Question

The Bank Of Al Ain Assignment 2 The Bank of Al Ain has operated for many years under the assumption that profitability could be increased

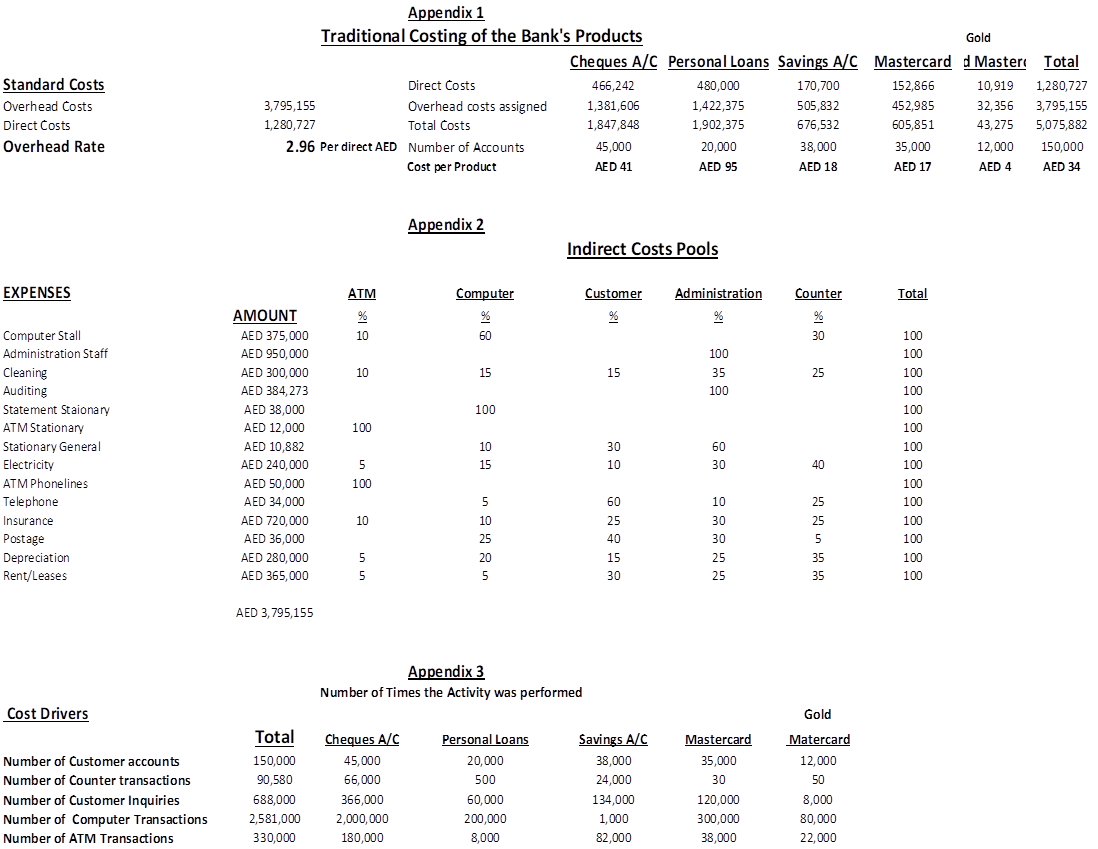

The Bank Of Al Ain Assignment 2 The Bank of Al Ain has operated for many years under the assumption that profitability could be increased by increasing dirham volumes. Historically, BAAs management efforts had been directed towards increasing total dirham sales by offering personal loans and credit cards and the total of dirhams held by customers in their account balances. In recent years, however, BAAs profits have been declining. Increased competition, particularly from Mortgage Lenders, Credit Unions and Building Societies, was the cause of the difficulties. Also, BAAs managers had no idea what their products were costing. Upon reflection, they realized that they had often made decisions to offer a new product, which promised to increase dirham balances, without any consideration of the actual cost to provide the service. There are currently five products that the bank offers Chequing Accounts, Personal Loans, Savings accounts, Mastercard and Gold Mastercard. In 2018, the total costs for the bank to provide the five services was 5,075,882 AED. Management had determined that the direct costs to all products was 1,280,727. The amount of direct costs for each product is shown in Appendix 1. The total indirect costs of 3,797,155 AED was incurred last year in support of all products. To determine the total cost for each product the bank allocated the indirect costs based on the direct costs that is 3,797,155/1,280,727 for an allocated overhead rate of 2.96 AED per direct AED. This traditional approach yielded the results as shown in Appendix 1. Managers at the bank are not certain that the way they costed the products is a true reflection of the products contribution to profit. They have been advised that there is an alternative method of product costing known as Activity Based Costing. After some discussion, the bank decided to hire an Activity Based Costing consultant to compute the costs of the banks products. You, (the expert in Activity Based Costing) began by analyzing the total indirect costs (Appendix 2) and have identified five cost pools ATM transactions, Computer transactions. Customer transactions, Administration and Over the Counter transactions cost pools. Based on discussions and interviews with the banks staff and a review of the banks annual data you have determined the percentage of each cost that could be associated with the five cost pools. This shown in Appendix 2. You have also identified the type of cost driver that would most likely drive the cost in each pool. You then estimated the total number of times the cost driver activity would be performed in a year and also broke that number down for each cost pool. (Appendix 3). With the information gathered you are ready to determine the total cost to provide each of the Banks products. Required: Develop an Activity Based Costing model for the Bank of Al Ain. PART 2 Analysis of the Chequing account profitability In view of the new cost information, Dana Hussein, the General Manager, wants to know whether a decision made two years ago to modify the banks cheque account product was sound or not. At that time the service charge was eliminated for accounts that had an average balance greater than 1,000. Based on increases in the total dollars in cheque accounts, Dana felt very pleased about the new product at the time. This cheque account product is described as follows: Chequing account balances greater than 500 earn interest of 2% per year, and A service charge of 5% per month is charged for balances less than 1,000. The bank earns 4% on cheque account deposits. Fifty percent of the accounts are less than 500 and have an average balance of 400 per account. Ten percent of the accounts are between 500 and 1,000 and average 750 per account Twenty-five percent of the accounts are between 1,000 and 2,767. The average balance is 2,000. The remaining accounts carry a balance greater than 2,767. The average balance for these accounts is 5,000. Research indicates that the 2,000 category was by far the greatest contributor to the increase volume when the cheque account product was modified two years ago. Required 1. Evaluate the cost and profitability of the cheque account product. Are all accounts profitable? Identify any products that could be dropped/cancelled. Compute the average annual profitability per account for the four categories of accounts described. Make recommendations to increase the profitability of the cheque account product. 2. Write a management report to the Bank of Al Ains senior Management outlining the Activity Based Costing model that you developed for the Bank and how you used the results to analyse the profitability of the chequing account.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started