Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Basics of Capital Budgeting: NPV 1. Business ethics/ shareholders wealth/ employee benefits 2.smaller/ larger 3. Higher/ lower 4.rd, Sri, WACC 5. accept/ reject 6.

The Basics of Capital Budgeting: NPV

1. Business ethics/ shareholders wealth/ employee benefits

2.smaller/ larger

3. Higher/ lower

4.rd, Sri, WACC

5. accept/ reject

6. Lowest positive, lowest negative, highest positive, highest negative

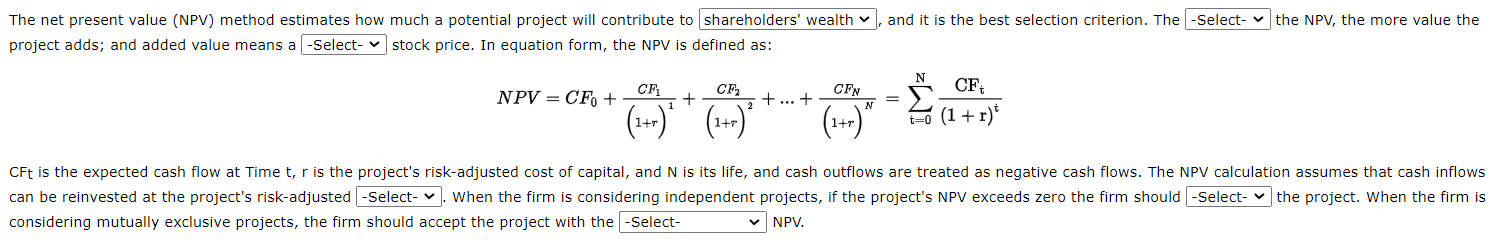

and it is the best selection criterion. The -Select-the NPV, the more value the The net present value (NPV) method estimates how much a potential project will contribute to shareholders' wealth project adds; and added value means a -Select-stock price. In equation form, the NPV is defined as: N NPV = CF. + CF CF CFN CF + + ... + (1+r)" (1+r)" t=0 (1 + r) CFt is the expected cash flow at Time t, r is the project's risk-adjusted cost of capital, and N is its life, and cash outflows are treated as negative cash flows. The NPV calculation assumes that cash inflows can be reinvested at the project's risk-adjusted -Select- v. When the firm is considering independent projects, if the project's NPV exceeds zero the firm should -Select the project. When the firm is considering mutually exclusive projects, the firm should accept the project with the -Select- NPVStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started