Answered step by step

Verified Expert Solution

Question

1 Approved Answer

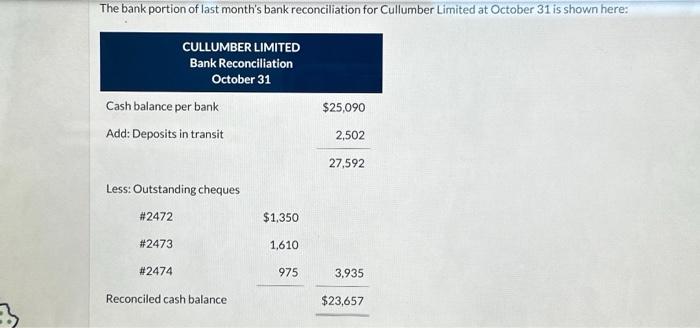

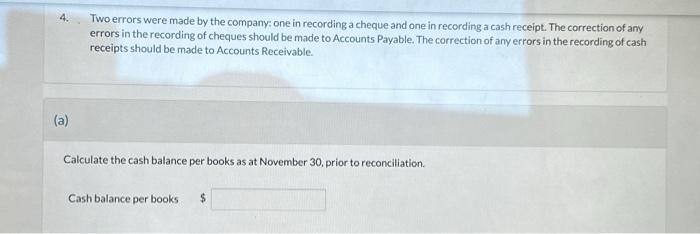

The bank portion of last month's bank reconciliation for Cullumber Limited at October 31 is shown here: Cash balance per bank Add: Deposits in transit

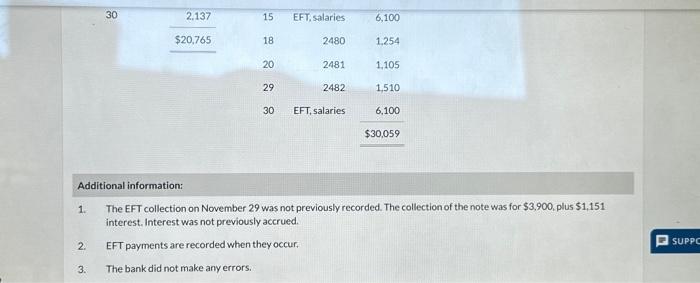

The bank portion of last month's bank reconciliation for Cullumber Limited at October 31 is shown here: Cash balance per bank Add: Deposits in transit Less: Outstanding cheques #2472 CULLUMBER LIMITED Bank Reconciliation October 31 #2473 #2474 Reconciled cash balance $1,350 1,610 975 $25,090 2,502 27,592 3,935 $23,657

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started