Answered step by step

Verified Expert Solution

Question

1 Approved Answer

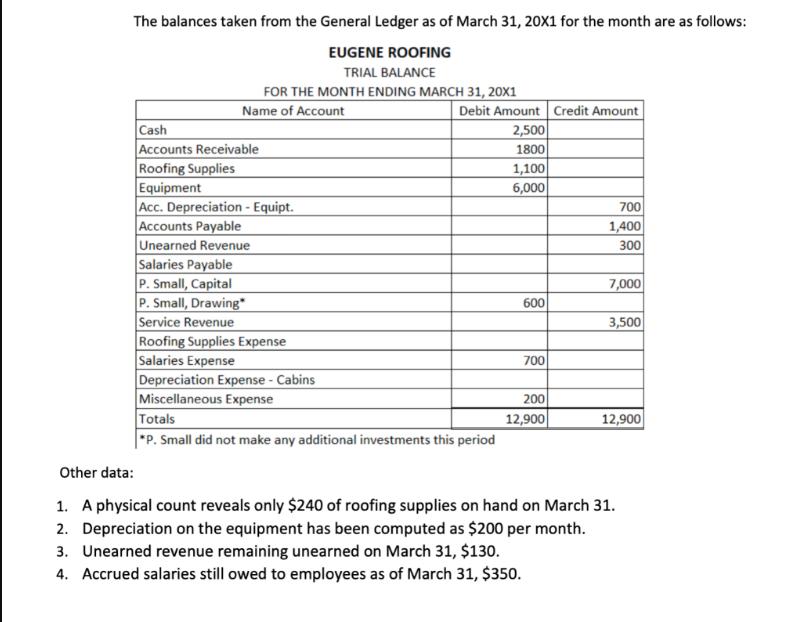

The balances taken from the General Ledger as of March 31, 20x1 for the month are as follows: EUGENE ROOFING TRIAL BALANCE FOR THE

