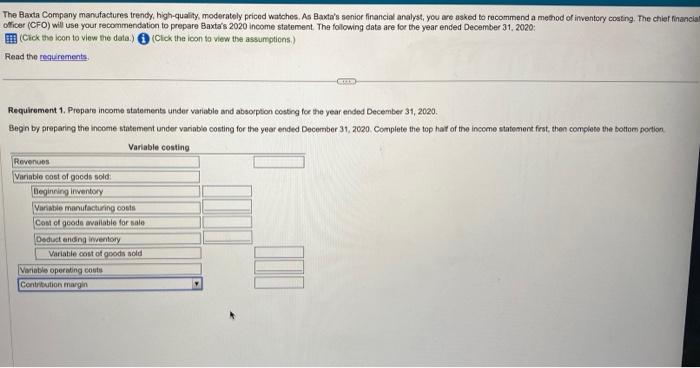

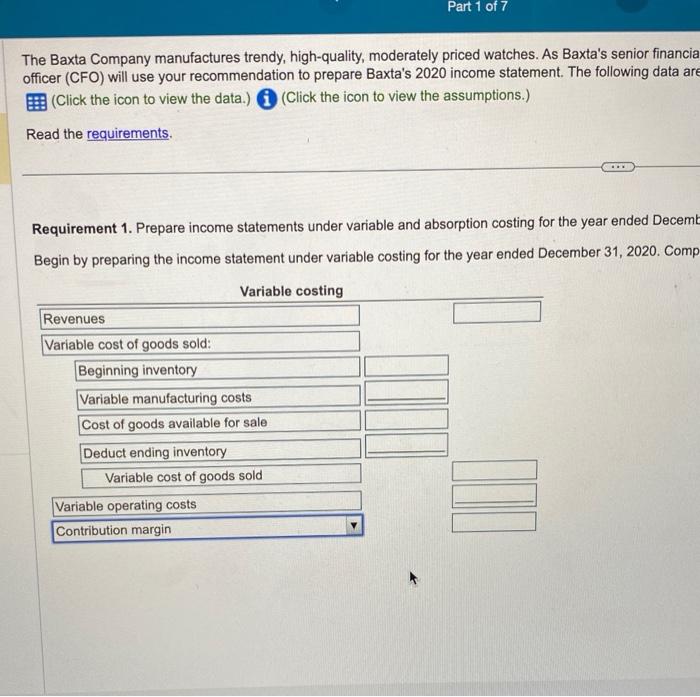

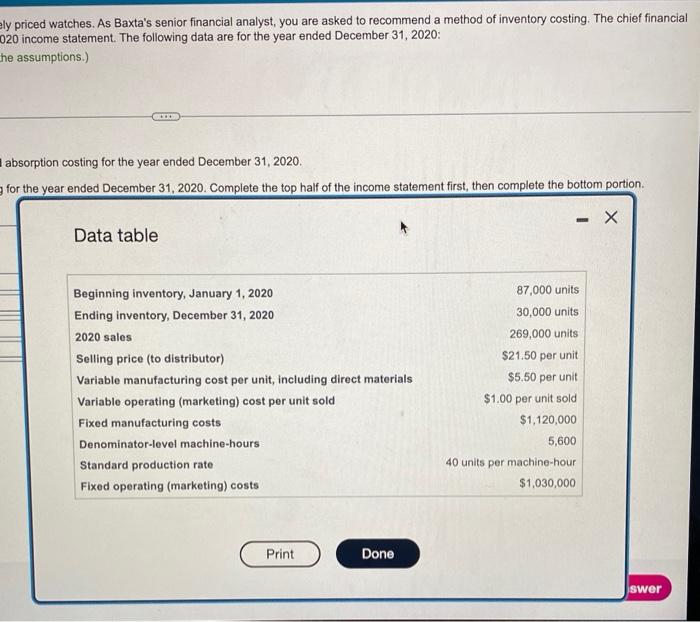

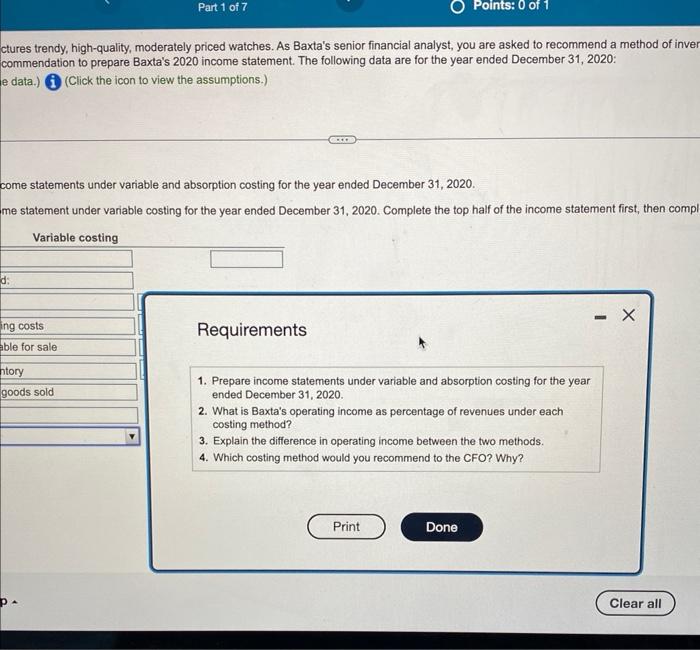

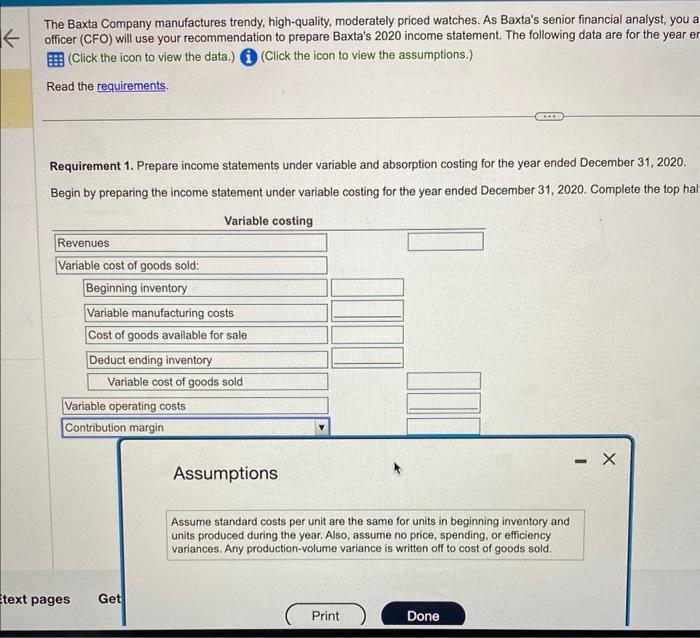

The Baxta Company manufactures trendy, high-quality, moderately priced watohes. As Baxta's senior financial analyst, you are asked to recommend a method of inventory costng. The chier financis officer (CFO) will use your recommendation to prepare Baxta's 2020 income statement. The following data are for the year ended December 31,2020 : (Cick the icon to view the data.) . (Click the icon ta view the assumptions.) Read the requirements, Requirement 1. Prepare income statements under vatiable and absorpton costing foe the year ended December 31, 2020. Begn by preparing the income statement under variable costing for the year ended December 31,2020 . Complete the top hat of the income statoment frst, then complete the boltom portion The Baxta Company manufactures trendy, high-quality, moderately priced watches. As Baxta's senior financia officer (CFO) will use your recommendation to prepare Baxta's 2020 income statement. The following data ar (Click the icon to view the data.) (Click the icon to view the assumptions.) Read the requirements. Requirement 1. Prepare income statements under variable and absorption costing for the year ended Decemt Begin by preparing the income statement under variable costing for the year ended December 31,2020 . Comp Iy priced watches. As Baxta's senior financial analyst, you are asked to recommend a method of inventory costing. The chief financial O20 income statement. The following data are for the year ended December 31,2020 : he assumptions.) absorption costing for the year ended December 31,2020. for the year ended December 31,2020. Complete the top half of the income statement first, then complete the bottom portion. ctures trendy, high-quality, moderately priced watches. As Baxta's senior financial analyst, you are asked to recommend a method of inver commendation to prepare Baxta's 2020 income statement. The following data are for the year ended December 31, 2020: e data.) (Click the icon to view the assumptions.) come statements under variable and absorption costing for the year ended December 31,2020. me statement under variable costing for the year ended December 31, 2020. Complete the top half of the income statement first, then compl Variable costing Requirements 1. Prepare income statements under variable and absorption costing for the year ended December 31, 2020. 