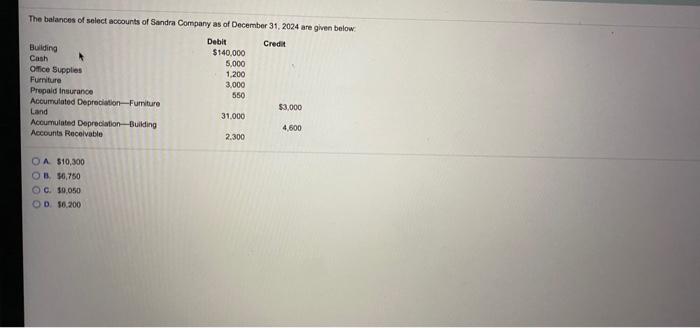

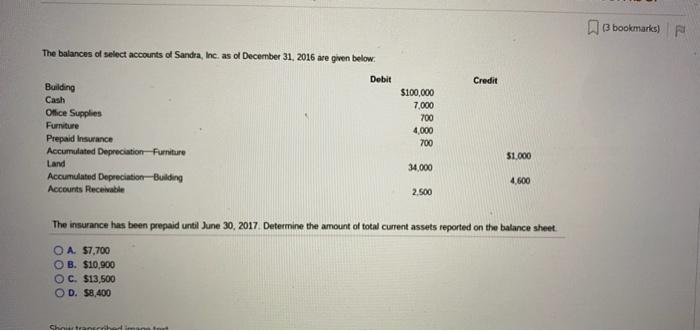

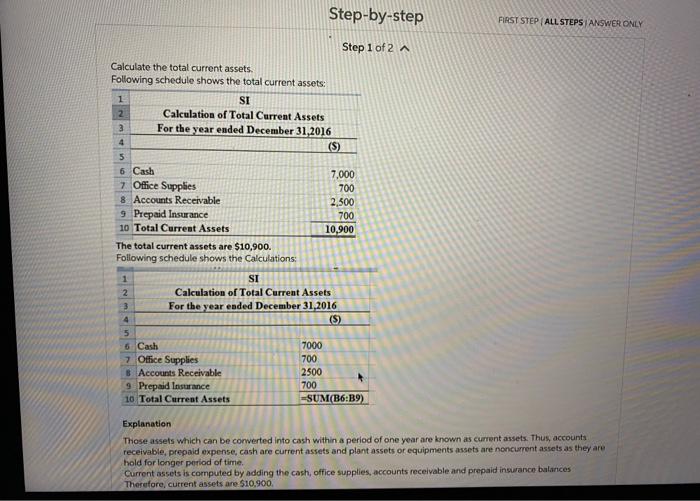

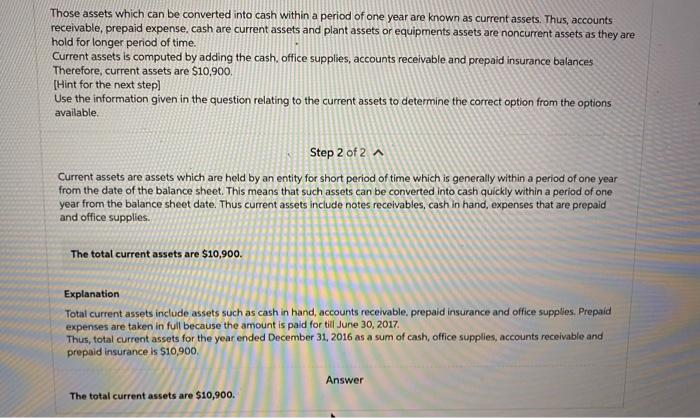

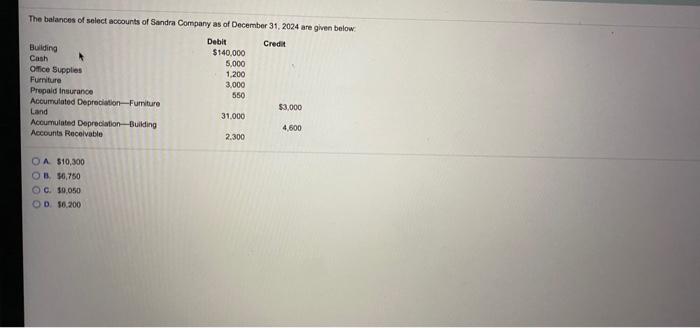

The balances of select accounts of Sandra Company as of December 31, 2024 are given below Debit Credit Building $140,000 Cash 5.000 Office Supplies 1.200 Furniture 3,000 Prepaid Insurance 550 Accumulated Depreciation Furniture $3,000 Land 31.000 Acourulated Depreciation Building 4,600 Accounts Receivable 2.300 OA 510,300 OB 56,750 OG 59,050 0 56.200 The balances of select accounts of Sandra Company as of December 31, 2024 are given below. Debit Credit Building $140,000 Cash 5,000 Office Supplies 1,200 Furniture 3,000 Prepaid Insurance 550 Accumulated Depreciation Furniture $3,000 Land 31,000 Accumulated Depreciation Building 4,600 Accounts Receivable 2,300 A. $10,300 B. $6,750 C. $9,050 D. $6,200 bookmarks) The balances of select accounts of Sandra, Inc. as of December 31, 2016 are given below: Debit Credit Building Cash Office Supplies Furniture Prepaid Insurance Accumulated Depreciation Furniture Land Accumulated Depreciation Building Accounts Receivable $100,000 7,000 700 4,000 700 51 000 34,000 4.600 2.500 The insurance has been prepaid until June 30, 2017 Determine the amount of total current assets reported on the balance sheet. O A. 7,700 OB. $10,900 OC. $13,500 OD. $8,400 Chate Step-by-step FIRST STEP ALL STEPS ANSWER ONLY 4 Step 1 of 2 ^ Calculate the total current assets. Following schedule shows the total current assets: 1 SI 2 Calculation of Total Current Assets 3 For the year ended December 31, 2016 (S) 5 6 Cash 7.000 7 Office Supplies 700 8 Accounts Receivable 2,500 9 Prepaid Insurance 700 10 Total Current Assets 10,900 The total current assets are $10,900. Following schedule shows the Calculations: 1 SI 2 Calculation of Total Current Assets 3 For the year eaded December 31,2016 4 (5) 5 6 Cash 7000 7 Office Supplies 