Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 January 2020, Avos Co agreed a four-year contract with Sandy Co to provide access to license Avos Co's software including customer support

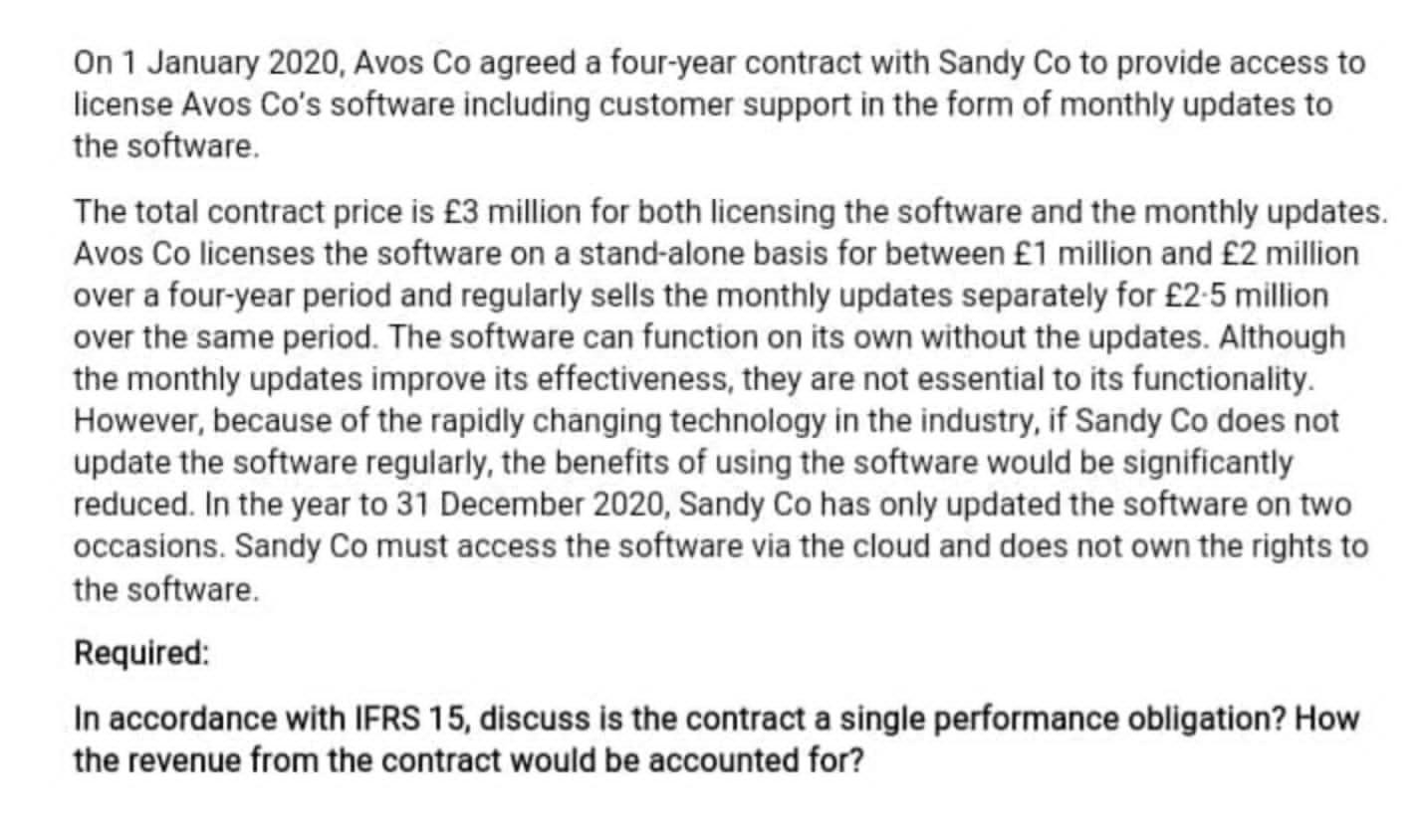

On 1 January 2020, Avos Co agreed a four-year contract with Sandy Co to provide access to license Avos Co's software including customer support in the form of monthly updates to the software. The total contract price is 3 million for both licensing the software and the monthly updates. Avos Co licenses the software on a stand-alone basis for between 1 million and 2 million over a four-year period and regularly sells the monthly updates separately for 2.5 million over the same period. The software can function on its own without the updates. Although the monthly updates improve its effectiveness, they are not essential to its functionality. However, because of the rapidly changing technology in the industry, if Sandy Co does not update the software regularly, the benefits of using the software would be significantly reduced. In the year to 31 December 2020, Sandy Co has only updated the software on two occasions. Sandy Co must access the software via the cloud and does not own the rights to the software. Required: In accordance with IFRS 15, discuss is the contract a single performance obligation? How the revenue from the contract would be accounted for?

Step by Step Solution

★★★★★

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

It is likely that the contract is a single performance obligation as the updates are not essential t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started