Question

The Bank of Ghana issued a 3-year bond with a semi-annual coupon of 16.65%. The BIVA Bank purchased GHS 50 million of the bonds

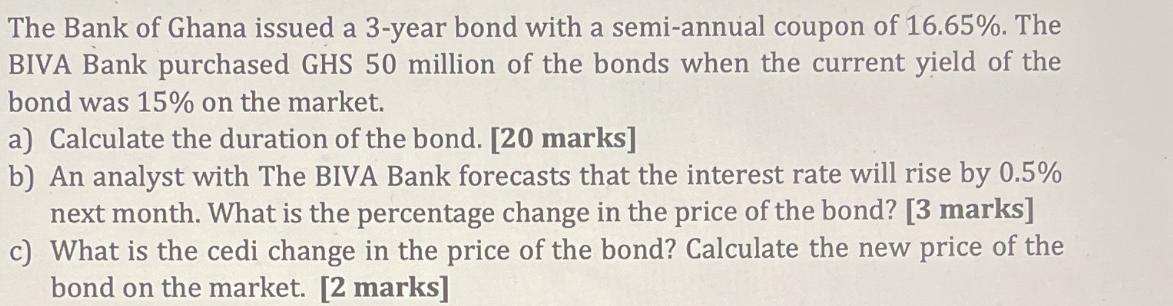

The Bank of Ghana issued a 3-year bond with a semi-annual coupon of 16.65%. The BIVA Bank purchased GHS 50 million of the bonds when the current yield of the bond was 15% on the market. a) Calculate the duration of the bond. [20 marks] b) An analyst with The BIVA Bank forecasts that the interest rate will rise by 0.5% next month. What is the percentage change in the price of the bond? [3 marks] c) What is the cedi change in the price of the bond? Calculate the new price of the bond on the market. [2 marks]

Step by Step Solution

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

a Duration of a bond is calculated using the following formula Duration Present Value of Bond Intere...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Government and Not for Profit Accounting Concepts and Practices

Authors: Michael Granof, Saleha Khumawala, Thad Calabrese, Daniel Smith

7th edition

1118983270, 978-1119175025, 111917502X, 978-1119175001, 978-1118983270

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App