Answered step by step

Verified Expert Solution

Question

1 Approved Answer

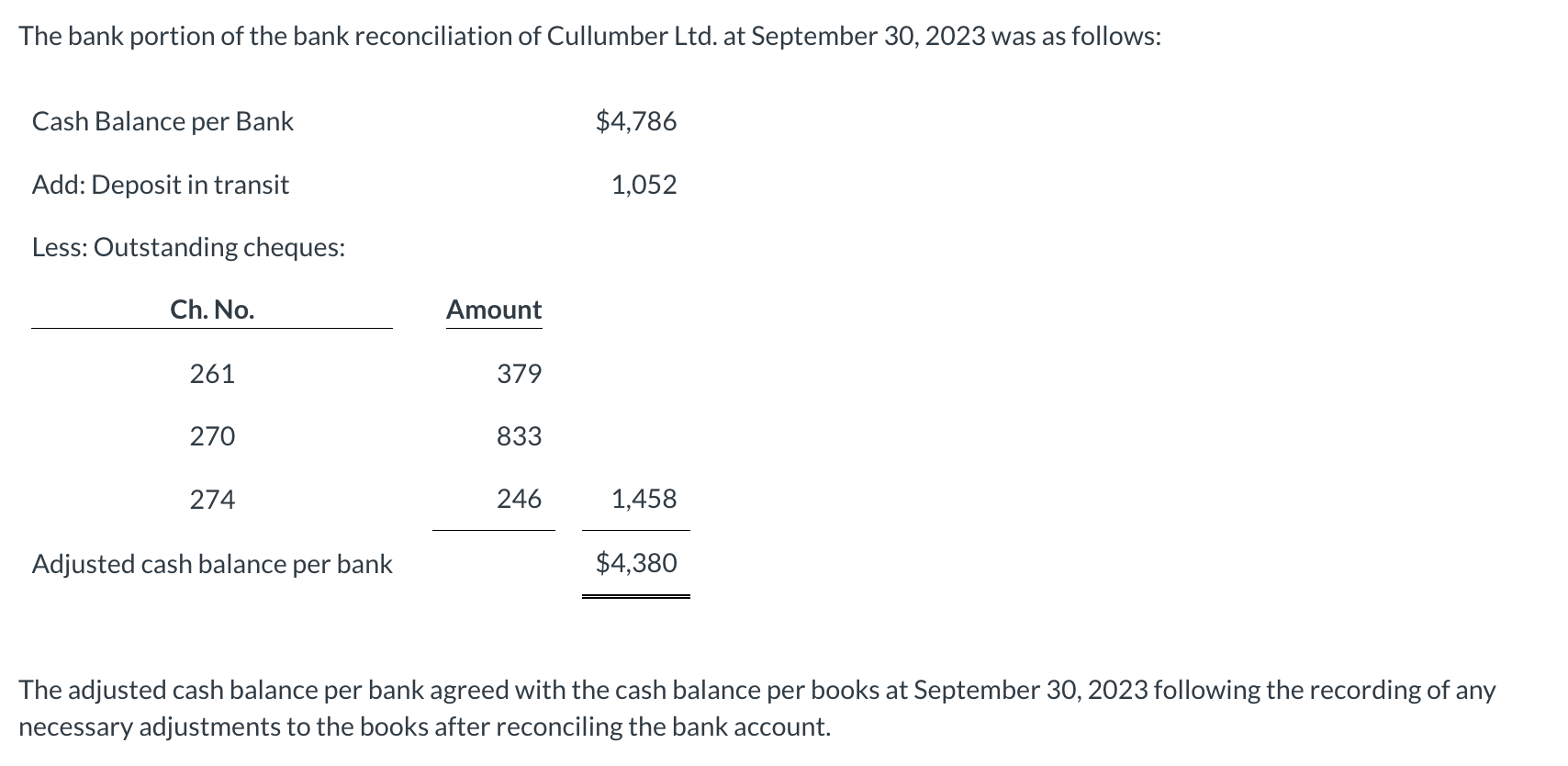

The bank portion of the bank reconciliation of Cullumber Ltd. at September 30, 2023 was as follows: The adjusted cash balance per bank agreed with

