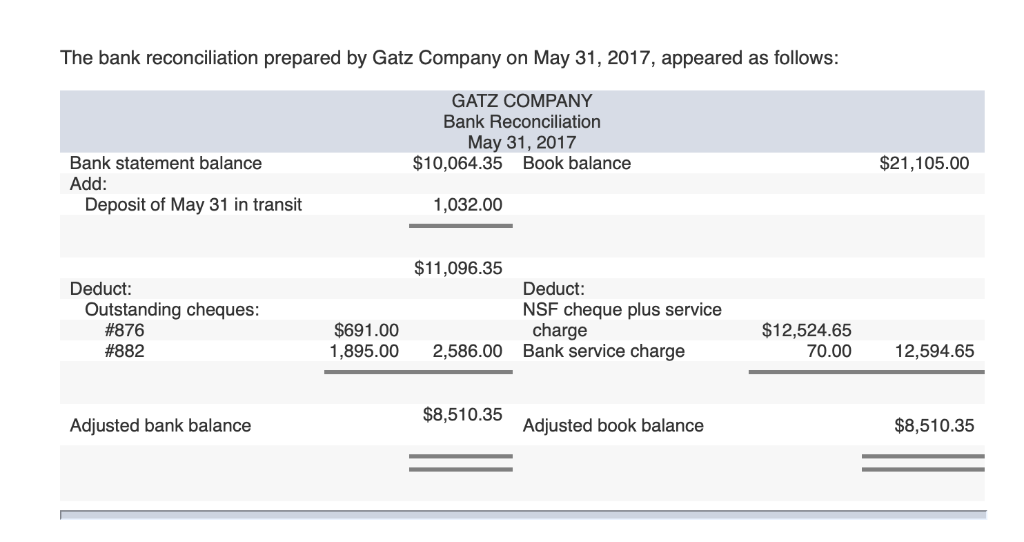

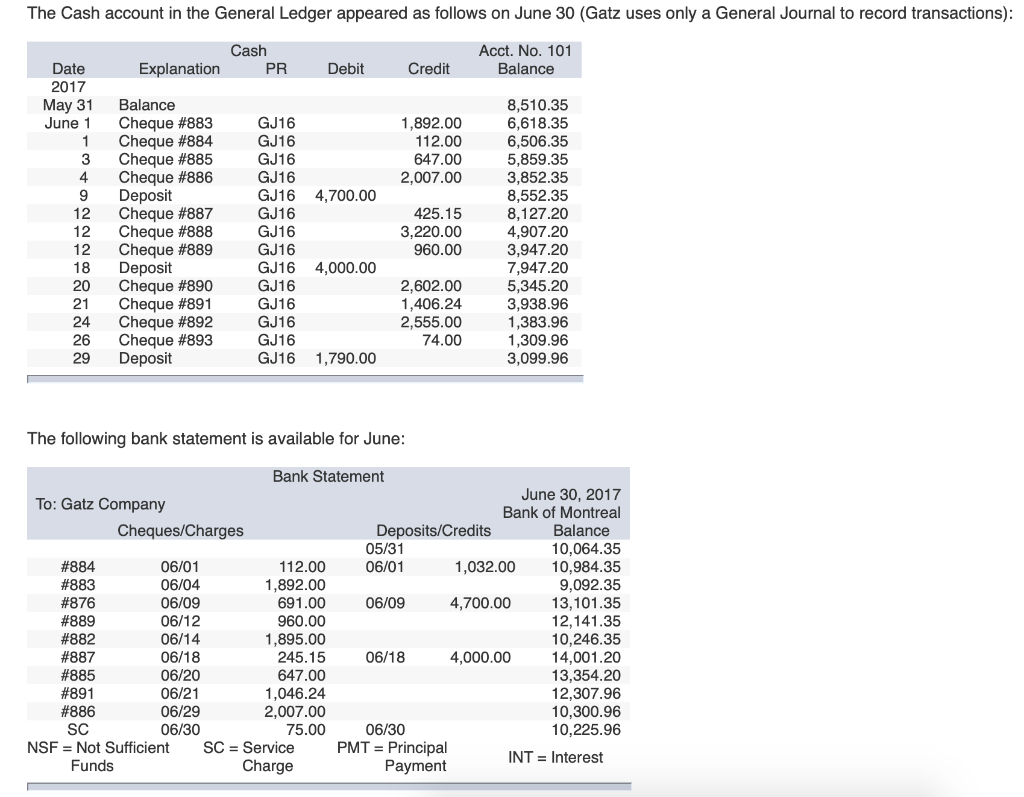

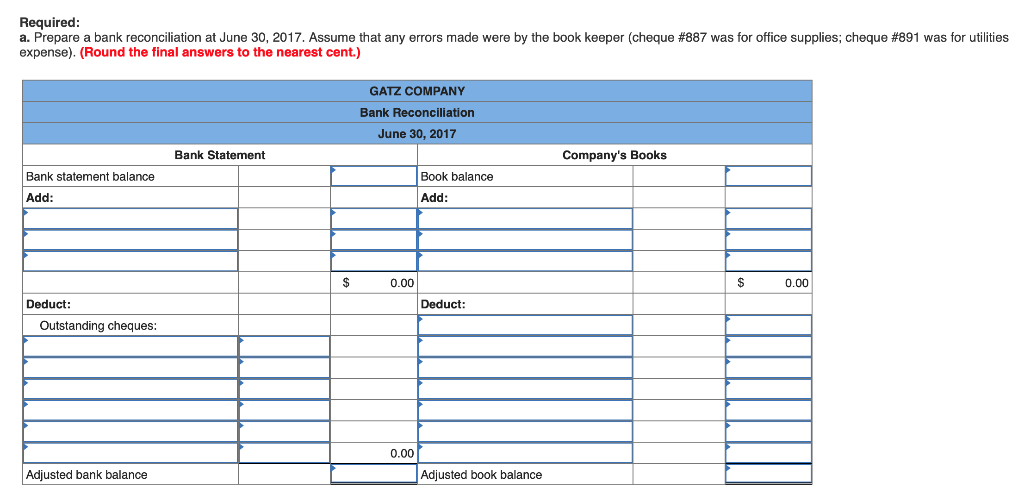

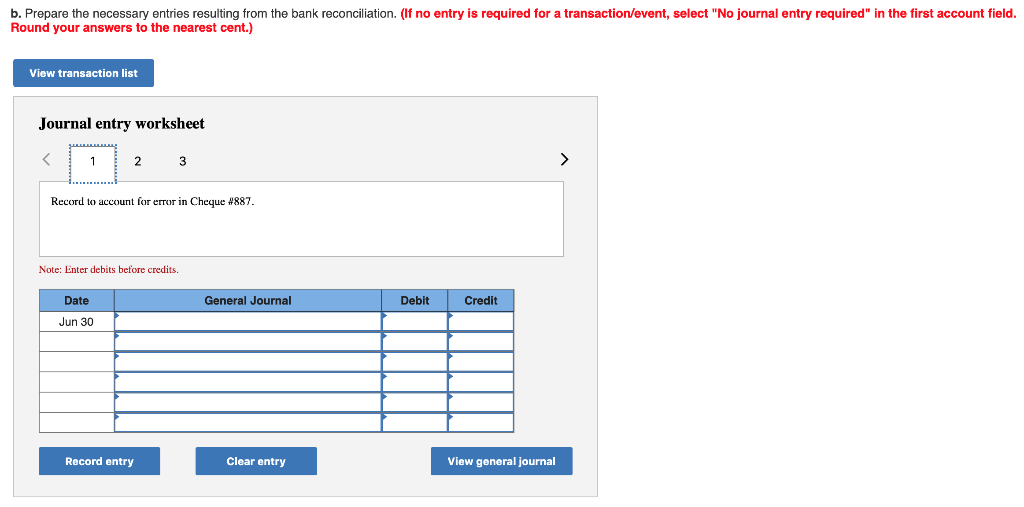

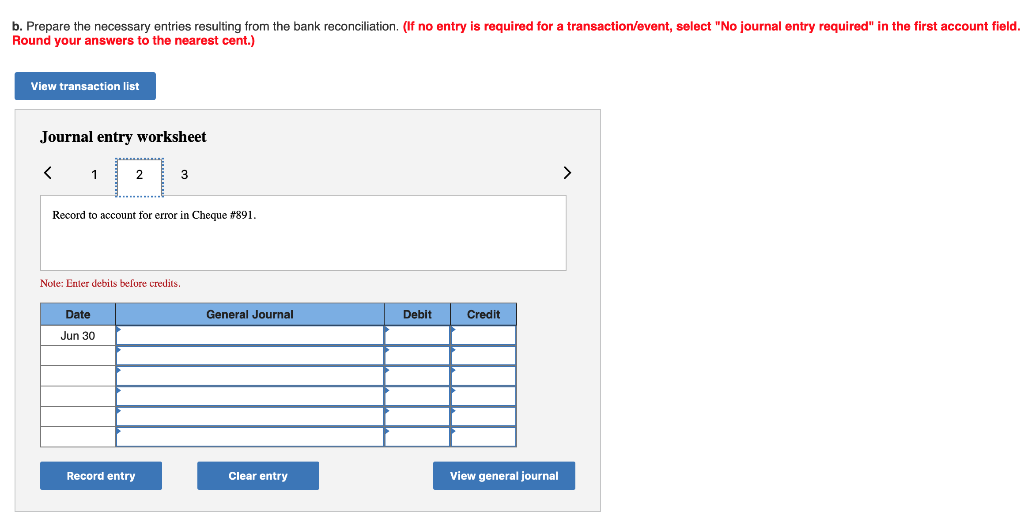

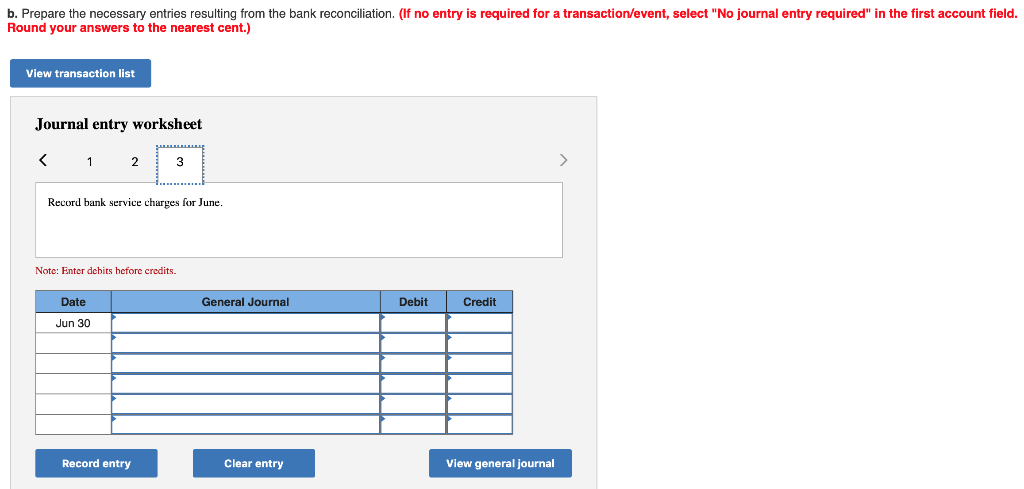

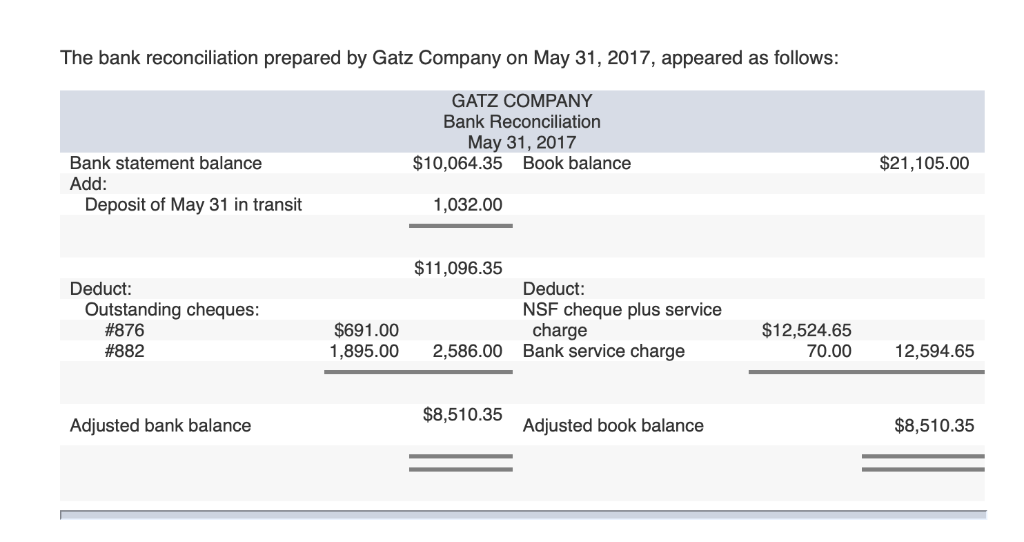

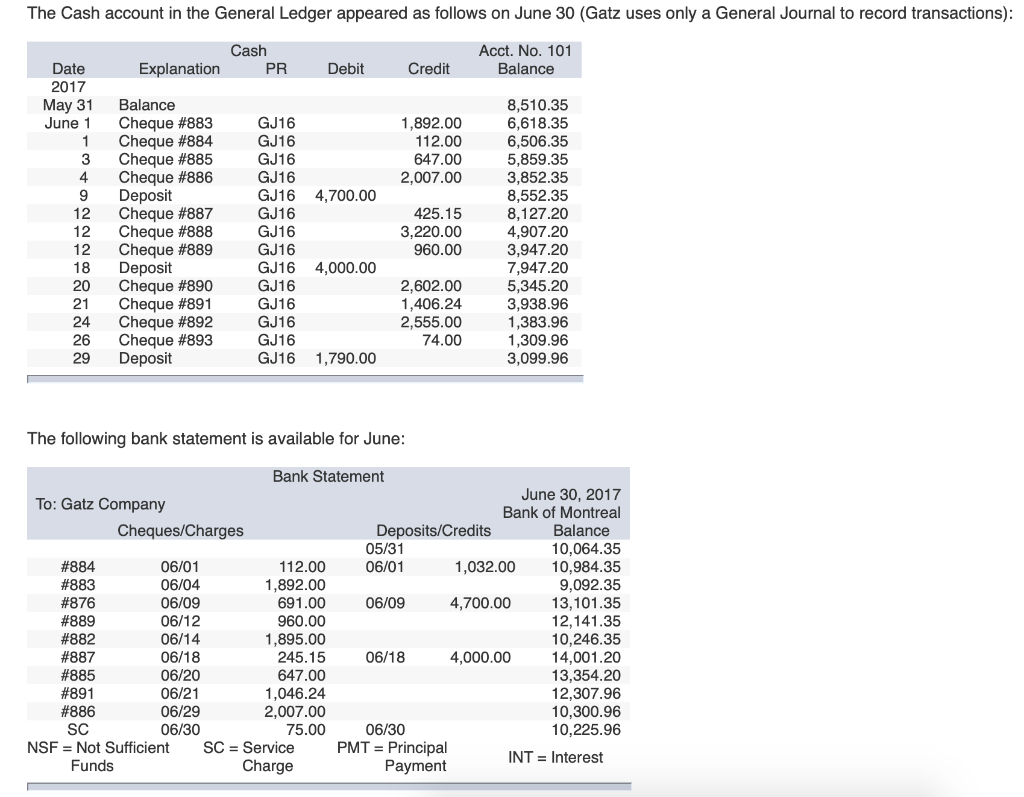

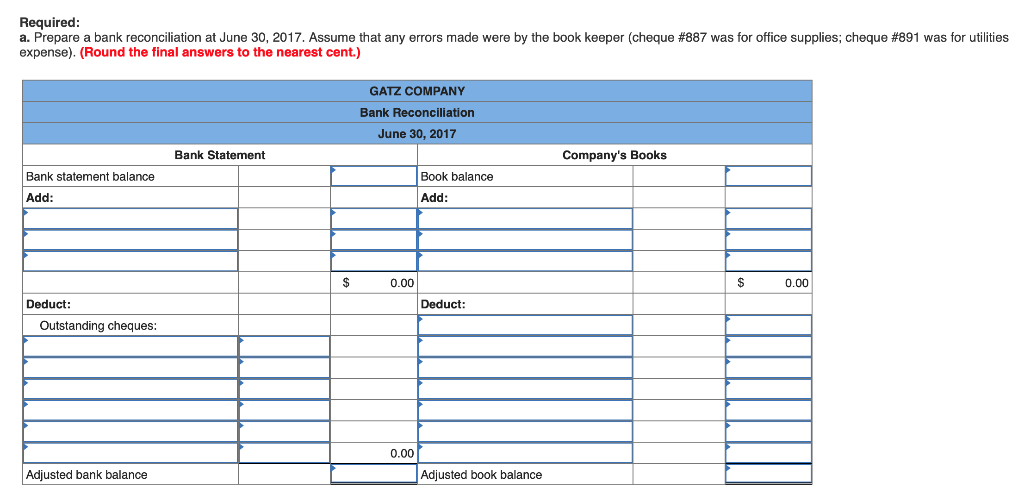

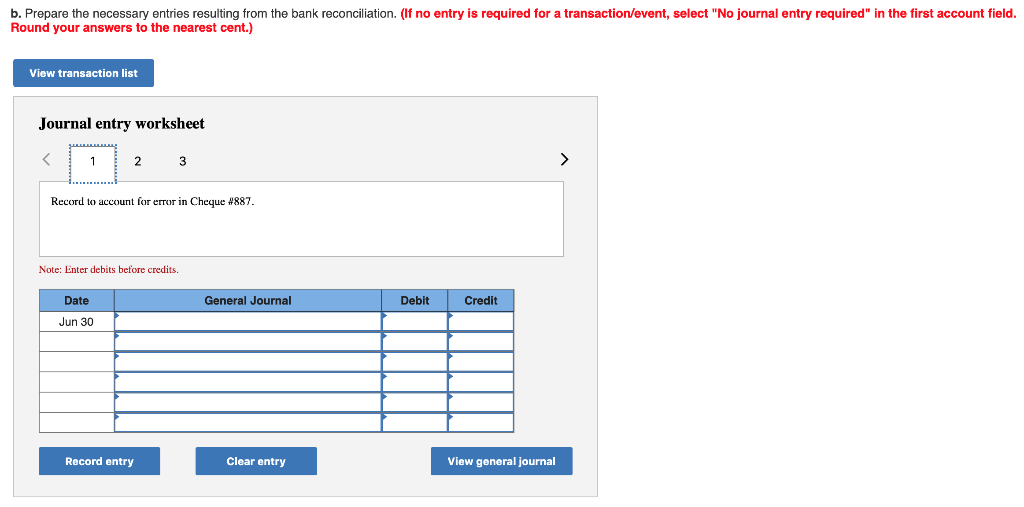

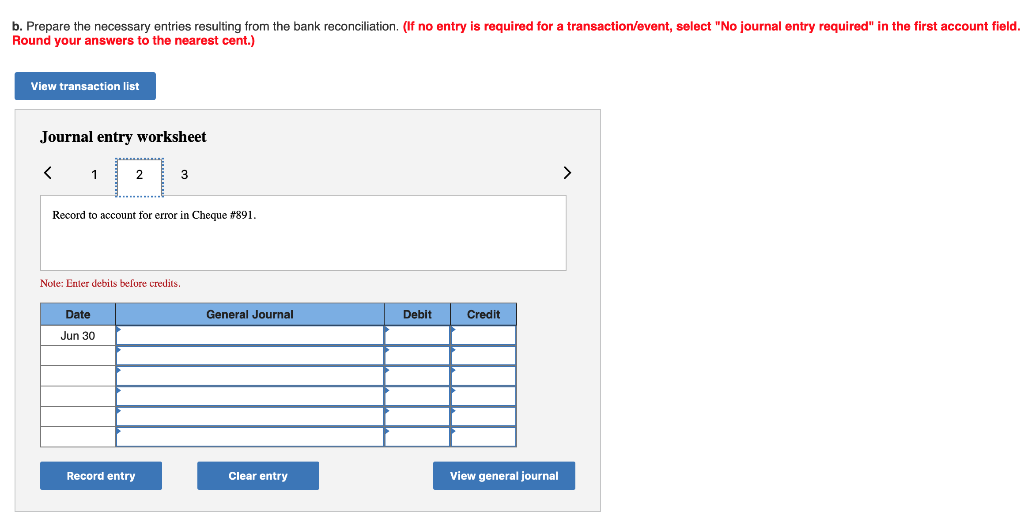

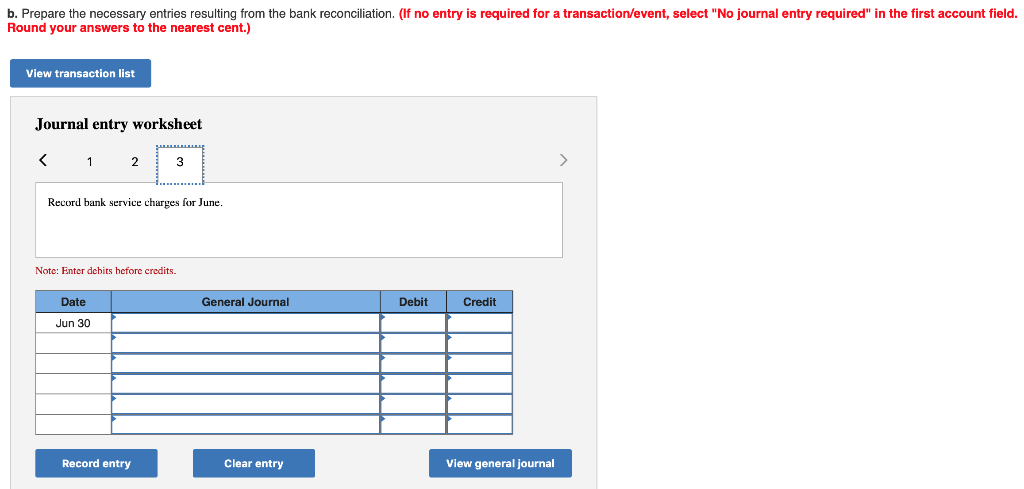

The bank reconciliation prepared by Gatz Company on May 31, 2017, appeared as follows: GATZ COMPANY Bank Reconciliation May 31, 2017 