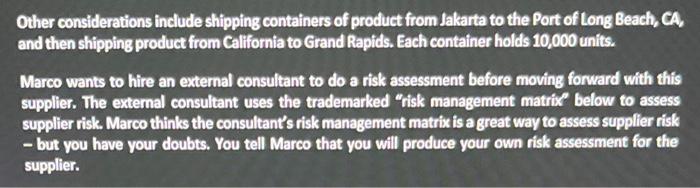

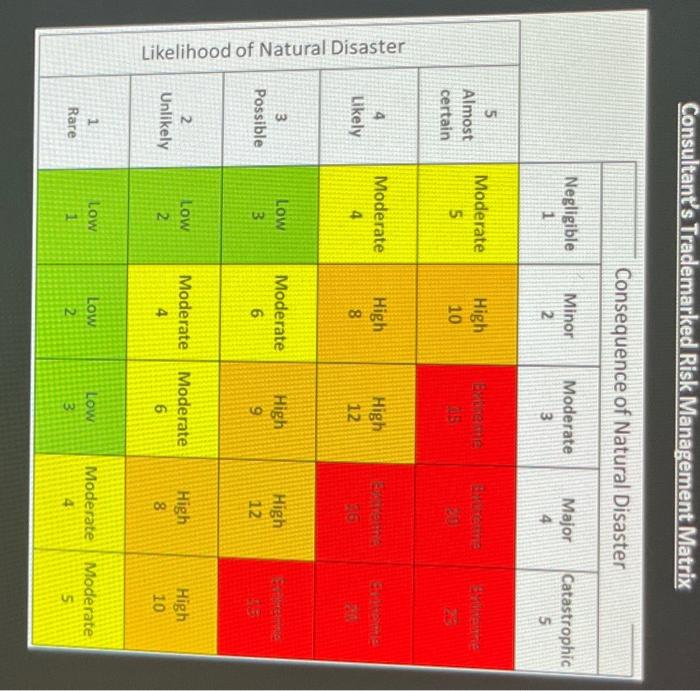

The Bean Boiler is Primo Caf's most basic model. The main materials used in manufacturing the Bean Boiler are aluminum and plastic. There are lots of suppliers for these materials. At present, Primo Caf's total cost for producing a Bean Boiler is $13 per unit and the product is competitively priced at $20 per unit. There are lots of other coffee makers that are very similar to the Bean Boiler on the market. Still, sales of the Bean Boiler are very stable. The company reliably sells 24,625 to 25,375 units of this product per month. The Family Man is Primo Caf's mid-market offering. Primo Caf manufactures most of the Family Man in-house, but buys the glass pot and the electronics that control the on/off function and the timer. At present, final assembly of the inhouse manufactured parts and the purchased sub-components occurs at Primo Caf's facility in Grand Rapids. Total cost for producing the Family Man is currently $32 per unit and each unit is sold for \$34.99. The Family Man's sleek, artistic design and range of unique colors helps to distinguish it from a wide selection of similar products offered by competitors. Prices for direct competitors range from $25 to $45. Sales of the Family Man range from 19,400 to 20,600 units per month. The Caffissimg is Primo Caf's high-end offering. Primo Caf produces the external metal parts of the casing for the Caffissime in-house, but buys all of the important sub-components from external suppliers. The most important sub-components for the Caffissime are the gauges that regulate the temperature and pressure of the water as it is forced through the coffee grounds. The proper working of these gauges ensure that the Caffissimg produces a perfect cup of coffee at brewing. The Caffissimo's design is a closely held company secret. The machine has won industry awards both in terms of its coffee making process and its external looks. Currently, the Caffissimo costs Ils for $600. Because of the relatively high price and unique design, demand for t to predict. Over the past year, demand has ranged from 8,500 to 11,500 units Marco is looking for ways to reduce production costs related to the Family Man. His latest idea is to fully outsource production of the coffeemaker to an external supplier. He has found a potential supplier, International Manufacturing Inc. Intemational Manufacturing Inc. has a small branch office in Grand Rapids, but operates three manufacturing facilities in Jakarta, Indonesia. The company was established three years ago and had revenues of roughly $460 million last year. It produces a wide range of products in the household appliances space such as coffee makers, toasters, air conditioning units, ceiling fans, electric can openers, and dishwashers. The company's website suggests that they are ISO 9001 compliant although it is not clear whether this is the same as being certified. You have asked for additional information on this point, but have not heard back from your contact yet. Still, the company has executed short-term contracts for some brand name home appliance retailers including Sears, Walmart, and Best Buy. International Manufacturing Inc. is a privately held subsidiary of the investment group PrivoCo Finance Limited, headquartered in Singapore. Therefore, it is difficult to obtain financial information on their operations. However, you were able obtain the following information for 2021. \begin{tabular}{|l|l|} \hline Current assets = & $775,000,000 \\ \hline Total assets = & $1,500,000,000 \\ \hline Current liabilities = & $742,500,000 \\ \hline Total liabilities = & $1,350,000,000 \\ \hline Retained earnings = & $25,740,000 \\ \hline Total stockholder equity = & $150,000,000 \\ \hline Sales = & $900,000,000 \\ \hline Earnings before interest and tax (EBIT)= & $468,000,000 \\ \hline Net income = & $257,400,000 \\ \hline \end{tabular} Other considerations include shipping containers of product from Jakarta to the Port of Long Beach, CA, and then shipping product from California to Grand Rapids. Each container holds 10,000 units. Marco wants to hire an external consultant to do a risk assessment before moving forward with this supplier. The external consultant uses the trademarked "risk management matrix" below to assess supplier risk. Marco thinks the consultant's risk management matrix is a great way to assess supplier risk - but you have your doubts. You tell Marco that you will produce your own risk assessment for the supplier. 1. Create a risk assessment using the excel format from class with at least three categories. Be sure to include both macro and micro risks. 2. Based on the financial information provided, calculate the supplier's Altman Z score. Be sure to show your all your calculations in the excel file. 3. Based on your risk assessment, provide a recommendation as to whether Primo Caf should go with this supplier. Why or why not? 4. Assuming Primo Caf does move forward with International Manufacturing Inc, as a supplier, describe three concrete steps that Marco can take to mitigate risks associated with the company. 