Answered step by step

Verified Expert Solution

Question

1 Approved Answer

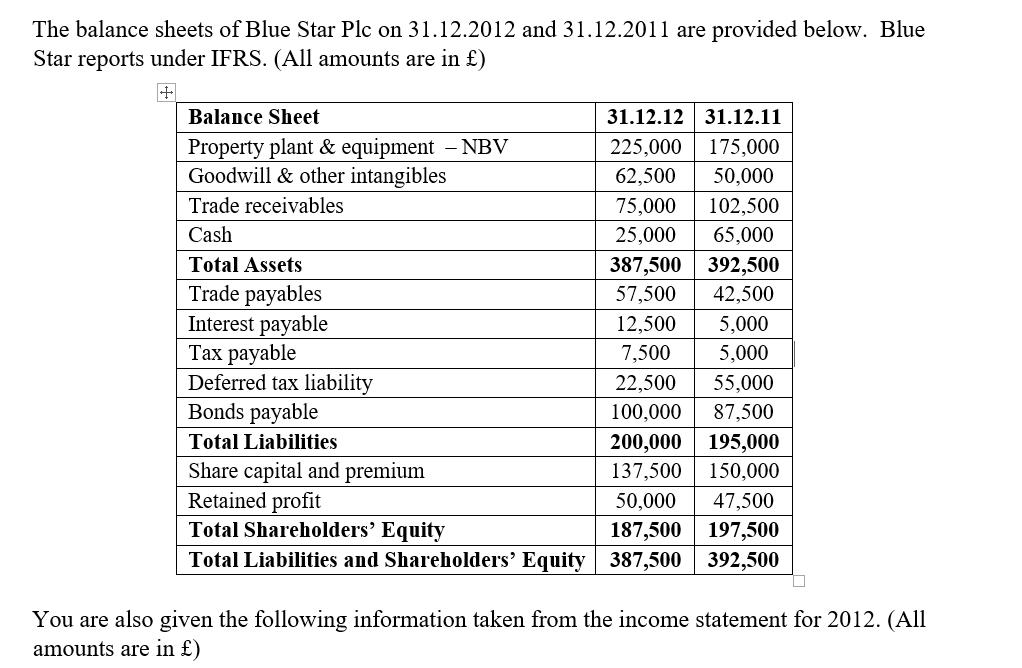

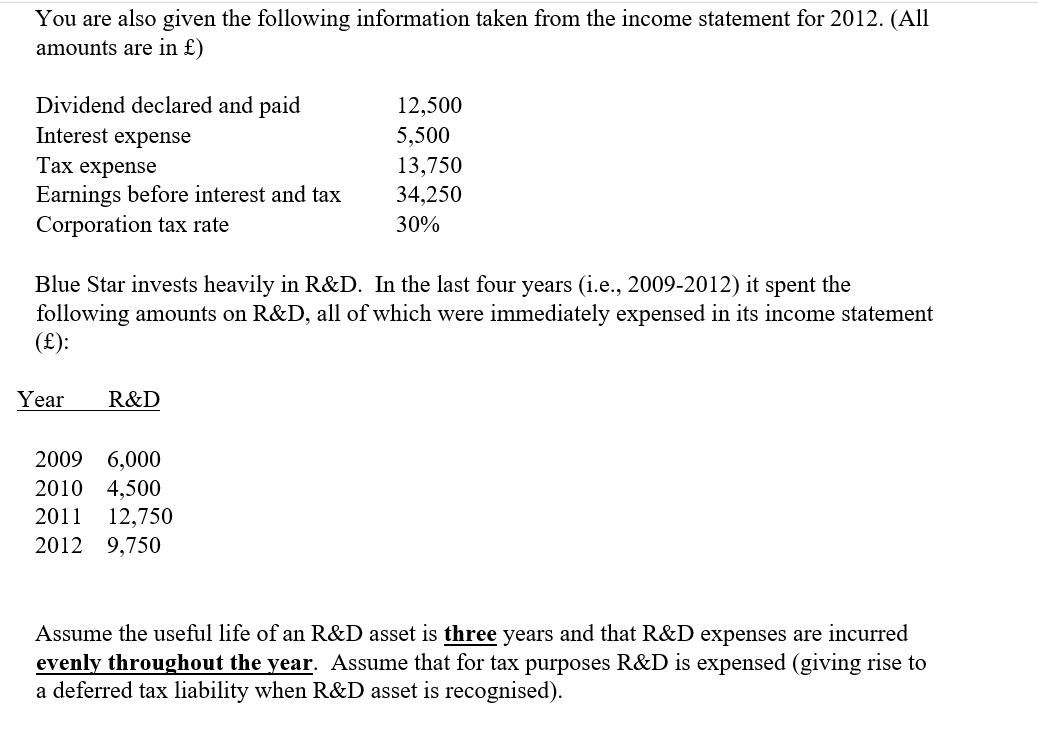

The balance sheets of Blue Star Plc on 31.12.2012 and 31.12.2011 are provided below. Blue Star reports under IFRS. (All amounts are in )

