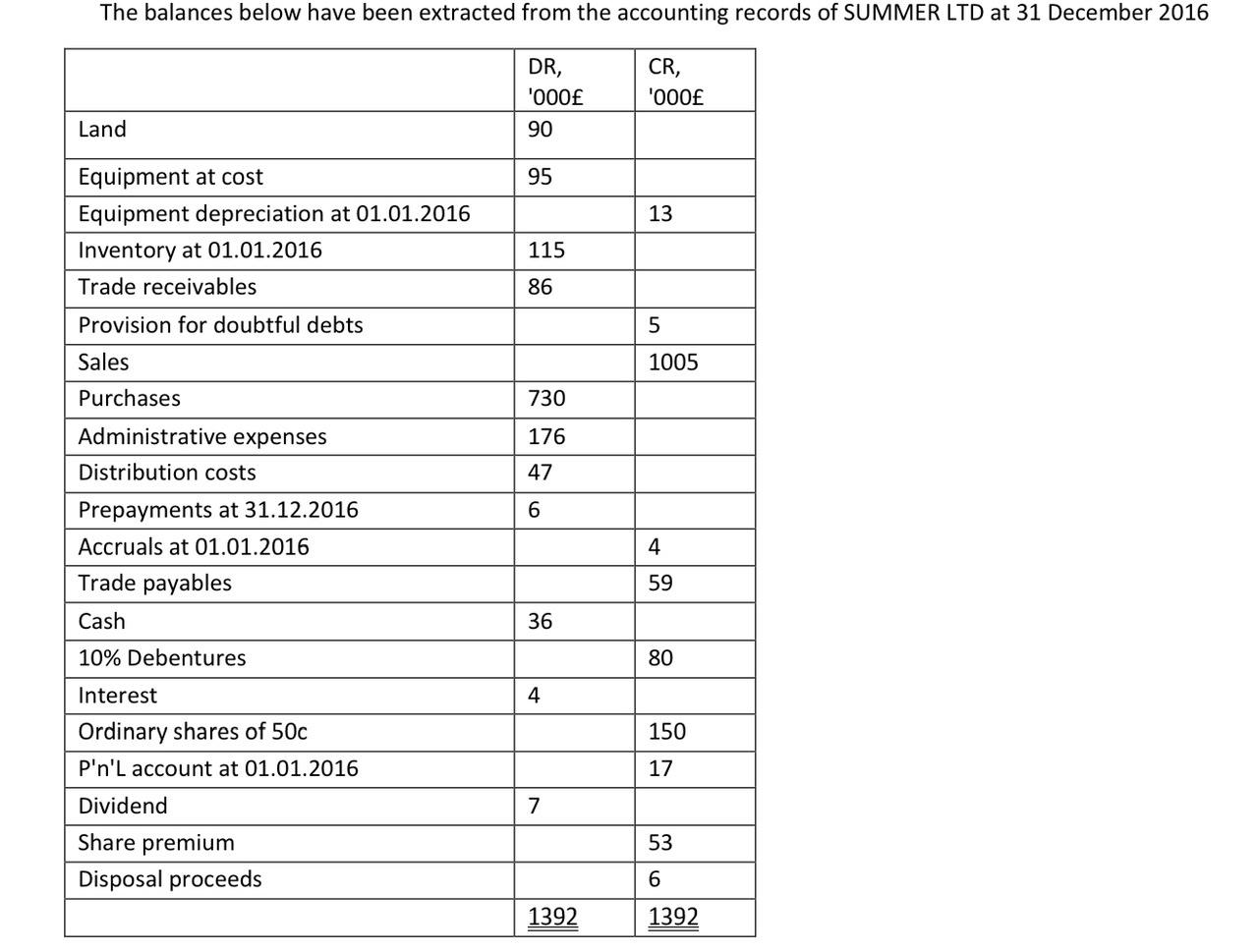

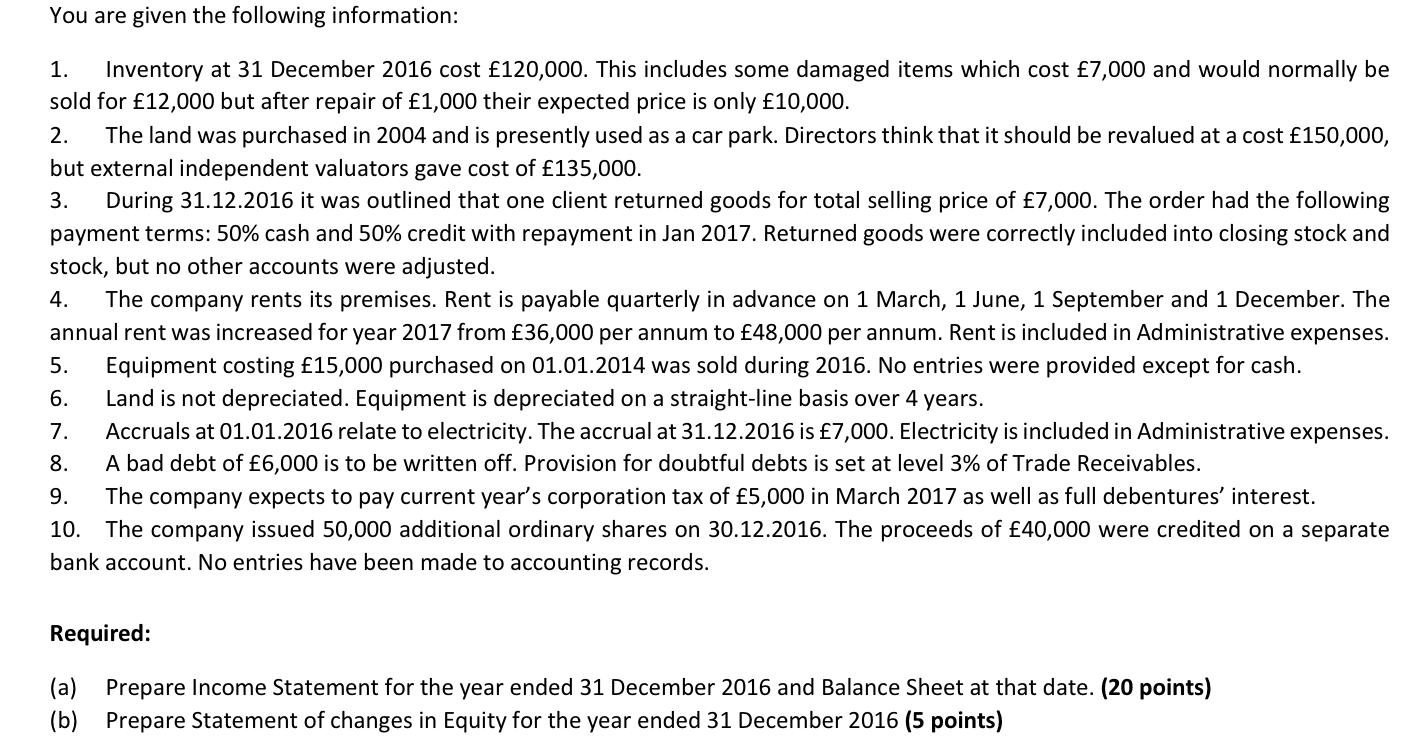

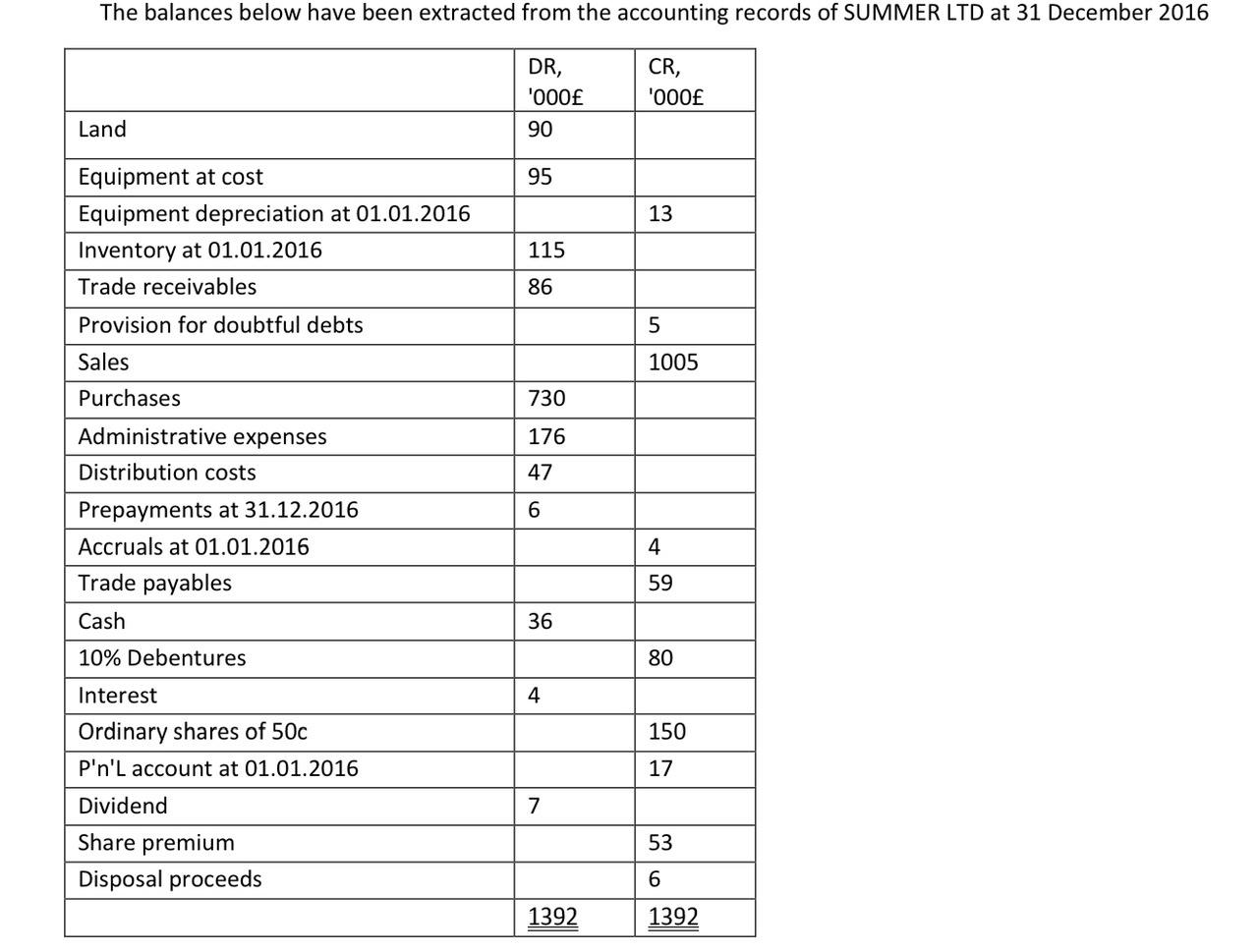

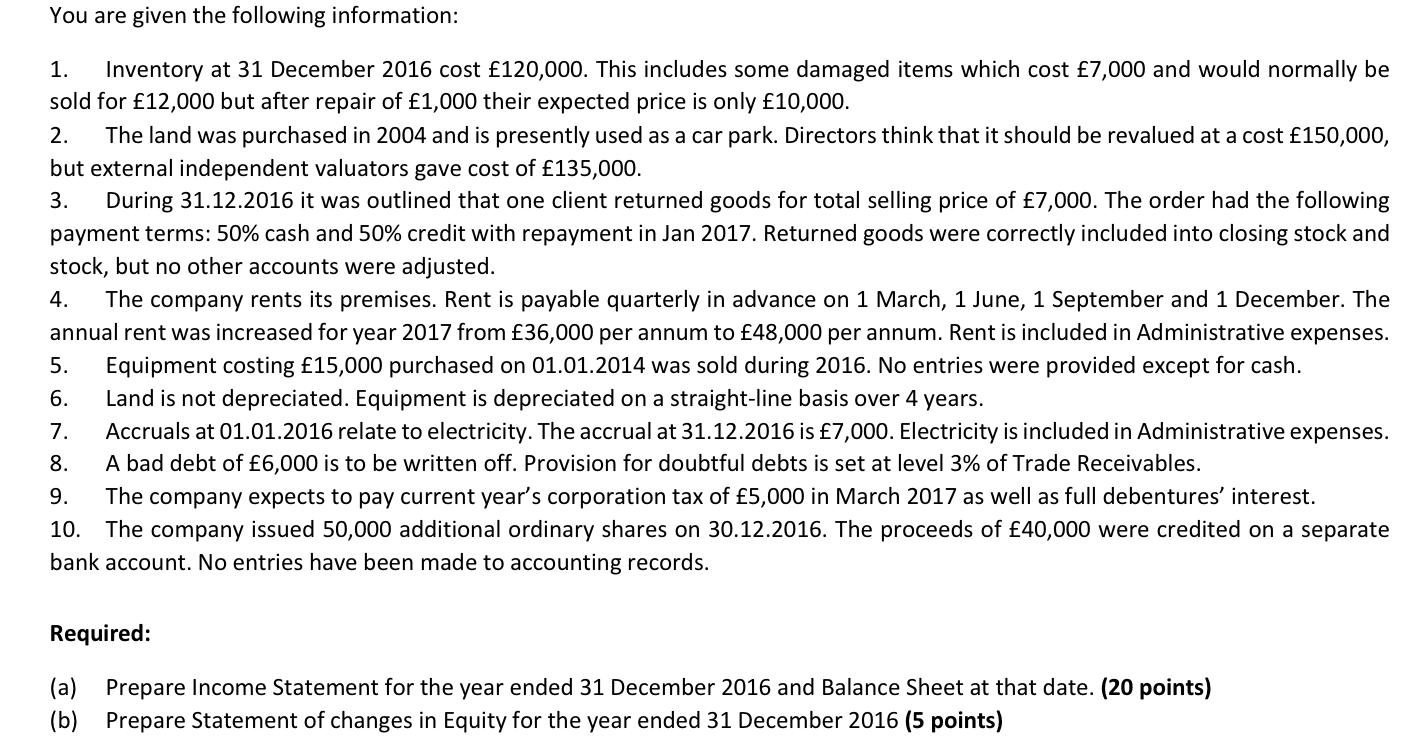

The balances below have been extracted from the accounting records of SUMMER LTD at 31 December 2016 \begin{tabular}{|l|l|l|} \hline & DR,000 & CR,000 \\ \hline Land & 90 & \\ \hline Equipment at cost & 95 & \\ \hline Equipment depreciation at 01.01.2016 & & 13 \\ \hline Inventory at 01.01.2016 & 115 & \\ \hline Trade receivables & 86 & \\ \hline Provision for doubtful debts & & 5 \\ \hline Sales & & 1005 \\ \hline Purchases & 730 & \\ \hline Administrative expenses & 176 & \\ \hline Distribution costs & 47 & \\ \hline Prepayments at 31.12.2016 & 6 & \\ \hline Accruals at 