Bank statement balance $10,064.35 $21,105.00 Book balance Add: Deposit of May 31 in transit 1,032.00 $11,096.35 Deduct: NSF cheque plus service charge Bank service charge Deduct: Outstanding cheques: #876 $691.00 1,895.00 $12,524.65 70.00 #882 2,586.00 12,594.65 $8,510.35 $8,510.35 Adjusted bank balance Adjusted book balance The Cash account in the General Ledger appeared as follows on June 30 (Gatz uses only a General Journal to record transactions): Cash PR Acct. No. 101 Balance Credit Date Explanation Debit 2017 8,510.35 6,618.35 6,506.35 5,859.35 3,852.35 8,552.35 8,127.20 4,907.20 3,947.20 7,947.20 5,345.20 3,938.96 1,383.96 1,309.96 3,099.96 May 31 June 1 Balance Cheque #883 Cheque #884 3 GJ16 GJ16 GJ16 GJ16 GJ16 GJ16 GJ16 GJ16 GJ16 GJ16 GJ16 1,892.00 112.00 647.00 2,007.00 1 Cheque #885 4 Cheque #886 Deposit Cheque #887 Cheque #888 Cheque #889 Deposit Cheque #890 Cheque #891 Cheque #892 Cheque #893 Deposit 9 4,700.00 12 12 12 18 425.15 3,220.00 960.00 4,000.00 2,602.00 1,406.24 2,555.00 74.00 20 21 24 GJ16 26 29 GJ16 GJ16 1,790.00 The following bank statement is available for June: Bank Statement June 30, 2017 Bank of Montreal To: Gatz Company Cheques/Charges Deposits/Credits 05/31 06/01 Balance 10,064.35 10,984.35 9,092.35 13,101.35 12,141.35 10,246.35 