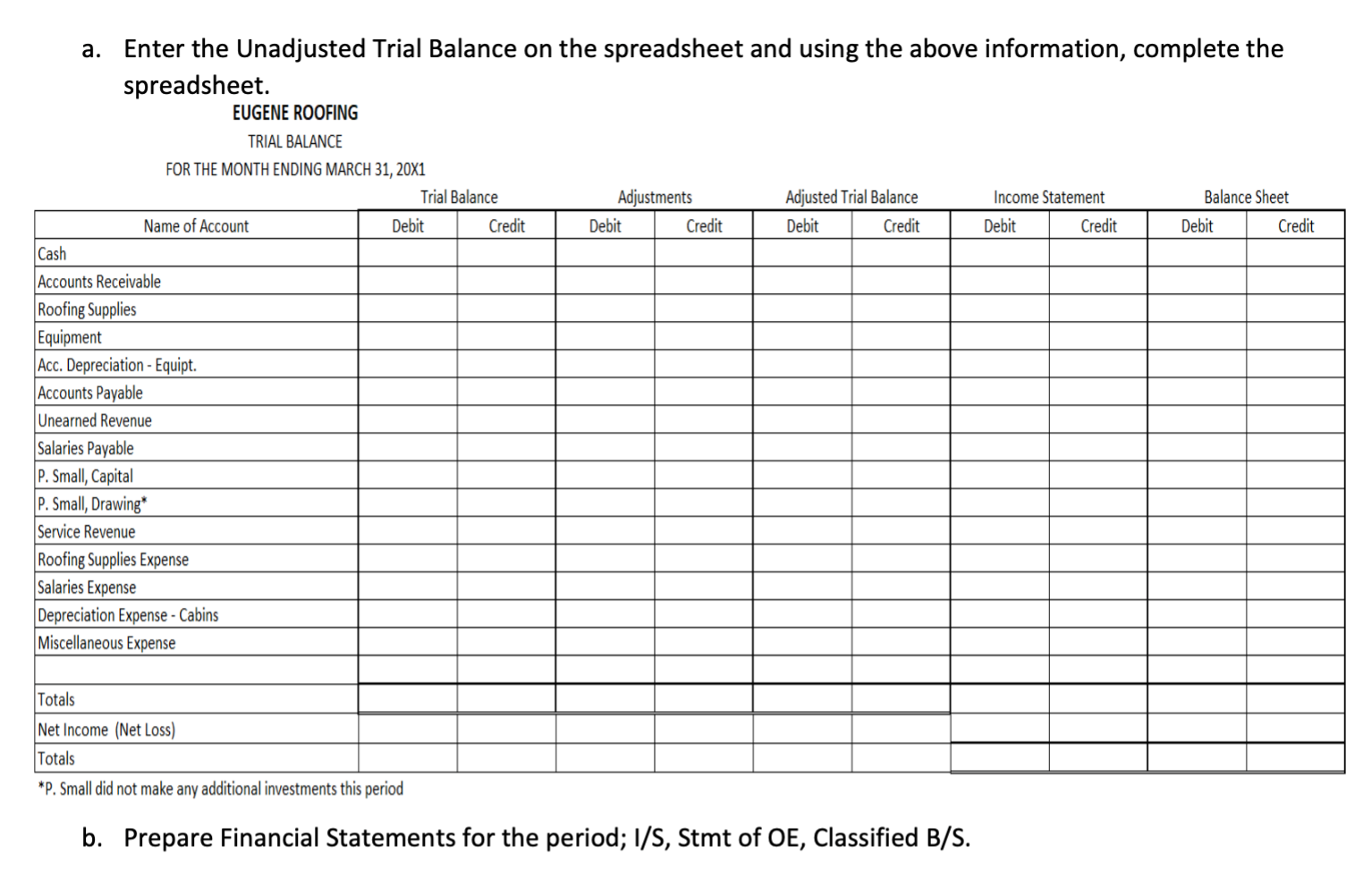

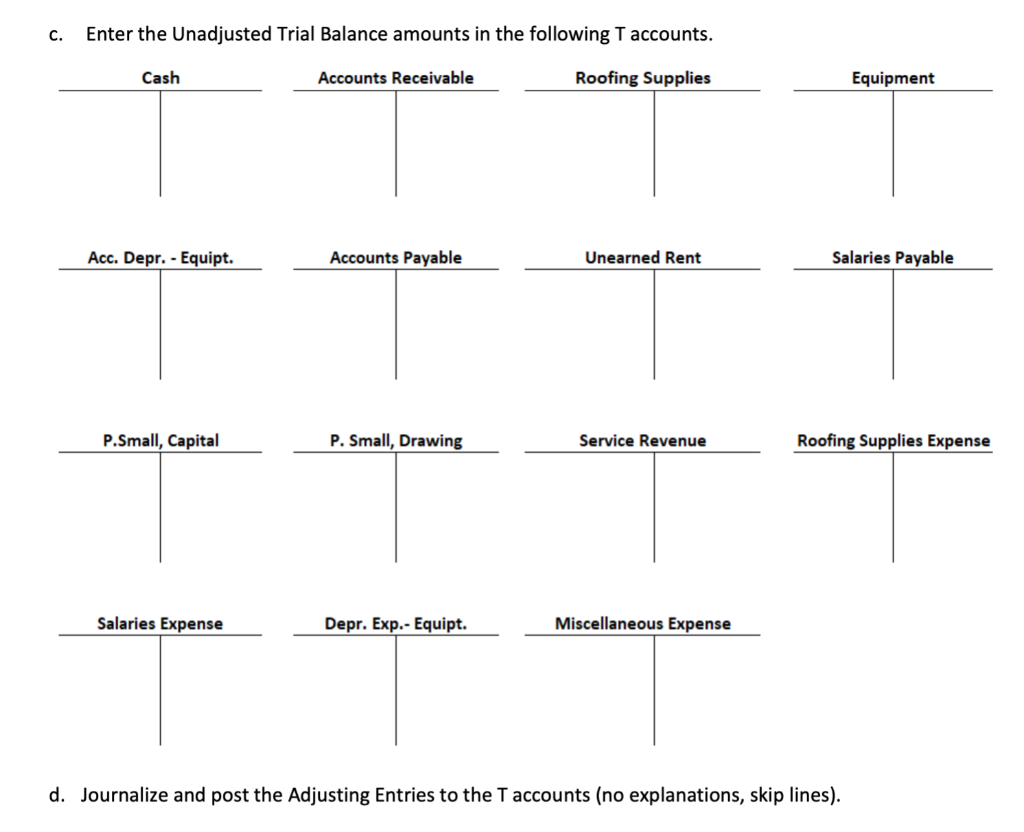

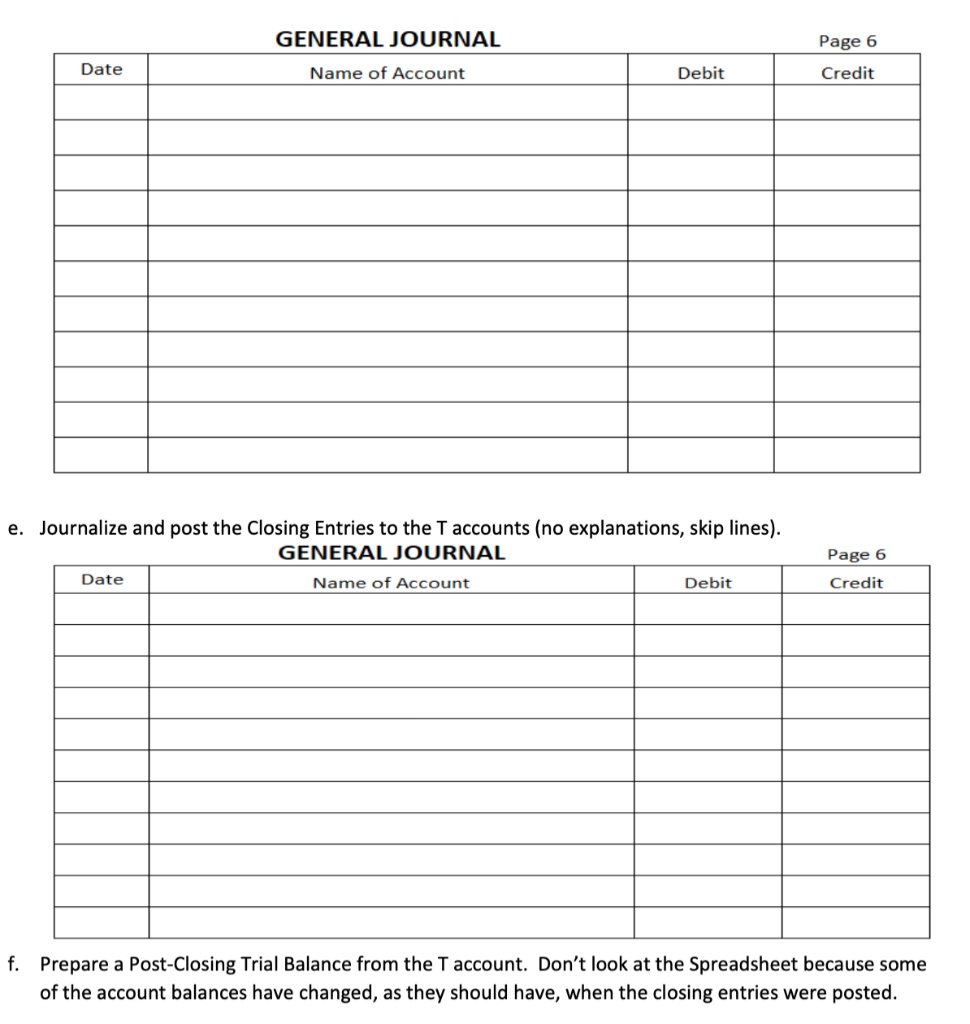

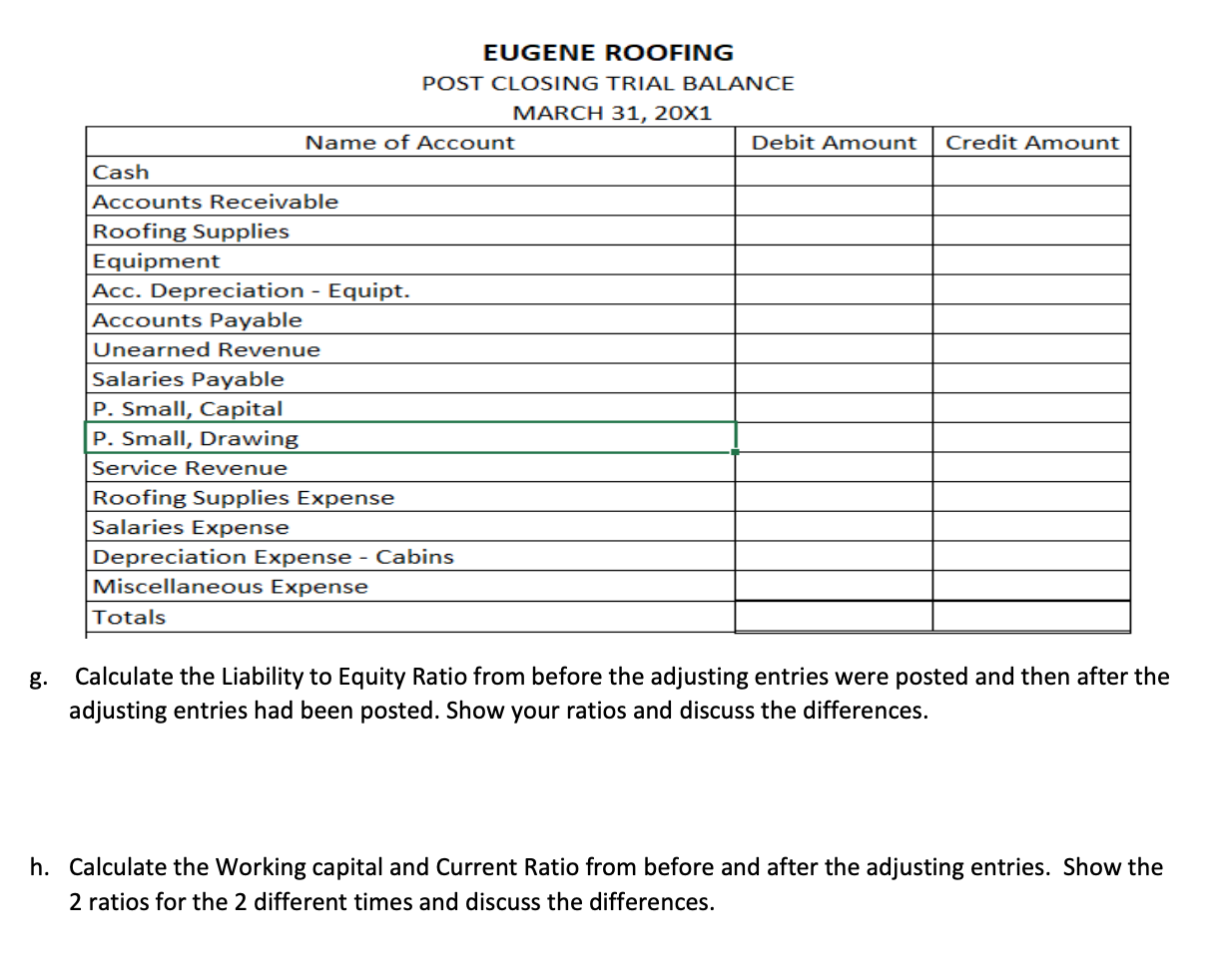

The balances taken from the General Ledger as of March 31, 20x1 for the month are as follows: EUGENE ROOFING TRIAL BALANCE FOR THE MONTH ENDING MARCH 31, 20X1 Name of Account Cash Accounts Receivable Roofing Supplies Equipment Acc. Depreciation - Equipt. Accounts Payable Unearned Revenue Salaries Payable P. Small, Capital P. Small, Drawing* Service Revenue Roofing Supplies Expense Salaries Expense Depreciation Expense - Cabins Miscellaneous Expense Debit Amount Credit Amount Totals *P. Small did not make any additional investments this period 2,500 1800 1,100 6,000 600 700 200 12,900 700 1,400 300 7,000 3,500 12,900 Other data: 1. A physical count reveals only $240 of roofing supplies on hand on March 31. 2. Depreciation on the equipment has been computed as $200 per month. 