5. Compare your risk assessment to the trademarked "risk management matrix" offered by the consultant. Which tool provides a better risk assessment? Why? Consultant's Trademarked Risk Management Matrix The Bean Boiler is Primo Caf's most basic model. The main materials used in manufacturing the Bean Boiler are aluminum and plastic. There are lots of suppliers for these materials. At present, Primo Caf's total cost for producing a Bean Boiler is $13 per unit and the product is competitively priced at $20 per unit. There are lots of other coffee makers that are very similar to the Bean Boiler on the market. Still, sales of the Bean Boiler are very stable. The company reliably sells 24,625 to 25,375 units of this product per month. The Family Man is Primo Caf's mid-market offering. Primo Caf manufactures most of the Family Man in-house, but buys the glass pot and the electronics that control the on/off function and the timer. At present, final assembly of the inhouse manufactured parts and the purchased sub-components occurs at Primo Caf's facility in Grand Rapids. Total cost for producing the Family Man is currently $32 per unit and each unit is sold for \$34.99. The Family Man's sleek, artistic design and range of unique colors helps to distinguish it from a wide selection of similar products offered by competitors. Prices for direct competitors range from $25 to $45. Sales of the Family Man range from 19,400 to 20,600 units per month. The Caffissimg is Primo Caf's high-end offering. Primo Caf produces the external metal parts of the casing for the Caffissime in-house, but buys all of the important sub-components from external suppliers. The most important sub-components for the Caffissime are the gauges that regulate the temperature and pressure of the water as it is forced through the coffee grounds. The proper working of these gauges ensure that the Caffissimg produces a perfect cup of coffee at brewing. The Caffissimo's design is a closely held company secret. The machine has won industry awards both in terms of its coffee making process and its external looks. Currently, the Caffissimo costs Ils for $600. Because of the relatively high price and unique design, demand for t to predict. Over the past year, demand has ranged from 8,500 to 11,500 units Marco is looking for ways to reduce production costs related to the Family Man. His latest idea is to fully outsource production of the coffeemaker to an external supplier. He has found a potential supplier, International Manufacturing Inc. Intemational Manufacturing Inc. has a small branch office in Grand Rapids, but operates three manufacturing facilities in Jakarta, Indonesia. The company was established three years ago and had revenues of roughly $460 million last year. It produces a wide range of products in the household appliances space such as coffee makers, toasters, air conditioning units, ceiling fans, electric can openers, and dishwashers. The company's website suggests that they are ISO 9001 compliant although it is not clear whether this is the same as being certified. You have asked for additional information on this point, but have not heard back from your contact yet. Still, the company has executed short-term contracts for some brand name home appliance retailers including Sears, Walmart, and Best Buy. International Manufacturing Inc. is a privately held subsidiary of the investment group PrivoCo Finance Limited, headquartered in Singapore. Therefore, it is difficult to obtain financial information on their operations. However, you were able obtain the following information for 2021. \begin{tabular}{|l|l|} \hline Current assets = & $775,000,000 \\ \hline Total assets = & $1,500,000,000 \\ \hline Current liabilities = & $742,500,000 \\ \hline Total liabilities = & $1,350,000,000 \\ \hline Retained earnings = & $25,740,000 \\ \hline Total stockholder equity = & $150,000,000 \\ \hline Sales = & $900,000,000 \\ \hline Earnings before interest and tax (EBIT)= & $468,000,000 \\ \hline Net income = & $257,400,000 \\ \hline \end{tabular} Other considerations include shipping containers of product from Jakarta to the Port of Long Beach, CA, and then shipping product from California to Grand Rapids. Each container holds 10,000 units. Marco wants to hire an external consultant to do a risk assessment before moving forward with this supplier. The external consultant uses the trademarked "risk management matrix" below to assess supplier risk. Marco thinks the consultant's risk management matrix is a great way to assess supplier risk - but you have your doubts. You tell Marco that you will produce your own risk assessment for the supplier. 1. Create a risk assessment using the excel format from class with at least three categories. Be sure to include both macro and micro risks. 2. Based on the financial information provided, calculate the supplier's Altman Z score. Be sure to show your all your calculations in the excel file. 3. Based on your risk assessment, provide a recommendation as to whether Primo Caf should go with this supplier. Why or why not? 4. Assuming Primo Caf does move forward with International Manufacturing Inc, as a supplier, describe three concrete steps that Marco can take to mitigate risks associated with the company. 5. Compare your risk assessment to the trademarked "risk management matrix" offered by the consultant. Which tool provides a better risk assessment? Why? Consultant's Trademarked Risk Management Matrix