Question

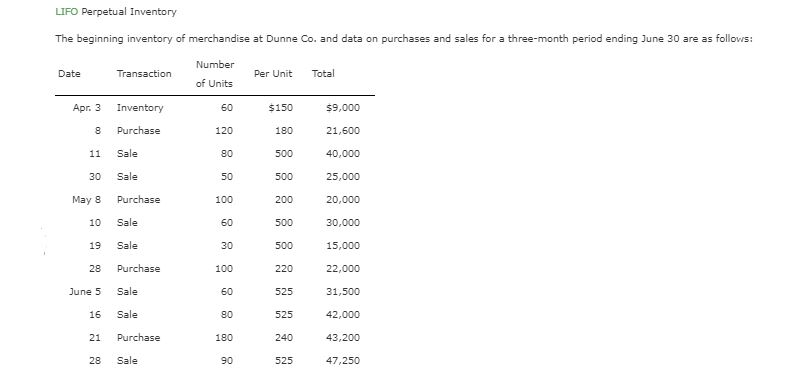

The beginning inventory of merchandise at Dunne Co. and data on purchases and sales for a three-month period ending June 30 are as follows: Date

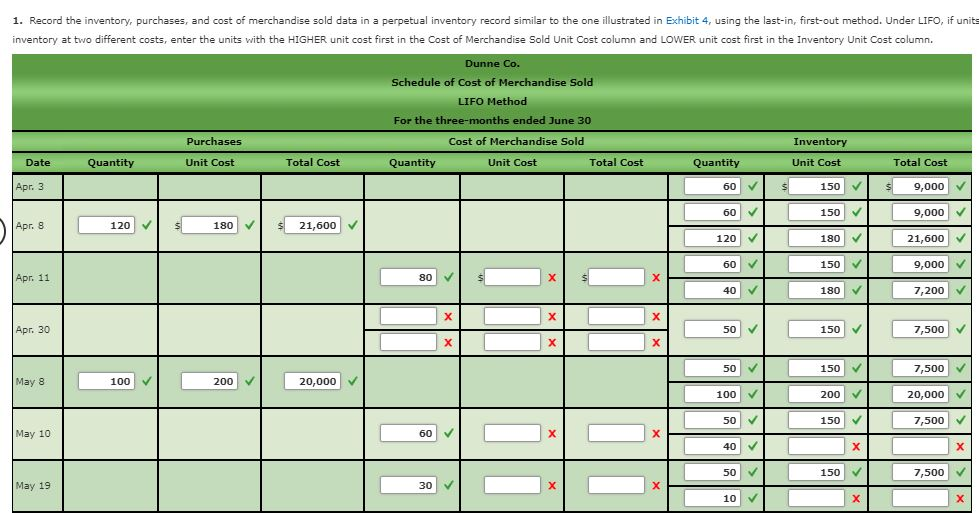

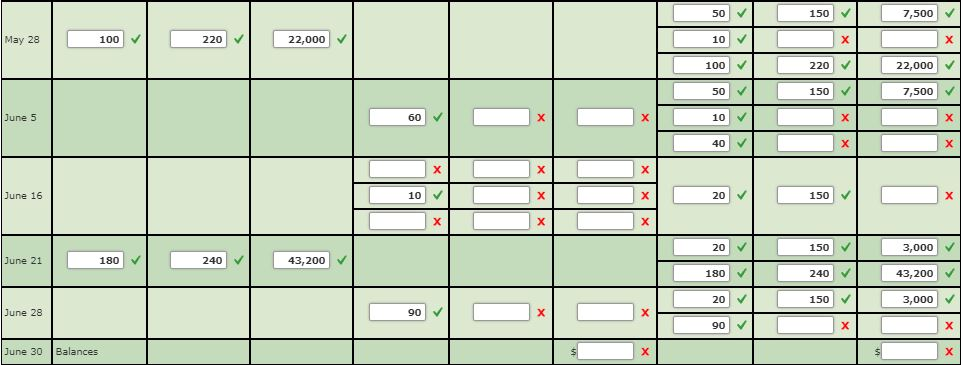

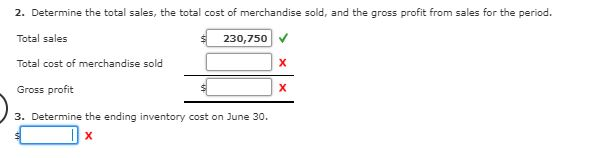

The beginning inventory of merchandise at Dunne Co. and data on purchases and sales for a three-month period ending June 30 are as follows: Date Transaction Number of Units Per Unit Total Apr. 3 Inventory 60 $150 $9,000 8 Purchase 120 180 21,600 11 Sale 80 500 40,000 30 Sale 50 500 25,000 May 8 Purchase 100 200 20,000 10 Sale 60 500 30,000 19 Sale 30 500 15,000 28 Purchase 100 220 22,000 June 5 Sale 60 525 31,500 16 Sale 80 525 42,000 21 Purchase 180 240 43,200 28 Sale 90 525 47,250 Required: 1. Record the inventory, purchases, and cost of merchandise sold data in a perpetual inventory record similar to the one illustrated in Exhibit 4, using the last-in, first-out method. Under LIFO, if units are in inventory at two different costs, enter the units with the HIGHER unit cost first in the Cost of Merchandise Sold Unit Cost column and LOWER unit cost first in the Inventory Unit Cost column.

The beginning inventory of merchandise at Dunne Co. and data on purchases and sales for a three-month period ending June 30 are as follows: Date Transaction Number of Units Per Unit Total Apr. 3 Inventory 60 $150 $9,000 8 Purchase 120 180 21,600 11 Sale 80 500 40,000 30 Sale 50 500 25,000 May 8 Purchase 100 200 20,000 10 Sale 60 500 30,000 19 Sale 30 500 15,000 28 Purchase 100 220 22,000 June 5 Sale 60 525 31,500 16 Sale 80 525 42,000 21 Purchase 180 240 43,200 28 Sale 90 525 47,250 Required: 1. Record the inventory, purchases, and cost of merchandise sold data in a perpetual inventory record similar to the one illustrated in Exhibit 4, using the last-in, first-out method. Under LIFO, if units are in inventory at two different costs, enter the units with the HIGHER unit cost first in the Cost of Merchandise Sold Unit Cost column and LOWER unit cost first in the Inventory Unit Cost column.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started