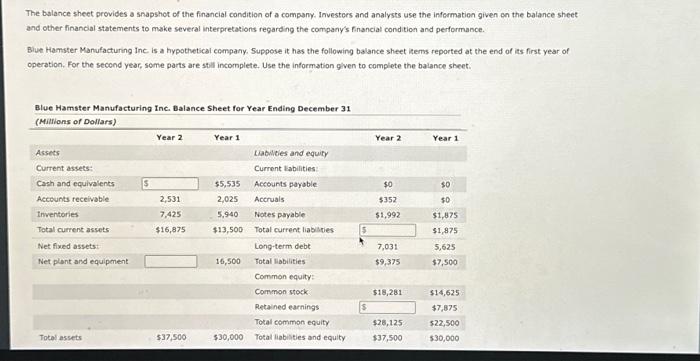

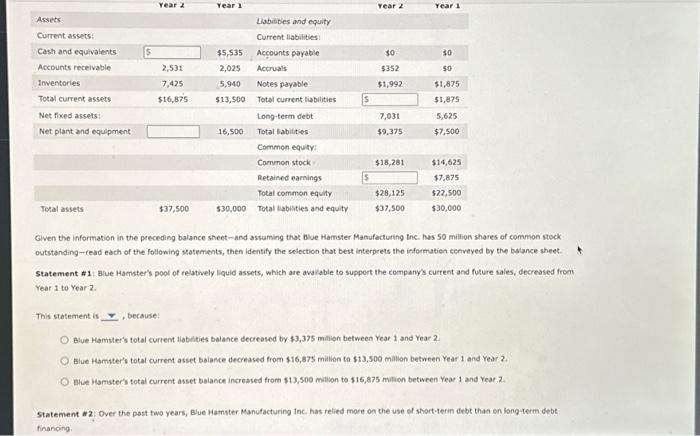

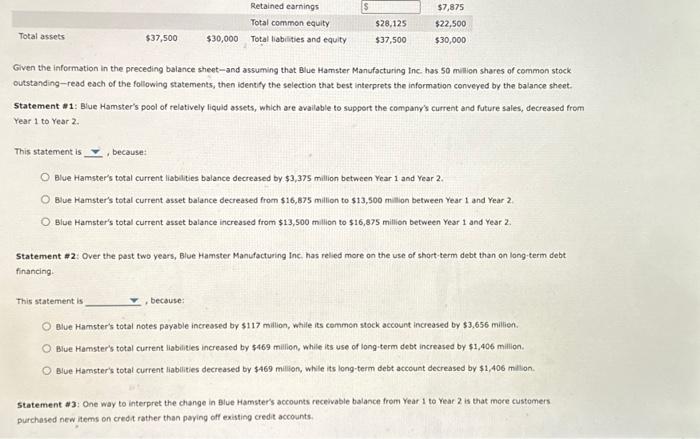

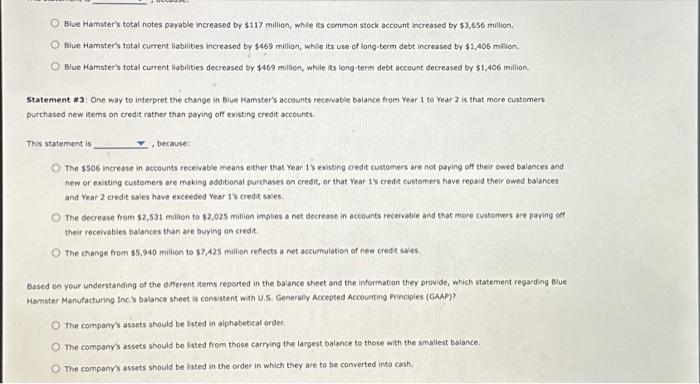

The balance sheet provides a snapshot of the financial condition of a company. Investors and analysts use the information given on the balance sheet and other financial statements to make several interpretasions regarding the company's financial condition and performance. Biue Hamster Manufacturing Inc is a hypothetical company, Suppose it has the following balance sheet items reported at the end of its first year of operation. For the second year, some parts are still incomplete. Use the information given to complete the balance sheet. Blue Hamster Manufacturind Inc. Dalance Sheet for Year Endino December 31 Given the information in the preceding balance sheet-and assuming that blue Hamster Manufacturihg Inc. has 50 million shares of common stock outstanding-read each of the following scatements, then identify the selection that best interprets the informatien cenveyed by the balance sheet Statement \# 1: Blue Hacrster's pool of relatively liquid assets, which are avaiable to support the company's current and fulure sales, decreased from Year 1 to Year? 2. This statement is , becsuse: Blue Hamster's total curtent liabdties balance decreased by $3,375 milion befween Year 1 and Year 2. Bluc Hamster's total current asset balance decreased from $16,875 milion to 513,500 milion between Year 1 and Year 2. Blue Hamster's total current asset balance increased from $13,500 milion bo 516,875 molion between Year 1 and Year 2 . Statearent in 2. Over the post two years, Blue Hamster Manufacturing Inc. has relied more on the use of short-terin debt than on long-term debe financing. Given the information in the preceding baiance sheet-and assuming that Blue Hamster Manufacturing Inc. has 50 million shares of common stock outstanding-read each of the following statements, then identify the selection that best interprets the information convered by the balance sheet. Statement a 1: Blue Hamster's pool of relatively liquid assets, which are avallable to support the company's current and future sales, decreased from Year 1 to Year 2. This statement is , because: Bive Hamster's total current liabilities balance decreased by $3,375 million between Year 1 and Year 2. Blue Hamster's total current asset balance decreased from $16,875 million to $13,500mililion between Year 1 and Year 2 . Blue Hamster's total current asset balance increased from $13,500 million to $16,875 million between Year 1 and Year 2 . Statement 22: Over the past two years, Blue Hamster Manufacturing inc. has relied more on the use of short-term debt than on long-term debt. financing. This statement is , bectuse: Blue Hamster's total notes payable increased by $117 milion, while its common stock account increased by $3,656 millien. Blue Hamster's total current liabilies increased by $469 million, while its use of long term debt increased by $1,406 million. Blue Hamster's total current liablities decreased by $469 milion, while its long-term debt account decreased by $1,406 millon. Statement a 3: One way to interpret the change in Blue Hamster's accounts receivable balance from Year 1 to Year 2 is that more customers purchased new items on credt rather than paying off existing credit accounts. Blue Hamster's total notes payable increased by $117 million, while its common stock account increased by 53,656 milion. Bive Hamster's total current labilities increased by $469 million, while its use of long-term debt increased by $1,406 milion. Blue Hamster's total current liabilities decreased by $459 milicn, while its long term debt account decreased by $1,406 milion. Statement w 3: One way to interpret the change in Biue Mamster's accounts tectivable balance from Year 1 to Year? is that mere customers purchased new items on eredit rather than poying off existing credit aceounts. This statement is becase: The 5506 increase in accounts recelable means either that Year 1 's existing credit customers are not paying off their owed balances and new or existing customers are making additional purchases on credit, or that Year 1 s crede customers have repaid their owed balences and Year 2 credit sales have exceeded Year 1 's credit sales. The decrease from 52,531 milion to $2,025 mition implies a net decrease in acceunts receivabie and that more customers are paying of their receivables balances than are buying on credi. The change from 15,940 milion to 57,425 milion reflects a net accumulation of fea credt saves. Based on your understanding of the dfferent items reported in the balance sheet and the information they provide, which statement regarding Biue Mamster Manufacturing Incis balance sheet is consivent with U.S. Ceneraly Accepted Accounting Frinciples (GAAP)? The compony's assets should be lsted in aiphabetical order