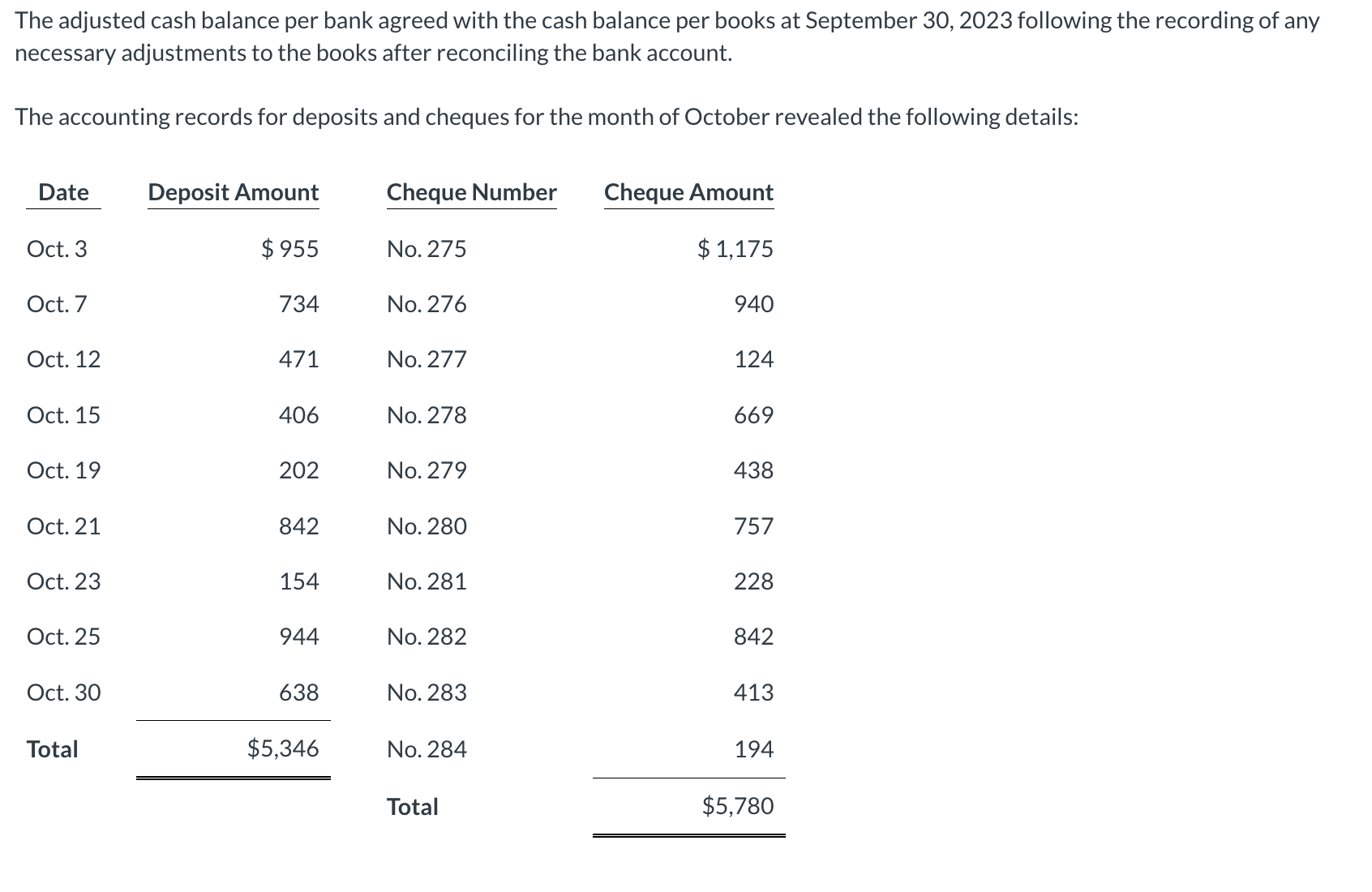

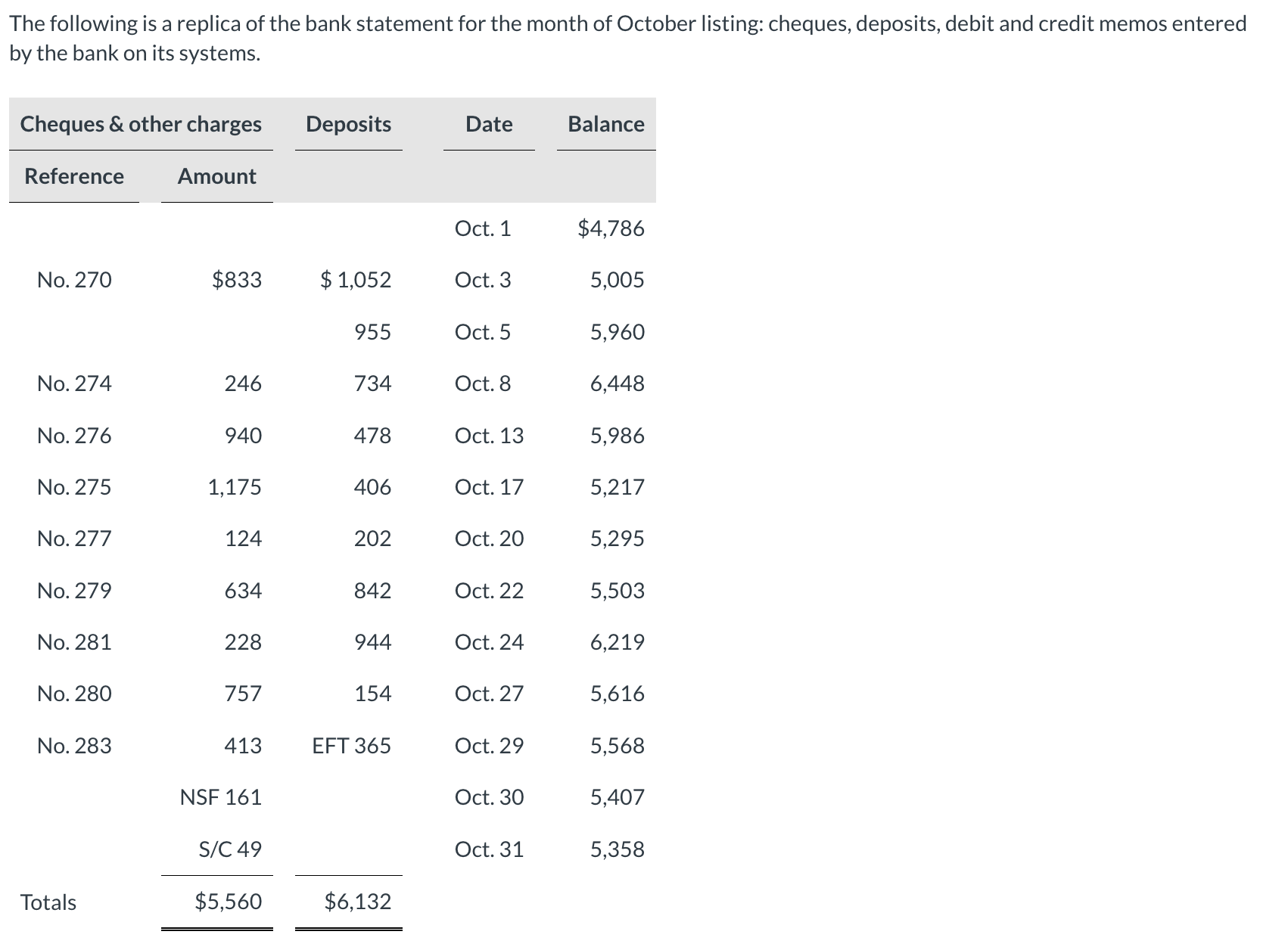

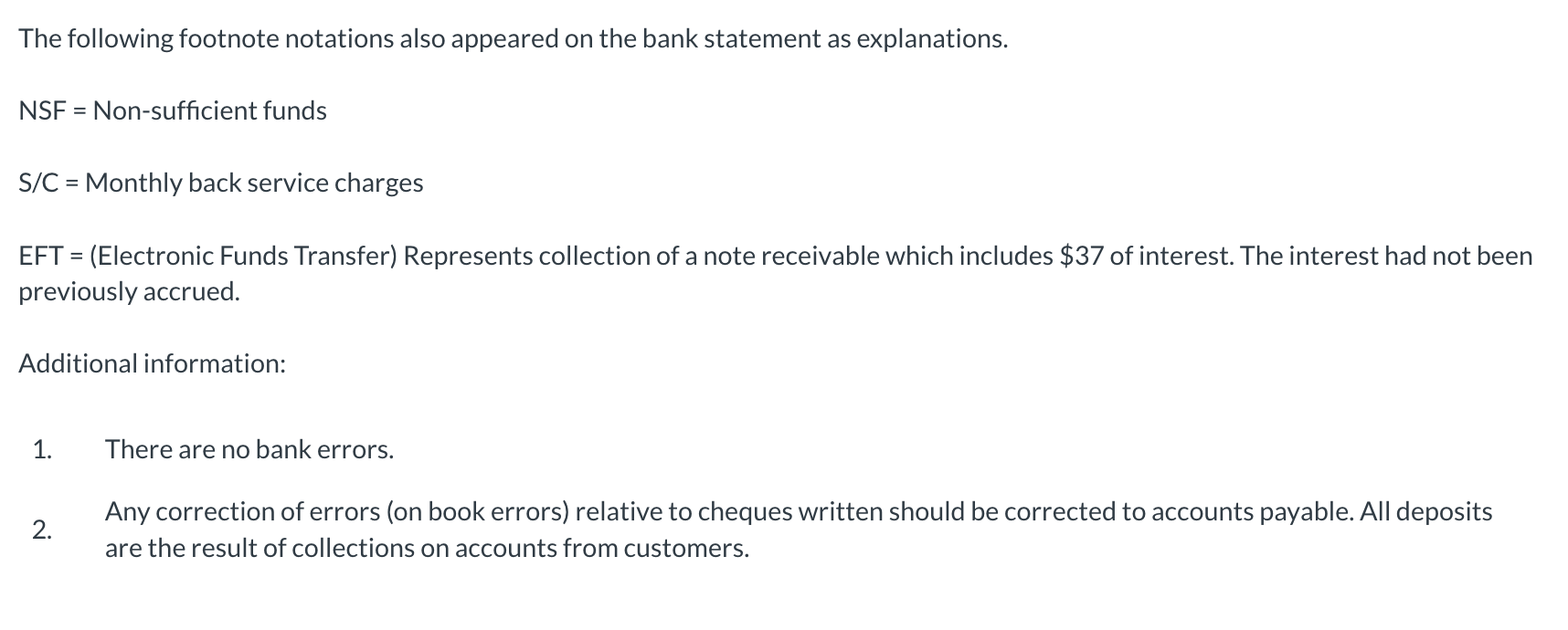

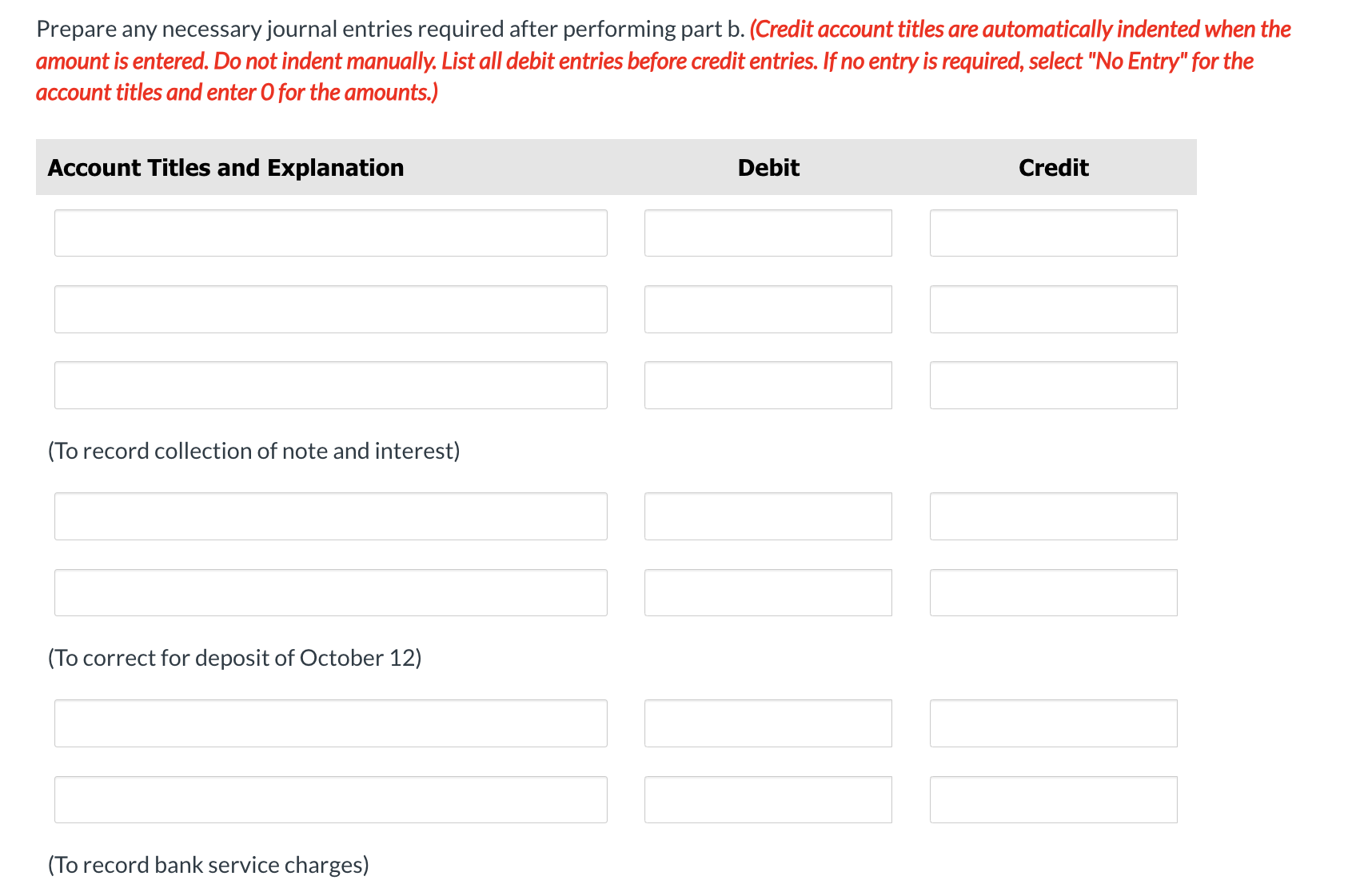

The bank portion of the bank reconciliation of Cullumber Ltd. at September 30, 2023 was as follows: The adjusted cash balance per bank agreed with the cash balance per books at September 30, 2023 following the recording of any necessary adjustments to the books after reconciling the bank account. The adjusted cash balance per bank agreed with the cash balance per books at September 30, 2023 following the recording of any necessary adjustments to the books after reconciling the bank account. The accounting records for deposits and cheques for the month of October revealed the following details: The following is a replica of