Answered step by step

Verified Expert Solution

Question

1 Approved Answer

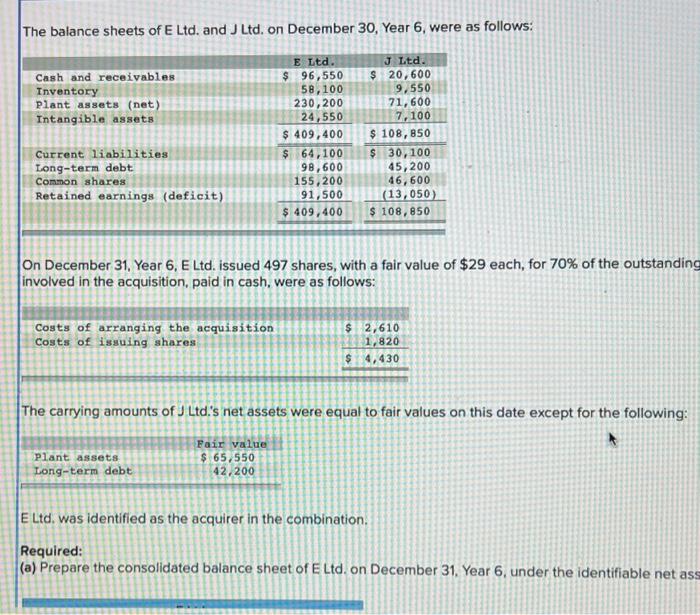

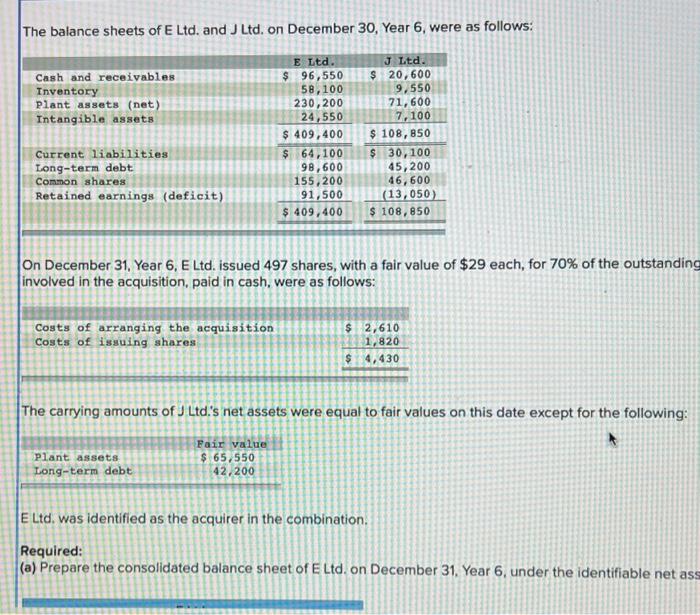

The balance sheets of E Ltd. and J Ltd. on December 30, Year 6, were as follows: J Ltd. $ 20,600 E Ltd. $ 96,550

