Question

The Bank of Tinytown has three loans that have the following characteristics. If the covariance between A and C is approximately 0.100 and the covariance

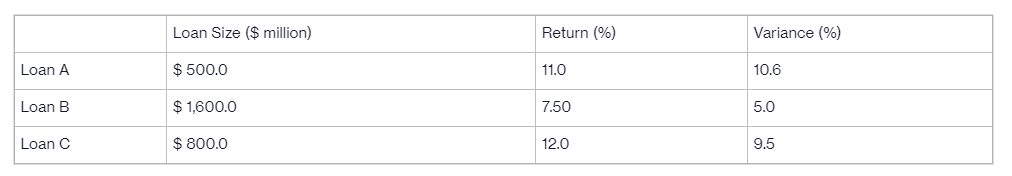

The Bank of Tinytown has three loans that have the following characteristics. If the covariance between A and C is approximately 0.100 and the covariance between Loan B and Loan C is approximately 0.065, what are the expected return and standard deviation of this portfolio? Given the covariances, can the calculation be simplified? What will the risk of the portfolio be, given the simplification? Loan Size ($ million) Return (%) Variance (%) Loan A $ 500.0 11.0 10.6 Loan B $ 1,600.0 7.50 5.0 Loan C $ 800.0 12.0 9.5

Briefly describe any way(s) that the risk of this portfolio may be reduced? Be specific and show calculations.

Loan Size ($ million) Return (%) Variance (%) Loan A $ 500.0 11.0 10.6 Loan B $ 1,600.0 7.50 5.0 Loan C $ 800.0 12.0 9.5Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started