Answered step by step

Verified Expert Solution

Question

1 Approved Answer

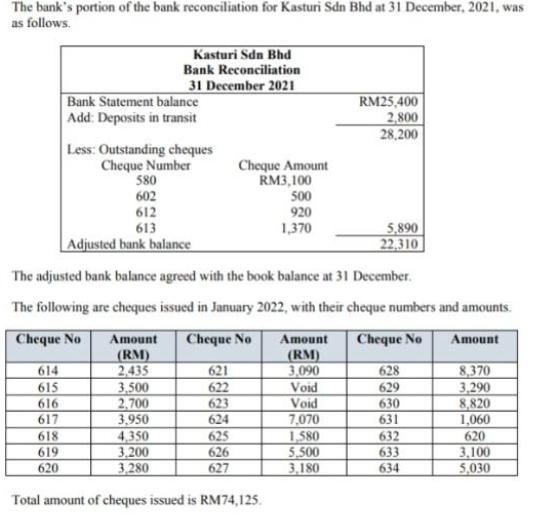

The bank's portion of the bank reconciliation for Kasturi Sdn Bhd at 31 December, 2021, was as follows. 614 615 616 617 618 619

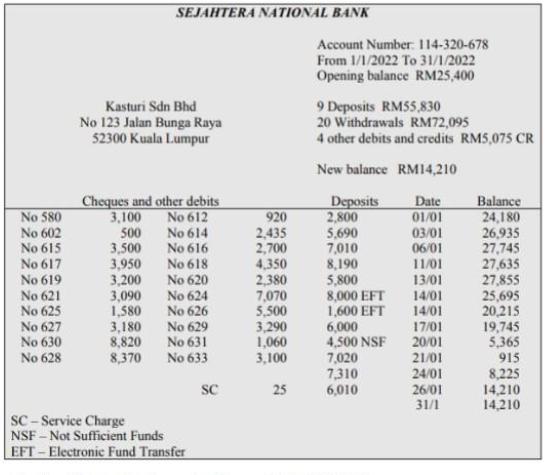

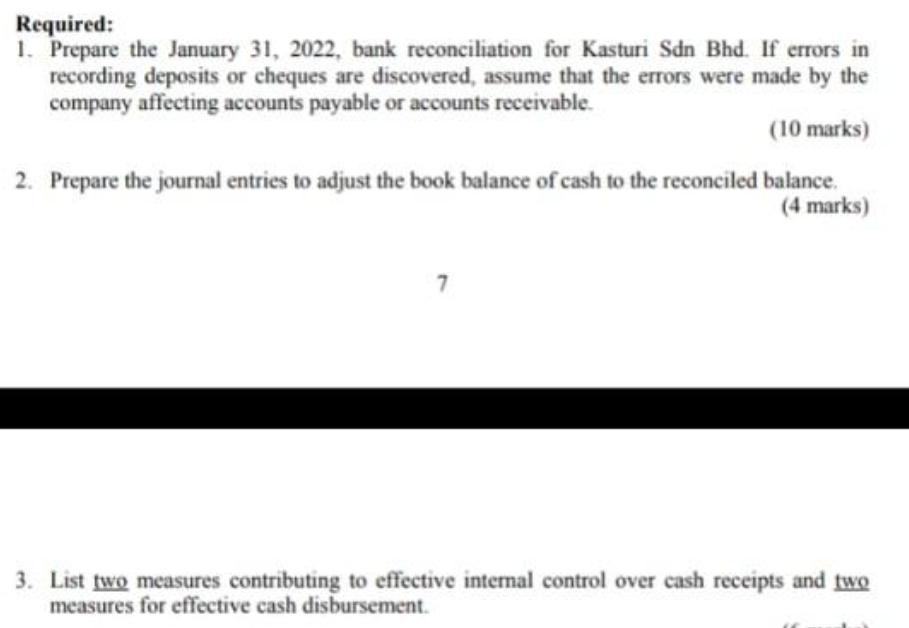

The bank's portion of the bank reconciliation for Kasturi Sdn Bhd at 31 December, 2021, was as follows. 614 615 616 617 618 619 620 Kasturi Sdn Bhd Bank Reconciliation 31 December 2021 Bank Statement balance Add: Deposits in transit Less: Outstanding cheques Cheque Number 580 602 612 613 Adjusted bank balance Amount (RM) 2,435 3,500 2,700 3,950 The adjusted bank balance agreed with the book balance at 31 December. The following are cheques issued in January 2022, with their cheque numbers and amounts. Cheque No Cheque No Cheque No 621 622 Cheque Amount RM3,100 500 920 1,370 623 624 625 626 627 4,350 3,200 3,280 Total amount of cheques issued is RM74,125. Amount (RM) 3,090 Void Void RM25,400 2,800 28,200 7,070 1,580 5,500 3,180 5,890 22,310 628 629 630 631 632 633 634 Amount 8,370 3,290 8,820 1,060 620 3,100 5,030 No 580 No 602 No 615 No 617 No 619 No 621 No 625 No 627 No 630 No 628 Kasturi Sdn Bhd No 123 Jalan Bunga Raya 52300 Kuala Lumpur SEJAHTERA NATIONAL BANK Cheques and other debits No 612 No 614 No 616 No 618 3,100 500 3,500 3,950 3,200 3,090 1,580 3,180 8,820 8,370 No 620 No 624 No 626 No 629 No 631 No 633 SC-Service Charge NSF - Not Sufficient Funds EFT-Electronic Fund Transfer SC 920 2,435 2,700 4,350 2,380 7,070 5,500 3,290 1,060 3,100 25 Account Number: 114-320-678 From 1/1/2022 To 31/1/2022 Opening balance RM25,400 9 Deposits RM55,830 20 Withdrawals RM72,095 4 other debits and credits RM5,075 CR New balance RM14,210 Deposits 2,800 5,690 7,010 8,190 5,800 8,000 EFT 1,600 EFT 6,000 4,500 NSF 7,020 7,310 6,010 Date 01/01 03/01 06/01 11/01 13/01 14/01 14/01 17/01 20/01 21/01 24/01 26/01 31/1 Balance 24,180 26,935 27,745 27,635 27,855 25,695 20,215 19,745 5,365 915 8,225 14,210 14,210 Required: 1. Prepare the January 31, 2022, bank reconciliation for Kasturi Sdn Bhd. If errors in recording deposits or cheques are discovered, assume that the errors were made by the company affecting accounts payable or accounts receivable. (10 marks) 2. Prepare the journal entries to adjust the book balance of cash to the reconciled balance. (4 marks) 7 3. List two measures contributing to effective internal control over cash receipts and two measures for effective cash disbursement.

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Bank Reconciliation Statement Particulars Ref No Amount Amount Bank Balance as per Statement of Ba...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started