the bank statement for the month of October listing: cheques, deposits, debit and credit memos entered by the bank on its systems. The following footnote notations also appeared on the bank statement as explanations. NSF = Non-sufficient funds S/C= Monthly back service charges EFT= (Electronic Funds Transfer) Represents collection of a note receivable which includes $37 of interest. The interest had not been previously accrued. Additional information: 1. There are no bank errors. 2. Any correction of errors (on book errors) relative to cheques written should be corrected to accounts payable. All deposits are the result of collections on accounts from customers. Prepare any necessary journal entries required after performing part b. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) (To record NSF cheque) (To correct error on cheque 279)

The bank portion of the bank reconciliation of Cullumber Ltd. at September 30, 2023 was as follows: The adjusted cash balance per bank agreed with the cash balance per books at September 30, 2023 following the recording of any necessary adjustments to the books after reconciling the bank account. The adjusted cash balance per bank agreed with the cash balance per books at September 30, 2023 following the recording of any necessary adjustments to the books after reconciling the bank account. The accounting records for deposits and cheques for the month of October revealed the following details: The following is a replica of the bank statement for the month of October listing: cheques, deposits, debit and credit memos entered by the bank on its systems. The following footnote notations also appeared on the bank statement as explanations. NSF = Non-sufficient funds S/C= Monthly back service charges EFT= (Electronic Funds Transfer) Represents collection of a note receivable which includes $37 of interest. The interest had not been previously accrued. Additional information: 1. There are no bank errors. 2. Any correction of errors (on book errors) relative to cheques written should be corrected to accounts payable. All deposits are the result of collections on accounts from customers. Prepare any necessary journal entries required after performing part b. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) (To record NSF cheque) (To correct error on cheque 279) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started