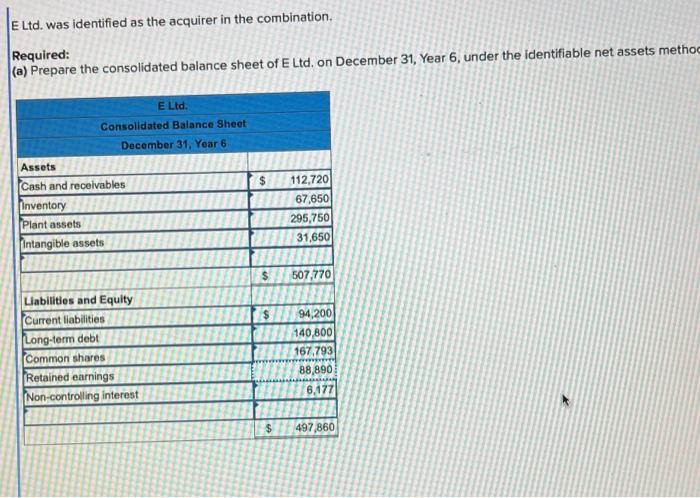

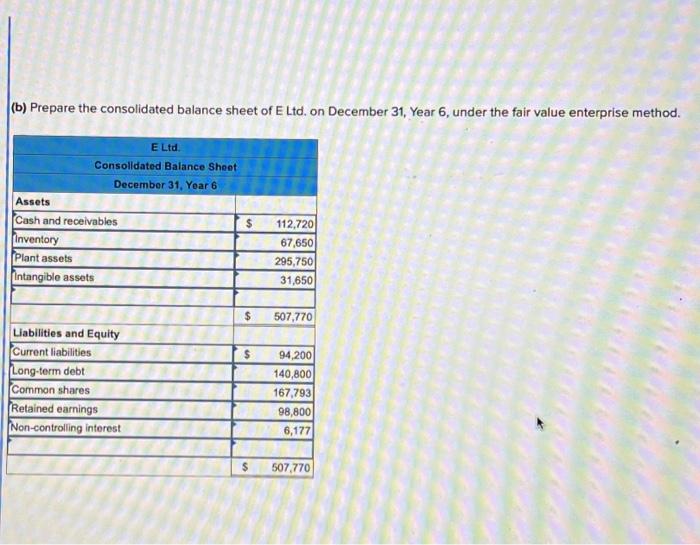

The balance sheets of E Ltd. and J Ltd. on December 30, Year 6, were as follows: J Ltd. $ 20,600 E Ltd. $ 96,550 58,100 230,200 24,550 9,550 71,600 7,100 $ 409,400 $ 108,850 $ $ 30,100 45,200 46,600 (13,050) Cash and receivables Inventory Plant assets (net) Intangible assets Current liabilities Long-term debt Common shares Retained earnings (deficit) Costs of arranging the acquisition Costs of issuing shares On December 31, Year 6, E Ltd. issued 497 shares, with a fair value of $29 each, for 70% of the outstanding involved in the acquisition, paid in cash, were as follows: Plant assets Long-term debt MEN 64,100 98,600 155,200 91,500 $ 409,400 The carrying amounts of J Ltd.'s net assets were equal to fair values on this date except for the following: Fair value $ 65,550 42,200 A D $ 108,850 E Ltd. was identified as the acquirer in the combination. Required: (a) Prepare the consolidated balance sheet of E Ltd. on December 31, Year 6, under the identifiable net ass TO $ 2,610 1,820 4,430 $

