Answered step by step

Verified Expert Solution

Question

1 Approved Answer

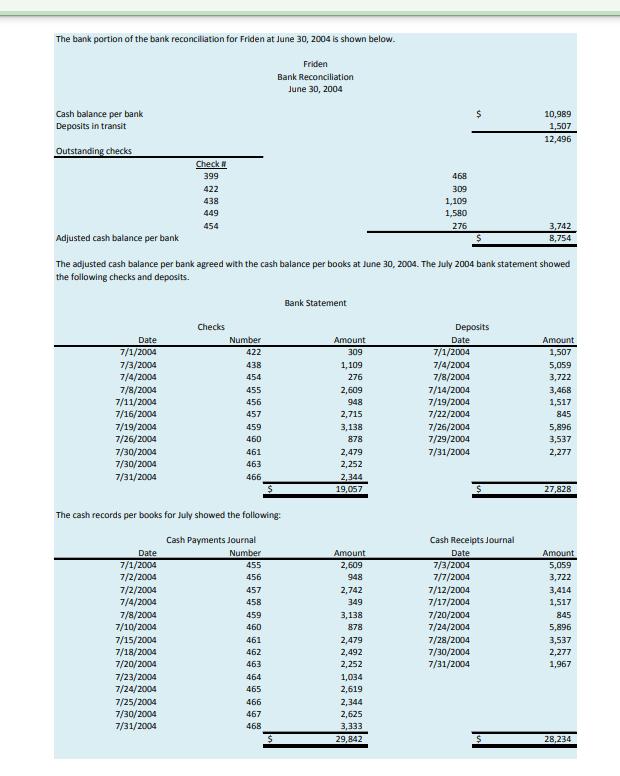

The bank portion of the bank reconciliation for Friden at June 30, 2004 is shown below. Friden Bank Reconciliation June 30, 2004 Cash balance

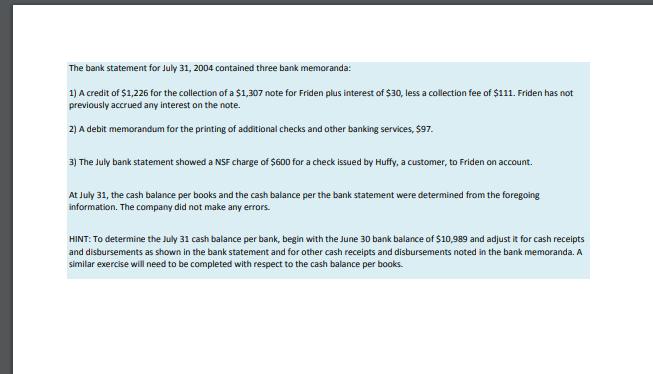

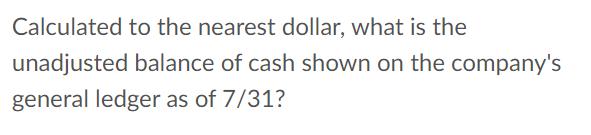

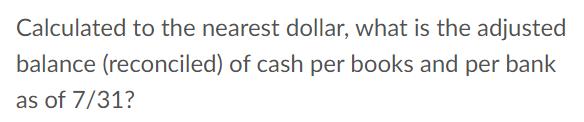

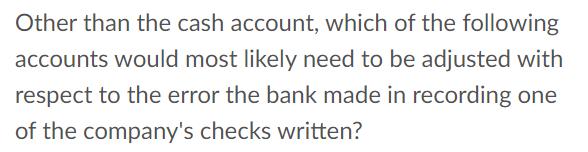

The bank portion of the bank reconciliation for Friden at June 30, 2004 is shown below. Friden Bank Reconciliation June 30, 2004 Cash balance per bank 10,989 Deposits in transit 1,507 12,496 Outstanding checks Check 399 468 422 309 438 1,109 449 1,580 454 276 3,742 Adjusted cash balance per bank 8,754 The adjusted cash balance per bank agreed with the cash balance per books at June 30, 2004. The July 2004 bank statement showed the following checks and deposits. Bank Statement Checks Deposits Date Number Amount Date Amount 7/1/2004 422 309 7/1/2004 1,507 7/3/2004 7/4/2004 7/8/2004 7/11/2004 7/16/2004 7/19/2004 7/26/2004 438 1,109 7/4/2004 5,059 454 276 7/8/2004 3,722 7/14/2004 7/19/2004 7/22/2004 455 2,609 3,468 456 948 1,517 457 2,715 845 459 3,138 7/26/2004 5,896 460 878 7/29/2004 3,537 7/30/2004 7/30/2004 7/31/2004 461 2,479 7/31/2004 2,277 463 2,252 466 2,344 19,057 27,828 The cash records per books for July showed the following: Cash Payments Journal Cash Receipts Journal Date 7/1/2004 7/2/2004 Number Amount Date Amount 5,059 7/3/2004 7/7/2004 455 2,609 456 948 3,722 7/2/2004 7/4/2004 7/12/2004 7/17/2004 457 2,742 3,414 458 349 1,517 7/8/2004 7/10/2004 3,138 7/20/2004 7/24/2004 459 845 460 878 5,896 7/15/2004 7/18/2004 7/20/2004 7/28/2004 7/30/2004 7/31/2004 461 2,479 3,537 462 2,492 2,277 463 2,252 1,967 7/23/2004 7/24/2004 7/25/2004 7/30/2004 7/31/2004 464 1,034 465 2,619 466 2,344 467 2,625 468 3,333 29,842 28,234 The bank statement for July 31, 2004 contained three bank memoranda: 1) A credit of $1,226 for the collection of a $1,307 note for Friden plus interest of $30, less a collection fee of $111. Friden has not previously accrued any interest on the note. 2) A debit memorandum for the printing of additional checks and other banking services, $97. 3) The July bank statement showed a NSF charge of $600 for a check issued by Huffy, a customer, to Friden on account. At July 31, the cash balance per books and the cash balance per the bank statement were determined from the foregoing information. The company did not make any errors. HINT: To determine the July 31 cash balance per bank, begin with the June 30 bank balance of $10,989 and adjust it for cash receipts and disbursements as shown in the bank statement and for other cash receipts and disbursements noted in the bank memoranda. A similar exercise will need to be completed with respect to the cash balance per books. Calculated to the nearest dollar, what is the balance of cash shown on the bank statement as of 7/31? Calculated to the nearest dollar, what is the unadjusted balance of cash shown on the company's general ledger as of 7/31? Calculated to the nearest dollar, what is the adjusted balance (reconciled) of cash per books and per bank as of 7/31? Other than the cash account, which of the following accounts would most likely need to be adjusted with respect to the error the bank made in recording one of the company's checks written?

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Part 1 Cash balance as per bank June 30 10989 Add Deposits 27828 Lesschecks 1905...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started