2. What is Baxta's operating income as percentage of revenues under each costing method? 3. Explain the difference in operating income between the two methods. 4. Which costing method would you recommend to the CFO? Why? The Baxta Company manufactures trendy, high-quality, moderately priced watches. As Baxta's senior financial analyst, you a officer (CFO) will use your recommendation to prepare Baxta's 2020 income statement. The following data are for the year el (Click the icon to view the data.) (Click the icon to view the assumptions.) Read the requirements. Requirement 1. Prepare income statements under variable and absorption costing for the year ended December 31,2020. Begin by preparing the income statement under variable costing for the year ended December 31,2020 . Complete the top ha Assumptions Assume standard costs per unit are the same for units in beginning inventory and units produced during the year. Also, assume no price, spending, or efficiency variances. Any production-volume variance is written off to cost of goods sold. The Baxta Company manufactures trendy, high-quality, moderately priced watohes. As Baxta's senior financial analyst, you are asked to recommend a method of inventory costng. The chier financis officer (CFO) will use your recommendation to prepare Baxta's 2020 income statement. The following data are for the year ended December 31,2020 : (Cick the icon to view the data.) . (Click the icon ta view the assumptions.) Read the requirements, Requirement 1. Prepare income statements under vatiable and absorpton costing foe the year ended December 31, 2020. Begn by preparing the income statement under variable costing for the year ended December 31,2020 . Complete the top hat of the income statoment frst, then complete the boltom portion The Baxta Company manufactures trendy, high-quality, moderately priced watches. As Baxta's senior financia officer (CFO) will use your recommendation to prepare Baxta's 2020 income statement. The following data ar (Click the icon to view the data.) (Click the icon to view the assumptions.) Read the requirements. Requirement 