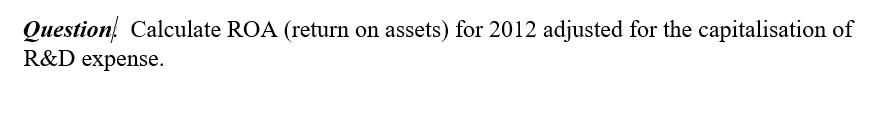

The balance sheets of Blue Star Plc on 31.12.2012 and 31.12.2011 are provided below. Blue Star reports under IFRS. (All amounts are in ) + Balance Sheet 31.12.12 31.12.11 Property plant & equipment -NBV Goodwill & other intangibles 225,000 175,000 62,500 50,000 Trade receivables 75,000 102,500 Cash 25,000 65,000 Total Assets 387,500 392,500 Trade payables Interest payable yable Deferred tax liability Bonds payable 57,500 42,500 12,500 5,000 7,500 5,000 22,500 55,000 100,000 87,500 200,000 137,500 Total Liabilities 195,000 Share capital and premium Retained profit Total Shareholders' Equity Total Liabilities and Shareholders' Equity 150,000 50,000 47,500 187,500 197,500 387,500 392,500 You are also given the following information taken from the income statement for 2012. (All amounts are in ) You are also given the following information taken from the income statement for 2012. (All amounts are in ) Dividend declared and paid Interest expense 12,500 5,500 pense Earnings before interest and tax Corporation tax rate 13,750 34,250 30% Blue Star invests heavily in R&D. In the last four years (i.e., 2009-2012) it spent the following amounts on R&D, all of which were immediately expensed in its income statement (): Year R&D 2009 6,000 2010 4,500 2011 12,750 2012 9,750 Assume the useful life of an R&D asset is three years and that R&D expenses are incurred evenly throughout the year. Assume that for tax purposes R&D is expensed (giving rise to a deferred tax liability when R&D asset is recognised). Question Calculate ROA (return on assets) for 2012 adjusted for the capitalisation of R&D expense. The balance sheets of Blue Star Plc on 31.12.2012 and 31.12.2011 are provided below. Blue Star reports under IFRS. (All amounts are in ) + Balance Sheet 31.12.12 31.12.11 Property plant & equipment -NBV Goodwill & other intangibles 225,000 175,000 62,500 50,000 Trade receivables 75,000 102,500 Cash 25,000 65,000 Total Assets 387,500 392,500 Trade payables Interest payable yable Deferred tax liability Bonds payable 57,500 42,500 12,500 5,000 7,500 5,000 22,500 55,000 100,000 87,500 200,000 137,500 Total Liabilities 195,000 Share capital and premium Retained profit Total Shareholders' Equity Total Liabilities and Shareholders' Equity 150,000 50,000 47,500 187,500 197,500 387,500 392,500 You are also given the following information taken from the income statement for 2012. (All amounts are in ) You are also given the following information taken from the income statement for 2012. (All amounts are in ) Dividend declared and paid Interest expense 12,500 5,500 pense Earnings before interest and tax Corporation tax rate 13,750 34,250 30% Blue Star invests heavily in R&D. In the last four years (i.e., 2009-2012) it spent the following amounts on R&D, all of which were immediately expensed in its income statement (): Year R&D 2009 6,000 2010 4,500 2011 12,750 2012 9,750 Assume the useful life of an R&D asset is three years and that R&D expenses are incurred evenly throughout the year. Assume that for tax purposes R&D is expensed (giving rise to a deferred tax liability when R&D asset is recognised). Question Calculate ROA (return on assets) for 2012 adjusted for the capitalisation of R&D expense. The balance sheets of Blue Star Plc on 31.12.2012 and 31.12.2011 are provided below. Blue Star reports under IFRS. (All amounts are in ) + Balance Sheet 31.12.12 31.12.11 Property plant & equipment -NBV Goodwill & other intangibles 225,000 175,000 62,500 50,000 Trade receivables 75,000 102,500 Cash 25,000 65,000 Total Assets 387,500 392,500 Trade payables Interest payable yable Deferred tax liability Bonds payable 57,500 42,500 12,500 5,000 7,500 5,000 22,500 55,000 100,000 87,500 200,000 137,500 Total Liabilities 195,000 Share capital and premium Retained profit Total Shareholders' Equity Total Liabilities and Shareholders' Equity 150,000 50,000 47,500 187,500 197,500 387,500 392,500 You are also given the following information taken from the income statement for 2012. (All amounts are in ) You are also given the following information taken from the income statement for 2012. (All amounts are in ) Dividend declared and paid Interest expense 12,500 5,500 pense Earnings before interest and tax Corporation tax rate 13,750 34,250 30% Blue Star invests heavily in R&D. In the last four years (i.e., 2009-2012) it spent the following amounts on R&D, all of which were immediately expensed in its income statement (): Year R&D 2009 6,000 2010 4,500 2011 12,750 2012 9,750 Assume the useful life of an R&D asset is three years and that R&D expenses are incurred evenly throughout the year. Assume that for tax purposes R&D is expensed (giving rise to a deferred tax liability when R&D asset is recognised). Question Calculate ROA (return on assets) for 2012 adjusted for the capitalisation of R&D expense.

Step by Step Solution

★★★★★

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

ROA Adjusted EBIT x 1tax rate Average adjusted total assets 3500...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started