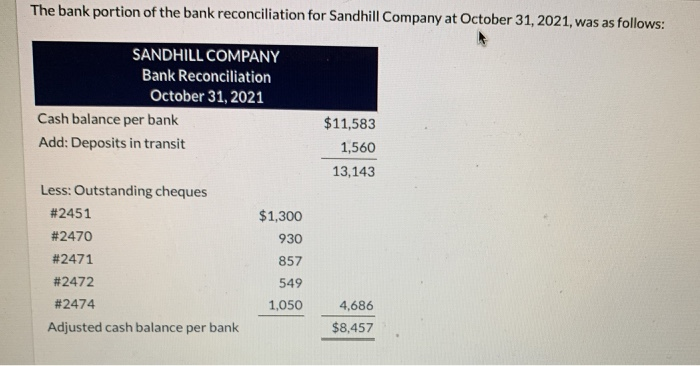

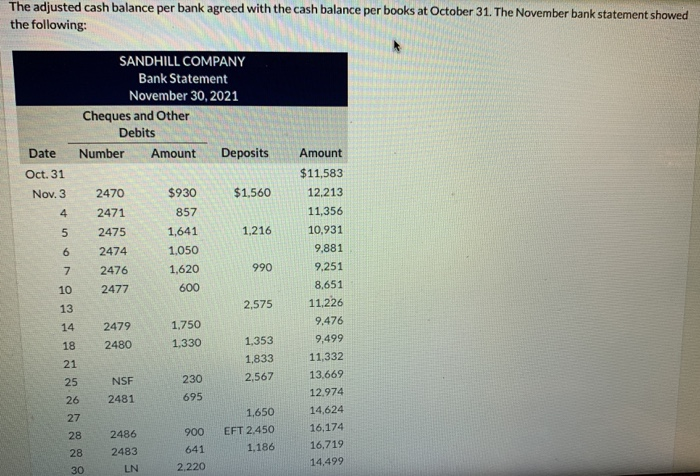

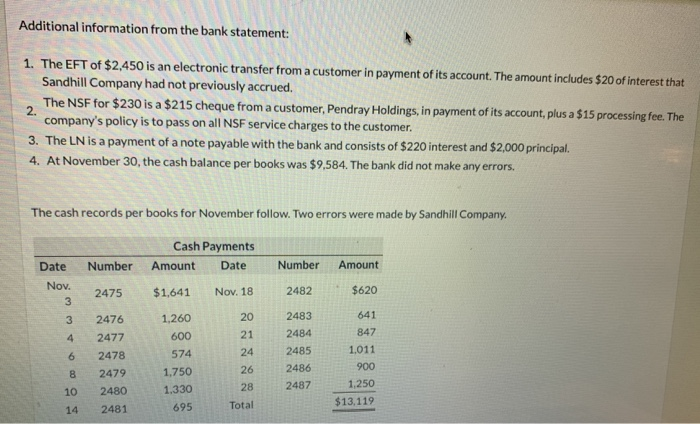

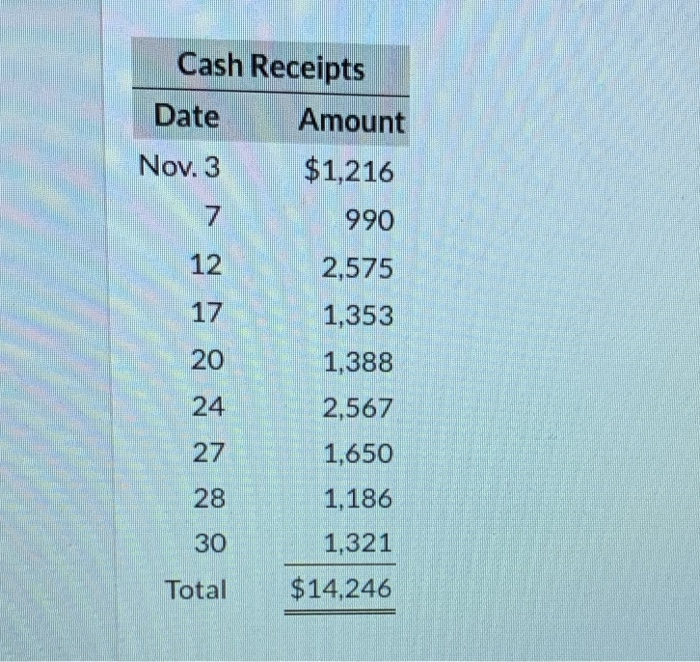

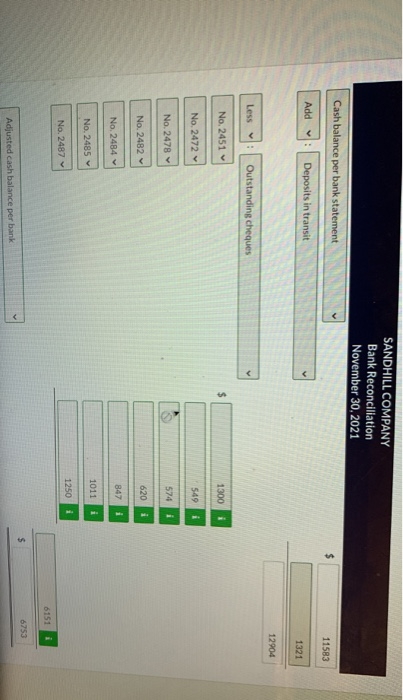

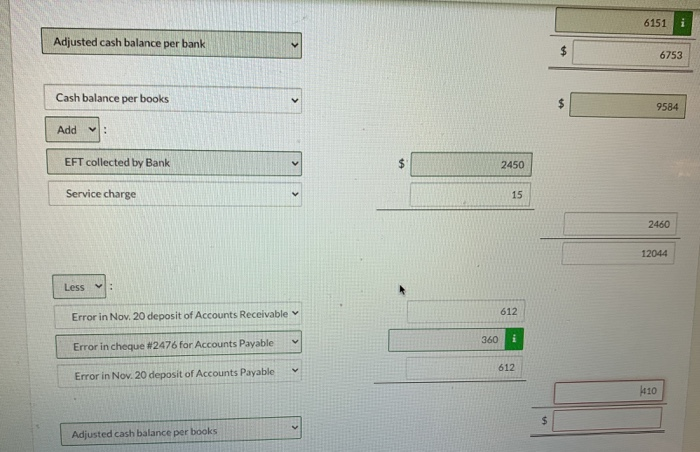

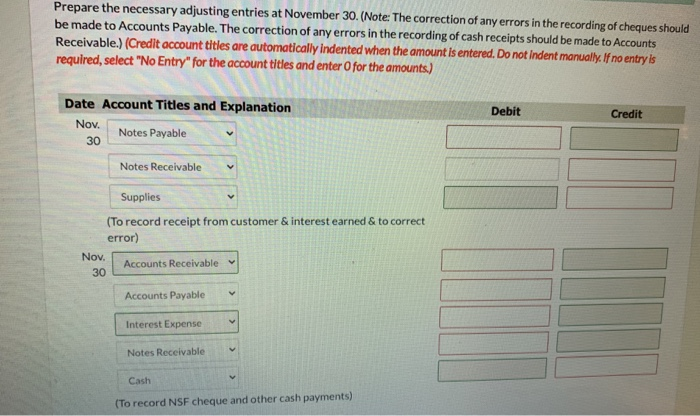

The bank portion of the bank reconciliation for Sandhill Company at October 31, 2021, was as follows: SANDHILL COMPANY Bank Reconciliation October 31, 2021 Cash balance per bank Add: Deposits in transit $11,583 1,560 13,143 $1,300 930 Less: Outstanding cheques #2451 #2470 #2471 #2472 #2474 Adjusted cash balance per bank 857 549 1,050 4,686 $8,457 The adjusted cash balance per bank agreed with the cash balance per books at October 31. The November bank statement showed the following: SANDHILL COMPANY Bank Statement November 30, 2021 Cheques and Other Debits Number Amount Deposits Date Oct. 31 Nov. 3 $1,560 4 5 Amount $11,583 12.213 11,356 10,931 9.881 9.251 8,651 2470 2471 2475 2474 2476 2477 $930 857 1,641 1.050 1,620 1.216 6 7 990 600 10 13 2,575 11,226 14 2479 2480 1,750 1.330 18 21 1.353 1.833 2,567 25 NSF 230 695 9.476 9,499 11,332 13,669 12.974 14,624 16.174 16,719 14,499 2481 26 27 28 2486 2483 LN 28 1,650 EFT 2.450 1,186 900 641 2.220 30 Additional information from the bank statement: 1. The EFT of $2,450 is an electronic transfer from a customer in payment of its account. The amount includes $20 of interest that Sandhill Company had not previously accrued. The NSF for $230 is a $215 cheque from a customer, Pendray Holdings, in payment of its account, plus a $15 processing fee. The company's policy is to pass on all NSF service charges to the customer. 3. The LN is a payment of a note payable with the bank and consists of $220 interest and $2,000 principal. 