Answered step by step

Verified Expert Solution

Question

1 Approved Answer

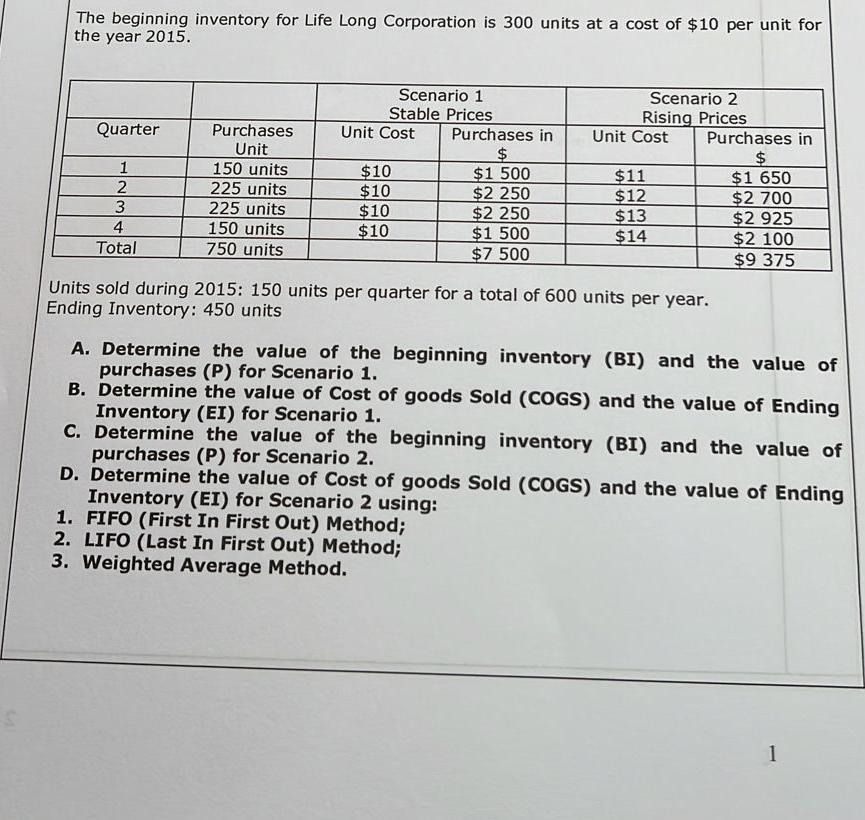

The beginning inventory for Life Long Corporation is 300 units at a cost of $10 per unit for the year 2015. Quarter 1 2

The beginning inventory for Life Long Corporation is 300 units at a cost of $10 per unit for the year 2015. Quarter 1 2 3 4 Total Purchases Unit 150 units 225 units 225 units 150 units 750 units Scenario 1 Stable Prices Unit Cost $10 $10 $10 $10 Purchases in $ $1.500 $2 250 $2 250 $1 500 $7.500 Scenario 2 Rising Prices Unit Cost $11 $12 $13 $14 Purchases in $ $1 650 $2 700 $2 925 $2 100 $9 375 Units sold during 2015: 150 units per quarter for a total of 600 units per year. Ending Inventory: 450 units A. Determine the value of the beginning inventory (BI) and the value of purchases (P) for Scenario 1. B. Determine the value of Cost of goods Sold (COGS) and the value of Ending Inventory (EI) for Scenario 1. C. Determine the value of the beginning inventory (BI) and the value of purchases (P) for Scenario 2. D. Determine the value of Cost of goods Sold (COGS) and the value of Ending Inventory (EI) for Scenario 2 using: 1. FIFO (First In First Out) Method; 2. LIFO (Last In First Out) Method; 3. Weighted Average Method. 1

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

A Scenario 1 Stable Prices In this scenario the unit cost remains at 10 throughout the year Beginning Inventory BI 300 units 10 per unit 3000 Purchase...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started