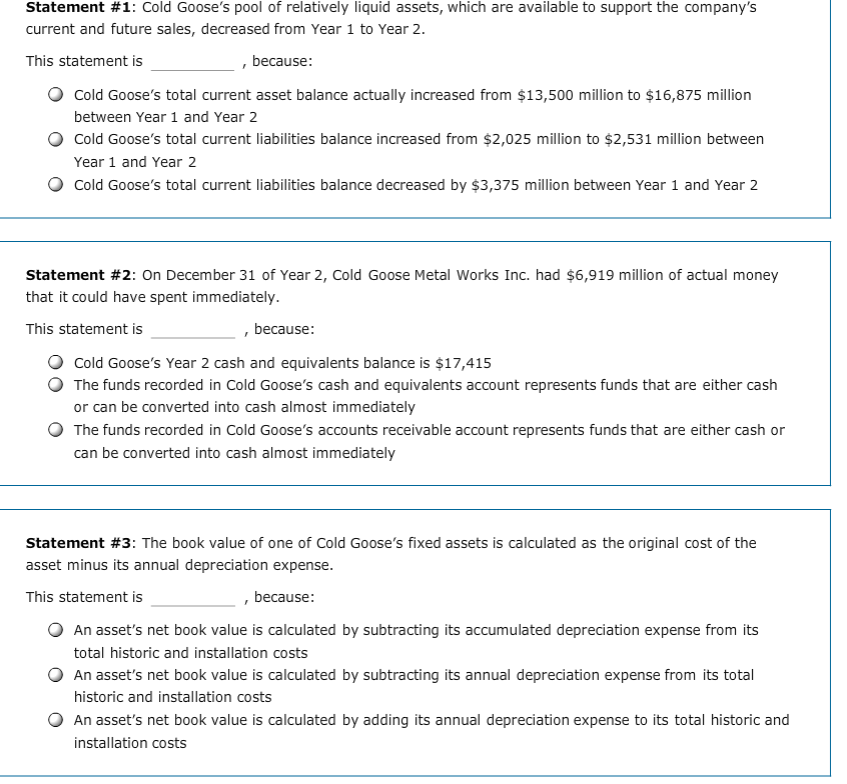

The balance sheet provides a snapshot of the financial condition of a company. Investors and analysts use the information given on the balance sheet and other financial statements to make several interpretations regarding the company's financial condition and performance Cold Goose Metal Works Inc. is a hypothetical company. Suppose it has the following balance sheet items reported at the end of its first year of operation. For the second year, some parts are still incomplete. Use the information given to complete the balance sheet Cold Goose Metal Works Inc. Balance Sheet for Year Ending December 31 (Millions of Dollars) Year 2 Year 1 Year 2 Year 1 Liabilities and equity Current liabilities: Assets Current assets: Cash and equivalents Accounts receivable Inventories $5,535 Accounts payable 352 2,531 7,425 $16,875 2,025 5,940 $13,500 Accruals Notes payable Total current liabilities Long-term debt 0 1,875 $1,875 5,625 $7,500 1,992 Total current assets Net fixed assets: 7,031 $9,375 Net plant and equipment $16,500 Total debt Common equity: 14,625 7,875 $22,500 $30,000 Common stock 18,281 Retained earnings Total common equity Total liabilities and equity $28,125 $37,500 Total assets $37,500 $30,000 Statement #1: Cold Goose's pool of relatively liquid assets, which are available to support the company's current and future sales, decreased from Year 1 to Year 2. This statement is because , Cold Goose's total current asset balance actually increased from $13,500 million to $16,875 million between Year 1 and Year 2 O Cold Goose's total current liabilities balance increased from $2,025 million to $2,531 million between Year 1 and Year 2 Cold Goose's total current liabilities balance decreased by $3,375 million between Year 1 and Year 2 statement #2: On December 31 of Year 2, Cold Goose Metal Works Inc. had $6,919 million of actual money that it could have spent immediately. This statement is , because: O Cold Goose's Year 2 cash and equivalents balance is $17,415 O The funds recorded in Cold Goose's cash and equivalents account represents funds that are either cash or can be converted into cash almost immediately O The funds recorded in Cold Goose's accounts receivable account represents funds that are either cash or can be converted into cash almost immediately Statement #3: The book value of one of Cold Goose's fixed assets is calculated as the original cost of the asset minus its annual depreciation expense. This statement is , because O An asset's net book value is calculated by subtracting its accumulated depreciation expense from its total historic and installation costs O An asset's net book value is calculated by subtracting its annual depreciation expense from its total historic and installation costs O An asset's net book value is calculated by adding its annual depreciation expense to its total historic and installation costs The balance sheet provides a snapshot of the financial condition of a company. Investors and analysts use the information given on the balance sheet and other financial statements to make several interpretations regarding the company's financial condition and performance Cold Goose Metal Works Inc. is a hypothetical company. Suppose it has the following balance sheet items reported at the end of its first year of operation. For the second year, some parts are still incomplete. Use the information given to complete the balance sheet Cold Goose Metal Works Inc. Balance Sheet for Year Ending December 31 (Millions of Dollars) Year 2 Year 1 Year 2 Year 1 Liabilities and equity Current liabilities: Assets Current assets: Cash and equivalents Accounts receivable Inventories $5,535 Accounts payable 352 2,531 7,425 $16,875 2,025 5,940 $13,500 Accruals Notes payable Total current liabilities Long-term debt 0 1,875 $1,875 5,625 $7,500 1,992 Total current assets Net fixed assets: 7,031 $9,375 Net plant and equipment $16,500 Total debt Common equity: 14,625 7,875 $22,500 $30,000 Common stock 18,281 Retained earnings Total common equity Total liabilities and equity $28,125 $37,500 Total assets $37,500 $30,000 Statement #1: Cold Goose's pool of relatively liquid assets, which are available to support the company's current and future sales, decreased from Year 1 to Year 2. This statement is because , Cold Goose's total current asset balance actually increased from $13,500 million to $16,875 million between Year 1 and Year 2 O Cold Goose's total current liabilities balance increased from $2,025 million to $2,531 million between Year 1 and Year 2 Cold Goose's total current liabilities balance decreased by $3,375 million between Year 1 and Year 2 statement #2: On December 31 of Year 2, Cold Goose Metal Works Inc. had $6,919 million of actual money that it could have spent immediately. This statement is , because: O Cold Goose's Year 2 cash and equivalents balance is $17,415 O The funds recorded in Cold Goose's cash and equivalents account represents funds that are either cash or can be converted into cash almost immediately O The funds recorded in Cold Goose's accounts receivable account represents funds that are either cash or can be converted into cash almost immediately Statement #3: The book value of one of Cold Goose's fixed assets is calculated as the original cost of the asset minus its annual depreciation expense. This statement is , because O An asset's net book value is calculated by subtracting its accumulated depreciation expense from its total historic and installation costs O An asset's net book value is calculated by subtracting its annual depreciation expense from its total historic and installation costs O An asset's net book value is calculated by adding its annual depreciation expense to its total historic and installation costs