Answered step by step

Verified Expert Solution

Question

1 Approved Answer

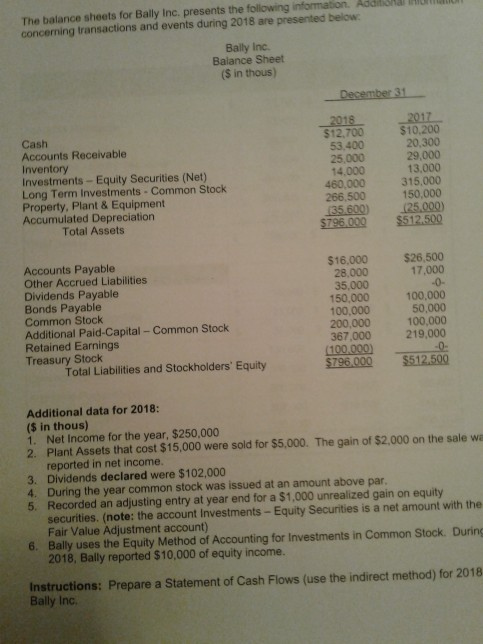

The balance sheets for Bally Inc. presents the following information. Addliai concerning transactions and events during 2018 are presented below Bally Inc. Balance Sheet (S

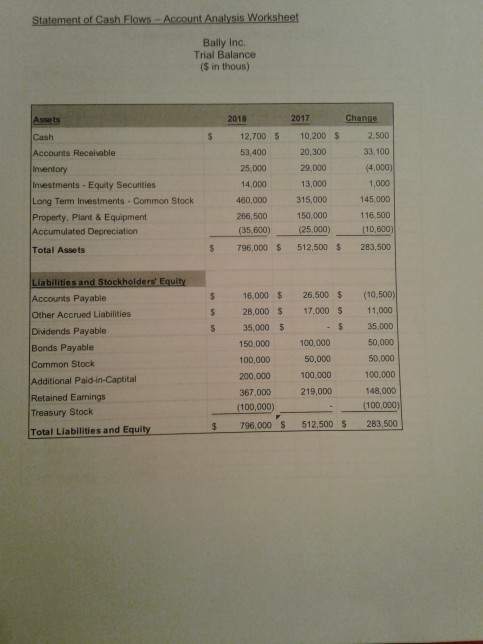

The balance sheets for Bally Inc. presents the following information. Addliai concerning transactions and events during 2018 are presented below Bally Inc. Balance Sheet (S in thous) 20182017 Cash Accounts Receivable Inventory Investments-Equity Securities (Net) Long Term Investments Common Stock Property, Plant & Equipment Accumulated Depreciation $12,700 53,400 25,000 14.000 460,000 266,500 $10.200 20,300 29,000 13,000 315,000 150,000 Total Assets $796.009 $512.500 Accounts Payable Other Accrued Liabilities Dividends Payable Bonds Payable Common Stock Additional Paid-Capital - Common Stock Retained Earnings Treasury Stock $16,000 28,000 35,000 150,000 100,000 200,000 367,000 $26,500 17,000 100,000 50,000 100,000 219,000 Total Liabilities and Stockholders' Equity $796,000 $512.500 Additional data for 2018: ($ in thous) 1. Net Income for the year, $250,000 2. Plant Assets that cost $15,000 were sold for $5,000. The gain of $2.000 on the sale wa reported in net income. 3. Dividends declared were $102,000 4. During the year common stock was issued at an amount above par 5. Recorded an adjusting entry at year end for a $1,000 unrealized gain on equity securities. (note: the account Investments- Equity Securities is a net amount with the Fair Value Adjustment account) 6. Bally uses the Equity Method of Accounting for Investments in Common Stock. During 2018, Bally reported $10,000 of equity income. Instructions: Prepare a Statement of Cash Flows (use the indirect method) for 2018 Bally Inc. 3 Statement of Cash Flows Account Analysis Worksheet Bally Inc. Trial Balance (S in thous) 2018 2017 $ 12,700 S 10,200 $ 2.500 33,100 (4,000) 1,000 145,000 116,500 (10,600) s 796,000 512,500 283,500 Accounts Receivable 53,400 29,000 13,000 315,000 150,000 (25,000) 14,000 460,000 266,500 (35,600) Investments-Equity Secuities Long Term Investments Common Stock Property, Plant & Equipment Accumulated Depreciation Total Assets $ 16,000 26,500 s (10.500) $ 28,000 S 17.000 11,000 -$35,000 50,000 50,000 100,000 367,000 219,000 148.000 Accounts Payable Other Accrued Liabilities Dividends Payable Bonds Payable Common Stock Additional Paid-in-Captital Retained Earnings Treasury Stock Total Liabilities and Equity 5 35,000 $ 100,000 50,000 100,000 150,000 200,000 100,000) 796,000 S 512,500 S 283,500 Bally Inc. Statement of Cash Flows For the year ended December 31, 2018 (S in thous) Net Income Net Increase to cash Cash Balance 12/31/2017 Cash Balance 12/31/2018

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started