1. Prepare income statements under variable and absorption costing for the year ended Decemt Begin by preparing the income statement under variable costing for the year ended December 31,2020 . Comp Iy priced watches. As Baxta's senior financial analyst, you are asked to recommend a method of inventory costing. The chief financial O20 income statement. The following data are for the year ended December 31,2020 : he assumptions.) absorption costing for the year ended December 31,2020. for the year ended December 31,2020. Complete the top half of the income statement first, then complete the bottom portion. ctures trendy, high-quality, moderately priced watches. As Baxta's senior financial analyst, you are asked to recommend a method of inver commendation to prepare Baxta's 2020 income statement. The following data are for the year ended December 31, 2020: e data.) (Click the icon to view the assumptions.) come statements under variable and absorption costing for the year ended December 31,2020. me statement under variable costing for the year ended December 31, 2020. Complete the top half of the income statement first, then compl Variable costing Requirements 1. Prepare income statements under variable and absorption costing for the year ended December 31, 2020. 2. What is Baxta's operating income as percentage of revenues under each costing method? 3. Explain the difference in operating income between the two methods. 4. Which costing method would you recommend to the CFO? Why? The Baxta Company manufactures trendy, high-quality, moderately priced watches. As Baxta's senior financial analyst, you a officer (CFO) will use your recommendation to prepare Baxta's 2020 income statement. The following data are for the year el (Click the icon to view the data.) (Click the icon to view the assumptions.) Read the requirements. Requirement 1. Prepare income statements under variable and absorption costing for the year ended December 31,2020. Begin by preparing the income statement under variable costing for the year ended December 31,2020 . Complete the top ha Assumptions Assume standard costs per unit are the same for units in beginning inventory and units produced during the year. Also, assume no price, spending, or efficiency variances. Any production-volume variance is written off to cost of goods sold