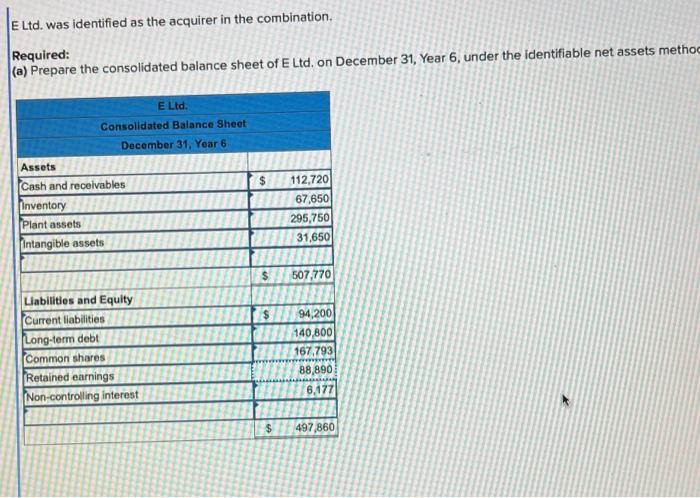

The balance sheets of E Ltd. and J Ltd. on December 30 , Year 6 , were as follows: On December 31, Year 6, E Ltd. issued 497 shares, with a fair value of $29 each, for 70% of the outstanding involved in the acquisition, paid in cash, were as follows: The carrying amounts of J Ltd's net assets were equal to fair values on this date except for the following: ELtd, was identified as the acquirer in the combination. Required: (a) Prepare the consolidated balance sheet of ELtd. on December 31, Year 6 , under the identifiable net as: ELtd. was identified as the acquirer in the combination. Required: (a) Prepare the consolidated balance sheet of E Ltd. on December 31, Year 6, under the identifiable net assets metho (b) Prepare the consolidated balance sheet of E Ltd. on December 31, Year 6, under the fair value enterprise method

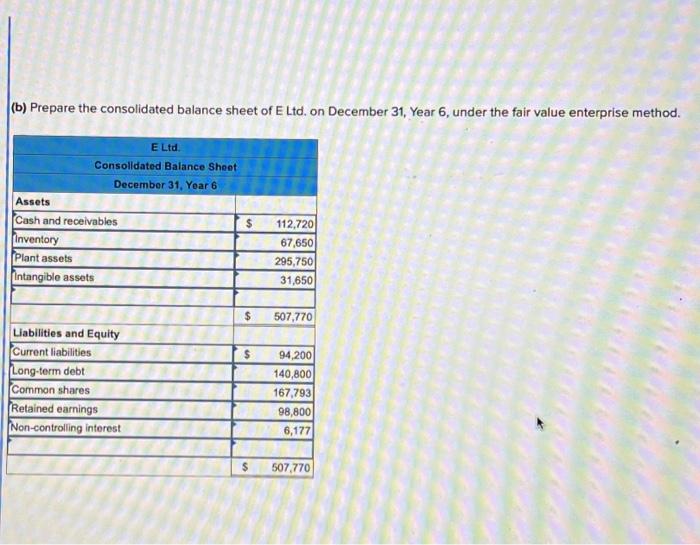

The balance sheets of E Ltd. and J Ltd. on December 30 , Year 6 , were as follows: On December 31, Year 6, E Ltd. issued 497 shares, with a fair value of $29 each, for 70% of the outstanding involved in the acquisition, paid in cash, were as follows: The carrying amounts of J Ltd's net assets were equal to fair values on this date except for the following: ELtd, was identified as the acquirer in the combination. Required: (a) Prepare the consolidated balance sheet of ELtd. on December 31, Year 6 , under the identifiable net as: ELtd. was identified as the acquirer in the combination. Required: (a) Prepare the consolidated balance sheet of E Ltd. on December 31, Year 6, under the identifiable net assets metho (b) Prepare the consolidated balance sheet of E Ltd. on December 31, Year 6, under the fair value enterprise method

The balance sheets of E Ltd. and J Ltd. on December 30, Year 6, were as follows: J Ltd. $ 20,600 E Ltd. $ 96,550 58,100 230,200 24,550 9,550 71,600 7,100 $ 409,400 $ 108,850 $ $ 30,100 45,200 46,600 (13,050) Cash and receivables Inventory Plant assets (net) Intangible assets Current liabilities Long-term debt Common shares Retained earnings (deficit) Costs of arranging the acquisition Costs of issuing shares On December 31, Year 6, E Ltd. issued 497 shares, with a fair value of $29 each, for 70% of the outstanding involved in the acquisition, paid in cash, were as follows: Plant assets Long-term debt MEN 64,100 98,600 155,200 91,500 $ 409,400 The carrying amounts of J Ltd.'s net assets were equal to fair values on this date except for the following: Fair value $ 65,550 42,200 A D $ 108,850 E Ltd. was identified as the acquirer in the combination. Required: (a) Prepare the consolidated balance sheet of E Ltd. on December 31, Year 6, under the identifiable net ass TO $ 2,610 1,820 4,430 $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started