01.01.2016 & & 4 \\ \hline Trade payables & & 59 \\ \hline Cash & 36 & \\ \hline 10\% Debentures & & 80 \\ \hline Interest & & 1392 \\ \hline Ordinary shares of 50c & & 17 \\ \hline P'n'L account at 01.01.2016 & & \\ \hline Dividend & & \\ \hline Share premium & & \\ \hline Disposal proceeds & & \\ \hline & & \\ \hline \end{tabular} 1. Inventory at 31 December 2016 cost 120,000. This includes some damaged items which cost 7,000 and would normally be sold for 12,000 but after repair of 1,000 their expected price is only 10,000. 2. The land was purchased in 2004 and is presently used as a car park. Directors think that it should be revalued at a cost 150,000, but external independent valuators gave cost of 135,000. 3. During 31.12.2016 it was outlined that one client returned goods for total selling price of 7,000. The order had the following payment terms: 50% cash and 50% credit with repayment in Jan 2017. Returned goods were correctly included into closing stock and stock, but no other accounts were adjusted. 4. The company rents its premises. Rent is payable quarterly in advance on 1 March, 1 June, 1 September and 1 December. The annual rent was increased for year 2017 from 36,000 per annum to 48,000 per annum. Rent is included in Administrative expenses. 5. Equipment costing 15,000 purchased on 01.01 .2014 was sold during 2016. No entries were provided except for cash. 6. Land is not depreciated. Equipment is depreciated on a straight-line basis over 4 years. 7. Accruals at 01.01.2016 relate to electricity. The accrual at 31.12 .2016 is 7,000. Electricity is included in Administrative expenses. 8. A bad debt of 6,000 is to be written off. Provision for doubtful debts is set at level 3% of Trade Receivables. 9. The company expects to pay current year's corporation tax of 5,000 in March 2017 as well as full debentures' interest. 10. The company issued 50,000 additional ordinary shares on 30.12 .2016 . The proceeds of 40,000 were credited on a separate bank account. No entries have been made to accounting records. Required: (a) Prepare Income Statement for the year ended 31 December 2016 and Balance Sheet at that date. (20 points) (b) Prepare Statement of changes in Equity for the year ended 31 December 2016 (5 points)