3. Unearned revenue remaining unearned on March 31, $130. 4. Accrued salaries still owed to employees as of March 31, $350. a. Enter the Unadjusted Trial Balance on the spreadsheet and using the above information, complete the spreadsheet. EUGENE ROOFING TRIAL BALANCE FOR THE MONTH ENDING MARCH 31, 20X1 Name of Account Cash Accounts Receivable Roofing Supplies Equipment Acc. Depreciation - Equipt. Accounts Payable Unearned Revenue Salaries Payable P. Small, Capital P. Small, Drawing* Service Revenue Roofing Supplies Expense Salaries Expense Depreciation Expense - Cabins Miscellaneous Expense Trial Balance Debit Credit Adjustments Debit Credit Adjusted Trial Balance Debit Credit Totals Net Income (Net Loss) Totals *P. Small did not make any additional investments this period b. Prepare Financial Statements for the period; I/S, Stmt of OE, Classified B/S. Income Statement Debit Credit Balance Sheet Debit Credit C. Enter the Unadjusted Trial Balance amounts in the following T accounts. Roofing Supplies Cash Acc. Depr. - Equipt. P.Small, Capital Salaries Expense Accounts Receivable Accounts Payable P. Small, Drawing Depr. Exp.- Equipt. Unearned Rent Service Revenue Miscellaneous Expense Equipment Salaries Payable Roofing Supplies Expense d. Journalize and post the Adjusting Entries to the T accounts (no explanations, skip lines). Date GENERAL JOURNAL Name of Account Date Debit e. Journalize and post the Closing Entries to the T accounts (no explanations, skip lines). GENERAL JOURNAL Name of Account Debit Page 6 Credit Page 6 Credit f. Prepare a Post-Closing Trial Balance from the T account. Don't look at the Spreadsheet because some of the account balances have changed, as they should have, when the closing entries were posted. g. Cash Accounts Receivable Roofing Supplies Equipment Name of Account Acc. Depreciation - Equipt. Accounts Payable Unearned Revenue Salaries Payable P. Small, Capital P. Small, Drawing Service Revenue Roofing Supplies Expense Salaries Expense EUGENE ROOFING POST CLOSING TRIAL BALANCE MARCH 31, 20X1 Totals Depreciation Expense - Cabins Miscellaneous Expense Debit Amount Credit Amount Calculate the Liability to Equity Ratio from before the adjusting entries were posted and then after the adjusting entries had been posted. Show your ratios and discuss the differences. h. Calculate the Working capital and Current Ratio from before and after the adjusting entries. Show the 2 ratios for the 2 different times and discuss the differences.

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a The unadjusted trial balance was provided in the question I copied it wordforword into the spreadsheet b Financial statements Income Statement Servi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started