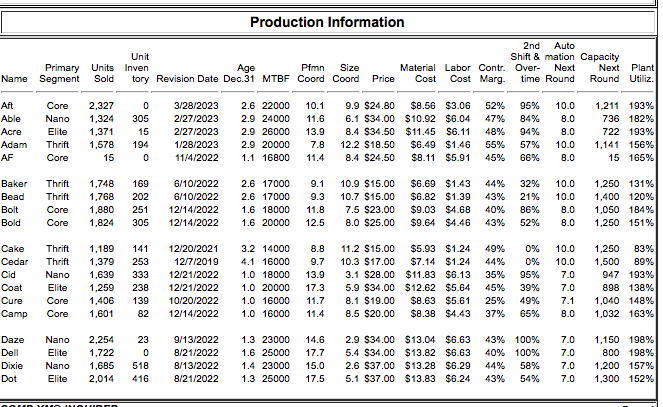

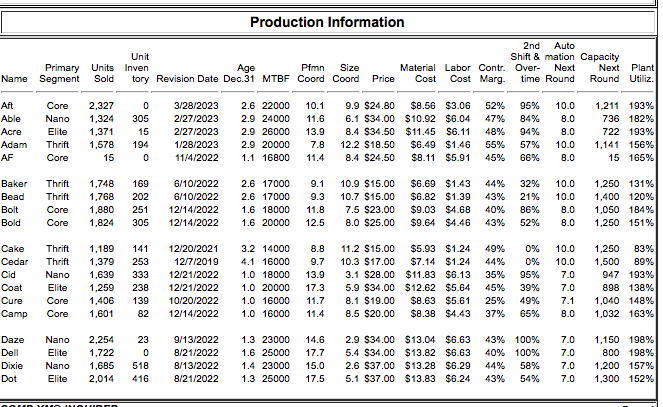

The Baldwin company wants to decrease its plant utilization for Bead by 15%. How many units would need to be produced next year to meet this production goal? Ignore impact of accounts payable on plant utilization. Select: 1

1,683

1,473

1,893

1,252

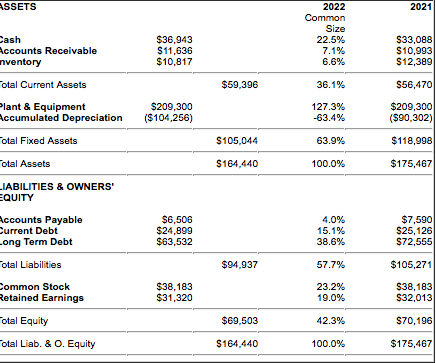

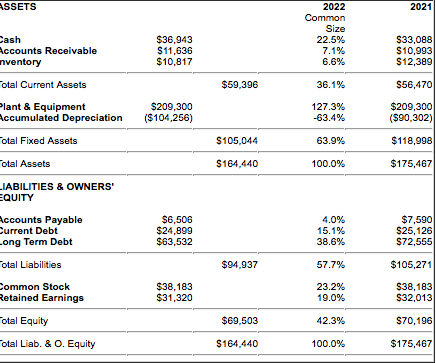

Production Information Primary Name Segment Units Sold Unit Inven Age Pfmn Size tory Revision Date Dec.31 MTBF Coord Coord 2nd Auto Shift & mation Capacity Material Labor Contr. Over- Next Next Plant Price Cost Cost Marg. time Round Round Utiliz. 3 Able Acre Adam Core 2,327 Nano1,324 Elite 1,371 Thrift 1,578 0 305 15 194 /28/2023 2/27/2023 2/27/2023 1/28/2023 11/4/2022 2.6 22000 2.9 24000 2.9 26000 2.9 20000 1.1 16800 10.1 11.6 13. 9 7.8 11.4 8 9.9 $24.80 6.1 $34.00 .4 $34.50 12.2 $18.50 8.4 $24.50 $8.56 $10.92 $11.45 $6.49 $8.11 $3.06 $6.04 $6.11 $1.46 $5.91 52% 47% 48% 55% 45% 95% 84% 94% 57% 66% 10.0 8. 0 8. 0 10.0 8.0 1.211 193% 7 36 182% 7 22 193% 1,141 156% 15 165% Baker Bead Thrift Thrift 1.748 1.768 169 202 6/10/2022 6/10/2022 12/14/2022 12/14/2022 2.6 17000 2.6 17000 1.6 18000 1.6 20000 9.1 9.3 11.8 12.5 10.9 $15.00 10.7 $15.00 7.5 $23.00 8.0 $25.00 $6.69 $6.82 $9.03 $9.64 $1.43 $1.39 $4.68 $4.46 44% 43% 40% 43% 32% 21% 86% 52% 10.0 10.0 8.0 8.0 1.250 131% 1,400 120% 1,050 184% 1,250 151% Bold Core 1.824 305 Cake Cedar Cid Coat Cure Thrift Thrift Nano Elite Core Core 1,189 141 1,379 253 1.639333 1,259 238 1.406 139 1.601 82 12/20/2021 12/7/2019 12/21/2022 12/21/2022 10/20/2022 12/14/2022 3 .2 14000 4.1 16000 1.0 18000 1.0 20000 1.0 16000 1.0 16000 8.8 9.7 13.9 7.3 11.7 11.4 11.2 $15.00 10.3 $17.00 3.1 $28.00 5.9 $34.00 8.1 $19.00 8.5 $20.00 $5.93 $1.24 $7.14 $1.24 $11.83 $6.13 $12.62 $5.64 $8.63 $5.61 $8.38 $4.43 49% 44% 35% 45% 25% 37% 0% 0% 95% 39% 49% 65% 10.0 10.0 7.0 7.0 7.1 8.0 1,250 83% 1,500 89% 947 193% 898 138% 1,040 148% 1,032 163% Daze Dell Dixie Dot Nano Elite Nano Elite 2,254 23 1.7220 1,685 518 ,014 416 9/13/2022 8/21/2022 8/13/2022 8/21/2022 1.3 23000 1.6 25000 1.4 23000 1.3 25000 14.6 17.7 15.0 17.5 2.9 $34.00 5.4 $34.00 2.6 $37.00 5.1 $37.00 $13.04 $13.82 $13.28 $13.83 $6.63 $6.63 $6.29 $6.24 43% 40% 44% 43% 100% 100% 58% 54% 7.0 7.0 7.0 7.0 1,150 198% 800 198% 1,200 157% 1,300 152% 2 ASSETS 2021 2022 Common Size 22.5% 7.1% 6.6% Cash Accounts Receivable nventory $36.943 $11.636 $10,817 $33,088 $10,993 $12,389 Total Current Assets $59,396 36.1% Plant & Equipment Accumulated Depreciation $209,300 ($104,256) 127.3% -63.4% $56,470 $209,300 ($90,302) Cotal Fixed Assets $105,044 63.9% $118,998 $175,467 Total Assets $164.440 100.0% LIABILITIES & OWNERS' EQUITY Accounts Payable urrent Debt .ong Term Debt $6,506 $24,899 $63,532 4.0% 15.1% 38.6% $7,5901 $25,126 $72,555 otal Liabilities $94.937 57.7% $105,271 ommon Stock letained Earnings $38,183 $31,320 23.2% 19.0% $38,183 $32,013 otal Equity 42.3% $69,503 $164.440 $70,196 $175,467 otal Liab. & O. Equity 100.0%