Answered step by step

Verified Expert Solution

Question

1 Approved Answer

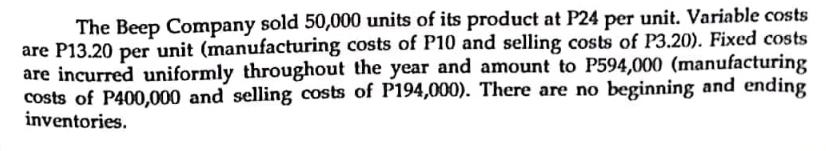

The Beep Company sold 50,000 units of its product at P24 per unit. Variable costs are P13.20 per unit (manufacturing costs of P10 and

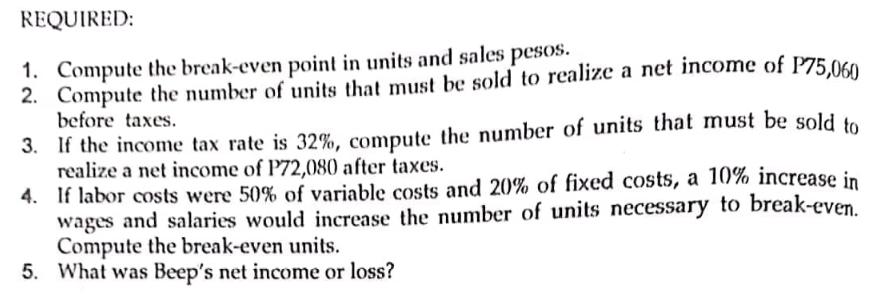

The Beep Company sold 50,000 units of its product at P24 per unit. Variable costs are P13.20 per unit (manufacturing costs of P10 and selling costs of P3.20). Fixed costs are incurred uniformly throughout the year and amount to P594,000 (manufacturing costs of P400,000 and selling costs of P194,000). There are no beginning and ending inventories. REQUIRED: 1. Compute the break-even point in units and sales pesos. 2. Compute the number of units that must be sold to realize a net income of P75,060 before taxes. 3. If the income tax rate is 32%, compute the number of units that must be sold to realize a net income of P72,080 after taxes. 4. If labor costs were 50% of variable costs and 20% of fixed costs, a 10% increase in wages and salaries would increase the number of units necessary to break-even. Compute the break-even units. 5. What was Beep's net income or loss?

Step by Step Solution

★★★★★

3.29 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Lets solve the given problems step by step 1 Compute the breakeven point in units and sales pesos Breakeven point in units Fixed costs Selling price p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started