700 B Accounts Receivable 2500 9 Prepaid Insurance 700 10 Total Current Assets =SUM(B6:39) Explanation Those assets which can be conwerted into cash within a period of one year are known as current assets. Thus, accounts receivable, prepaid expense, cash are current assets and plant assets or equipments assets are noncurrent assets as they are hold for longer period of time. Current assets is computed by adding the cash, office supplies, accounts receivable and prepaid insurance balances Therefore, current assets are $10.900 Those assets which can be converted into cash within a period of one year are known as current assets. Thus, accounts receivable, prepaid expense, cash are current assets and plant assets or equipments assets are noncurrent assets as they are hold for longer period of time. Current assets is computed by adding the cash, office supplies, accounts receivable and prepaid insurance balances Therefore, current assets are $10,900. [Hint for the next step] Use the information given in the question relating to the current assets to determine the correct option from the options available. Step 2 of 2 Current assets are assets which are held by an entity for short period of time which is generally within a period of one year from the date of the balance sheet. This means that such assets can be converted into cash quickly within a period of one year from the balance sheet date. Thus current assets include notes receivables, cash in hand, expenses that are prepaid and office supplies. The total current assets are $10,900. Explanation Total current assets include assets such as cash in hand, accounts receivable, prepaid insurance and office supplies. Prepaid expenses are taken in full because the amount is paid for till June 30, 2017. Thus, total current assets for the year ended December 31, 2016 as a sum of cash, office supplies, accounts receivable and prepaid insurance is $10,900, Answer The total current assets are $10,900