14,001.20 13,354.20 12,307.96 10,300.96 10,225.96 #884 #883 #876 #889 #882 #887 #885 #891 #886 SC NSF Not Sufficient Funds 06/01 112.00 1,892.00 691.00 960.00 1,032.00 06/04 06/09 06/12 06/14 06/18 06/20 06/21 06/29 06/30 06/09 4,700.00 1,895.00 245.15 647.00 06/18 4,000.00 1,046.24 2,007.00 75.00 SC Service 06/30 PMT Principal Payment INT = Interest Charge Required: a. Prepare a bank reconciliation at June 30, 2017. Assume that any errors made were by the book keeper (cheque #887 was for office supplies; cheque #891 was for utilities expense). (Round the final answers to the nearest cent.) GATZ COMPANY Bank Reconciliation June 30, 2017 Company's Books Bank Statement Book balance Bank statement balance Add: Add: 0.00 0.00 Deduct: Deduct Qutstanding cheques: 0.00 Adjusted bank balance Adjusted book balance b. Prepare the necessary entries resulting from the bank reconciliation. (lf no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to the nearest cent.) View transaction list Journal entry worksheet 2 3 1 Record to account for error in Cheque # 887. Note: Enter debits before credits. Date General Journal Debit Credit Jun 30 Record entry Clear entry View general journal b. Prepare the necessary entries resulting from the bank reconciliation. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to the nearest cent.) View transaction list Journal entry worksheet 1 2 3 Record to account for error in Cheque #891 Note: Enter debits before credits. Date General Journal Debit Credit Jun 30 View general journal Record entry Clear entry b. Prepare the necessary entries resulting from the bank reconciliation. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to the nearest cent.) View transaction list Journal entry worksheet 1 2 3 Record bank service charges for June. Note: Enter dcbits hefore credits. General Journal Date Credit Debit Jun 30 View general journal Record entry Clear entry