Question

The balance sheets of Abdul Co. and Lana Co. on June 30, Year 2, just before the transaction described below, were as follows: Abdul Lana

The balance sheets of Abdul Co. and Lana Co. on June 30, Year 2, just before the transaction described below, were as follows:

| Abdul | Lana | |||

| Receivables | $ | 103,000 | $ | 25,150 |

| Inventory | 65,500 | 8,650 | ||

| Plant assets (net) | 246,000 | 71,350 | ||

| $ | 414,500 | $ | 105,150 | |

| Current liabilities | $ | 70,500 | $ | 32,600 |

| Long-term debt | 99,250 | 45,100 | ||

| Common shares | 145,500 | 45,050 | ||

| Retained earnings (deficit) | 99,250 | (17,600) | ||

| $ | 414,500 | $ | 105,150 | |

On June 30, Year 2, Abdul Co. purchased all of Lana Co. assets and assumed all of Lana Co. liabilities for $68,000 in cash. The carrying amounts of Lanas net assets were equal to fair value except for the following:

| Fair Value | |

| Inventory | $10,550 |

| Plant assets | 75,100 |

| Long-term debt | 38,800 |

Required:

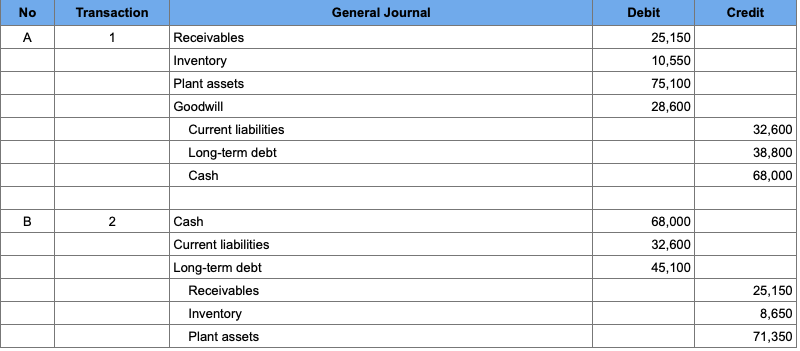

(a) Prepare the journal entries for Abdul Co. and for Lana Co. to record this transaction. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

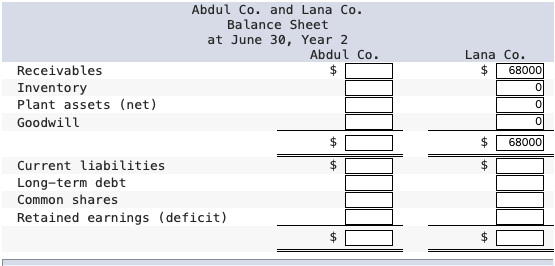

(b) Prepare balance sheets for Abdul Co. and Lana Co. at June 30, Year 2, after recording the transaction noted above. (Leave no cells blank - be certain to enter "0" wherever required. Omit $ sign in your response.)

NOTE: I've done required (a). I'm just confused and need help with part (b) of the question.

No General Journal Debit Credit Transaction 1 A Receivables Inventory Plant assets Goodwill Current liabilities Long-term debt Cash 25,150 10,550 75,100 28,600 32,600 38,800 68,000 B N 68,000 32,600 45,100 Cash Current liabilities Long-term debt Receivables Inventory Plant assets 25,150 8,650 71,350 Abdul Co. and Lana Co. Balance Sheet at June 30, Year 2 Abdul Co. $ Receivables Inventory Plant assets (net) Goodwill Lana Co. $ 68000 0 0 0 ta tA 68000 $ $ Current liabilities Long-term debt Common shares Retained earnings (deficit) $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started