4. At November 30, the cash balance per books was $9,584. The bank did not make any errors. 2. The cash records per books for November follow. Two errors were made by Sandhill Company. Cash Payments Amount Date Date Number Number Amount Nov. 3 2475 $1,641 Nov. 18 2482 $620 3 2476 20 21 4 2477 24 6 8 2478 2479 2480 2481 1,260 600 574 1,750 1.330 695 2483 2484 2485 2486 2487 641 847 1.011 900 1,250 $13,119 26 28 10 Total 14 Cash Receipts Date Amount Nov. 3 $1,216 7 990 12 2,575 17 1,353 20 1,388 24 2,567 27 28 1,650 1,186 1,321 $14,246 30 Total SANDHILL COMPANY Bank Reconciliation November 30, 2021 Cash balance per bank statement Add: Deposits in transit 11583 1321 12904 Less: Outstanding cheques No. 2451 $ 1300 No. 2472 549 No. 2478 574 i No. 2482 620 i 847 No. 2484 1011 No. 2485 1250 No. 2487 6151 $ 6753 Adjusted cash balance per bank * 6151 Adjusted cash balance per bank 6753 Cash balance per books 9584 Add : EFT collected by Bank $ 2450 Service charge 15 2460 12044 Less 612 Error in Nov. 20 deposit of Accounts Receivable 360 i Error in cheque #2476 for Accounts Payable 612 Error in Nov. 20 deposit of Accounts Payable 1410 $ Adjusted cash balance per books Prepare the necessary adjusting entries at November 30. (Note: The correction of any errors in the recording of cheques should be made to Accounts Payable. The correction of any errors in the recording of cash receipts should be made to Accounts Receivable.) (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Debit Credit Date Account Titles and Explanation Nov. Notes Payable 30 Notes Receivable Supplies (To record receipt from customer & interest earned & to correct error) Nov. Accounts Receivable 30 Accounts Payable Interest Expense Notes Receivable Cash (To record NSF cheque and other cash payments)